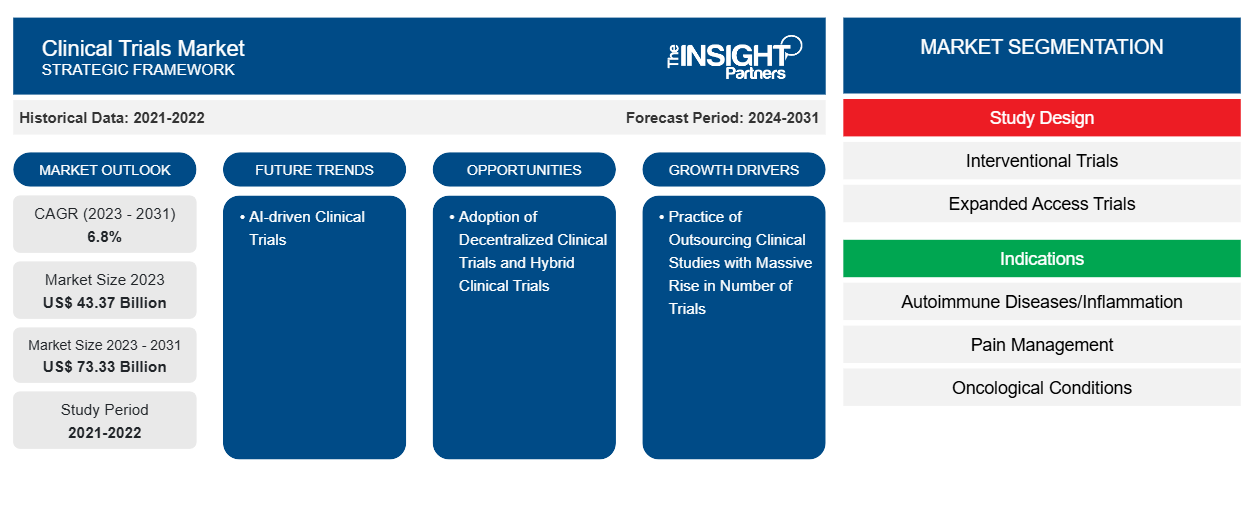

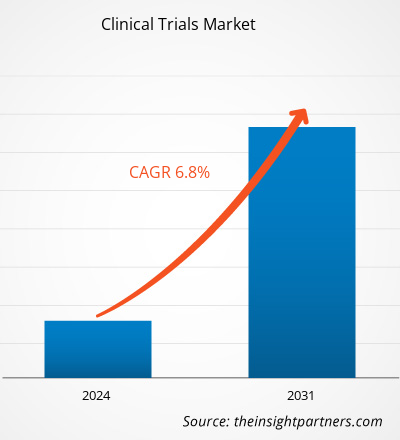

The clinical trials market size is projected to reach US$ 73.33 billion by 2031 from US$ 43.37 billion in 2023. The market is expected to register a CAGR of 6.8% during 2023–2031. AI-driven clinical trials is likely to act as a future trend in the market in the coming years.

Clinical Trials Market Analysis

The clinical trial market is mainly driven by continuous efforts made by pharmaceutical, biotechnology, and medical device companies for product innovations. Other factors contributing to the market progress include the globalization of clinical trials, rapid advancements in associated technologies, and an increase in demand for CROs for conducting clinical trials. Further, conferences such as "Global Clinical Trials Connect 2022" offer companies in this marketplace a platform to get acquainted with advancements in clinical trials and clinical research.

Clinical Trials Market Overview

Increasing strategic initiatives by companies such as product launches, mergers and acquisitions, partnerships, and geographic expansions benefit the clinical trials market. In September 2023, ICON plc released its next-generation Clinical Trial Tokenisation solution. Combining its proprietary tokenization engine, access to real-world data, and advanced clinical analytics expertise, ICON now delivers a cohesive and seamless operational model, providing valuable, long-term insights on drug safety and efficacy throughout the product development lifecycle. In February 2023, Labcorp announced its plans to form a new company—Fortrea—following the planned spin-off of its Clinical Development business. Upon completion of the spin-off from Labcorp, Fortrea will operate as an independent, publicly traded global CRO to offer comprehensive drug and medical device development services.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Clinical Trials Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Clinical Trials Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Clinical Trials Market Drivers and Opportunities

Practice of Outsourcing Clinical Studies with Massive Rise in Number of Trials Fuels Market

Clinical trials are conducted to determine if a new form of medical product, i.e., a drug, diet, or medical device, is safe and effective. The trials are mainly a part of the overall drug development process. According to the National Library of Medicine (NLM), ~52,000 new studies were registered with NLM (ClinicalTrials.gov) in 2020, and the number increased to ~58,000 in 2023. In January 2023, the NLM reported 38,837 active clinical trials in the US and 105,172 active trials worldwide. According to the European Medicine Agency, in the European Union (EU), ~4,000 clinical trials are authorized annually, of which about 60% of studies are associated with the pharmaceutical industry. An upsurge in the number of clinical trials can be attributed to the rising prevalence of chronic diseases worldwide, which creates an immense demand for more effective treatments.

