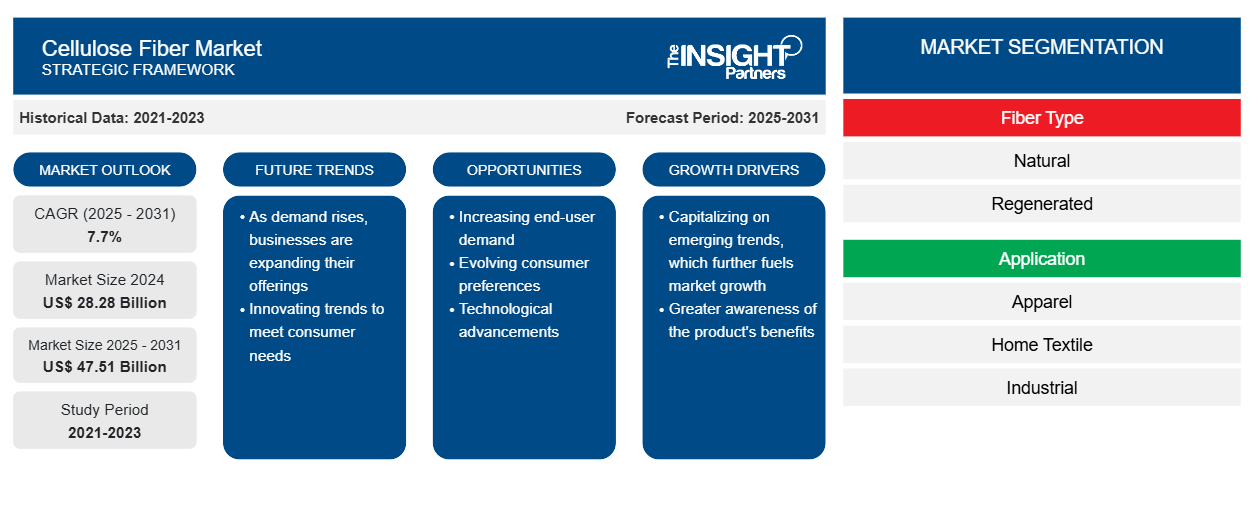

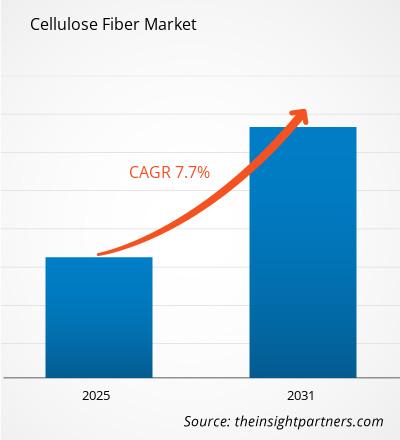

The Cellulose Fiber Market size is projected to reach US$ 47.51 billion by 2031 from US$ 26.26 billion in 2023. The market is expected to register a CAGR of 7.7% in 2023–2031. Development of nanocellulose and growing circular economy initiatives, are likely to remain key cellulose fiber market trends.

Cellulose Fiber Market Analysis

Cellulose fibers are derived from plant stems called bast fibers. Cellulose fibers can be obtained naturally or synthetically. Growing demand for technical textiles and the adoption of cellulose fibers in medical applications drives the cellulose fiber market. Technical textiles are explicitly produced to serve a defined purpose and incorporate physical properties. Technical textiles are divided into several categories: protective textiles, sports textiles, transportation textiles, and medical and industrial textiles. Emerging environmental concerns have encouraged sustainable approaches throughout the technical textile supply chain. In 2021, the Production-Linked Incentive (PLI) scheme was announced by the government of India, worth US$ 1.44 billion, for man-made fibers and technical textiles manufacturing over five years. The significant transition towards sustainable production and textiles further drives the market.

Cellulose Fiber Market Overview

Cellulose fiber is a natural fiber derived from cellulose, which is a complex carbohydrate. Natural cellulose fibers include cotton, linen, hemp, jute, kenaf, and bamboo. Regenerated cellulose fibers are produced by chemically dissolving and regenerating cellulose into fibers. The physical and chemical properties of natural and regenerated fibers vary depending on the source of cellulose and the regeneration process. Some common regenerated cellulose fibers include rayon, lyocell, modal, Tencel, and viscose. Cellulose fiber offers many properties, such as softness, absorbency, durability, versatility, and sustainability. Cellulosic fibers are key components of fabrics like cotton, linen, and rayon. These fibers are known for their breathability, moisture-wicking properties, and comfort, making them suitable for clothing and bed linen

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cellulose Fiber Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cellulose Fiber Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Cellulose Fiber Market Drivers and Opportunities

Growing Textile Industry to Favor Market

The textile industry has benefitted from globalization with the ability to source raw materials and labor from different parts of the world. This has further led to increased production capacity and cost efficiencies. Advancements in textile manufacturing technologies, such as automation and digital printing, have improved efficiency and product quality. These innovations have also led to the development of smart textiles and functional fabrics. Growing awareness of environmental issues has driven the adoption of sustainable practices in the textile industry. According to a report published by the European Commission in 2021, venture capital investment in advanced technologies has increased in the French textile industry. France is among the top 3 textile manufacturers in the EU, representing ~10% of EU turnover. The growing textile industry across the world is a major driver of global cellulose fiber market share.

