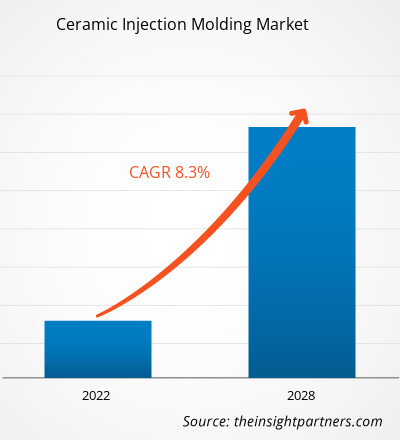

The ceramic injection molding market is projected to reach US$ 603.17 million by 2028 from US$ 349.84 million in 2021. It is expected to register a CAGR of 8.3% from 2022 to 2028.

The demand for ceramic injection molding is growing due to various benefits offered by ceramic injection molding. The increase in application of ceramic injection molding in the automotive & electronics industry in developed and developing regions is expected to provide lucrative opportunities for the market growth. Asia Pacific dominated the market in terms of revenue, and it is also expected to be the fastest-growing region over the forecast period. The alumina segment is dominating the market. The growth of the zirconia segment is expected to positively impact the market growth.

In 2021, Europe held the largest share of the global ceramic injection molding market, and Asia Pacific is estimated to register the fastest CAGR during the forecast period. In 2019, Asia Pacific contributed to the largest share in the global ceramic injection molding market. The growth of the ceramic injection molding market in this region is primarily attributed to the wide availability of ceramic materials such as alumina and zirconia at reduced cost. The expansion in the application of ceramic injection molding in the production of medical instruments and consumer electronics favors its demand in Asia Pacific. The advancements in technologies and rising trend for the use of advanced products boost the demand for ceramic injection molding. Besides all these, the rise in the application of the process in healthcare, industrial machinery, automotive and consumer goods is another factor that provides ample opportunities for the growth of the ceramic injection molding in the region.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ceramic Injection Molding Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ceramic Injection Molding Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Greater Utilization of Technology by Automotive and Electronics Industry

Ceramic injection molding is highly exploited by industries such as automotive, electronics, and consumer goods. Ceramic injection molding technology can produce highly accurate, complex ceramic components and parts for electronics, mobile phones, and consumer goods industries. For the past few years, the production of portable computing devices, cellular phones, gaming systems, and other personal electronic devices has increased exponentially. Hence, the rise in the adoption of these products drives the expansion of the ceramic injection molding industry. Rapid urbanization has further lead to the rise in the adoption of mobile phones, electronic items, vehicles, and others. The tremendous growth of the automobile industry combined with huge production demand for this technology is stimulating a positive impact. The demand for molded miniature products is escalating in the automotive sector, attributed to their high strength and complexity in their structures. Complex and vital components in electronic systems, engines, and locking mechanisms are usually manufactured by injection molding processes, which is a considerable driver to expanding the ceramic injection molding market. Technical ceramics function efficiently under extreme conditions such as high temperatures, corrosive atmospheres, and abrasive conditions. Also, advanced ceramics integrate with excellent mechanical characteristics with a low specific weight. Owing to this property of advanced ceramics, they are considered lightweight construction materials and thus find applications in moving aeronautics and automotive components and engine components. Further, rising disposable income and enhancing living standards in the developing regions are assisting the growth of these end-user industries, eventually amplifying the market growth.

