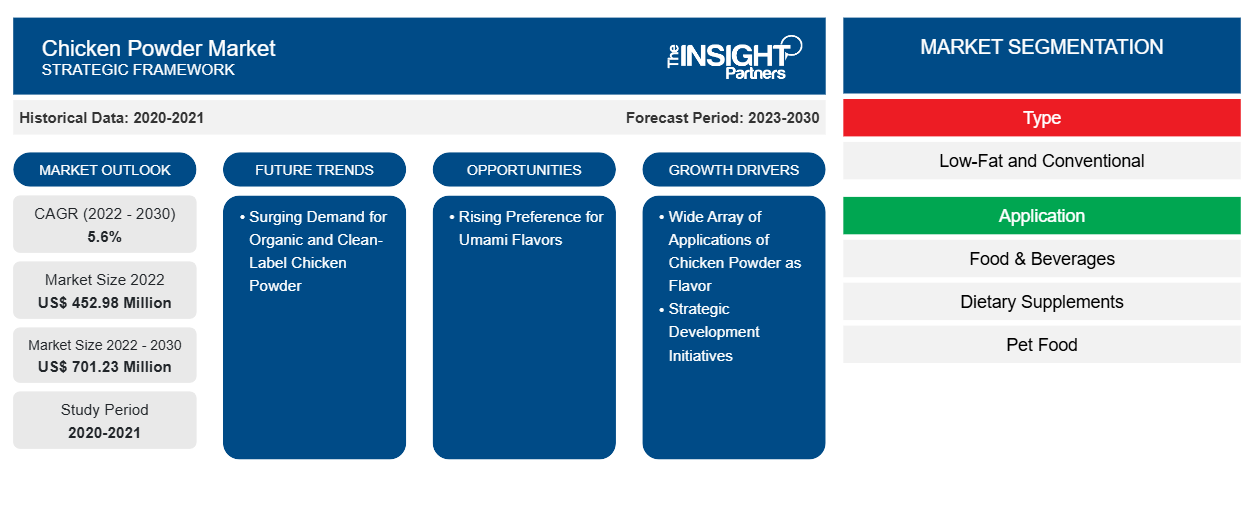

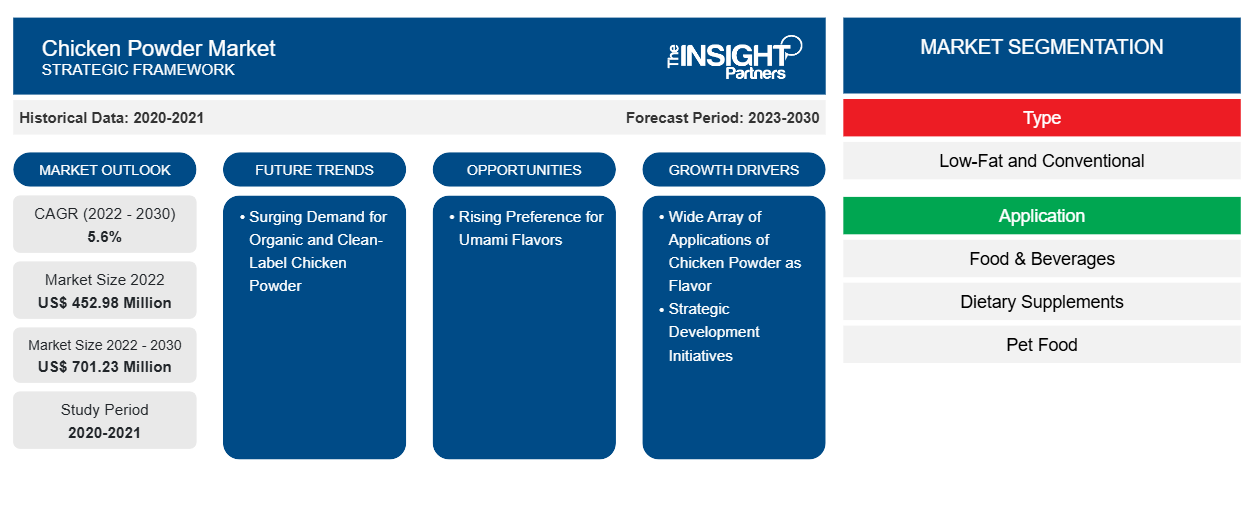

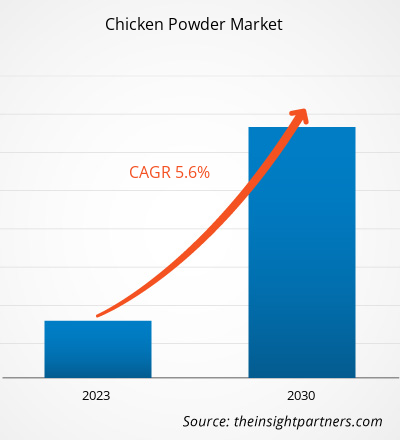

[Research Report] The chicken powder market is expected to grow from US$ 452.98 million in 2022 to US$ 701.23 million by 2030; it is expected to record a CAGR of 5.6% from 2022 to 2030.

Market Insights and Analyst View:

Chicken powder is a versatile ingredient made by dehydrating the chicken meat, bone, cartilage, viscera, and other parts and grinding them into fine powder or by making the concentrated extract of chicken and chicken parts in water and spray drying the liquid extract. The powder is widely used as a flavoring agent due to its unique umami and meaty flavor. It can also be used as a fortifying agent due to its high protein and collagen content. Chicken powder is well-suited for different product formations, including liquid, dry, and paste. It is also economical and requires less transportation and storage costs than liquid chicken extracts. These factors significantly drive the demand for chicken powder across various application areas such as food and beverages, pet food, animal feed, and dietary supplements.

Growth Drivers and Challenges:

Rising modernization, changing lifestyles, and changing taste preferences boost the demand for umami flavors across the world. Umami is considered the fifth primary taste—next to sweet, sour, bitter, and salty. Umami flavor imparts a savory taste to the food items. Thus, it has become a popular flavor among food and beverage manufacturers aiming to improve the taste of low-sodium offerings. Umami adds a ‘brothy’ or ‘meaty’ taste to end products. Thus, with increasing popularity, the demand for umami-flavored products is increasing among the global population.

