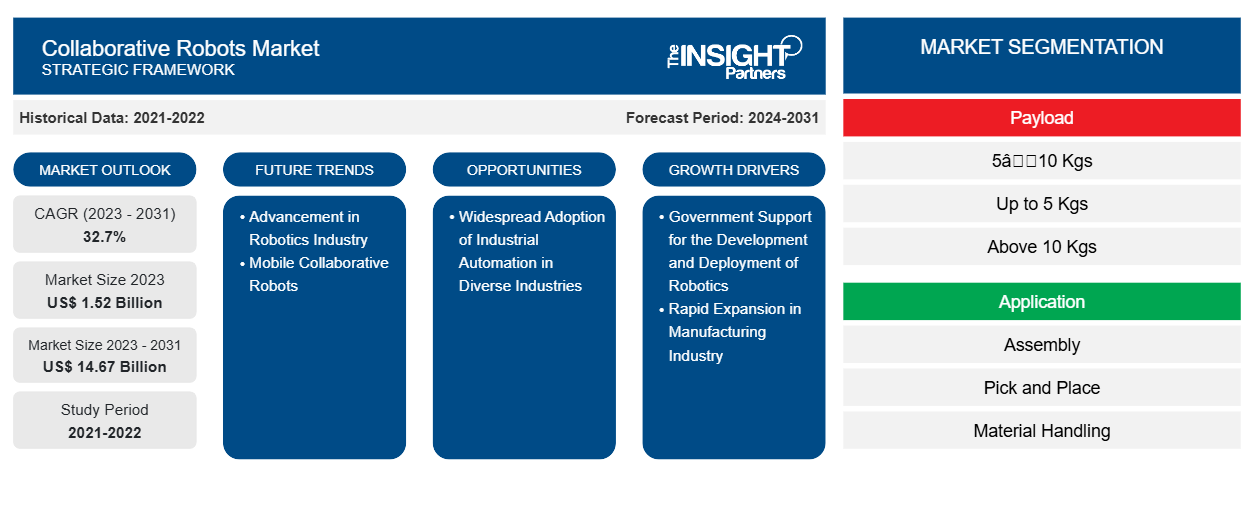

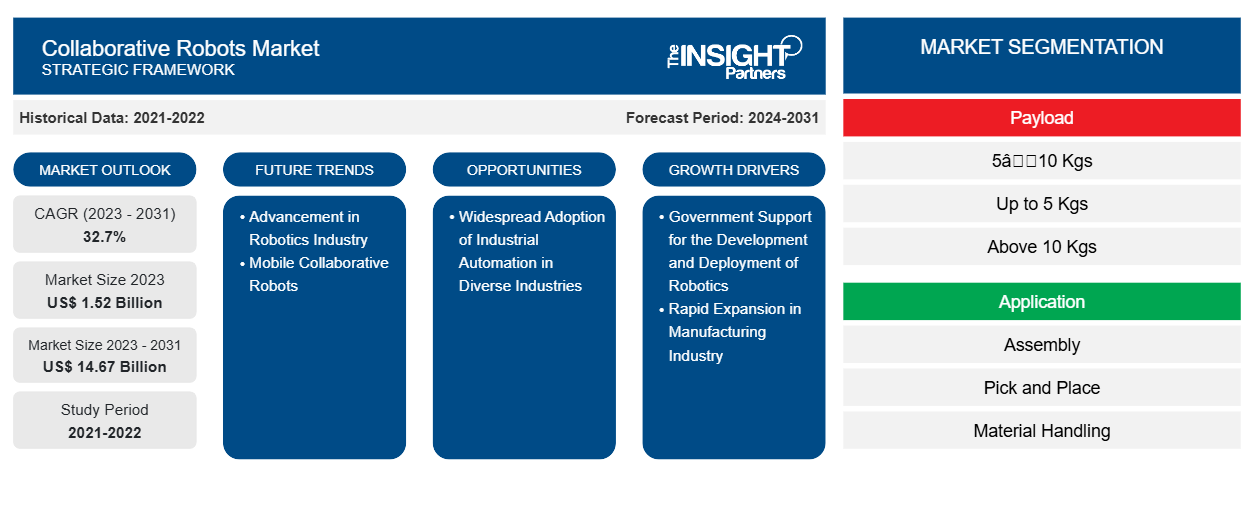

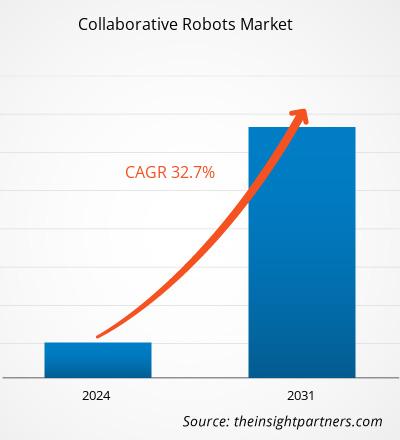

The collaborative robots market size is projected to reach US$ 14.67 billion by 2031 from US$ 1.52 billion in 2023. The market is expected to register a CAGR of 32.7% during 2023–2031. Mobile collaborative robots are likely to bring in new trends in the market.