The increasing complexity of clinical trials adds to the cruciality of the proper execution and overseeing of operations carried out in research-based organizations. To avoid errors due to improper execution, many research-based organizations outsource clinical trials to clinical research organizations (CROs). CROs assist in successfully implementing clinical trials through the services they offer from their high-quality facilities and deep subject matter expertise. They have gradually become a backbone of the clinical trial industry through their efficient and cost-effective operations that benefit trial sponsors. According to a blog published by Thermo Fisher Scientific, in 2022, CROs executed ~3 out of 4 clinical trials to reassure the clinical programs of drug developers, provide a wealth of expertise, drive time and cost efficiencies, and deliver customized, high-quality data. Thus, the increasing number of clinical trials, and the practice of outsourcing trials to CROs to boost cost-effectiveness and reduce errors are the major factors driving the clinical trials market growth.

Adoption of Decentralized Clinical Trials and Hybrid Clinical Trials to Offer Opportunities for Market

Subjects enrolled in decentralized clinical trials (DCT) do not need to access hospital-based trial sites frequently. In DCTs, digital technologies are used to enable remote data collection and monitoring, along with streamlined communications between investigators and participants. A hybrid clinical trial approach combines home-based and on-site activities, bringing the best patient experience and meeting complex protocol regimes, gaining traction across various therapeutic areas and trial phase journeys. Challenges such as patient privacy, data security, regulatory barriers, and complex protocol regimes hindered the adoption of DCTs in the past. However, the COVID-19 pandemic compelled the sponsors of clinical trials to adopt decentralized and hybrid clinical techniques for developing drugs, as in-person studies were not feasible amid the health crisis. With restrictions imposed on commute, the only way to gather data and keep trials going was to work remotely and make optimal use of technologies to accelerate processes. According to the data provided by McKinsey, ~70% of the potential participants for clinical trials reside away from trial sites. Therefore, decentralization broadens trial access to reach a more significant number of subjects, consisting of potentially a more diverse pool of patients. Hybrid clinical trials allow sponsors to strategically incorporate DCT elements into study designs. These trial models offer unprecedented flexibility; thus, more companies are showing interest in hybrid trials, which is redefining the industry landscape. According to ObvioHealth, the FDA had plans to unveil protocols to support the use of DCT methods in 2023 to enhance the credibility of future clinical research. Thus, the increasing focus on using decentralized and hybrid clinical trials over traditional clinical trial methods is expected to provide lucrative opportunities for the clinical trials market during the forecast period.

Clinical Trials Market Report Segmentation Analysis

Key segments that contributed to the derivation of the clinical trials market analysis are study design, indications, and phase.

- Based on study design, the clinical trials market is bifurcated into interventional trials and expanded access trials. The interventional trials segment held a larger market share in 2023.

- By indication, the market is segmented into cardiovascular diseases, oncological conditions, neurological disorders, autoimmune diseases/inflammation, pain management, diabetes, obesity, metabolic disorders, and others. The oncological conditions segment held the largest market share in 2023.

- Based on phase, the clinical trials market is divided into Phase I, Phase II, and Phase III. The Phase II segment held the largest market share in 2023.