Type-Based Insights

Based on type, the ceramic injection molding market is categorized into alumina, zirconia, and others. The alumina segment held the largest share in the market in 2021. The zirconia segment is expected to register the highest CAGR during the forecast period. Zirconium oxide also known as zirconia refers to a white crystalline oxide of zirconium. Mineral baddeleyite is the most natural occurring form of zirconia that bears a monoclinic crystalline structure. Ceramic powder of zirconia is widely used in injection molding. Zirconia possesses greater thermal expansion capacity as compared to alumina. It is biocompatible and has high chemical inertness, high fracture resistance and low thermal conductivity. Zirconia powder is employed in the production of dental implants through injection molding. The production of ceramic injection molding parts using yttrium oxide stabilized tetragonal zirconia appears to be feasible. The strength and variability of yttrium oxide stabilized tetragonal zirconia parts is usually more as compared to other conventional parts. Mullite zirconia is identified as a potential material for high temperature structural industry verticals owing to its high thermal shock resistance, high temperature strength, and low coefficient thermal expansion. The zirconia powder used in injection molding possesses the ability to fabricate the complex shapes that are made from the mullite zirconia composites. The zirconia powder is mainly used in the injection molding of optical fibers ferrules and wire bond nozzles. The zirconia-toughened alumina ceramics serve as interesting materials for biomedical and engineering industry verticals due to hardness, high strength and abrasion resistance. For this reason, the ceramic injection molding appears to be an attractive option for producing zirconia-toughened alumina. Zirconia is mainly used in industry verticals where alumina strength is considered to be insufficient.

Category Insights

Industrial Vertical-Based Insights

Based on industrial verticals, the ceramic injection molding market is segmented into industrial machinery, automotive, healthcare, electricals and electronics, consumer goods, and others. The healthcare segment accounted for the largest market share in 2020. The use of ceramic injection molding in dental implants, tweezers, endoscopic tools, and other applications supports the market for ceramic injection molding in the healthcare industry. The oxides of zirconia and alumina are used in the fabrication of numerous appliances, which further drives the demand for ceramic injection molding in the healthcare industry. The ability of ceramic injection molding process to modulate the roughness and surface quality of the components used in healthcare applications support the growth of the market. The growing healthcare industry is yet another factor that provides lucrative opportunities for the development of this segment. Further, the formation of micro-ceramic injection molding parts and their application in various products used in healthcare industry boost the growth of the healthcare segment in the ceramic injection molding market.

The major players operating in the ceramic injection molding market include AMT Pte. Ltd.; Arburg GmbH + Ko. KG.; Ceramco, Inc.; CoorsTek, Inc.; Indo MIM; KLAGER; Micro; Morgan Advanced Materials; Nishimura; Advanced Ceramics, Co. Ltd.; and OECHSLER AG. These companies are emphasizing on new product launches and geographical expansions to meet the growing consumer demand worldwide. They have a widespread global presence, which provides them to serve a large set of customers worldwide and subsequently increases their market share. These market players focus heavily on new product launches and regional expansions to increase their product range in specialty portfolios.

Ceramic Injection Molding Market Regional Insights

Ceramic Injection Molding Market Regional Insights

The regional trends and factors influencing the Ceramic Injection Molding Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Ceramic Injection Molding Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Ceramic Injection Molding Market

Ceramic Injection Molding Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 349.84 Million |

| Market Size by 2028 | US$ 603.17 Million |

| Global CAGR (2021 - 2028) | 8.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Ceramic Injection Molding Market Players Density: Understanding Its Impact on Business Dynamics

The Ceramic Injection Molding Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Ceramic Injection Molding Market are:

- AMT Pte. Ltd.

- Arburg GmbH + Ko. KG.

- Ceramco, Inc.

- CoorsTek, Inc.

- Indo MIM

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Ceramic Injection Molding Market top key players overview

Report Spotlights

- Progressive industry trends in the ceramic injection molding market to help companies develop effective long-term strategies

- Business growth strategies adopted by the ceramic injection molding market players in developed and developing countries

- Quantitative analysis of the market from 2019 to 2028

- Estimation of global demand for ceramic injection molded products

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers in the ceramic injection molding market

- Recent developments to understand the competitive market scenario

- Market trends and outlook, as well as factors driving and restraining the growth of the ceramic injection molding market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest

- Size of the ceramic injection molding market at various nodes

- A detailed overview and ceramic injection molding industry dynamics

- Size of the ceramic injection molding market in various regions with promising growth opportunities

