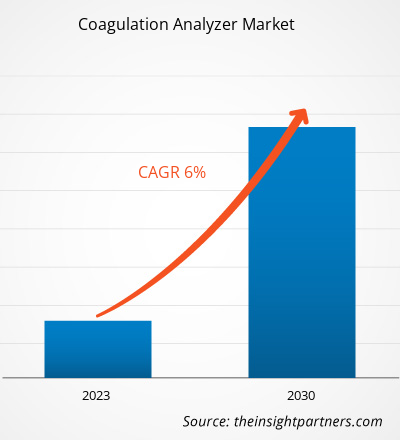

[Research Report] The coagulation analyzer market size is expected to grow from US$ 4,183.71 million in 2022 to US$ 6,690.08 million by 2030; it is estimated to register a CAGR of 6.0% from 2022 to 2030.

Analyst’s ViewPoint

The coagulation analyzer market analysis include driving factors such as rising prevalence of blood disorders among the population and growing incidence of cardiovascular diseases. Further, point-of-care testing coagulation analyzers acts as a future trend for the market to grow during 2022–2030. According to the segmentation profiled in the report, based on product type segment, the clinical laboratory analyzers segment accounted the largest share in 2020. In terms of test type, the 2D prothrombin time testing segment dominated the market by accounting maximum share. By technology, the optical technology segment will account a considerable share for the coagulation analyzers to dominate the market growth during the forecast period. Based on application, the clinical laboratories segment is expected to account the maximum share for the coagulation analyzers market growth during 2022–2030.

Coagulation analyzers measure blood platelet levels in a fast and simple process. A coagulation analyzer is used for measuring a coagulation pathway speed checking thrombolin and thromboplastin levels in low as in a few minutes. Also, several top companies are manufacturing innovative coagulation analyzers for hemostasis testing. The Sysmex CS-2500 system is one such example that employs smartly designed technologies involving assay-based preanalytical sample-quality checks using PSI technology, automated mixing studies, automated platelet aggregation, and clot waveform analysis. Such automated processes improve efficiency, exceptional accuracy, and reliable first-run results.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Coagulation Analyzer Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Coagulation Analyzer Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Rising Prevalence of Blood Disorders

A coagulation analyzer is a device that measures and evaluates the speed of clot formation or clot coagulation. It provides a fast, simple way to measure blood platelet levels and thrombolin and thromboplastin levels accurately. According to the National Organizations of Rare Disorders, hemophilia A is a common X-linked recessive disorder and the second most common inherited clotting factor deficiency after von Willebrand disease. In the US, approximately 1 in 5,000 newborn males suffer from hemophilia A. According to the National Library of Medicine (NLM), in 2020, approximately 30,000-33,000 males were affected with hemophilia in the US. According to the US Department of Health & Human Services, in 2020, ~100,000 Americans had sickle cell disease (SCD), the most commonly inherited blood disorder. Furthermore, by 2050, the number of people suffering from SCD is expected to grow by ~30%. As per the National Library of Medicine, in 2022, ~1% of all individuals (unselected population) are suffering from von Willebrand disease, i.e., 125 per 1 million. Similarly, in European Union, 80 million people suffer from blood disorders, ranging from cancer to bleeding disorders, as per research published in NLM in 2020. According to National Organization for Rare Disorders, in 2022, in the US immune thrombocytopenia (ITP), an autoimmune bleeding disorder, affects approximately 66 adults per 1 million each year. Moreover, in the US, the incidence of ITP in adults is ~3.3 per 100,000/year, while the prevalence is 9.5 per 100,000. Thus, the increasing prevalence of blood disorders is driving the coagulation analyzers market growth.

