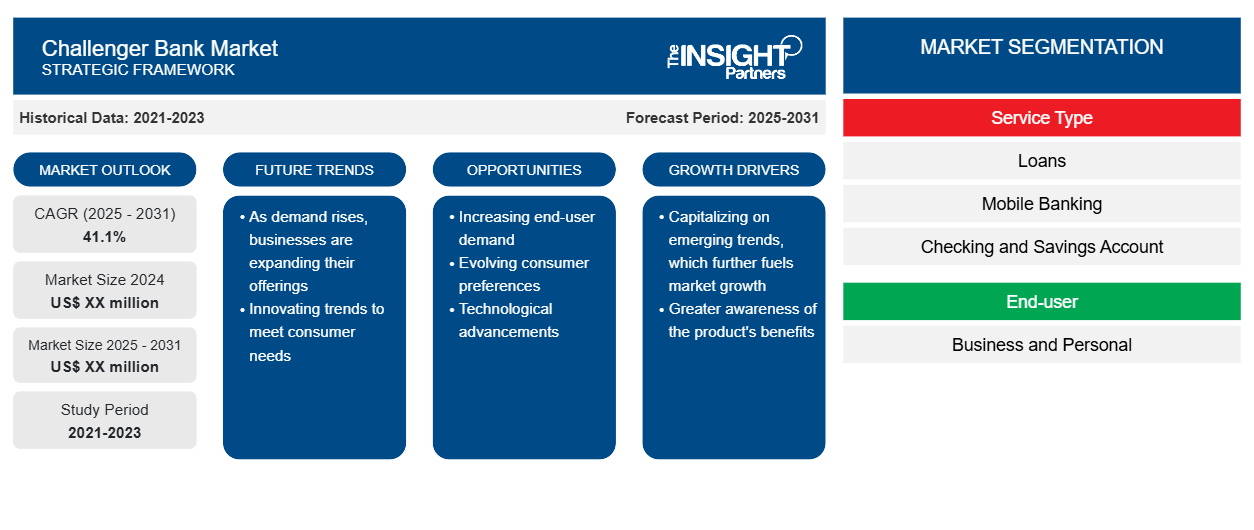

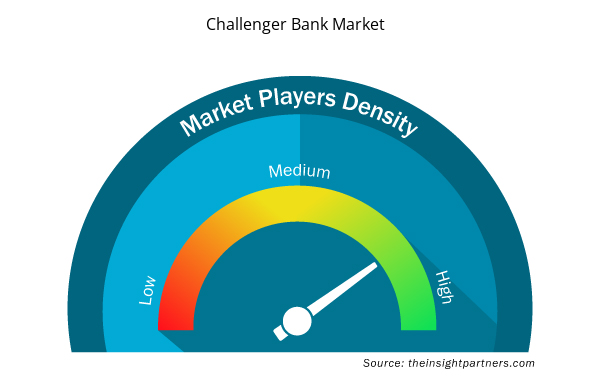

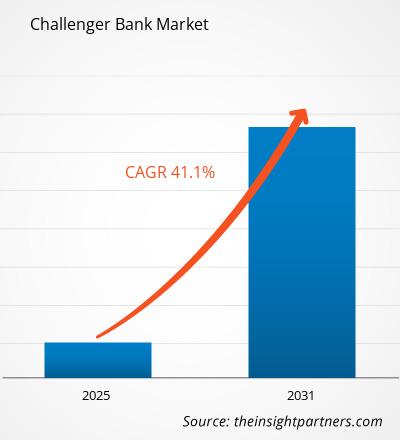

The challenger bank market is anticipated to expand at a CAGR of 41.1% from 2025 to 2031. The rising mobile penetration is fueling the challenger bank market growth.

Challenger Bank Market Analysis

The challenger bank market has experienced remarkable growth in recent years, disrupting the traditional banking sector with innovative products, digital-first approaches, and customer-centric services. These banks, also known as neobanks, have leveraged technology to offer a range of financial services without the overhead costs associated with brick-and-mortar branches. This has allowed them to provide competitive rates, lower fees, and enhanced user experiences, attracting a growing number of customers, particularly among younger demographics and tech-savvy consumers.

