The clear aligners market size is projected to reach US$ 21,755.94 million by 2031 from US$ 6,600.00 million in 2024. The market is expected to register a CAGR of 18.8% during 2025–2031. The development of customized grafts is likely to bring in new market trends during the forecast period.

Clear Aligners Market Analysis

The prevalence of dental and oral conditions such as crooked teeth, overbites, underbites, crossbites, spaces between teeth, teeth overcrowding, and temporomandibular disorders (TMD) is increasing the use of clear aligners, subsequently propelling the market growth. Factors causing dental problems include periodontal diseases, injuries, and accidents. As per an article published in Reuters 2022, approximately 3.5 billion people worldwide are affected by oral diseases, with untreated dental caries (tooth decay) impacting nearly 2.5 billion individuals. According to the American Association of Orthodontists, in 2022, approximately 3.15 million patients aged 8 to 17 were undergoing orthodontic treatment in the US, representing ~7.4% of the population in this age group. As per the BMC Oral Health 2025, the number of adults receiving orthodontic treatment in the US increased from 1.55 million in 2016 to an estimated 1.61 million in 2018.

Clear Aligners Market Overview

The clear aligners market is expanding due to rising aesthetic preferences, advances in technology, growing awareness of oral health, increasing disposable income, and integration of teleorthodontics and remote monitoring. Customizable clear aligners that cater to individual preferences and dental conditions can be a major opportunity in the future.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

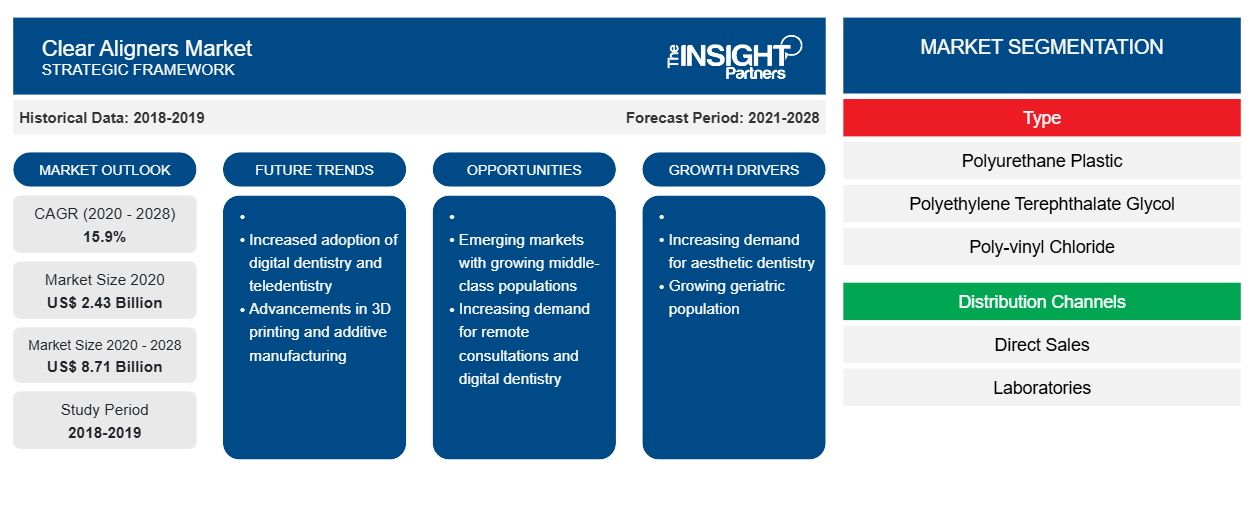

Clear Aligners Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Clear Aligners Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Clear Aligners Market Drivers and Opportunities

Increasing Prevalence of Malocclusions Among Children

People with malocclusion traits, including maxillary overjet, anterior irregularities, and anterior spacing, have a poor dental appearance and masticatory performance. As per the Dental Tribune International 2025, malocclusion is among the most prevailing clinical dental conditions, affecting approximately 60 to 75 % of the global population. Annually, ~21 million people globally elect treatment by orthodontists. As per prevalence, malocclusion is ranked third, after tooth decay and periodontal disease registered globally. Malocclusion is more prevalent among children with autism spectrum disorder (ASD). Posterior crossbite, grown overjet, and adverse maxillary crowding were the most widely diagnosed malocclusion traits in children.