Collaborative Robots Market Analysis

Collaborative robots are a segment of service robots used in material handling, manufacturing, and labs. The increasing demand in factories—particularly in the manufacturing sector, where humans and robots have already begun to work in harmony—is resulting in the growth of the collaborative robots market. The advent of collaborative robots has enabled a trustworthy working environment where humans can safely work alongside robots. Key factors driving the market include government support for the development and deployment of robotics and rapid expansion in the manufacturing industry.

Collaborative Robots Market Overview

The governments of several nations worldwide are taking initiatives to support and promote the development and adoption of robotics in their respective countries. Such initiatives and measures taken by governments are expected to propel the market growth for industrial robotics globally, thereby bolstering the demand for collaborative robots as well. In 2022, Europe held the largest revenue share of the global collaborative robots market. In Europe, the robust automobile sector and the presence of major premium car manufacturers are anticipated to drive the collaborative robots market. Further, the growth of electric vehicle manufacturing is anticipated to drive market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Collaborative Robots Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Collaborative Robots Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Collaborative Robots Market Drivers and Opportunities

Government Support for Development and Deployment of Robotics

Governments of several nations worldwide are taking initiatives to support and promote the development and adoption of robotics in their respective countries. For instance, the government of Singapore, under its Industry Transformation Program, announced several measures to facilitate innovation, automation, and expansion of the companies and obtain financing. The Government of India has taken various measures to boost smart manufacturing in India, including the Production Linked Incentive (PLI) scheme. As a major government initiative to promote manufacturing in India, the PLI scheme was launched in 2020 and covered 14 sectors, including automotive, pharmaceuticals, textiles, food processing, and white goods. Further, the government of China has taken several measures for the deployment of industrial robotics in the country's manufacturing sector. This includes the "Made in China 2025" plan for the development of high-tech industries. In addition, the government also announced a five-year "Robotics Industry Development Plan" for the expansion of China's industrial robotics sector. The government is offering considerable subsidies and tax breaks for industrial automation. Moreover, Germany's Industry 4.0 initiative includes the development and deployment of industrial robots. The government announced offering non-refundable cash grants of ~US$ 78 million each year to support research institutes, companies, and academics during 2016–2020 for human-technology interaction research. Currently, ~300 study programs related to automation and robotics have been made available by the government.

The South Korean government announced a US$ 2.7 million investment plan, Second Basic Plan for Intelligent Robot Development, 2014–2018. After the end of the Second Basic Plan (2014–2018), the government formulated and carried out the third Intelligent Robot Basic Plan (2019–2023).

Widespread Adoption of Industrial Automation in Diverse Industries

The penetration of industrial automation is increasing in various industries other than automotive, such as logistics, food & beverages, electrical & electronics, and rubber & plastics. In the recent past, the nonautomotive industries were underpenetrated compared to the automotive industry. With the increasing functionality of equipment such as collaborative robots, it is anticipated that the nonautomotive industries will further accelerate the adoption of collaborative robots. The penetration of industrial automation is also increasing among countries. Developed markets, including China, the US, and Japan, have high penetration; however, there is still a lot of opportunity for the industrial market to grow further, even in the developed markets. The prospective for further robot installations is remarkable in many of these countries, particularly in the automotive industry. This growth is attributed to the necessary modernization and transformation required in these markets. These statistics are promising for collaborative robot manufacturers as they signify the huge scope for further increase in adoption. It is expected that the low penetration will propel considerable growth during the forecast period as long as there is considerable support from the government to the manufacturers.

Collaborative Robots Market Report Segmentation Analysis

Key segments that contributed to the derivation of the collaborative robots market analysis are payload, application, type, end-user industry, and functionality.

- Based on payload, the market is segmented into 5–10 Kgs, up to 5 Kgs, and above 10 Kgs. The 5–10 Kgs segment held the largest market share in 2023.

- Based on application, the market is categorized into assembly, pick and place, material handling, quality testing, machine tending, welding, packaging, and others. The assembly segment held the largest market share in 2023.

- By type, the market is divided into robotic arm, welding guns, grippers, and others. The robotic arm segment held the largest market share in 2023.

- By end-user industry, the market is segmented into automotive, electronics, metal and machinery, food and beverage, logistics, pharmaceuticals, and others. The automotive segment dominated the market in 2023.

- By functionality, the market is divided into static robot and mobile robot. The static robot segment dominated the market in 2023.