Challenger Bank

Industry Overview

- Challenger banks are, in most cases, small modern retail banks that challenge longer-established institutes by offering modern financial technology and are more focused on the customer. Challenger banks are also called neo-banks. Before changes in the British regulatory landscape, there had hardly been any competition in the market.

- One of the key drivers behind the growth of challenger banks is their ability to capitalize on changing consumer behaviors and preferences. As digital natives become the dominant force in the market, there is an increasing demand for seamless, convenient, and personalized banking solutions that can be accessed anytime, anywhere, through mobile devices. Challenger banks have risen to meet this demand by offering intuitive mobile apps, streamlined account opening processes, and features such as budgeting tools, instant payments, and real-time transaction notifications.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Challenger Bank Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Challenger Bank Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Challenger Bank Market Drivers and Opportunities

An increase in Mobile Penetration is driving the challenger bank market.

Increasing mobile penetration can serve as a significant driver for the Challenger bank market in several ways:

- As more people gain access to smartphones and mobile internet, they can easily engage with financial services offered by Challenger banks anytime and anywhere. This accessibility breaks down traditional barriers to banking, especially for those in underserved or remote areas.

- Challenger banks typically operate without physical branches, relying heavily on digital platforms. With higher mobile penetration, the cost of acquiring and servicing customers decreases, allowing Challenger banks to offer competitive rates and fees compared to traditional banks.

- Mobile penetration fosters a tech-savvy consumer base accustomed to convenient digital experiences. Challenger banks leverage this trend to introduce innovative features such as real-time transaction tracking, automated savings tools, and personalized financial insights, attracting customers seeking modern banking solutions.

Challenger Bank Market Report Segmentation Analysis

- Based on service type, the challenger bank market is segmented into loans, mobile banking, checking and savings accounts, payment and money transfers, and others.

- The loans segment is expected to hold a substantial challenger bank market share in 2023.

- Offering loans allows challenger banks to generate significant revenue through interest payments and fees.

- Providing competitive loan products attracts customers to challenger banks, helping them grow their customer base and retain existing clients.

- By offering loans in addition to other banking services like savings accounts and payment solutions, challenger banks can provide a comprehensive suite of financial products, appealing to a wider range of customers.