Development of Point-of-Care (POC) Coagulation Analyzers

A rapid, reliable assessment of hemostasis is essential for patients with trauma or other bleeding problems. Due to the requirements of sample preparation and the analytical process, routine coagulation assays cannot visualize the process of clot formation, and their results are obtained only after 30–90 minutes. Point-of-care (POC) devices such as viscoelastic coagulation tests, platelet function tests, blood gas analysis, and other coagulometers are available for assessment of hemostasis. A POC measurement tool can be used both inside and outside the hospital as a decision-making and management tool. When time is paramount, POC analyzer provide immediate, actionable results in emergency rooms, coronary care units, surgery, and procedure suites. In addition to outpatient clinics and physicians' offices, these devices can assist with patient management in pharmacies, care centers, and patients' homes. POC coagulation analyzer offer timely results without compromising diagnostic quality control provided by central labs. In POC testing, it is important to provide fast results, along with accuracy and quality assurance.

In 2021, Siemens Healthineers launched fully automated CN-3000 and CN-6000 systems, which are mid- and high-volume handheld POC coagulation testing devices. Siemens Healthineers' Xprecia Stride Coagulation Analyser was cleared by the FDA as a POC coagulation analyzer device. The device has demonstrated PT/INR (i.e., prothrombin time/international normalized ratio) testing performance equivalence to Roche CoaguChek XS.

Thus, the growing development of POC coagulation analyzers is likely to propel the market growth during the forecast period.

Report Segmentation and Scope

Product Type-Based Insights

Based on product type, the coagulation analyzers market is segmented as clinical laboratory analyzers and point-of-care testing analyzers. The clinical laboratory analyzers is further bifurcated into system and consumables. The clinical laboratory analyzers segment held a larger market share in 2022. The point-of-care testing analyzers accounted a significant CAGR for the coagulation analyzers market. Point of care (POC) testing analyzers are used to obtain results of the blood protein. These analyzers are used in doctors’ offices, hospitals. POCT testing analyzers offer quick feedback on several medical tests.

Benefit of POCT

- Portability

- Convenience

- Speed

- Connectivity

- Sample Quality

- Quality Assurance

These devices measure electrochemical, optical, and mechanical parameters of clotting blood. POC tests for coagulation monitoring, with the help of various activators, play an important role in detecting bleeding disorders and monitoring of anticoagulant drugs. In this regard, advanced technologies such as microfluidics, fluorescent microscopy, electrochemical sensing, photoacoustic detection, and micro/nano electromechanical systems have been employed to develop highly accurate, robust, and cost-effective POC devices, e.g., Roche Diagnostics CoaguChek XS System, and ARKRAY, Inc. SPOTCHEM HS HS-7710.

Test Type-Based Insights

Based on test type, the global coagulation analyzers market is segregated into prothrombin time testing, fibrinogen testing, D-dimer testing, platelets function testing, activated clotting time testing, activated partial thromboplastin time testing, and others. The prothrombin time testing segment accounted the largest market share in 2022. The D-dimer testing segment is expected to grow at the highest CAGR during the forecast period. A prothrombin time (PT) is a test used to help detect and diagnose a bleeding disorder or excessive clotting disorder; the international normalized ratio is calculated from a PT result and is used to monitor the blood-thinning medication (anticoagulant) warfarin (Coumadin) working to prevent blood clots.

A PT measures the number of seconds it takes for a clot to form in sample of blood after substances (reagents) are added. The PT is often performed along with a partial thromboplastin time (PTT) and together they assess the amount and function of proteins called coagulation factors that are an important part of proper blood clot formation.

A PT and INR are ordered on a regular basis when a person is prescribed to take anticoagulant drug warfarin to make sure that the drug is producing the desired effect.

Likewise, D-dimer tests are used to help rule out the presence of an inappropriate blood clot (thrombus). Some of the conditions that the D-dimer test is used to help rule out include Deep Vein Thrombosis, Stroke and Pullmonary Embolism. This test may be used to diagnose diseases and conditions that cause hypercoagulability—a tendency to clot inappropriately. A D-dimer level may also be used to help diagnose disseminated intravascular coagulation (DIC) and to monitor the effectiveness of DIC treatment.

