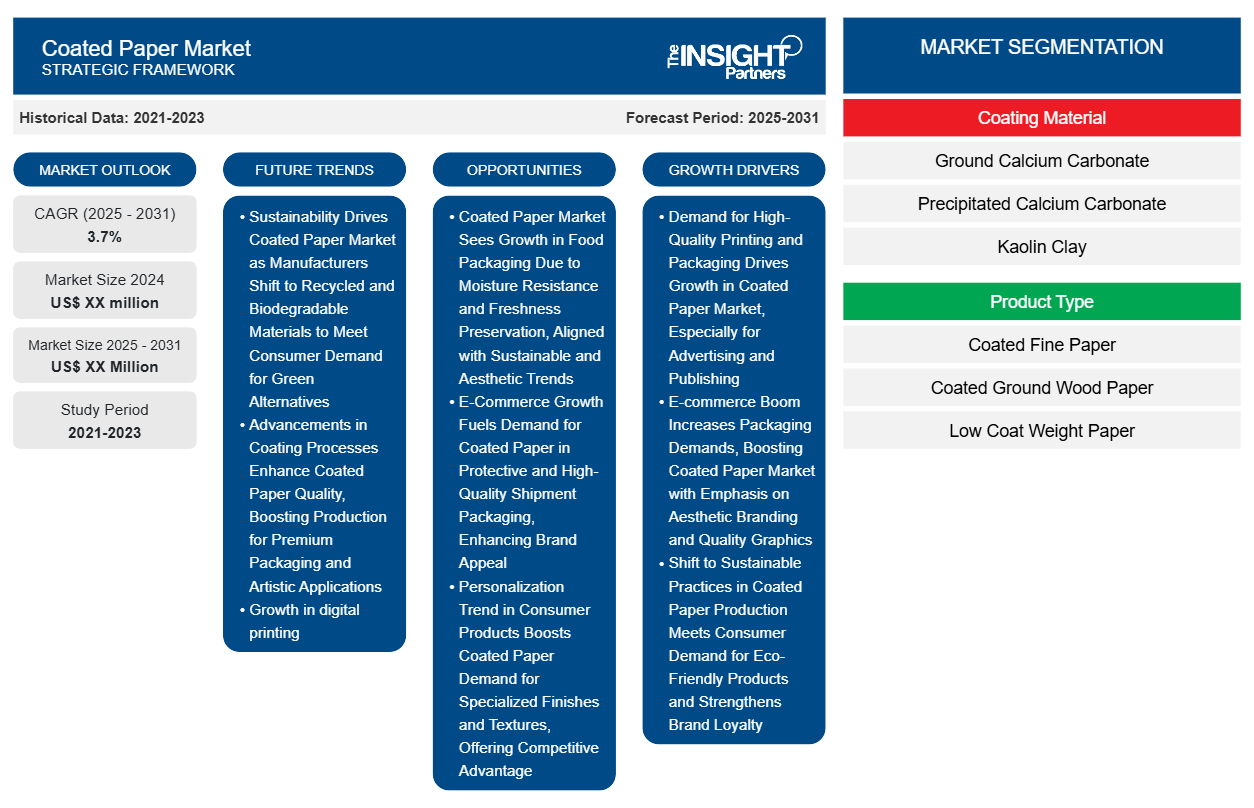

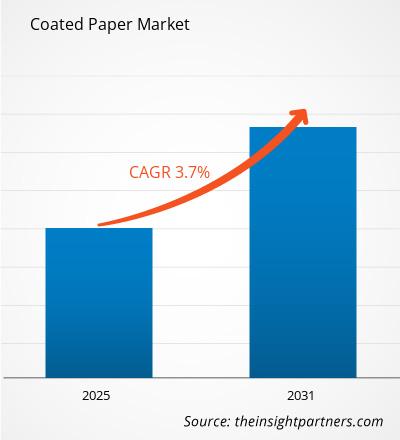

The Coated Paper Market is expected to register a CAGR of 3.7% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Coating Material (Ground Calcium Carbonate (GCC), Precipitated Calcium Carbonate (PCC), Kaolin Clay, Wax, Starch, and Others). The report is also segmented based on Product Type (Coated Fine Paper, Coated Ground Wood Paper, Low Coat Weight Paper, and Others) and Application (Packaging, Printing, Labeling, and Others). The report scope covers 5 regions: North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America and key countries under each region. The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Coated Paper Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Coated Paper Market Segmentation

