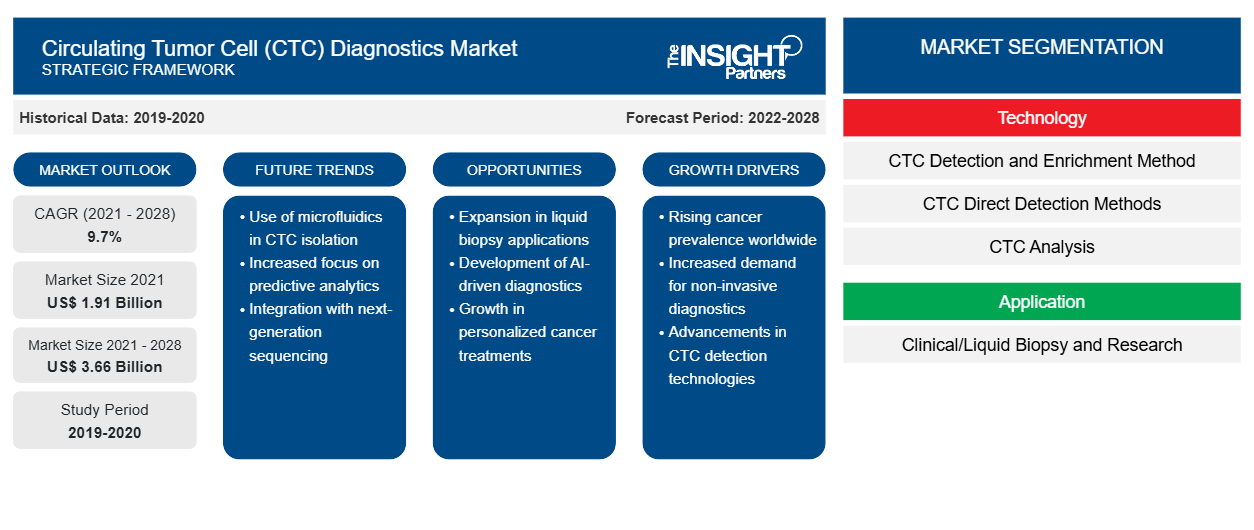

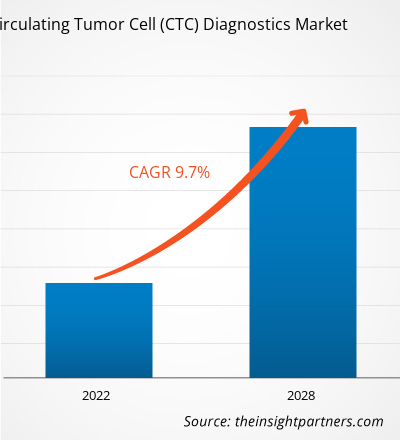

The circulating tumor cell (CTC) diagnostics market is projected to reach US$ 3,656.38 million by 2028 from US$ 1,909.41 million in 2021; it is estimated to grow at a CAGR of 9.7% from 2021 to 2028.

Circulating tumor cells (CTCs) have tremendous potential in diagnosing and treating cancer. Many techniques have been developed and are under continuous improvement to enhance their efficacy of CTC detection, isolation, enrichment, and analysis. Mostly used approach for CTC detection and isolation is immune-based detection, whereby antibodies selectively bind cell surface antigens. Tumor cells express different cell surface markers than blood cells and are separated from the circulatory cells. CTCs help detect minor subgroups of cells present in the primary tissue, which might eventually cause treatment resistance or relapse of the disease. Hence, detecting and characterizing CTCs can become an inevitable step in treating solid tumor malignancies.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Circulating Tumor Cell (CTC) Diagnostics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Circulating Tumor Cell (CTC) Diagnostics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

