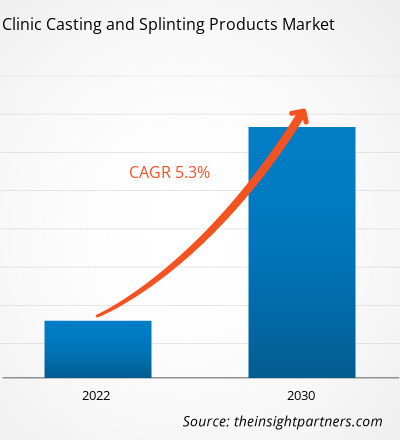

The clinic casting and splinting products market size is projected to reach US$ 2,085.57 million by 2030 from US$ 1,383.42 million in 2022. The market is expected to register a CAGR of 5.3% during 2022–2030. The use of fiberglass and polyester material in casting and splinting offers high patient compliance in terms of easy removal, smooth lamination, and enhanced X-ray transparency that are likely to remain key trends in the market.

Clinic Casting and Splinting Products Market Analysis

Casts and splints are hard bandages used to protect and support injured bones, tendons, ligaments, and other tissues. The growing demand for casting and splinting products is because of the increasing number of traumatic injuries in accidents thereby leading to market growth. Technological breakthroughs, including advances in automation and artificial intelligence, are revolutionizing production processes, leading to greater efficiency and lower costs. Additionally, the growing number of e-commerce and digital platforms is expanding market reach and facilitating convenient access for consumers worldwide.

Clinic Casting and Splinting Products Market Overview

The rising number of musculoskeletal problems resulting from sports and adventure injuries have, increased the demand for casts and splinting products thereby boosting market growth. In addition, the increasing number of musculoskeletal injuries due to traffic accidents is a crucial factor for growth. Additionally, companies are increasingly focusing on sustainability initiatives such as carbon footprint reduction, recycling initiatives, and the use of eco-friendly materials to meet growing consumer demand for eco-friendly products. Additionally, with the proliferation of online shopping, e-commerce has become a dominant force in the clinical cast and splint products market. Companies are investing in robust e-commerce strategies to reach wider audiences and improve customer experiences.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Clinic Casting and Splinting Products Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Clinic Casting and Splinting Products Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Clinic Casting and Splinting Products Market Drivers and Opportunities

High Prevalence of Age-Related Orthopedic Disorders

Arthritis, osteoarthritis, rheumatoid arthritis, bursitis, elbow pain, and fractures are among the most common orthopedic disorders. Among these, arthritis, osteoporosis, and fractures are a few common problems faced by older people. Osteoporosis is one of the most common bone system diseases that is linked to a high risk of bone fracture, resulting in various complications in the patients. The prevalence of osteoporosis is expected to increase with age and has therefore become a serious problem among the elders. According to a study by National Library of Medicine, in 2020, the prevalence of osteoporosis among elders in Spain and China was 39.3% and 39.4%, respectively. The World Health Organization (WHO) recognizes osteoporosis as the second largest global healthcare problem. According to UN DESA’s Population Division, the number of individuals aged 65 years and above is estimated to increase from 761 million in 2021 to 1.6 billion by 2050. Therefore, the rising prevalence of orthopedic disorders among the aged population propels the demand for casting and splinting products.

Advancements in 3D Technology for Casting and Splinting Products

The rapid development of 3D printing implies fast penetration 3D printing techniques into the healthcare system, especially for treating fractures. In rehabilitation tool manufacturing, 3D printing technology is applied to orthopedic cast fabrication to create patient-specific features with an appropriate fit and a ventilated structure. 3D printing makes the fabrication process simpler and in shorter period, especially in a customized design. On that account, the application of 3D printing in biomedical engineering is growing and promising to be practiced in the future. Also, the customizable hand cast made by using 3D printing technique is reliable and provides comfort and satisfaction to the patients. The 3D-printed cast proved to be superior in terms of satisfaction, comfort, and perceived function as compared to the fiberglass. Thus, the above-mentioned factors would create significant opportunities for the clinic casting and splinting products market in the coming years.

Clinic Casting and Splinting Products Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Clinic Casting and Splinting Products market analysis are product, application, and material.

- Based on product, the clinic casting and splinting products market is bifurcated into casting and splinting. The casting segment held the largest market share in 2022 because when it comes to serious fractures, orthopedic casts are usually the best option and they are typically made from stronger materials than splints, making them more durable and less likely to break or come loose. However, splinting segment is expected to register highest CAGR during the forecast period.