According to Elsevier B.V.data, the prevalence of severe deep overbite was ~8% in the US, with the average overbite ranging from 36.5% to 39.2% in children between the ages of 5 and 6. In a study published in the National Center for Biotechnology Information (NCBI), an analysis of occlusion in some groups of adolescents between the ages of 12 and 18 was performed. According to the study, more than 93% of the subjects confirmed some form of malocclusion. The prevalence of malocclusion was higher in European adolescents. As per the data of the National Center for Biotechnology Information (NCBI) 2021, the cases of class I (34.9%) and class II, division 1 malocclusions (40.0%) were higher. Increased malocclusion (18%), reduced bites (14%), increased (25.1%), and reversed overjet (10%) were reported in the population. As per the data of PeerJ Journal published in 2019, a high prevalence of Angle Class II, namely 38.2%, was reported among 12 to 15-year-old adolescents in Japan. Anterior crowding was more dominant among girls than boys. Thus, the rising incidence of malocclusions in teenagers is increasing the use of clear aligners, thereby propelling market growth.

Rising Demand for Aesthetic Dental Procedures

Dental cosmetic surgery is among the most common cosmetic procedures worldwide. The American Academy of Cosmetic Dentistry (AACD) is the primary dental resource for patients as they attempt to maintain their health function and look for their lifetime. According to the American Society for Plastic Surgery (ASPS) 2022, cosmetic dentistry experienced a recent boom, with a 47% increase in procedures demanded by people aged 51 to 64. As per the GlobeNewswire 2025, nearly 30 million cosmetic dental procedures are performed annually worldwide, encompassing treatments from tooth whitening to complex full-mouth reconstructions. Aesthetic procedures are no longer restricted to only the rich and famous. The middle-class population in North America is undergoing these procedures due to the growing urge to have enhanced aesthetic appeals. The easy accessibility of surgical dental procedures contributes to the adoption of clear aligners.

The cost of a dental cosmetic procedure is less in Mexico. The difference in the price of the average cosmetic dentist procedure and a top cosmetic dentist procedure in the country is ~US$ 50 to US$ 150 per crown or veneer. Dentists in Mexico provide crowns that are less costly and made in laboratories with high-quality materials. Asian countries are working toward cosmetic procedures with lower costs and advanced methods. Thailand, Singapore, India, and Malaysia are among the top destinations for dental cosmetic procedures. Patients come from developed countries such as the US and UK to choose Singapore for their treatment. There are dental spas present in these countries that offer innovative dental treatment and procedures for the patients. For instance, Bangkok Dental Spa (located in Bangkok, Thailand) provides dental services for overseas patients. Thus, the cost-effectiveness of dental cosmetic procedures fuels the utilization of clear aligners and drives market growth.

Clear Aligners Market Report Segmentation Analysis

Key segments that contributed to the derivation of the clear aligners market analysis are type, age group, and end user.

- Based on type, the clear aligners market is segmented into polyurethane plastic, polyethylene terephthalate glycol (PETG), polyvinyl chloride (PVC), and others. The polyurethane plastics segment held the largest share of the clear aligners market in 2024.

- In terms of age group, the market is bifurcated into adults and pediatrics. The adults segment held the largest share in the clear aligners market in 2024.

- By end user, the market is segmented into hospitals & retail pharmacies, online channel, and others. The hospitals and retail pharmacies segment held the largest share of the clear aligners market in 2024.

