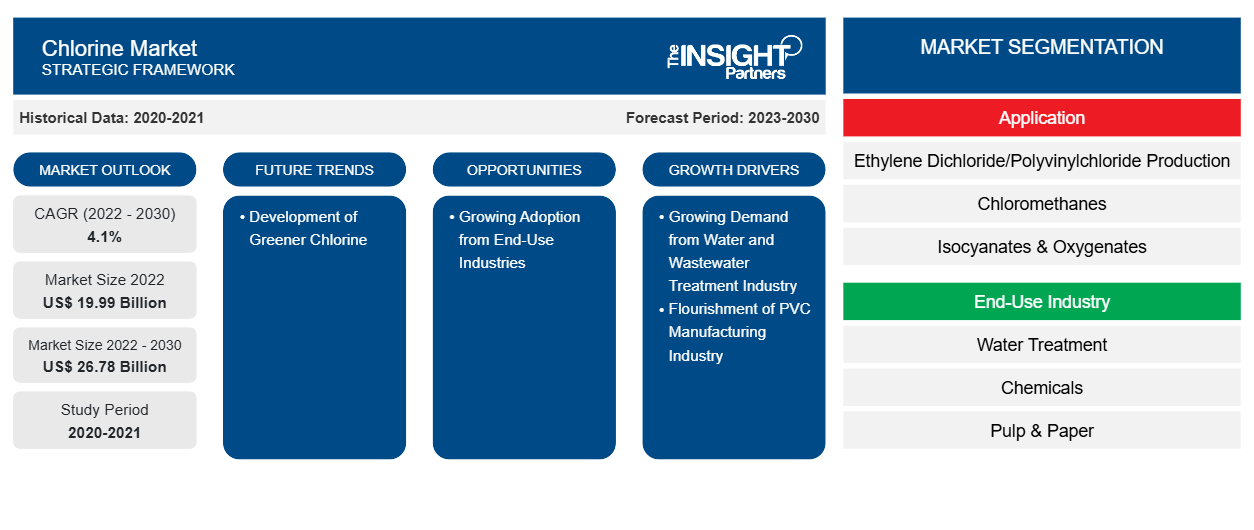

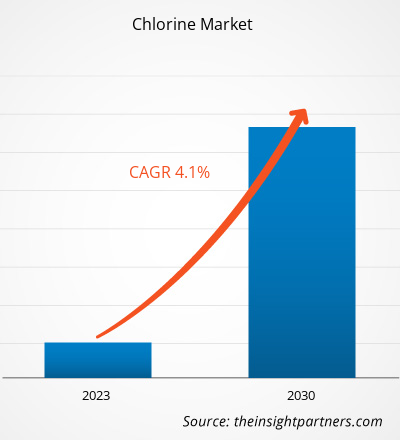

[Research Report] The chlorine market size was valued at US$ 19,988.92 million in 2022 and is expected to reach US$ 26,777.66 million by 2030; it is estimated to register a CAGR of 4.1% from 2022 to 2030.

Market Insights and Analyst View:

Chlorine is a versatile chemical with a wide range of end-user industries, such as water treatment, chemicals, pulp & paper, and plastics. It is manufactured by the electrolysis of sodium chloride solution using a diaphragm cell and a membrane cell. It is an essential raw material for various products and processes in different sectors. Chlorine is widely used as a disinfectant in municipal water treatment plants to destroy harmful bacteria, viruses, and other pathogens, ensuring the safety and quality of drinking water. In addition, chlorine is an important component of polyvinyl chloride (PVC) production. PVC is used in applications such as pipes, window frames, flooring, packaging films, and automotive components. The pharmaceutical industry uses chlorine to synthesize active pharmaceutical ingredients (APIs) and other pharmaceutical compounds. Chlorine is used to manufacture pesticides, herbicides, and other agrochemicals to protect crops and improve agricultural productivity. It is also employed in various chemical reactions to produce chlorinated compounds used in many industrial applications, such as solvents, bleaching agents, and cleaning products. Chlorine is employed in electronics manufacturing for bonding components and protecting sensitive parts. These factors are expected to drive the chlorine market growth.