- By application, the market is segmented into acute fractures or sprains, tendon and ligament injuries, and others. The acute fractures or sprains segment held the largest share of the market in 2022 and is anticipated to register highest CAGR during 2020–2030.

- Based on material, the clinic casting and splinting products market is segmented into fiberglass, plaster of Paris, and others. The plaster of Paris segment held the largest market share in 2022. However, fiberglass segment is expected to register highest CAGR during the forecast period.

Clinic Casting and Splinting Products Market Share Analysis by Geography

The geographic scope of the clinic casting and splinting products market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the clinic casting and splinting products market. Factors leading to the growth of the clinic casting and splinting products market in North America are the rising rates of musculoskeletal injuries and growing geriatric population and associated orthopedic disorders. In addition, the reimbursement regulations in the region also enable access to pricey casting and splinting equipment, supporting market growth. In North America the US held the largest market share in 2023. As per the United States Bone and Joint Initiative (USBJI), in the US approximately three out of four people 65 and over and one in every two persons 18 and above is affected by musculoskeletal diseases. Corresponding to the data by the Centers for Disease Control and Prevention (CDC), the number of adults 65 or above is anticipated to reach 80.8 million and 94.7 million by 2040 and 2060 respectively, which would make up nearly 25% of the US population. Thus, the rising prevalence of musculoskeletal conditions and osteoporosis will boost the demand for casting and splinting products in the US.

Clinic Casting and Splinting Products Market Regional Insights

The regional trends and factors influencing the Clinic Casting and Splinting Products Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Clinic Casting and Splinting Products Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Clinic Casting and Splinting Products Market

Clinic Casting and Splinting Products Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,383.42 Million |

| Market Size by 2030 | US$ 2,085.57 Million |

| Global CAGR (2022 - 2030) | 5.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

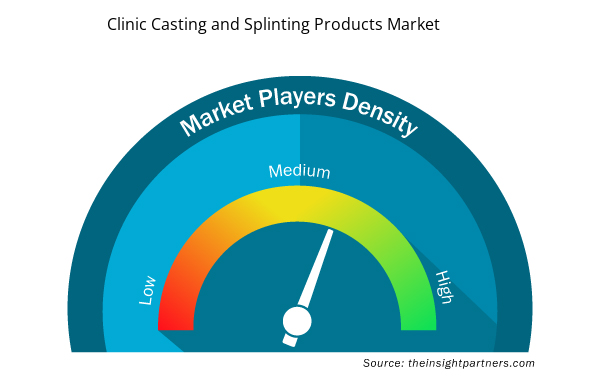

Clinic Casting and Splinting Products Market Players Density: Understanding Its Impact on Business Dynamics

The Clinic Casting and Splinting Products Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Clinic Casting and Splinting Products Market are:

- DeRoyal Industries

- Prime Medical Inc

- 3M Co

- Corflex Inc

- Essity AB

- Ossur hf

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Clinic Casting and Splinting Products Market top key players overview

Clinic Casting and Splinting Products Market News and Recent Developments

The clinic casting and splinting products market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the clinic casting and splinting products market are listed below:

- 3M Health Care launched the Scotchcast One-Step Splint, a lightweight and breathable splint designed to immobilize fractures and other injuries. The splint can be applied in a single step and easily removed for re-adjustment. (Source: 3M, Press Release, July 2021)

- Össur Americas acquired College Park Industries, a prosthetic feet, ankles, and knees manufacturer. The acquisition aimed to expand Össur Americas' product offerings in the prosthetics market. (Össur, Press Release, June 2020)

Clinic Casting and Splinting Products Market Report Coverage and Deliverables

The “Clinic Casting and Splinting Products Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Clinic casting and splinting products market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Clinic casting and splinting products market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Clinic casting and splinting products market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the clinic casting and splinting products market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Application, and Material

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

5.3% is the CAGR of the clinic casting and splinting products market.

US$ 2.20 billion would be the estimated value of the clinic casting and splinting products market by 2031.

Dynatronics Corporation and DeRoyal Industries are the leading players operating in the clinic casting and splinting products market.

Advances in casting and casting materials related to fiberglass is likely to act as future trends for the clinic casting and splinting products market.

The rising prevalence of musculoskeletal conditions and high prevalence of age-related orthopedic disorders are the driving factors impacting the clinic casting and splinting products market.

The North America region dominated the clinic casting and splinting products market in 2023.

Get Free Sample For

Get Free Sample For