D-dimer is one of the protein fragments produced when a blood clot gets dissolved in the body. It is normally undetectable or detectable at a very low level unless the body is forming and breaking down blood clots. Then, its level in the blood can significantly rise. This test detects D-dimer in the blood.

Technology-Based Insights

In terms of technology, the coagulation analyzers market is segmented as optical technology, mechanical technology, electrochemical technology, and others. The optical technology segment accounted the largest coagulation analyzers market share in 2022. Optical coagulation analyzers are used together with the test reagents to deliver quick-lab quality results that support clinical decisions in cardiology, surgery, and intensive care. The Wondfo's point-of-care testing (POCT) coagulation analyzer is the first instrument that can test PT/INR/APTT, TT, FIB, and ACT. Likewise, viscoelastic properties of blood can be monitored by studying its optical properties either by through light scattering or light transmission. In laser speckle rheometers, light scattering due to the Brownian motion in the blood gives direct information about viscoelastic properties or coagulation of the blood. In order to measure this, the time-varying speckle intensity of fluctuations is measured by finding auto correlation curve from a series of image frames while the clotting blood is illuminated with a laser. LSR method also suggests a rapid assessment of anticoagulation status in real-time.

Application-Based Insights

By application, the market is segmented as clinical laboratories, hospitals, and others. The clinical laboratories segment held the highest market share in 2022 and will register highest CAGR during the forecast period. Clinical laboratories are healthcare facilities providing a wide range of laboratory procedures that aid the physicians in carrying out the diagnosis, treatment, and management of patients. Clinical laboratories are the primary uses for molecular diagnostics products and services. It has well-established facilities as per the regulatory requirements. The laboratories use all possible blood analysis in different parameters. The sample collected from the patients is analyzed and studied using different instruments, reagents, methods, and technologies. The labs provide services to hospitals, clinics, and others. The increasing prevalence of chronic diseases, infectious diseases, lifestyle disorders is one of the major factors promoting the growth of the market.

Regional Analysis

North America dominated the coagulation analyzers market accounting maximum share. In North America, the US is the largest market for coagulation analyzers. The growth of this market is primarily driven by increasing incidence of blood disorders, growing prevalence of cardiovascular diseases such as atrial fibrillation (AFib), developments by the market players, and presence of major market players in the US. As per the Centers for Disease Control and Prevention (CDC), in 2019, AFib was mentioned on ~183,321 death certificates in the US; it was the primary cause of death in nearly 26,535 of those deaths. It is anticipated that 12.1 million people will suffer from AFib by 2030 in the US. As per the Canadian Task Force on Preventive Health Care, the incidence of Atrial Fibrillation (AFib) in Canada increases by 4.5% per year, with lifetime risk of ~25% people older than 40 years. The increasing incidence of blood disorders is likely to propel the demand for coagulation analyzers. For instance, as per the CDC, Hemophilia A affects 1 in 5,000 male births. Nearly 400 babies are born with Hemophilia A each year. It also mentioned that ~33,000 males in the US were diagnosed with hemophilia during 2012–2018. Further, approximately 300,000 Canadians carry an inherited bleeding disorder gene. One in 10 of these people—at least 30,000 Canadians—have symptoms severe enough to require medical care. Many of them have not been properly diagnosed. Only 10,000 people with inherited bleeding disorders are registered in the Canadian network of inherited bleeding disorder comprehensive care clinics.

Coagulation Analyzer Market Regional Insights

The regional trends and factors influencing the Coagulation Analyzer Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Coagulation Analyzer Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Coagulation Analyzer Market

Coagulation Analyzer Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4.18 Billion |

| Market Size by 2030 | US$ 6.69 Billion |

| Global CAGR (2022 - 2030) | 6.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Coagulation Analyzer Market Players Density: Understanding Its Impact on Business Dynamics

The Coagulation Analyzer Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Coagulation Analyzer Market are:

- Abbott Laboratories

- Danaher Corp

- Siemens Healthcare GmbH

- Thermo Fisher Scientific Inc

- Sysmex Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Coagulation Analyzer Market top key players overview

The increasing awareness program for blood disorders is likely to the favor market growth for coagulation analyzers. Hemophilia Health Education and Prevention Funded Projects is the largest program in CDC’s division of blood disorders. CDC has funded projects that are designed to promote health and prevent complications related to bleeding disorders.