Growth Drivers and Challenges:

Robust water disinfection methods have become critical with the rise of antibiotic-resistant bacteria and the emergence of waterborne diseases. In addition to its primary role in pathogen removal, chlorine is used in water treatment to control algae and algae toxin growth, remove iron and manganese, and address other water quality concerns. An increasing demand for chlorine from the water & wastewater industry due to the rising water consumption from growing global population and the increasing need to ensure safe and clean drinking water consumption drives the chlorine market growth. Furthermore, PVC films and sheets are widely used in packaging applications, particularly for food and pharmaceutical products. With the increasing demand for packaging goods and the growing focus on hygiene and product safety, the demand for PVC-based packaging materials has soared, further contributing to the chlorine demand from the PVC industry. In the electrical sector, PVC cables and wires are extensively used for electrical insulation due to their excellent electrical properties and fire-retardant characteristics. As the global demand for electricity and electrical infrastructure continues to rise, the need for PVC-based electrical materials propels, consequently bolstering the chlorine demand. Thus, since PVC remains a preferred material in construction, automotive, packaging, and electrical applications, the need for chlorine in the polymerization process remains strong. Thus, growing demand from water treatment, PVC manufacturing, and other end-use industries is driving the chlorine market growth.

The high production, handling, and disposal of chlorine by various industries and applications pose potential risks to human health and the environment. Governments across the world have recognized these risks and implemented stringent regulations to ensure the safe and responsible use of chlorine. Therefore, concerns regarding chlorine use and rising regulations to control chlorine use negatively impact the chlorine market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Chlorine Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Chlorine Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

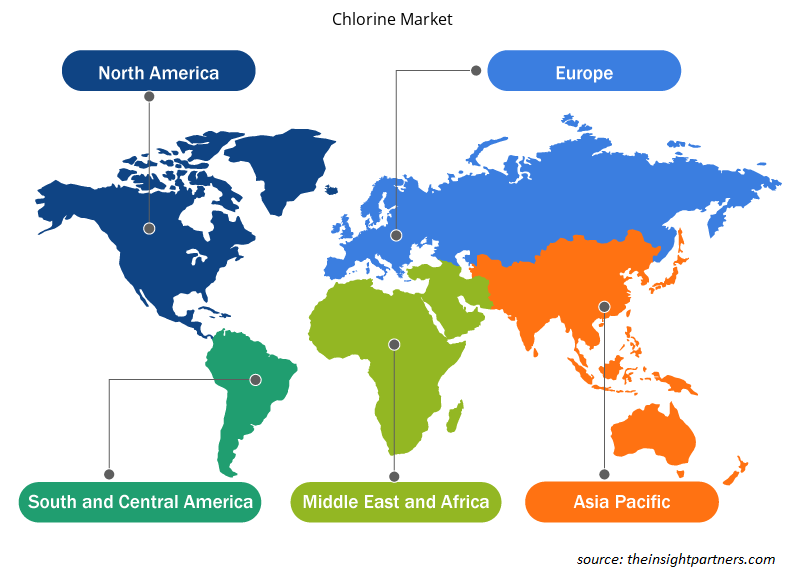

The global chlorine market is segmented on the basis of application, end-use industry, and geography. Based on application, the chlorine market is segmented into ethylene dichloride/polyvinylchloride production, chloromethanes, isocyanates & oxygenates, solvents, and others. In terms of end-use industry, the chlorine market is segmented into water treatment, chemicals, pulp & paper, plastics, pharmaceuticals, and others. By geography, the chlorine market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on application, the chlorine market is segmented into ethylene dichloride/polyvinylchloride production, chloromethanes, isocyanates & oxygenates, solvents, and others. The isocyanates & oxygenates segment is expected to register significant growth from 2022 to 2030. Isocyanates are extensively used in the production of polyurethane, a versatile material used in foams, adhesives, sealants, coatings, and elastomers. These polyurethane materials find applications in products such as furniture, mattresses, automotive parts, insulation, and footwear. Though chlorine does not appear in the polyurethane molecule, it is used to make the intermediates, the isocyanates.