The umami flavor is mainly obtained from various meat extracts such as beef, chicken powder, and pork extracts. Chicken powder is used in various foods and beverages to bring the umami taste and mouthfeel. Moreover, umami gives a meaty flavor to the end product. The savory quality of Umami can make food items taste richer without adding sodium or fat. Therefore, the preference for umami flavor increases among manufacturers to cater to the rising demand of consumers. Kerry Group offers umami stocks that are clean-label and can be used in prepared meals, soups, sauces, gravies, burgers, and poultry applications.

Thus, the rising preference for umami flavors is expected to provide lucrative opportunities for the global chicken powder market during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Chicken Powder Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Chicken Powder Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Global Chicken Powder Market" is segmented on the basis of type, application, and geography. Based on type, the market is bifurcated into low-fat and conventional. Based on application, the chicken powder market is segmented into food & beverages, dietary supplements, pet food, and animal feed. The market for the food & beverages segment is sub segmented into RTE and RTC meals; soups, sauces, and dressings; savory snacks; noodles and pastas; and others. The chicken powder market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Chile, and the Rest of South & Central America).

Segmental Analysis:

Based on type, the chicken powder market is bifurcated into low-fat and conventional. The conventional segment held a larger share of the chicken powder market in 2022. The low-fat segment is expected to register a higher CAGR during the forecast period owing to the rising consumer preference for low-fat food products and rising health concerns. Low-fat chicken powder contributes to fewer calories than conventional chicken powder, making it a healthier option. In addition, increasing consumer dietary preferences for low-fat, low-cholesterol, and low-ketogenic intake propel the demand for low-fat chicken powder in different industries. Key manufacturers in the market, such as Symrise AG, International Dehydrated Foods Inc, and F R Benson & Partners Ltd offer low-fat chicken powder to meet the growing consumer demand.