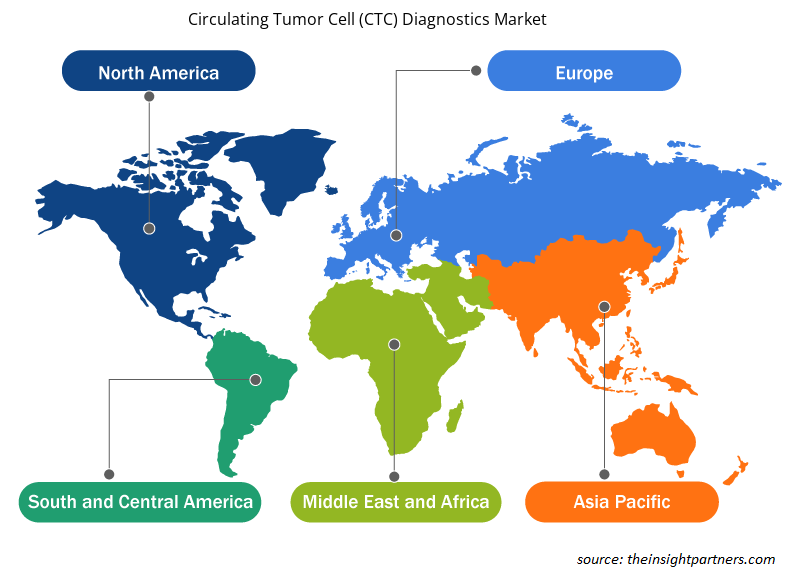

The circulating tumor cell (CTC) diagnostics market is segmented on the basis of technology, application, end-user, and geography. The market, by geography, is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The report offers insights and in-depth analysis of the market, emphasizing parameters such as market trends, technological advancements, and market dynamics, along with the analysis of the competitive landscape of the globally leading market players.

Market Insights

Rising Demand for Minimally Invasive Diagnostic Procedures to Drive Circulating Tumor Cell (CTC) Diagnostics Market Growth during Forecast Period

There is a growing preference for minimally invasive or noninvasive procedures among patients for diagnostic purposes. Early cancer detection, mutation detection, tumor monitoring throughout treatment, and recurrence monitoring are possible using circulating tumor cell diagnostics, which uses a noninvasive method. Researchers can trace all epigenetic and genetic changes in solid tumors using blood samples with circulating tumor cells. Patients are at a lesser risk with these tests, and clinicians can readily perform them multiple times. Patients prefer minimally invasive procedures because the advanced instruments used in such procedures allow for more delicate and complex work to be performed with lower risk, less pain, and less scarring.

Due to technological advancements in feasibility and processing times, circulating tumor cell diagnostics and liquid biopsy have recently attracted considerable interest as a noninvasive alternative to tissue biopsy in cancer patients. Liquid biopsy adoption will be aided by an increased understanding of improved minimally invasive cancer detection technologies. The market growth will be influenced by rising demand for noninvasive tools and laboratory acceptance of CTCs tests and liquid biopsy. A liquid biopsy is a noninvasive and simple alternative to surgical biopsies that allows doctors to discover a range of information about tumors from a simple blood sample. Blood tests are painless, noninvasive, bear no risks, and cut down the cost and time to diagnose a problem. In addition, CTCs, cfDNAs, exosomes, and microvesicles can be detected in a blood sample, making blood-based liquid biopsies more popular. Thus, the increased demand for minimally invasive diagnostic tests is spurring the market growth.

Technology Insights

Based on technology, the global circulating tumor cell (CTC) diagnostics market is segmented into CTC detection and enrichment method, CTC direct detection methods, and CTC analysis. In 2020, the CTC detection and enrichment segment held the largest share of the market. Moreover, the same segment is expected to register the highest CAGR in the market during 2021–2028. With the help of CTC diagnostics, individuals can be diagnosed early. Therefore, the adaption of these technologies is increasing, which is expected to drive the market during the forecast period.

Application Insights

Based on application, the global circulating tumor cell (CTC) diagnostics market is bifurcated into clinical/liquid biopsy and research. In 2020, the research segment held a larger share of the market and the same segment is expected to register a higher CAGR in the market during 2021–2028. Owing to the rise in the detection and diagnosis of various medical conditions across the globe, the market is expected to grow in the future.

End-User Insights

Based on end-users, the circulating tumor cell (CTC) diagnostics market is segmented into hospital and clinics, research and academic institutes, and diagnostic centers. The research and academic institutes segment held the largest market share in 2021 and is expected to register the highest CAGR in the market during the forecast period. The increasing research on cancer diagnosis and therapeutic development, growing awareness related to cancer diagnosis, and high investment from government and other enterprises are a few of the critical factors supporting the market growth for the Research and Academic Institutes segment.

Product launches, and mergers and acquisitions are highly adopted strategies by the global circulating tumor cell (CTC) diagnostics market players. A few of the recent key market developments are listed below:

- In January 2022, Thermo Fisher Scientific Inc. announced the complete acquisition of PeproTech for a total cash purchase price of approx. US$ 1.85 billion.

- In December 2021, Epic Sciences, Inc. announced the launch of DefineMBC, a novel metastatic breast cancer (MBC) test that includes both cell-based and cell-free analysis from a single blood draw.

The COVID-19 pandemic had a negative impact on the people suffering from cancer and cancer surveillance capacities. Also, due to the pandemic, reduced resources and availability to care made cancer detection and treatment difficult, resulting in higher mortality, and lower survival. Due to a compromised immune system caused by cancer and/or its treatment, cancer patients are susceptible to infectious pathogens (e.g., surgery and chemotherapy). This has raised fears that COVID-19 problems and mortality may be common in cancer patients. Thus, the pandemic negatively impacts the circulating tumor cell (CTC) diagnostics market.