Thus, increasing number of blood disorders, growing prevalence of cardiovascular diseases, and government support for preventing blood disorders in the region are anticipated to boost the North America coagulation analyzers market growth during the forecast period.

The report profiles leading players operating in the global coagulation analyzers market. These involve Abbott Laboratories, Danaher Corp, Siemens Healthcare GmbH, Thermo Fisher Scientific Inc, Sysmex Corporation, Horiba Ltd., Nihon Kohden Corp, F. Hoffmann-La Roche Ltd, Maccura Biotechnology Co Ltd, and Bio Group Medical System SRL.

In February 2021, Siemens Healthineers and Sysmex Corporation announced the renewal of the companies' long-standing global supply, distributorship, sales and service agreement for a broad portfolio of hemostasis products including a multi-year extension. As part of the agreement, Siemens Healthineers will distribute the new Sysmex CN Systems.

In July 2020, Sysmex announced the launch of a new product- “Automated Blood Coagulation Analyzers CN-6000 and CN-3000” in the EMEA region.

Company Profiles

- Abbott Laboratories

- Danaher Corp

- Siemens Healthcare GmbH

- Thermo Fisher Scientific Inc

- Sysmex Corporation

- Horiba Ltd.

- Nihon Kohden Corp

- F. Hoffmann-La Roche Ltd

- Maccura Biotechnology Co Ltd

- Bio Group Medical System SRL

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Playout Solutions Market

- Unit Heater Market

- Social Employee Recognition System Market

- Pharmacovigilance and Drug Safety Software Market

- Compounding Pharmacies Market

- Europe Tortilla Market

- Energy Recovery Ventilator Market

- Medical Collagen Market

- Aircraft Landing Gear Market

- Airport Runway FOD Detection Systems Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Test, Technology, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Based on product type, the clinical laboratory analyzers segment took the forefront lead in the global market by accounting largest share in 2020 and is expected to continue to do so till the forecast period.

Coagulation analyzers measure blood platelet levels in a fast and simple process. The coagulation analyzer is used for measuring a coagulation pathway speed and thrombolin and thromboplastin levels in low as in a few minutes. Also, several top companies are manufacturing innovative coagulation analyzers for hemostasis testing. The Sysmex CS-2500 system is one such example that employs smartly designed technologies involving assay-based preanalytical sample-quality checks using PSI technology, automated mixing studies, automated platelet aggregation, and clot waveform analysis. Such automated processes improve efficiency, exceptional accuracy, and reliable first-run results.

Abbott Laboratories, Danaher Corp, Siemens Healthcare GmbH, Thermo Fisher Scientific Inc, Sysmex Corporation, Horiba Ltd., Nihon Kohden Corp, F. Hoffmann-La Roche Ltd, Maccura Biotechnology Co Ltd, and Bio Group Medical System SRL, among others are among the leading companies operating in the global coagulation analyzers market.

The prothrombin time testing segment dominated the global coagulation analyzers market and accounted for the largest revenue in 2022.

Rising prevalence of blood disorders is a standalone factor responsible for driving the overall coagulation analyzers market growth during the forecast period.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Report Companies - Coagulation Analyzers Market

- Abbott Laboratories

- Danaher Corp

- Siemens Healthcare GmbH

- Thermo Fisher Scientific Inc

- Sysmex Corporation

- Horiba Ltd.

- Nihon Kohden Corp

- F. Hoffmann-La Roche Ltd

- Maccura Biotechnology Co Ltd

- Bio Group Medical System SRL

Get Free Sample For

Get Free Sample For