Clock Buffer Market Key Players and Opportunities by 2028

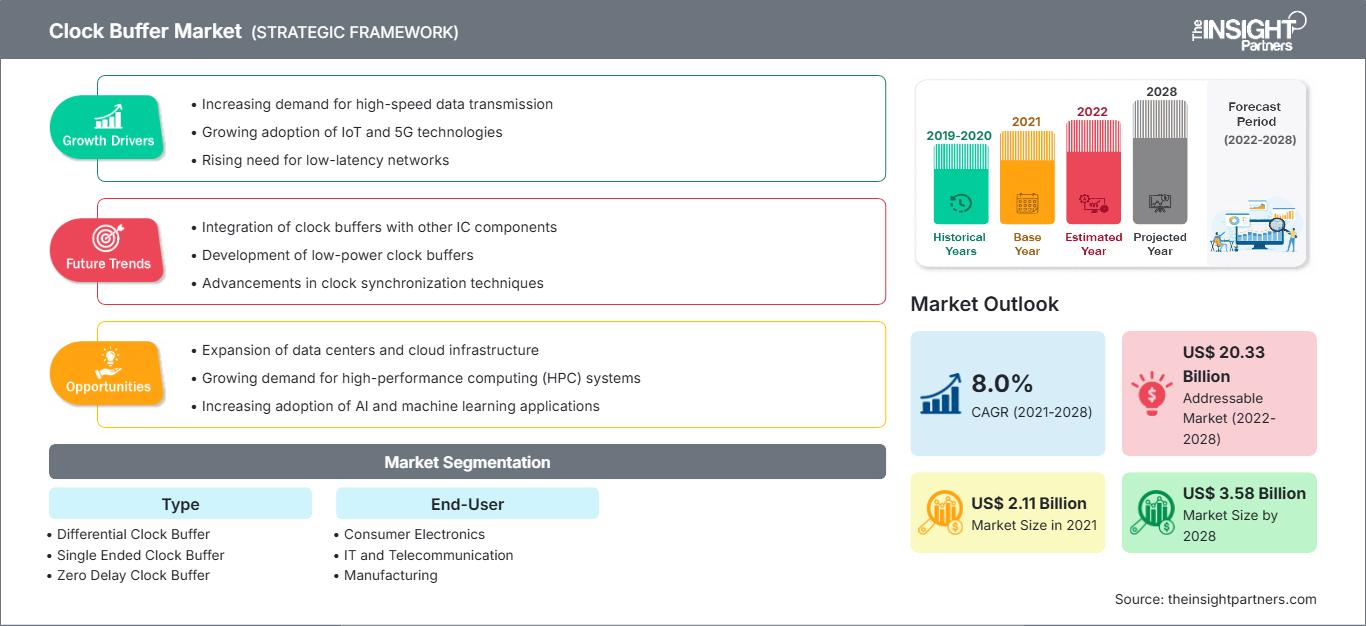

Clock Buffer Market Forecast to 2028 - Analysis By Type (Differential Clock Buffer, Single Ended Clock Buffer, and Zero Delay Clock Buffer) and End-User (Consumer Electronics, IT and Telecommunication, Manufacturing, Automotive, Medical and Healthcare, and Military and Defense)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : May 2022

- Report Code : TIPRE00012040

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 153

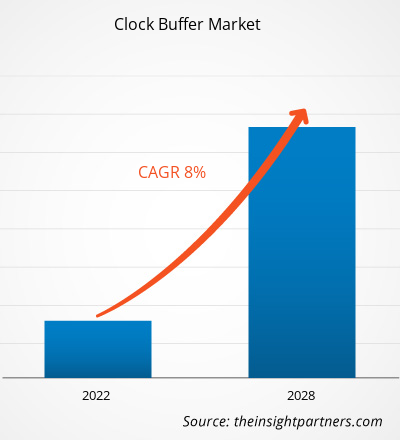

The clock buffer market size is projected to reach US$ 3,579.91 million by 2028 from US$ 2,112.53 million in 2021; it is expected to grow at a CAGR of 8.0% from 2022 to 2028.

The global clock buffer market based on geography is segmented into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. In 2021, North America led the clock buffer market analysis with 40.5% share, followed by Asia Pacific and Europe.

In recent years, the demand for cloud computing has been witnessing significant growth, which has surged the penetration of the internet. Therefore, many FDIs are investing massive capital in North America, which positively impacts cloud computing. The US government has taken many initiatives to boost the consumer electronics industry. For instance, on May 6, 2022, the US government proposed a new bipartisan proposal to fuel the country’s printed circuit board (PCB) sector. Many established companies in the electronics manufacturing industry in the US have welcomed the proposal. The bill will support the CHIPS Act of 2021 and American Printed Circuit Boards Act of 2022. As a result, the key operating players in the North America clock buffer market would experience lucrative opportunities in the coming years.