Circulating Tumor Cell (CTC) Diagnostics Market Regional Insights

The regional trends and factors influencing the Circulating Tumor Cell (CTC) Diagnostics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Circulating Tumor Cell (CTC) Diagnostics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Circulating Tumor Cell (CTC) Diagnostics Market

Circulating Tumor Cell (CTC) Diagnostics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1.91 Billion |

| Market Size by 2028 | US$ 3.66 Billion |

| Global CAGR (2021 - 2028) | 9.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Circulating Tumor Cell (CTC) Diagnostics Market Players Density: Understanding Its Impact on Business Dynamics

The Circulating Tumor Cell (CTC) Diagnostics Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Circulating Tumor Cell (CTC) Diagnostics Market are:

- Thermo Fisher Scientific Inc.

- STEMCELL Technologies Inc.

- QIAGEN

- Precision Medicine Group, LLC.

- Advanced Cell Diagnostics, Inc. (BIO-TECHNE CORPORATION)

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Circulating Tumor Cell (CTC) Diagnostics Market top key players overview

Circulating Tumor Cell (CTC) Diagnostics Market Segmentation

The global circulating tumor cell (CTC) diagnostics market is segmented on the basis of technology, application, end-user, and geography. In terms of technology, the market is segmented into CTC detection and enrichment method, CTC direct detection methods, and CTC analysis. Based on application, the global circulating tumor cell (CTC) diagnostics market is bifurcated into clinical/liquid biopsy and research. Based on end-users, the circulating tumor cell (CTC) diagnostics market is segmented into hospital and clinics, research and academic institutes, and diagnostic centers. The market, by geography, is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South and Central America.

Company Profiles

- Thermo Fisher Scientific Inc.

- STEMCELL Technologies Inc.

- QIAGEN

- Precision Medicine Group, LLC.

- Advanced Cell Diagnostics, Inc. (BIO-TECHNE CORPORATION)

- Epic Sciences

- ScreenCell

- Ikonisys, Inc.

- IVDiagnostics

- Fluxion Biosciences Inc0

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

A Circulating Tumor Cell (CTC) is a cell that shed into lymphatics from the primary tumor and carried out throughout the body with blood circulation. Circulating tumor cells are the seeds for growth and metastases for additional tumors in distant organs and is responsible for majority of cancer related deaths. The diagnosis, detection and analysis of CTC can assist in patients’ prognoses determine appropriate tailored treatments for the patients. The CTC diagnosis has a lot of advantages for traditional diagnostic procedures. The advantages of CTC detection include, it is non-invasive, effective and can be used repeatedly. The CTC detection and enrichment, CTC direct detection and CTC analysis are the technologies used for CTC detection.

Key factors that are driving the growth of this market are increasing prevalence of cancer across the globe along with rising demand for minimally invasive diagnostic procedures.

The CTC detection and enrichment method segment dominated the global circulating tumor cell (CTC) diagnostics market and held the largest revenue share of 62.85% in 2021.

The research segment dominated the global circulating tumor cell (CTC) diagnostics market and accounted for the largest revenue share of 67.65% in 2021.

Global circulating tumor cell (CTC) diagnostics market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa and South & Central America. In North America, the U.S. is the largest market for sleep apnea diagnostics. The market growth in the country is attributed to the factors such as most foreign companies in the healthcare sector have R&D centres in the United States. Moreover, the increase in prevalence of cancer in the country along with various organic and inorganic developments done by the companies. And, Asia Pacific is the fastest-growing region growing at the CAGR of 10.3% during the forecast period.

The circulating tumor cell (CTC) diagnostics market majorly consists of the players such as Thermo Fisher Scientific, Stemcell Technologies, Inc, QIAGEN, Precision Medicine Group, LLC, Advanced Cell Diagnostics (Bio-Techne Corporation), Epic Lifesciences, Screencell, Ikonisys, Inc, IV Diagnostics, Fluxion Biosciences, among others

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Circulating Tumor Cell (CTC) Diagnostics Market

- Thermo Fisher Scientific Inc.

- STEMCELL Technologies Inc.

- QIAGEN

- Precision Medicine Group, LLC.

- Advanced Cell Diagnostics, Inc. (BIO-TECHNE CORPORATION)

- Epic Sciences

- ScreenCell

- Ikonisys, Inc.

- IVDiagnostics

- Fluxion Biosciences Inc.

Get Free Sample For

Get Free Sample For