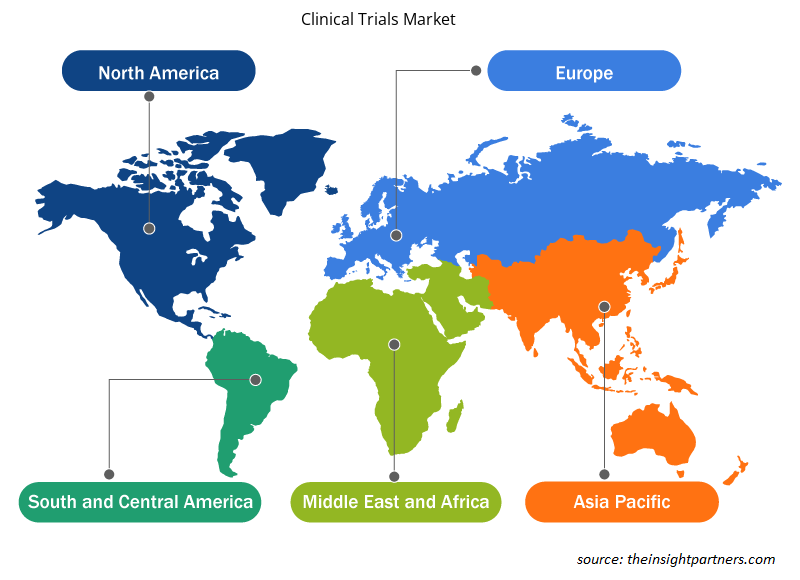

Clinical Trials Market Share Analysis by Geography

The geographic scope of the clinical trials market report is mainly divided into five regions: North America, Asia Pacific, Europe, South & Central America, and the Middle East & Africa. North America dominated the market in 2023. The US is the largest and fastest-growing market for clinical trials. The US is emerging as a leading clinical research destination, and various companies are offering innovative clinical trial services. The US has become a leading clinical research destination. Nearly half of the clinical trials are conducted in the US. Additionally, most pharmaceutical research companies prefer to conduct clinical trials in the country due to established medical infrastructure, rapid approval timelines, a favorable regulatory framework, and accepted clinical trial-generated data globally. A World Health Organization (WHO) report states that the US had the highest number of clinical trials, with 157,618 trials in 2021.

Clinical Trials Market Regional Insights

The regional trends and factors influencing the Clinical Trials Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Clinical Trials Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Clinical Trials Market

Clinical Trials Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 43.37 Billion |

| Market Size by 2031 | US$ 73.33 Billion |

| Global CAGR (2023 - 2031) | 6.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Study Design

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Clinical Trials Market Players Density: Understanding Its Impact on Business Dynamics

The Clinical Trials Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Clinical Trials Market are:

- IQVIA Holdings Inc

- Parexel International Corporation

- IXICO Plc

- Charles River Laboratories Inc

- ICON Plc

- WuXi AppTec Co Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Clinical Trials Market top key players overview

Clinical Trials Market News and Recent Developments

The clinical trials market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- Oracle announced new capabilities in Oracle Clinical One Randomization and Trial Supply Management (RTSM). With new enhancements for use, access, and regionalization, Clinical One RTSM users can address dynamic, country-specific regulatory requirements, and gain speed, reliability, and transparency in trials from commencement to closeout. (Source: Oracle Corp, Company Website, May 2024)

- Parexel and Palantir Technologies Inc., a leading builder of artificial intelligence (AI) systems, entered into a multiyear strategic partnership to leverage AI to aid in enhanced, accelerated, safe, and effective clinical trials worldwide. Under this collaboration, Parexel leverages Palantir's Foundry and Artificial Intelligence Platform (AIP) to power its clinical data platform focused on driving clinical trial efficiency while maintaining the highest level of safety and regulatory rigor. (Source: Parexel International Corp, Company Website, April 2024)

Clinical Trials Market Report Coverage and Deliverables

The "Clinical Trials Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Clinical trials market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Clinical trials market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Clinical trials market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the clinical trials market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Study Design, Phase, and Indication

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

IQVIA Holdings Inc, Parexel International Corporation, IXICO Plc, Charles River Laboratories Inc, ICON Plc, WuXi AppTec Co Ltd, SGS SA, Syneos Health Inc, SIRO Clinpharm Private Limited, Thermo Fisher Scientific Inc, Laboratory Corp of America Holdings, CliniRx, Caidya, Oracle Corp, and Medpace are among the key players in the market.

AI-driven clinical trials are expected to emerge as a prime trend in the market in the coming years.

The clinical trials market value is expected to reach US$ 73.33 billion by 2031.

The market is expected to register a CAGR of 6.8% during 2023–2031.

North America dominated the market in 2023.

The practice of outsourcing clinical studies with a massive rise in the number of trials and the flourishing pharmaceutical industry with a surge in R&D activities are among the most significant factors fueling the market growth.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Clinical Trials Market

- IQVIA Holdings Inc

- Parexel International Corp

- IXICO Plc

- Charles River Laboratories International Inc

- ICON Plc

- WuXi AppTec Co Ltd,

- SGS SA

- Syneos Health Inc

- SIRO Clinpharm Pvt Ltd

- Thermo Fisher Scientific Inc

Get Free Sample For

Get Free Sample For