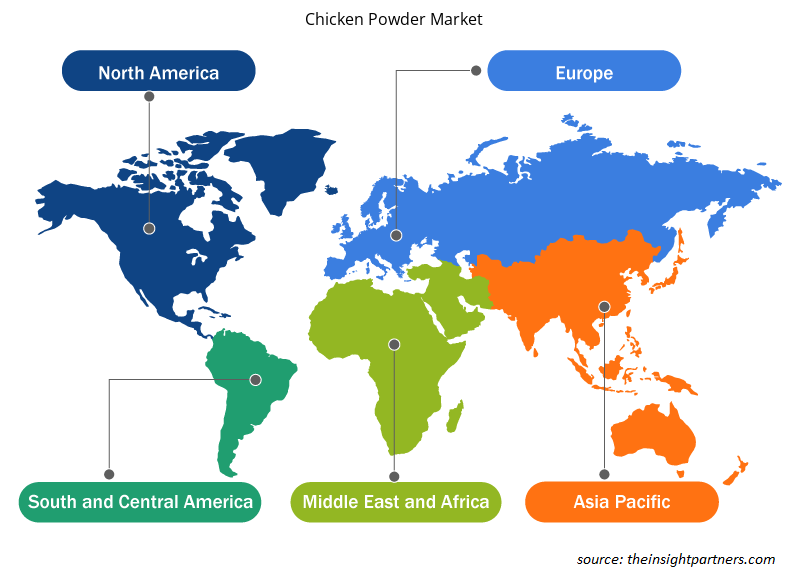

Regional Analysis:

The chicken powder market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. The global chicken powder market was dominated by North America and was estimated to be ~US$ 100 million in 2022. North America is one of the prominent regions for the chicken powder market due to the increasing consumption of meat-based products as protein-rich food. The US is the world’s largest poultry meat exporter and a major egg producer. Growing consumer preference for cleaner meat options due to changing dietary patterns boosts the demand for chicken-based meat in the region. Chicken powder enhances the flavor of meat-based food products and other food & beverages. Thus, growing consumption of meat-based food increases the demand for chicken powder. These factors fuel the demand for chicken powder. Moreover, consumers in countries such as the US and Canada have started opting for chicken-based RTE and RTC products owing to the convenience and flavor offered by the products. Chicken powder is also used in culture media preparation. Owing to all these factors, the demand for chicken powder is increasing across the region.

North America has been a desirable market for chicken powder providers, with the majority of consumers leading demanding lifestyles and seeking processed products, such as meat-based soups and sauces, broths, and snacks. Chicken powder is a major raw material for manufacturing these products. Moreover, consumers' clean-label requirements create demand for developing new technologies that maintain the integrity of the extraction process. There is a high concentration of prominent chicken powder market players such as The Scoular Company.

Furthermore, chicken powder enhances the palatability of pet food and animal feed. According to the National Pet Owners Survey (2021–2022) conducted by the American Pet Food Association, pet ownership increased from ~67% in the US households in 2021 to 70% in 2022. Thus, increasing pet ownership boosts the demand for chicken powder among pet food manufacturers. These factors propel the market growth in North America.

COVID-19 Pandemic Impact:

The COVID-19 pandemic adversely affected economies and industries in various countries. Lockdowns, travel restrictions, and business shutdowns in leading countries in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA) hindered the growth of various industries, including the food & beverages industries. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and various essential and nonessential product sales. Various companies announced possible delays in product deliveries and a slump in future sales of their products in 2020. In addition, the bans imposed by various governments in Europe, Asia Pacific, and North America on international travel forced the companies to put their collaboration and partnership plans on a temporary hold. Moreover, the closure of slaughterhouses due to lockdown negatively impacted the market growth. All these factors hampered the food & beverages industry in 2020 and early 2021, thereby restraining the growth of the chicken powder market.

Chicken Powder Market Regional Insights

Chicken Powder Market Regional Insights

The regional trends and factors influencing the Chicken Powder Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Chicken Powder Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Chicken Powder Market

Chicken Powder Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 452.98 Million |

| Market Size by 2030 | US$ 701.23 Million |

| Global CAGR (2022 - 2030) | 5.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

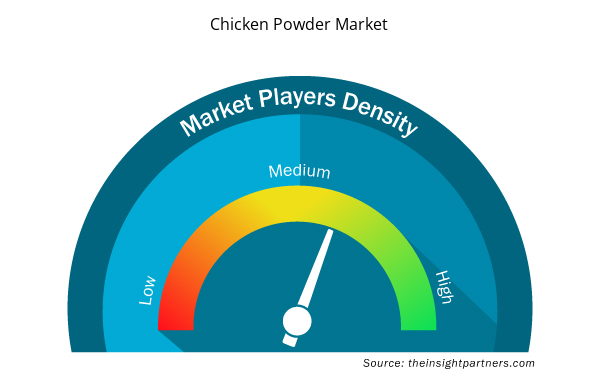

Chicken Powder Market Players Density: Understanding Its Impact on Business Dynamics

The Chicken Powder Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Chicken Powder Market are:

- Proliver Srl

- Symrise AG

- F R Benson and Partners Ltd.