Coating Material

- Ground Calcium Carbonate

- Precipitated Calcium Carbonate

- Kaolin Clay

- Wax

- Starch

Product Type

- Coated Fine Paper

- Coated Ground Wood Paper

- Low Coat Weight Paper

Application

- Packaging

- Printing

- Labeling

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Coated Paper Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Coated Paper Market Growth Drivers

- Demand for High-Quality Printing and Packaging Drives Growth in Coated Paper Market, Especially for Advertising and Publishing: The demand for high-grade and sophisticated printing within the coated paper market in the sectors such as the printing and publishing industry, for packaging and advertising, among others, is a major factor contributing to the market growth. Coated papers improve the sharpness of the images and the richness of the colors which makes them very suitable for business for instance, creating brochures, magazines, and high-end packaging which a lot of businesses are looking for to enhance their visual appeal.

- E-commerce Boom Increases Packaging Demands, Boosting Coated Paper Market with Emphasis on Aesthetic Branding and Quality Graphics: The boom in the ecommerce sector has come with a fair share of its challenges and one of the most prominent has to be the increased packaging needs, especially for aesthetic and branding. Coated paper is used because it facilitates good quality graphics and long-lasting prints allowing brands to design box openings in the most appealing ways possible, therefore the growth of the coated paper market.

- Shift to Sustainable Practices in Coated Paper Production Meets Consumer Demand for Eco-Friendly Products and Strengthens Brand Loyalty: There is a rise in the demand for environmentally friendly products, and as a result the coated paper market is experiencing a shift to sustainable development. More and more manufacturers have started making coated paper using already used materials or coatings that are friendly to the environment to meet the demands of the green consumers. This practice apex meeting the regulatory requirement also protects the brand equity and customer retention.

Coated Paper Market Future Trends

- Sustainability Drives Coated Paper Market as Manufacturers Shift to Recycled and Biodegradable Materials to Meet Consumer Demand for Green Alternatives: Recent developments in the coated paper industry show a rising global trend towards sustainability as end consumers and businesses individually opt for green alternatives. In reaction, the manufacturers are producing coated papers that are made from recycled materials and even biopapers. This change not only aids manufacturers in compliance but also meets the suitable needs of the market for the green products.

- Advancements in Coating Processes Enhance Coated Paper Quality, Boosting Production for Premium Packaging and Artistic Applications: Transitional improvements in the coating processes are improving the quality and the performance of coated papers. Modern methods allow for better coatings in terms of adhesion, print quality as well as wear and tear. Therefore, it becomes easier for the production of high quality coated paper for use in a variety of fields ranging from artistic works to premium boxes and packaging thus increasing the markets.

- Growth in digital printing: Digital Printing Growth Spurs Demand for High-Quality Coated Papers with Superior Ink Adhesion and Clarity, Shaping the Coated Paper Market: The coated paper market is largely shaped by developments in digital printing . Considering that more and more companies are incorporating digital printing to produce small quantities and/or customized products, the need for high grade coated papers with good ink quality and clarity is on the rise. This dynamic evolution of the coated paper market is altering the inventory composition and enhancing the growth of the market.

Coated Paper Market Opportunities

- Coated Paper Market Sees Growth in Food Packaging Due to Moisture Resistance and Freshness Preservation, Aligned with Sustainable and Aesthetic Trends: The coated paper industry remains poised with a considerable opportunity presented by the food packaging industry. Coated papers are being used more frequently for the wrapping and packing of various food products, thanks to their resistance to moisture, and their ability to keep the products fresh. This reinforces the already existent trend of looking for sustainable and aesthetic food packaging.

- E-Commerce Growth Fuels Demand for Coated Paper in Protective and High-Quality Shipment Packaging, Enhancing Brand Appeal: Statistics also indicate that the aforementioned growth in e-commerce sales has led to an increase in the use of coated paper for packing functions. Consequently, businesses want well-designed, effective and above all, shipment packaging that ensures protection of the brands. Therefore, coated paper is strong enough and has good quality printing allowing investors to take full advantage of this sector.