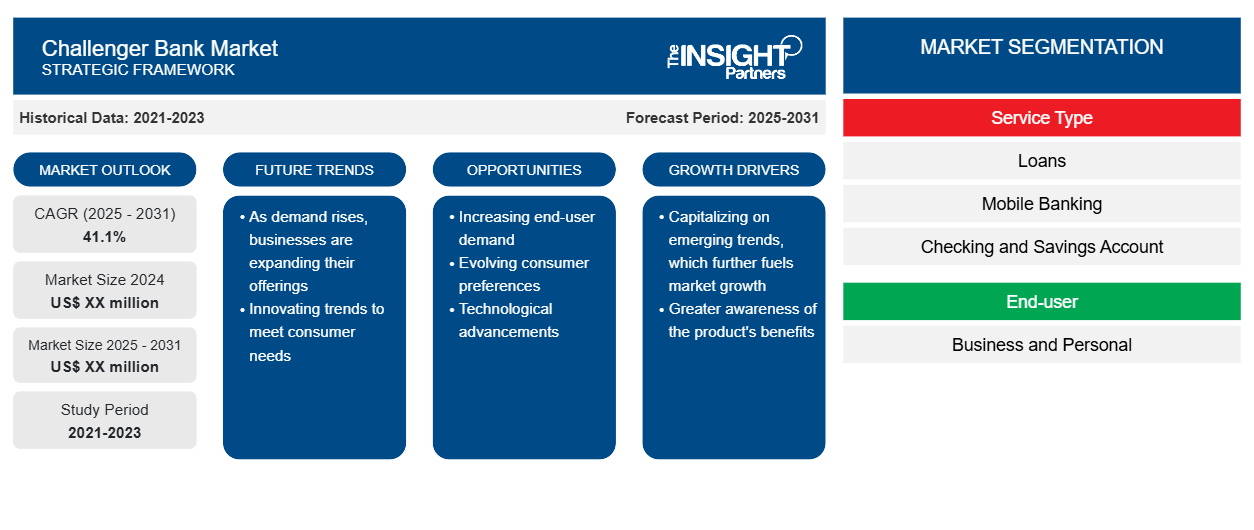

Challenger Bank Market Share Analysis by Geography

The scope of the challenger bank market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. In the case of challenger banks, North America accounted for the largest share. There has been a rapid expansion in the market growth in North America. Financial companies differentiate themselves from traditional banks by offering state-of-the-art, client-centered financial services using technology. Several firms are competing in this sector for a share of the evolving banking landscape. One of the main drivers of the challenger bank markets in North America is the expanding need for digital and mobile banking products. These banks respond to customers' need for more practical and efficient methods to handle their accounts by offering user-friendly apps, smooth online experiences, and enhanced customer care.

Challenger Bank Market Regional Insights

Challenger Bank Market Regional Insights

The regional trends and factors influencing the Challenger Bank Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Challenger Bank Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Challenger Bank Market

Challenger Bank Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX million |

| Global CAGR (2025 - 2031) | 41.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Challenger Bank Market Players Density: Understanding Its Impact on Business Dynamics

The Challenger Bank Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Challenger Bank Market are:

- Revolut Ltd

- N26 AG

- Chime Financial, Inc.

- Monzo Bank Limited

- Varo Bank, N.A.

- Starling Bank

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Challenger Bank Market top key players overview

The " Challenger Bank Market Analysis" was carried out based on service type, end-user, and geography. In terms of service type, the market is segmented into loans, mobile banking, checking and savings accounts, payment and money transfers, and others. Based on end-user, the market is segmented into business and personal. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Challenger Bank Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the challenger bank market. A few recent key market developments are listed below:

- In January 2024, Revolut launched Mobile Wallets, allowing for faster transfers across the world. Mobile Wallets redefined remittance experiences by offering a low-friction, intuitive process. Users send money abroad quickly using only recipient IDs, such as their name alongside their phone number or email addresses. Mobile Wallets reduce potential risks associated with some traditional payment methods, such as money being sent to the wrong account details or money being stuck with banks. Now, Revolut customers in the UK and most European countries (EEA) can send money to Bangladesh (bKash) and Kenya (M-Pesa) using Mobile Wallets, with other wallet routes expected to be launched soon.

[Source: Revolut Ltd, Company Website]

Challenger Bank Market Report Coverage & Deliverables

The challenger bank market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report “Challenger Bank Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Small Satellite Market

- Greens Powder Market

- Redistribution Layer Material Market

- Cosmetic Bioactive Ingredients Market

- Environmental Consulting Service Market

- Visualization and 3D Rendering Software Market

- Pharmacovigilance and Drug Safety Software Market

- Malaria Treatment Market

- Micro-Surgical Robot Market

- Pressure Vessel Composite Materials Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global challenger bank market is expected to grow at a CAGR of 41.1 % during the forecast period 2024 - 2031.

The key players holding majority shares in the global challenger bank market are Revolut Ltd; N26 AG; Chime Financial, Inc.; Monzo Bank Limited; and Varo Bank, N.A.

Rising mobile penetration is the major factors that propel the global challenger bank market.

Growing digitization and increasing mobile penetration are anticipated to play a significant role in the global challenger bank market in the coming years.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Revolut Ltd

- N26 AG

- Chime Financial, Inc.

- Monzo Bank Limited

- Varo Bank, N.A.

- Starling Bank

- Atom Bank

- Monese Credit Limited

- Movencorp Newco Inc

- Tandem.

Get Free Sample For

Get Free Sample For