Oxygenates are a broad class of organic compounds that contain oxygen atoms, typically in the form of hydroxyl groups. A few common types of oxygenates are alcohols (e.g., ethanol and methanol), ethers (e.g., methyl tert-butyl ether), and ketones (e.g., acetone). Oxygenates have diverse applications as solvents, fuel additives, and chemical intermediates in various industries. Ethanol, for example, is used as a biofuel additive to reduce emissions and enhance fuel performance. Chlorine plays a crucial role in chemical processes involving chlorinated intermediates. The chlorination of methane can produce methyl chloride, which undergoes a series of chemical reactions to produce methanol. All these factors are driving the growth of isocyanates & oxygenates segment in the chlorine market.

Regional Analysis:

Based on geography, the chlorine market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. The global chlorine market was dominated by Asia Pacific, which accounted for ~US$ 9,500 million in 2022. The region has become a global manufacturing hub, with industries spanning chemicals, textiles, plastics, and electronics. Chlorine is a crucial chemical in various industrial processes, such as the production of chemicals, solvents, and intermediates for pharmaceuticals. The rising manufacturing activities across the region to meet domestic and international demands are anticipated to fuel the demand for chlorine, an essential raw material. Thus, as the region progresses and industrializes, the demand for chlorine and its derivatives is expected to remain strong, which is expected to boost the chlorine market growth in Asia Pacific from 2023 to 2030. Europe is expected to register a CAGR of over 4% from 2023 to 2030. The region relies on chlorine and its derivatives for various applications, leading to a steady and sustained demand for this versatile chemical. The demand for chlorine is growing in the wastewater treatment sector in Europe due to several reasons that highlight the significance of chlorine as a crucial water disinfection agent. As European countries strive to improve quality of water, protect public health, and meet stringent environmental regulations, chlorine has emerged as a reliable and effective solution for wastewater treatment. All these factors are driving the chlorine market growth in Europe. North America is also expected to witness significant growth, reaching over US$ 5,500 million in 2030.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the chlorine market are listed below:

- In December 2022, INEOS Enterprises completed the acquisition of ASHTA Chemicals from Bigshire Mexico S. de R.L. de C.V. The deal consists of a 100ktpa Potassium Hydroxide (KOH)/65 kte chlorine plant.

- In April 2022, OxyVinyls, the chemical division of Occidental Petroleum, announced that it is planning a US$ 1.1 billion expansion and modernization project at its chlor-alkali plant in La Porte, Texas, according to documents filed with the Texas Comptroller's Office.

COVID-19 Impact:

The COVID-19 pandemic adversely affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA) hampered the growth of several industries, including the chemical & materials industry. The shutdown of manufacturing units of chlorine companies disturbed global supply chains, manufacturing activities, and delivery schedules. Various companies reported delays in product deliveries and a slump in their product sales in 2020. Most of the industrial manufacturing facilities were shut down during the pandemic, decreasing the consumption of chlorine. In addition, the COVID-19 pandemic has caused fluctuations in chlorine prices. However, various industries revived their operations after supply constraints were resolved, which led to a revival of the chlorine market. Moreover, the rising demand for chlorine from the industrial and residential sectors is substantially promoting the chlorine market growth.

