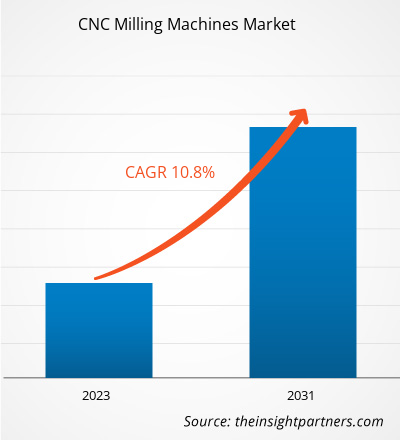

The CNC milling machines market size is projected to reach US$ 19571.55 million by 2031 from US$ 8616.03 million in 2023. The market is expected to register a CAGR of 10.8% in 2023–2031. The growing demand for electric vehicles globally is strongly driving the automotive industry. The automotive industry across the globe is experiencing significant changes such as rise in production of electric vehicles and autonomous vehicles. Many automotive manufacturers have increased their production through the adoption of automation and production plant expansion across the globe. As per the International Energy Agency (IEA), electric vehicle (EV) sales nearly doubled in 2021 compared to 2020, despite supply chain bottlenecks and the COVID-19 pandemic. Nearly 6.6 million EVs were sold in 2021, and a total of 16.5 million EVs were present on the road globally. In 2021, 3.3 million EVs were sold in China, compared to 1.2 million in 2020. The automotive industry is one of the largest users of CNC milling machines. In the automotive industry, CNC milling machines manufacture interior panels, traction motors, and various custom parts. CNC machining also helps the automotive industry develop functional prototypes, which can go into mass production after testing and validation. Thus, the growth of the automotive industry is primarily driving the CNC milling machines market.

CNC Milling Machines Market Analysis

The automotive industry across the globe is experiencing significant changes such as rise in production of electric vehicles and autonomous vehicles. Many automotive manufacturers have increased their production through the adoption of automation and production plant expansion across the globe. A few of the new manufacturing plants opened in recent years are mentioned below:

- In September 2021, Ford announced the opening of its new electric vehicle manufacturing plant in the US with an investment of US$ 11.4 billion.

- In September 2022, Continental unveiled its new automotive production plant in Texas with an investment of US$ 110 million.

- In October 2021, Nissan announced the opening of its new production plant in Tochigi. The factory is engaged in the manufacturing of next-generation vehicles for attaining carbon neutrality.

The opening of new production plants across the globe is contributing to the rise in vehicle production. The rise in vehicle production in units across a few countries in 2022 compared to 2021 is mentioned below:

Country | 2021 | 2022 | % change |

United States | 9,167,214 | 10,060,339 | 10% |

Germany | 3,308,692 | 3,677,820 | 11% |

China | 26,082,220 | 27,020,615 | 3% |

India | 4,399,112 | 5,456,857 | 24% |

Indonesia | 1,121,967 | 1,470,146 | 31% |

South Africa | 499,087 | 555,889 | 11% |

Argentina | 434,753 | 536,893 | 24% |

Source: International Organization of Motor Vehicle Manufacturers

CNC milling machines are used widely for automotive production, including the manufacturing of several parts such as interior panels, gearboxes, custom parts, and motors. Thus, the growing automotive production across the globe is driving the demand for CNC milling machines, thereby contributing to the growth of the CNC milling machines market.

CNC Milling Machines Market Overview

Computerized numerical control (CNC) milling machines are the most important machines for subtractive manufacturing, removing materials from the workpiece to create a finished product. This differs from additive manufacturing processes such as 3D printing, casting, or injection molding in which material is added to create a finished product. The process begins with a two- or three-dimensional computer-aided design (CAD) representation of the part to be produced. CAD guides the cutting process of the workpiece and precisely defines the measurements and requirements for the part. CNC milling was the first type of CNC process used in 1952 and can reshape various materials such as metal, glass, alloy, plastic, or wood. It is the most common CNC process and can be programmed to produce custom-designed parts to exact and accurate specifications. Presently, many market players offer a broad range of products with various specifications, sizes, and functionalities.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

CNC Milling Machines Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

CNC Milling Machines Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

CNC Milling Machines Market Drivers and Opportunities

Increase in Production of Military Aircraft

The defense aircraft industry is tremendously dynamic in terms of orders, production volume, component supply, supply, profits, and cost. Governments of various countries, as well as public and private companies, are investing capital in enhancing aircraft capabilities to meet the aircraft requirements during combat or non-combat scenarios. For instance, the US government announced the inaugural of new F-16 production facility in North Carolina. The rising threat of terrorism, troop transportation, and border security is creating an immense need for advanced military aircraft support.

CNC milling machines are used in aircraft production for manufacturing and assembling several aircraft parts. Thus, the rising production of military aircraft is driving the demand for CNC milling machines, thereby contributing to the growth of the market.