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Industry Vertical

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Rising awareness regarding the design flexibility and low-cost delivered by ceramic injection molding are estimated to provide potential market opportunities in the coming years. Various key players such as Indo-MIM, Coorstek, Inc., and many others are providing awareness regarding the cost-efficiency of the technology. Besides, the cost efficiency and complex designing capabilities of ceramic injection molding technology offer a higher economy of scale by eliminating the production steps such as machining and finishing. Ceramic injection molding is an innovative technology that provides economical solutions to produce complicated, repeatable ceramic parts and components. Also, the ceramic injection molding process is a highly flexible process to manufacture products that are considered difficult and expensive to produce using other conventional manufacturing techniques.

Based on the industrial verticals, healthcare segment is projected to grow at the fastest CAGR over the forecast period. The use of ceramic injection molding in prosthetic components offers the possibility to modulate the roughness or the surface quality on a singular component for combining various materials that can portray more homogenous mechanical properties. The simple shaped ceramic components for prosthetic dental components are manufactured by ceramic injection molding. Several injection molding zirconia ceramic tweezers pincers are also manufactured by many companies. Endoscopic ceramic insulators produced by ceramic injection molding are increasing adopted in the endoscopic surgeries conducted in hospitals.

Ceramic advantages offered by the ceramic injection molding is driving the ceramic injection molding market. ceramic injection molding employs dependable equipment and advanced ceramic materials as well as compounds to produce ceramic components in a carefully controlled environment. This results in products of exceptional quality that meets the quality and aesthetic standards specific to a particular industry. Besides, businesses attain financial benefits from high-volume manufacturing, especially if they require new components as an alternative to existing designs. In addition, ceramic injection molding also helps acquire custom-made moldings of exceptional durability that meet all the required industry criteria. Also, ceramic injection molding components offer all the benefits associated with technical ceramics, including corrosion resistance, wear resistance, superior hardness, thermal stability, high mechanical strength, and dimensional stability. Thus, the advantages offered by ceramic injection molding is augmenting the growth of the market.

The major players operating in the global ceramic injection molding market are AMT Pte. Ltd.; Arburg GmbH + Ko. KG.; Ceramco, Inc.; CoorsTek, Inc.; Indo MIM; KLAGER; Micro; Morgan Advanced Materials; Nishimura; Advanced Ceramics, Co. Ltd.; and OECHSLER AG

Europe accounted for the largest share of the global ceramic injection molding market. Europe has matured the automotive, aerospace, medical, and consumer electronics sector, and it is further supported by high technology connectivity environment. Along with the advancing technology, the trend of using advanced products is boosting the demand for ceramic materials and further influencing the market growth for the ceramic injection molding market. Additionally, the rising personal disposable income of the consumers has led to increasing demand for consumer electronic products. These factors boost the ceramic injection molding market in Europe.

Based on type, alumina segments mainly have the largest revenue share. The alumina components that are employed in ceramic injection molding possess high wear & corrosion stability, high surface finish quality and good electrical insulation. They are stable dimensionally and has the capacity to withstand high working temperatures. Owing to the good mechanical properties along with low specific weight, the ceramic injection molding alumina is used in engineering for sensor tubes, sensor covers and micro electrodes for ultrasonic welding. It is also used in textile industry for wire guides and textile thread guides. In electrical components it is used for microwave electric components. Ceramic insulation molding alumina is being highly demanded as it the most common used material in micro-CIM and 2C-CIM technologies.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Ceramic Injection Molding Market

- AMT Pte. Ltd.

- Arburg GmbH + Ko. KG.

- Ceramco, Inc.

- CoorsTek, Inc.

- Indo MIM

- KLAGER

- Micro

- Morgan Advanced Materials

- Nishimura Advanced Ceramics, Co. Ltd.

- OECHSLER AG

Get Free Sample For

Get Free Sample For