Demand for Nonwoven Fabrics – An Opportunity in Cellulose Fiber Market

Cellulose fibers can be used to make nonwoven products such as wet wipes, disposable diapers, and medical dressings. Cellulosic fibers are also the primary raw material in paper production. In the form of filter paper, cellulosic fibers are used in applications like laboratory filtration and industrial filtration processes. In 2021, Production-Linked Incentive scheme was announced by the government of India, worth US$ 1.44 billion for man-made fibers and technical textiles manufacturing over a five-year period. In 2021, Welspun India introduced Wel-Trak 2.0, a patented end-to-end traceability technology to track textile raw materials throughout the supply chain. The demand for nonwoven fabrics is expected to have a positive impact on the cellulose fiber market.

Cellulose Fiber Market Report Segmentation Analysis

Key segments that contributed to the derivation of the cellulose fiber market analysis are fiber type, and application.

- Based on fiber type, the cellulose fiber market is divided into natural, and regenerated. Natural segment held a larger market share in 2023.

- By application, the market is segmented into apparel, home textile, industrial, and others. The apparel segment held the largest share of the market in 2023.

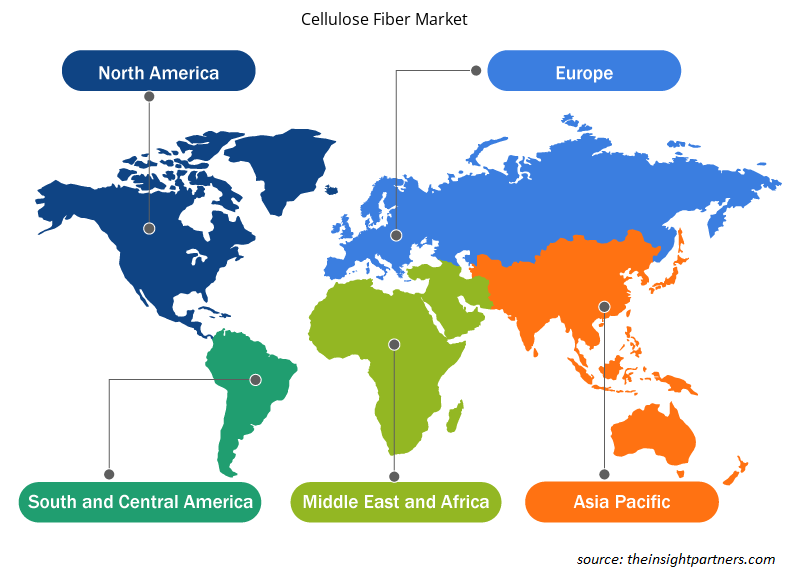

Cellulose Fiber Market Share Analysis by Geography

The geographic scope of the cellulose fiber market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

Asia Pacific has dominated the cellulose fiber market. China and India are amongst the major global textile economies. Asia Pacific marks the presence of the largest and most competitive textile industries in the world. This drives the demand for cellulose fibers used in making cotton, jute, linen, and rayon textiles. Asia Pacific is also home to a high number of small and medium-sized fabric manufacturers. According to the Chinese government report, China exported the equivalent of US$ 293.6 billion worth of textiles and apparel in 2023. Thus, the region represents a market of opportunities due to rising demand for textiles and personal care products.

Cellulose Fiber Market Regional Insights

The regional trends and factors influencing the Cellulose Fiber Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Cellulose Fiber Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Cellulose Fiber Market

Cellulose Fiber Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 28.28 Billion |

| Market Size by 2031 | US$ 47.51 Billion |

| Global CAGR (2025 - 2031) | 7.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Fiber Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

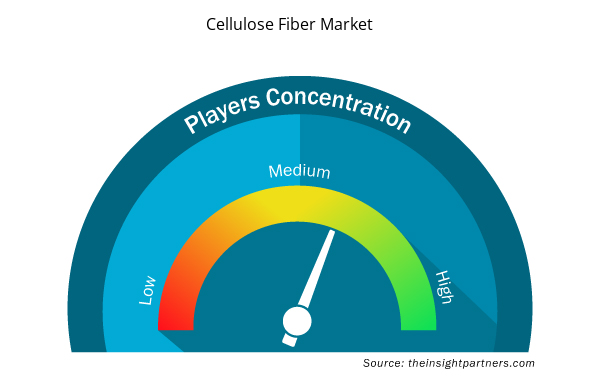

Cellulose Fiber Market Players Density: Understanding Its Impact on Business Dynamics

The Cellulose Fiber Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Cellulose Fiber Market are:

- Daicel Corporation

- Eastman Chemical Company

- Fulida Group Holding Co Ltd

- Grasim Industries Ltd

- International Paper Company

- Kelheim Fibers GmbH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Cellulose Fiber Market top key players overview

Cellulose Fiber Market News and Recent Developments

The cellulose fiber market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion and strategies:

- In November 2023, SaXcell BV signed a Memorandum of Understanding (MoU) with the Birla Cellulose, for production of recycled man-made cellulosic fibers. (Source: Birla Cellulose, Press Release)

- In July 2021, Lenzing AG collaborated with Orange Fiber, to launch the TENCEL branded lyocell fiber made of orange pulp and wood sources – presenting a new sustainable offering for the fashion industry. (Source: Lenzing AG, Press Release)

- In December 2019, Lenzing AG introduced performance fabric made with 100% cellulose fibers. The company collaborated with FLOCUS, Marchi & Fildi, Studio MLR, and PYRATEX® on a new sustainable fabric design (Source: Lenzing AG, Press Release)

Cellulose Fiber Market Report Coverage and Deliverables

The “Cellulose Fiber Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Get Free Sample For

Get Free Sample For