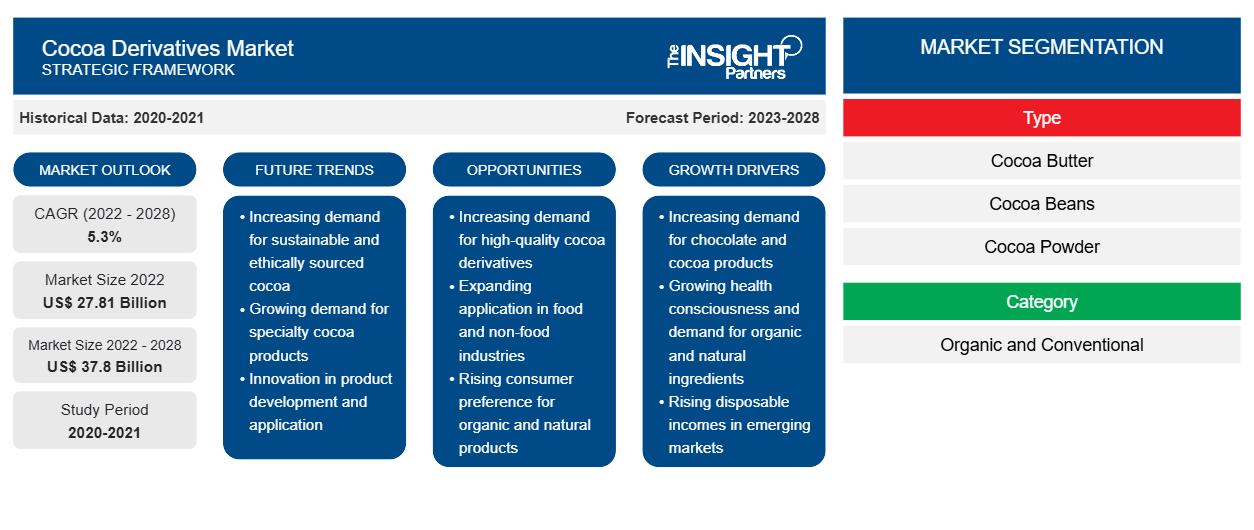

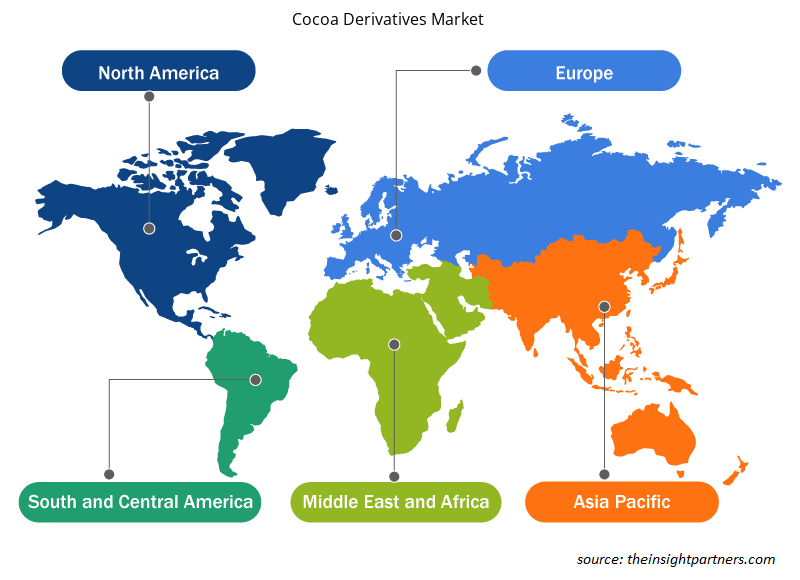

The cocoa derivatives market size is expected to grow from US$ 27,807.13 million in 2022 to US$ 37,799.86 million by 2028; it is estimated register a CAGR of 5.3% from 2022 to 2028.

Cocoa derivatives are cocoa products derived from the processing of cocoa. The types of cocoa derivatives include cocoa beans, cocoa butter, and cocoa powder. These derivatives are also available in organic and conventional categories. The demand for organic and Fairtrade-certified cocoa beans is growing in the global market. Consumers are inclined toward consuming safer products that help them maintain overall health. The rising interest in pesticide-free food products positively affects the demand for organically grown cocoa. According to the World of Organic Agriculture 2022 report by the Research Institute of Organic Agriculture (FiBL) and the International Federation of Organic Agriculture Movements (IFOAM), the cultivation area of organic cocoa across the world reached 3.1% in 2020. Further, Lindt & Sprüngli have indicated that their organic cocoa products sales in Europe are growing at a much faster pace than overall cocoa products sales. Thus, manufacturers are adding organic products to their portfolios to cater to the increasing demand. For instance, Barry Callebaut offers domestically produced, organic-certified, non-alkalized cocoa powder.