The clock buffer market in Asia Pacific is segmented into India, China, Japan, Australia, and the rest of Asia Pacific. Many governments in the region have been forced to revise their approaches to purchase upgraded devices, such as desktops, laptops, and personal computers, and general-purpose server equipment from designated suppliers and manufacturers due to the COVID-19 crisis. Thus, the demand for other communications systems, such as routers, modems, wire, and wireless electronics systems (panels), and other peripherals is rising, which has created many lucrative opportunities for the key vendors operating the clock buffer market. In India, the information, communication, and technology services and solutions providers have shifted their business models to remote working due to the onset of the COVID-19 crisis. Further, the schools and colleges continued to operate remotely in 2022, making the need for a computing device critical for students. Some students who previously used smartphones/tablets for virtual classes have switched to PCs as it offers benefits such as larger screens and ease of use, positively impacting the clock buffer market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONClock Buffer Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Clock Buffer Market

Owing to the favorable government policies to boost innovation and reinforce infrastructure capabilities, North America has the highest acceptance and development rate of emerging technologies. As per CBRE's North American Data Center Trends Report 2020, the region’s data center sector was strong in the first half of 2020 due to the implementation of hybrid IT infrastructure by the organizations to develop remote working capabilities. The COVID-19 pandemic in North America has forced companies to implement work-from-home (WFH) strategy to continue business processes during the crisis, which bolstered the demand for big data and data analytics. In 2020, companies explored AI applications and big data analytics to provide insights for users to plan resource use for specific challenges in medical science and proposed a health model based on AI and big data analytics. However, from the Q1 of 2021, the supply lines of the automotive and electronics industry started to stabilize, and revenue of these industries showcased positive momentum, which subsequently propelled the clock buffer market growth in North America.

Market Insights – Clock Buffer Market

The clock buffer market in Europe is segmented into France, Germany, Russia, the UK, and the rest of Europe. The emergence of smart home appliances, such as in washing machines, air conditioners, safety and security cameras, and microwave ovens are further contributing to the growth of the clock buffer market. Consumers in Europe have improved their standard of living. Also, the rising penetration of Wi-Fi and Bluetooth has led to the procurement of electric household appliances. Thus, the demand for smart devices is high. The Google Nest Thermostat, the latest smart home appliance, uses a smartphone app that controls the HVAC system, and when a user moves near it, the device wakes up and activates the display. The demand for clock buffer will increase with the growth in consumer electronics.

Type-Based Insights

Based on type, the clock buffer market is segmented into differential clock buffer, zero clock buffer, and single-ended clock buffer. Single-ended output buffers may have single-ended or differential inputs. Single-ended output clock buffers are LVCMOS, whereas differential output buffers may be LVPECL, HSTL, or Low Voltage Differential Signaling (LVDS).

The market is segmented on the basis of type, end user, and geography. Based on type, the market is segmented into differential clock buffer, zero clock buffer, and single-ended clock buffer. Based on end user, the market is segmented into consumer electronics, IT and telecommunication, manufacturing, automotive, medical and health care, and military and defense. Based on geography, the market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America.

Renesas Electronics Corporation, Texas Instruments, Infineon Technologies AG, Analog Devices, and Texas Instruments are a few players profiled during the study of the clock buffer market.

Clock Buffer Market Regional InsightsThe regional trends and factors influencing the Clock Buffer Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Clock Buffer Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Clock Buffer Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2.11 Billion |

| Market Size by 2028 | US$ 3.58 Billion |

| Global CAGR (2021 - 2028) | 8.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Clock Buffer Market Players Density: Understanding Its Impact on Business Dynamics

The Clock Buffer Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Clock Buffer Market top key players overview

The clock buffer market players are mainly focused on the development of advanced and efficient products.

- In 2021, Skyworks Solutions, Inc. entered into a definitive agreement with Silicon Laboratories Inc. for a smart, connected world, under which Skyworks will acquire the infrastructure and automotive business of Silicon Labs in an all-cash asset transaction valued at US$ 2.75 billion.

- In 2022, Renesas Electronics Corporation introduced the first clock buffers and multiplexers that meet stringent PCIe Gen6 specifications. The new devices join Renesas' low jitter 9SQ440, 9FGV1002, and 9FGV1006 clock generators to provide clients with a complete PCIe Gen6 timing solution for data center/cloud computing, networking, and high-speed industrial applications.

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For