Integration of Smart Manufacturing Technology with CNC Milling Machines

Smart manufacturing, over the years, has gained momentum across all manufacturing plants, including electronics, automobiles, and aircraft. Smart manufacturing enables automation across production plants, thereby reducing operational time and cost. CNC milling machines are being increasingly integrated with smart manufacturing technology as it allows program-specific machining operations. This is enabling the manufacturers to enhance the precision and accuracy of operations by reducing human error. Further, the integration of smart manufacturing technology with CNC machining is also enabling the automation of repetitive functions. Thus, the integration of smart manufacturing technologies with CNC milling machines is expected to contribute to the growth of the CNC milling machines market over the forecast period.

CNC Milling Machines Market Report Segmentation Analysis

Key segments that contributed to the derivation of the CNC milling machines market analysis are structure, x-axis working range, number of axis, and application.

- The CNC milling machines market based on structure, the CNC milling machines market is segmented into gantry, moving table, fixed table, and column type. The gantry segment accounted for a larger market share in 2023.

- Based on x-axis working range, the CNC milling machine market is segmented into less than 2000 mm, 2001 mm to 5000 mm, 5001 mm to 7000 mm, and above 7000 mm. The less than 2000 mm segment accounted for a larger market share in 2023.

- Based on number of axis, the CNC milling machine market is segmented into 3-axis, 4-axis, 5-axis, and others. The 3-axis segment accounted for a larger market share in 2023.

- Based on application, the CNC milling machines market is segmented into automotive & transportation, aerospace & defense, oil & gas, and others. The automotive & transportation segment accounted for a larger market share in 2023.

CNC Milling Machines Market Share Analysis by Geography

The global CNC milling machines market is broadly segmented into North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and South America (SAM). Based on geography, the North America CNC milling machine market is segmented into the US, Canada, and Mexico. The US and Canada have a significant presence of automotive and aerospace manufacturing companies, which is influencing the rise in demand for CNC milling machines across the region, thereby contributing to the North America CNC milling machines market.

Ford, Chevrolet, Jeep, GMC, Dodge, Cadillac, Chrysler, Tesla, and Lucid are among the major automotive manufacturers present in North America. The region has experienced a significant rise in investment by these automotive companies to expand their geographical presence and increase their annual production, which is further increasing the demand for CNC milling machines from the automotive industry. Since 2010, the US automotive industry has witnessed an increase in investments to develop new manufacturing plants. For instance, Ford, Rivian, and Hyundai invested ~US$ 33 billion in 2022 to establish electric vehicle and battery manufacturing plants nationwide. Similarly, in September 2022, Hyundai announced the development of its electric vehicle production plant in the US. CNC milling machines are widely used across the automotive industry for vehicle prototyping applications and for producing several parts of cars, such as internal panels, starter motors, cylinder heads, drive axles, and gearboxes. Thus, the constant growth in the automotive industry across the region is fueling the growth of the North America CNC milling machines market.

North America homes a robust aerospace industry. The aircraft manufacturing industry has experienced constant pressure from the commercial aviation sector to deliver the required volume of aircraft. The growing demand for aircraft is majorly due to the rise in expansion strategies adopted by full-service carriers (FSC). Aircraft manufacturers such as Boeing is thereby increasing several commercial aircraft manufacturing orders from across the globe. Boeing delivered 340 commercial aircraft in 2021 and 157 aircraft in 2020. CNC milling machines are widely used across the aerospace industry for designing and producing complex aircraft parts. Thus, the rise in aircraft production across the region is propelling the growth of the North America CNC milling machines market.

CNC Milling Machines Market Regional Insights

CNC Milling Machines Market Regional Insights

The regional trends and factors influencing the CNC Milling Machines Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses CNC Milling Machines Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for CNC Milling Machines Market

CNC Milling Machines Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 8616.03 Million |

| Market Size by 2031 | US$ 19571.55 Million |

| Global CAGR (2023 - 2031) | 10.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Structure

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

CNC Milling Machines Market Players Density: Understanding Its Impact on Business Dynamics

The CNC Milling Machines Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the CNC Milling Machines Market are:

- Okuma Corporation

- Nidec Corporation

- NICOLÁS CORREA

- S.A

- AWEA MECHANTRONIC CO., Ltd

- EMCO GmbH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the CNC Milling Machines Market top key players overview

CNC Milling Machines Market News and Recent Developments

The CNC milling machines market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In January 2023, EMCO and GLM are on their way to EMCO GLM GMBH. After a very successful preparatory phase, in which the cooperation of the two companies in the areas of sales, application technology, automation, and service has already got off to a good start, the foundation of the new company EMCO GLM GmbH, with a majority stake of EMCO, was initiated. (Source: EMCO, Press Release)

- In December 2022, TRIMILL has successfully delivered a 5-axis TRIMILL VFC 3021 milling machine to a customer in Germany. The milling machine is equipped with a 2-axis fork-type milling head T21C, designed for continuous milling and provides high precision and rigidity. TRIMILL claimed to provide its customers with high-quality and customized milling solutions, as well as its ability to deliver and install machines worldwide successfully. (Source: TRIMILL, Press Release)

CNC Milling Machines Market Report Coverage and Deliverables

The “CNC Milling Machines Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- CNC milling machines market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities

- CNC milling machines market trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- CNC milling machines market analysis covering key market trends, Global and regional framework, major players, regulations, and recent market developments

- CNC milling machines market landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments.

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Structure, X-Axis Working Range, Number of Axis, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For