- BRF S.A.

- International Dehydrated Foods Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Chicken Powder Market top key players overview

Competitive Landscape and Key Companies:

Proliver Srl, Symrise AG, F R Benson and Partners Ltd, BRF SA, International Dehydrated Foods Inc, HE Stringer Flavours Ltd, The Scoular Co, Henningsen Netherland BV, Nikken Foods Co Ltd, and Fuji Foods Inc are among the prominent players operating in the global chicken powder market. These chicken powder manufacturers offer cutting-edge extract solutions with innovative features to deliver a superior experience to consumers.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Blood Collection Devices Market

- Greens Powder Market

- Biopharmaceutical Tubing Market

- Aerospace Forging Market

- Aircraft MRO Market

- Airport Runway FOD Detection Systems Market

- Vision Care Market

- Nitrogenous Fertilizer Market

- Advanced Planning and Scheduling Software Market

- Electronic Data Interchange Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Based on the application, food and beverages segment is projected to grow at the fastest CAGR over the forecast period. The increasing utilization of chicken powder as a flavor enhancer in various products is expected to surge the demand for chicken powder in the food & beverages industry. In addition, rising preference for umami flavors is expected to positively increase the demand for chicken powder in the food & beverage industry. Food and beverages are further sub-segmented into soups, sauces, and dressing; RTC and RTC meals; savory snacks; noodles and pasta; and others.

The application industries of the chicken powder market across the world invest significantly in strategic development initiatives such as product innovation to attract consumers and enhance their market position. In July 2019, Hormel Foods Corporation introduced two new flavors to its snacking portfolio – Mediterranean-style chicken with bruschetta jack cheese and chipotle chicken with queso quesadilla cheese and flaxseed corn chips. An innovative product-level innovation approach initiated by the company aims to offer a convenient way for people to consume snacks. Thus, increasing innovations in end products ultimately boost the demand for chicken powder.

North America accounted for the largest share of the global chicken powder market. North America is one of the prominent regions for the chicken powder market due to the increasing consumption of meat-based products as protein-rich food. The US is the world’s largest poultry meat exporter and a major egg producer. Growing consumer preference for leaner meat options, due to changing dietary patterns, boosts the demand for chicken-based meat in the region. Chicken powder enhance the flavor of meat-based food products and other food & beverages. Thus, growing consumption of meat-based food increase the demand for chicken powder. These factors are expected to fuel the demand for chicken powder.

Rising modernization, changing lifestyles, and changing taste preferences boost the demand for umami flavors across the world. Umami is considered the fifth primary taste—next to sweet, sour, bitter, and salty. Umami flavor imparts a savory taste to the food items. Thus, it has become a popular flavor among food and beverage manufacturers aiming to improve the taste of low-sodium offerings. Umami adds a ‘brothy’ or ‘meaty’ taste to end products. Thus, with increasing popularity, the demand for umami-flavored products is increasing among the global population.

Based on type, conventional segments hold the largest revenue. Conventional chicken powder is expected to hold a significant market share in 2022. The growth is attributed to easy availability, low cost, and less processing required compared to the low-fat chicken powder. However, in the coming years, the demand for conventional chicken powder is expected to decrease as consumers become more health-conscious due to increased obesity and lifestyle issues. Further, less awareness regarding low-fat chicken powder is boosting the demand for conventional chicken powder.

The major players operating in the global chicken powder market are Proliver Srl, Symrise AG, F R Benson and Partners Ltd, BRF SA, International Dehydrated Foods Inc, HE Stringer Flavours Ltd, The Scoular Co, Henningsen Netherland BV, Nikken Foods Co Ltd, and Fuji Foods Inc.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Chicken Powder Market

- Proliver Srl

- Symrise AG

- F R Benson and Partners Ltd.

- BRF S.A.

- International Dehydrated Foods Inc.

- HE Stringer Flavours Ltd.

- The Scoular Co.

- Henningsen Netherland B.V.

- Nikken Foods Co Ltd.

- Fuji Foods Inc.

Get Free Sample For

Get Free Sample For