Chlorine Market Regional Insights

Chlorine Market Regional Insights

The regional trends and factors influencing the Chlorine Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Chlorine Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Chlorine Market

Chlorine Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 19.99 Billion |

| Market Size by 2030 | US$ 26.78 Billion |

| Global CAGR (2022 - 2030) | 4.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Chlorine Market Players Density: Understanding Its Impact on Business Dynamics

The Chlorine Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Chlorine Market are:

- Aditya Birla Chemicals India Ltd

- BASF SE

- Ercros SA

- Hanwha Solutions Corp

- INEOS Group Holdings SA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Chlorine Market top key players overview

Competitive Landscape and Key Companies:

Aditya Birla Chemicals India Ltd, BASF SE, Ercros SA, Hanwha Solutions Corp, INEOS Group Holdings SA, Occidental Petroleum Corp, Olin Corp, Tata Chemicals Ltd, Vynova Belgium NV, and Sumitomo Chemical Co Ltd are among the players operating in the global chlorine market. The global chlorine market players focus on providing high-quality products to fulfill customer demand.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application, and End-Use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Chlorine is widely used as a disinfectant in municipal water treatment plants to kill harmful bacteria, viruses, and other pathogens, ensuring the safety and quality of drinking water. In addition, chlorine is an important component of polyvinyl chloride (PVC) production. PVC is used in applications such as pipes, window frames, flooring, packaging films, and automotive components. The pharmaceutical industry uses chlorine to synthesize active pharmaceutical ingredients (APIs) and other pharmaceutical compounds. Chlorine is used to manufacture pesticides, herbicides, and other agrochemicals to protect crops and improve agricultural productivity. Growing demand from these end-used industries is driving the demand for chlorine from 2022 to 2030.

The plastics segment held the largest share of the global chlorine market in 2022. The production of PVC involves the polymerization of vinyl chloride monomers, and chlorine is a key raw material in this chemical process. The construction and infrastructure development is growing substantially. PVC pipes, fittings, and profiles are extensively used in construction due to their durability, cost-effectiveness, and versatility. As urbanization continues to accelerate in many parts of the world, the demand for PVC-based construction materials rises in tandem, leading to a higher need for chlorine to meet the polymerization requirements.

Pharmaceutical segment is estimated to register the fastest CAGR in the global chlorine market over the forecast period. Chlorine and chlorine-based compounds play an important role in the pharmaceutical industry, contributing to the synthesis of various medications and pharmaceutical products. Chlorine-containing compounds serve as essential intermediates and reagents in the synthesis of pharmaceutical compounds, enabling the production of a wide range of drugs. Chlorine synthesizes many active pharmaceutical ingredients (APIs), primarily biologically active components in medications. Growing demand for pharmaceuticals is expected to drive the demand for the chlorine from 2022 to 2030.

In 2022, Asia Pacific held the largest share of the global chlorine market. The region has become a global manufacturing hub, with industries spanning chemicals, textiles, plastics, and electronics. Chlorine is a crucial chemical in various industrial processes, such as the production of chemicals, solvents, and intermediates for pharmaceuticals. The rising manufacturing activities across the region to meet domestic and international demands are anticipated to fuel the demand for chlorine, an essential raw material. All these factors led to the dominance of the Asia Pacific region in 2022.

A few players operating in the global chlorine market include Aditya Birla Chemicals India Ltd, BASF SE, Ercros SA, Hanwha Solutions Corp, INEOS Group Holdings SA, Occidental Petroleum Corp, Olin Corp, Tata Chemicals Ltd, Vynova Belgium NV, Sumitomo Chemical Co Ltd.

The isocyanates & oxygenates segment held the largest share in the global chlorine market in 2022. Isocyanates are extensively used in the production of polyurethane, a versatile material used in foams, adhesives, sealants, coatings, and elastomers. These polyurethane materials find applications in items like furniture, mattresses, automotive parts, insulation, and footwear. Thus, growing demand from the application sectors led to the dominance of the isocyanates & oxygenates segment in 2022.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Chlorine Market

- Aditya Birla Chemicals India Ltd

- BASF SE

- Ercros SA

- Hanwha Solutions Corp

- INEOS Group Holdings SA

- Occidental Petroleum Corp

- Olin Corp

- Tata Chemicals Ltd

- Vynova Belgium NV

- Sumitomo Chemical Co Ltd

Get Free Sample For

Get Free Sample For