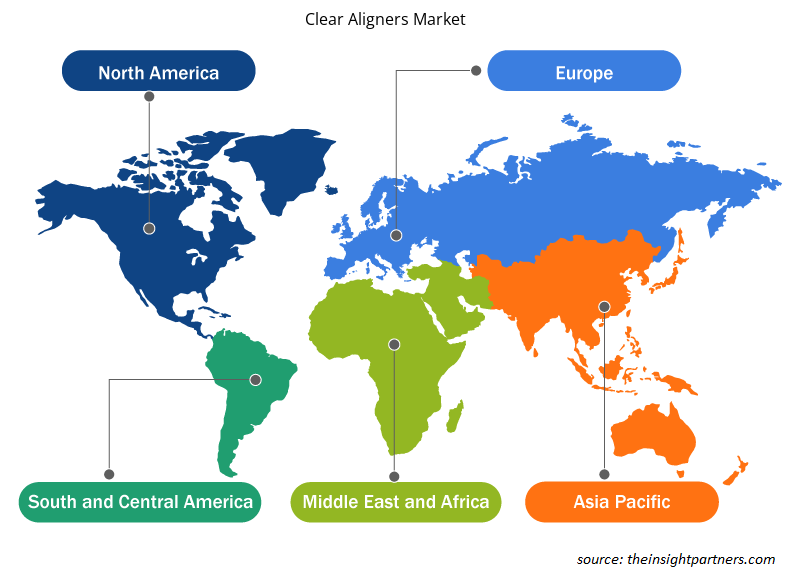

Clear Aligners Market Share Analysis by Geography

The geographic scope of the clear aligners market report mainly focuses on five regions: North America, Asia Pacific, Europe, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the market in 2024. It is expected to continue its dominance in the market during the forecast period. The US represents a significant portion of the clear aligners market, with a notable number of procedures performed annually. According to the Dentistry and Oral Health Care study published in Biores Scientia Journal in 2023, in the US, nearly 30% of people have normal occlusion, and the prevalence of Class I malocclusion was between 50–55%. The increasing prevalence of malocclusion is fueling the demand for clear aligners due to their aesthetics, comfort, and convenience than traditional metal braces. The clear aligners are virtually invisible and removable, making them a more attractive option for adults and teens who seek to straighten their teeth without the visibility and inconvenience of traditional orthodontics. Additionally, they offer the convenience of fewer office visits compared to traditional braces, which require regular adjustments. Key players implementing strategic initiatives such as product launches, product approvals, and collaborations fuel the market growth. In May 2024, OrthoFX launched a new generation of advanced clear aligner polymers, NiTime Clear Aligners. It is the first and only clear aligner system explicitly designed for shorter wear time approved by the US Food and Drug Administration (FDA) 510(k) and is available nationwide for doctors treating all classes of dental malocclusions.

Clear Aligners Market Regional Insights

The regional trends and factors influencing the Clear Aligners Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Clear Aligners Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Clear Aligners Market

Clear Aligners Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 6,600.00 Million |

| Market Size by 2031 | US$ 21,755.94 Million |

| Global CAGR (2025 - 2031) | 18.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

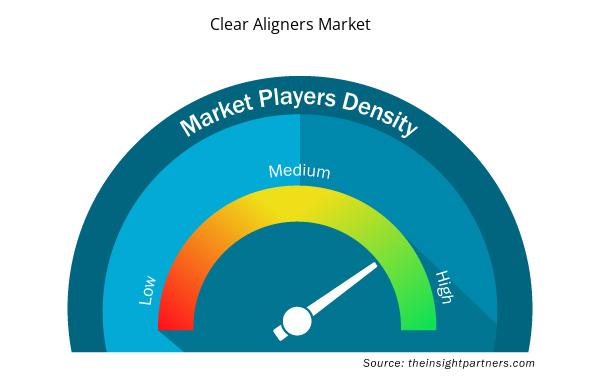

Clear Aligners Market Players Density: Understanding Its Impact on Business Dynamics

The Clear Aligners Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Clear Aligners Market are:

- Align Technology Inc.

- Dentsply Sirona

- Danaher

- Institut Straumann AG

- 3M

- Henry Schein Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Clear Aligners Market top key players overview

Clear Aligners Market News and Recent Developments

The clear aligners market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. Below are a few of the key developments witnessed in the clear aligners market:

- Henry Schein UK launched Smilers and Smilers Expert, twin aligner solutions aimed at general dental practitioners and orthodontists. According to Henry Schein, the products provide customizable treatment for malocclusion that empowers dental practitioners to deliver premium orthodontic care. (Source Henry Schein UK, February 2025)

- Align Technology, Inc. announced that it has received CE Mark in Europe under the Medical Device Regulation (MDR 2017/745) for Align’s Invisalign Palatal Expander System. The Invisalign Palatal Expander System has completed registration with MHRA for the United Kingdom and overseas territories. (Source: Align Technology, Inc., Press Release, November 2024)

Clear Aligners Market Report Coverage and Deliverables

The "Clear Aligners Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Clear aligners market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Clear aligners market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Clear aligners market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the clear aligners market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type , Distribution Channels , and Age

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America dominated the market in 2024.

The rising incidence of dental disorders and increasing prevalence of malocclusions among children are significant factors fueling the market growth.

The clear aligners market value is expected to reach US$ 21,755.94 million by 2031.

The growing digitization of CAD/CAM technology is likely to emerge as a new growth trend in the market in the coming years.

Align Technology Inc., Dentsply Sirona, Danaher, Institut Straumann AG, 3M, Henry Schein Inc., TP Orthodontics Inc., DynaFlex, Great Lakes Dental Technologies, and SCHEU DENTAL GmbH are among the key players operating in the market.

The market is expected to register a CAGR of 18.8% during 2024–2031.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Clear Aligners Market

- Align Technology Inc.

- Dentsply Sirona

- Danaher

- Institut Straumann AG

- 3M

- Henry Schein Inc.

- TP Orthodontics Inc.

- DynaFlex

- Great Lakes Dental Technologies

- SCHEU DENTAL GmbH

Get Free Sample For

Get Free Sample For