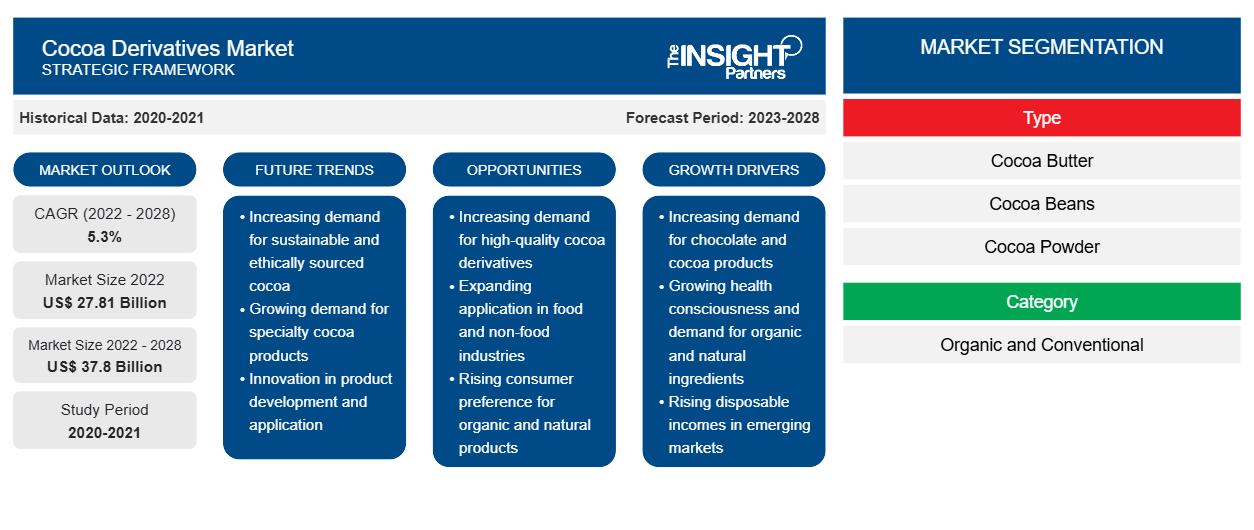

In 2022, Europe held the largest share of the cocoa derivatives market. The market in Asia Pacific is estimated to grow at the highest CAGR during the forecast period. The market growth in the region is attributed to the increasing popularity of gourmet chocolates among Europeans. Hence, different high-end chocolate brands have extensively been looking for ways to differentiate their products, along with focusing on sourcing single-estate products. Thus, the demand for high-quality cocoa and single-origin cocoa flavors is on the rise in the region. For instance, Valrhona Inc., the world's finest chocolate producer based in France, has been harvesting cocoa beans from Maria Trinidad Sanchez, a single-origin cocoa estate from Further, consumer inclination toward healthy living triggers the demand for superior-quality cocoa derivatives, such as cocoa butter, cocoa powder, and cocoa beans.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cocoa Derivatives Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cocoa Derivatives Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Cocoa Derivatives Market

The COVID-19 pandemic affected economies and industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) hampered the growth of several industries, including the food & beverage industry. The shutdown of manufacturing units led to disturbances in global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. Various companies witnessed delays in product deliveries and a slump in sales of their products in 2020. Moreover, the bans imposed by governments of various countries in Europe, Asia Pacific, and North America on international travel compelled companies to temporarily discontinue their collaboration and partnership plans. All these factors hampered various industries in 2020 and early 2021, thereby restraining the growth of various markets.

Changes in socioeconomic situations negatively impacted the consumption pattern of premium products in 2020. The restrictions imposed by governments of several countries in the world during the global crisis caused financial losses for farmers growing cocoa in small yet relevant cocoa-producing countries as the production surpassed the demand in the initial months of the pandemic. This led to a significant decline in the prices of cocoa. According to the International Cocoa Organization (ICCO), in New York, cocoa contract prices averaged ~US$ 2,528 per ton in January 2021, registering a 6% decrease compared to prices in the previous year (US$ 2,675 per ton). Moreover, the shutdown of facilities in the personal care, and food & beverages industries affected the performance of the cocoa derivatives market.

In 2021, several economies resumed operations as governments announced relaxation in the previously imposed restrictions, which boosted the global marketplace. Moreover, manufacturers were permitted to operate at full capacities, which helped them overcome the demand and supply gaps, and other repercussions. As a majority of the global population was fully vaccinated by 2021, the cocoa derivatives manufacturers focused on scaling up production operations to revive their businesses.