- Personalization Trend in Consumer Products Boosts Coated Paper Demand for Specialized Finishes and Textures, Offering Competitive Advantage: The growing near universal trend of personalization of most consumer products has its perks even on coated paper manufacturers who can make personalized and specialty papers. This consists of constructive particular finishing, texture and coating in relation to the specific market for which such papers would be used such as high end products, card invitations or advertising materials. Such developments can serve to bring out competitive advantage to the products and broaden the target market.

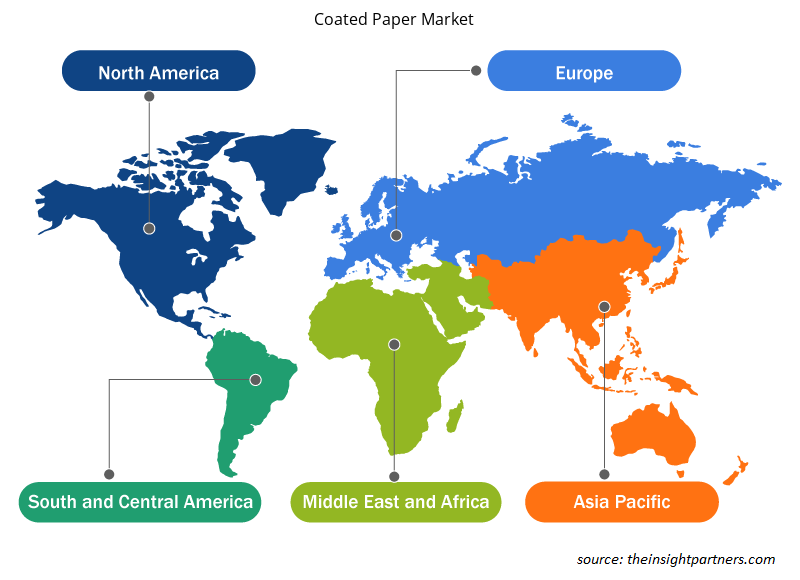

Coated Paper Market Regional Insights

The regional trends and factors influencing the Coated Paper Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Coated Paper Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Coated Paper Market

Coated Paper Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 3.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Coating Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

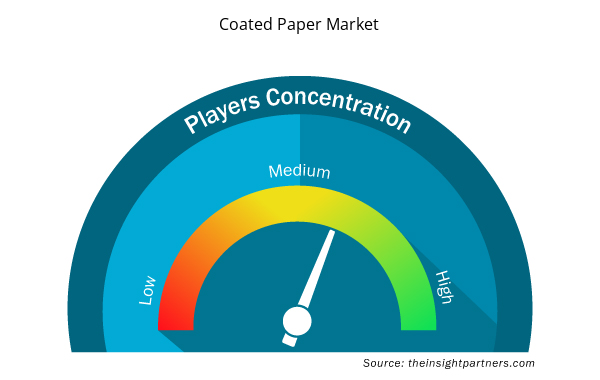

Coated Paper Market Players Density: Understanding Its Impact on Business Dynamics

The Coated Paper Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Coated Paper Market are:

- Asia Pulp and Paper

- Oji Holdings Corporation

- Nippon Paper Industries Co., Ltd.

- Stora Enso Oyj

- UPM-Kymmene Oyj

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Coated Paper Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Coated Paper Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Coated Paper Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Based on geography, Asia Pacific held the largest share of the coated papers market.

The report can be delivered in PDF/Word format, we can also share excel data sheet based on request.

Increasing adoption of sustainable and durable paper-based products is likely to remain the key trend in the market.

OJI Paper Co Ltd, Lansheng, Mitsubishi Paper Mills Limited, Stora Enso Oyj, UPM, Sappi Paper Holding GmbH, Burgo Group SPA, Safepack Industries Limited, Crusader Paper Company Inc, and Asia Pulp and Paper Group are among the leading players operating in the coated papers market.

Rising demand for high-quality printing is driving the market growth

The Coated Paper Market is estimated to witness a CAGR of 3.7% from 2023 to 2031

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies

1. Asia Pulp and Paper

2. Oji Holdings Corporation

3. Nippon Paper Industries Co., Ltd.

4. Stora Enso Oyj

5. UPM-Kymmene Oyj

6. Sappi Limited

7. Burgo Group Spa

8. NewPage Corporation

9. Michelman, Inc.

10. Arjowiggins SAS

Get Free Sample For

Get Free Sample For