Market Insights

Strategic Developments by Key Players Favor Cocoa Derivatives Market Growth

In September 2020, Olam Group Ltd launched Olam Cocoa for professionals, making its premium deZaan cocoa powders available to restaurants, caterers, and patisseries. The strategy aimed to cater to the rising demand for high-quality cocoa ingredients from professional chefs and bakers. Such strategic developments by key players in the market are expected to propel the growth of the cocoa derivatives market in the coming years.

Type Insights

Based on type, the cocoa derivatives market is segmented into cocoa beans, cocoa butter, cocoa powder, and others. The cocoa beans segment held the largest market share in 2022, and the cocoa powder segment is expected to register the highest CAGR during the forecast period. Cocoa powder is an unsweetened powder obtained by crunching cocoa beans extracted from the fruits of cocoa trees. The chocolate liquor is pressed to remove cocoa butter, and the residual cocoa solids are then processed to create a fine unsweetened cocoa powder. The increasing consumer inclination toward better flavor, color, and texture drives demand for cocoa powder.

Application Insights

Based on application, the cocoa derivatives market is segmented into food and beverages, personal care, and others. Cocoa derivates are widely used in making bakery products, beverages, confectioneries, dairy products, and snacks. However, an emerging demand for clean-label and vegan products is resulting in burgeoning sales of plant-based ingredients, such as cocoa butter, cocoa powder, cocoa nibs, and cocoa liquor. Hence, the increasing demand for plant-based products in food & beverage industry fueling the cocoa derivatives market growth. Olam International, and Cargill, Incorporated are the major manufacturers offering cocoa derivatives for food & beverage applications.

Olam Group Ltd, Indcre SA, Cargill Inc, Natra SA, JB Foods Ltd, Ecuakao Group Ltd, United Cocoa Processor Inc, Barry Callebaut AG, Moner Cocoa SA, and Altınmarka Gıda San ve Tic AS are among the major players operating in the cocoa derivatives market. These companies mainly focus on product innovation to expand their market size and follow emerging trends.

Cocoa Derivatives Market Regional Insights

The regional trends and factors influencing the Cocoa Derivatives Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Cocoa Derivatives Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Cocoa Derivatives Market

Cocoa Derivatives Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 27.81 Billion |

| Market Size by 2028 | US$ 37.8 Billion |

| Global CAGR (2022 - 2028) | 5.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Cocoa Derivatives Market Players Density: Understanding Its Impact on Business Dynamics

The Cocoa Derivatives Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Cocoa Derivatives Market are:

- Olam Group Ltd

- Indcre SA

- Cargill Inc

- Natra SA

- JB Foods Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Cocoa Derivatives Market top key players overview

Report Spotlights

- Progressive industry trends in the cocoa derivatives market to help companies develop effective long-term strategies

- Business growth strategies adopted by market players in developed and developing countries

- Quantitative analysis of the market from 2022 to 2028

- Estimation of global demand for cocoa derivatives

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers in the cocoa derivatives market

- Recent developments to understand the competitive market scenario

- Market trends and outlook, and growth drivers and restraints in the cocoa derivatives market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest

- Size of the cocoa derivatives market at various nodes

- Detailed overview and segmentation of the market and growth dynamics of the cocoa derivatives industry

- Size of the cocoa derivatives market in various regions with promising growth opportunities

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Category, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The rising demand for cocoa-based confectioneries and the utilization of cocoa as a sustainable beauty ingredient by the cosmetic industry are some of the key driving factors for the cocoa derivatives market.

Based on application, personal care is the fastest-growing segment in the cocoa derivatives market due to its high antioxidant properties and its richness in flavanols.

Europe accounted for the largest share of the global cocoa derivatives market. The market growth is attributed to the increasing popularity of specialty chocolates among the European population which boost the demand for cocoa derivatives.

Based on the type, the cocoa beans segment accounted for the largest revenue share as it promotes healthy digestion due to their fibre content. The fibre content helps soften bowel movements, prevent haemorrhoids and help with other digestive conditions. it finds wide application in industries such as food & beverage, confectionery, and pharmaceuticals.

Increasing demand for organic and fairtrade cocoa derivatives is further expected to create lucrative opportunities for cocoa derivatives market growth.

The major players operating in the global cocoa derivatives market are Olam Group Ltd, Indcre SA, Cargill Inc, Natra SA, JB Foods Ltd , Ecuakao Group Ltd, United Cocoa Processor Inc, Barry Callebaut AG, Moner Cocoa SA, Altınmarka Gıda San ve Tic AS among few others.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Cocoa Derivatives Market

- Olam Group Ltd

- Indcre SA

- Cargill Inc

- Natra SA

- JB Foods Ltd

- Ecuakao Group Ltd

- United Cocoa Processor Inc

- Barry Callebaut AG

- Moner Cocoa SA

- Alt?nmarka G?da San ve Tic AS

Get Free Sample For

Get Free Sample For