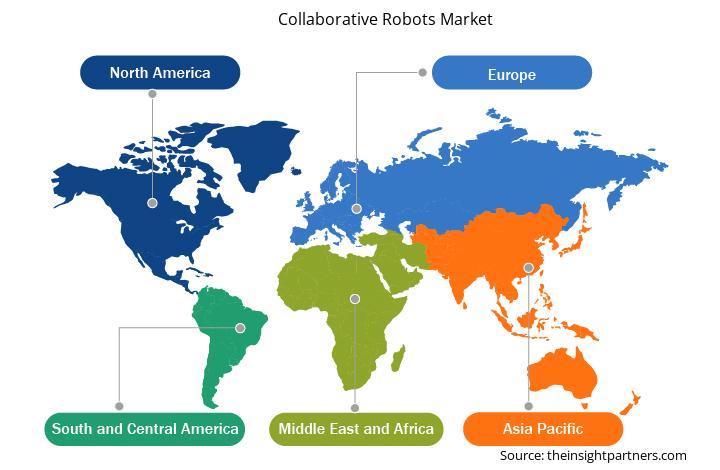

Collaborative Robots Market Share Analysis by Geography

The geographic scope of the collaborative robots market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific held a significant market share in 2023. Asia Pacific consists of many developing countries witnessing significant growth in their manufacturing sector. The region has become a global manufacturing hub with the presence of diverse manufacturing industries. Among China's evolution into a high-skilled manufacturing hub, other developing countries such as India, South Korea, Taiwan, and Vietnam are attracting several businesses with an aim to relocate their low to medium-skilled manufacturing facilities to neighboring countries, offering low labor costs. Further, governments of these countries are encouraging investment initiatives to promote manufacturing activities. However, the lack of skilled labor, low productivity, and developed infrastructure scarcity are a few of the restraints that are required to be addressed to strengthen their position as a key manufacturing hub in the region.

Governments of developing economies in Asia Pacific are offering tax rebates, funds, subsidies, and other such support to attract manufacturing companies to set up their plants in the respective countries. Further, several governments have taken initiatives such as Made in China 2025 and Make in India. However, China, the largest manufacturing hub, is experiencing a rise in the country's labor cost owing to the aging population of the country. This has resulted in manufacturing companies seeking investments in countries in Southeast Asia. The improving infrastructure, rising domestic consumption, and lower costs are a few of the factors attracting manufacturing companies in these countries.

China is the largest producer of passenger cars worldwide. Japan, India, and South Korea are a few of the other major vehicle manufacturing countries in Asia Pacific. Apart from the automotive industry, several other industries in China are deploying collaborative robots; for instance, at Xiamen Runner Industrial Corporation—one of the largest bathroom accessories manufacturers in China—64 robots from Universal Robots were deployed on the production line for varied tasks, ranging from tending and injecting-molding machines to the product assembly.

Collaborative Robots Market Regional Insights

The regional trends and factors influencing the Collaborative Robots Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Collaborative Robots Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Collaborative Robots Market

Collaborative Robots Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.52 Billion |

| Market Size by 2031 | US$ 14.67 Billion |

| Global CAGR (2023 - 2031) | 32.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Payload

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

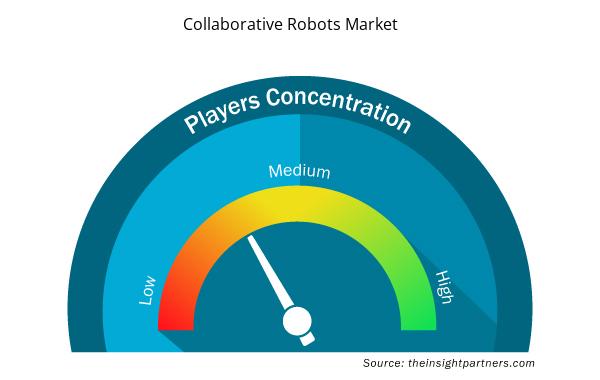

Collaborative Robots Market Players Density: Understanding Its Impact on Business Dynamics

The Collaborative Robots Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Collaborative Robots Market are:

- Kuka AG

- Yaskawa America Inc

- Aubo (Beijing) Robotics Technology Co Ltd

- Doosan Robotics Inc

- Fanuc Corp

- ABB Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Collaborative Robots Market top key players overview

Collaborative Robots Market News and Recent Developments

The collaborative robots market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the collaborative robots market are listed below:

- OMRON has announced the availability of the OMRON TM S Series collaborative robots, designed for diverse applications across multiple industries. These cobots introduce advanced hardware, more safety features and certifications, and next-generation configuration capabilities, making them easier to use than ever before. (Source: OMRON, Press Release, September 2023)

- TÜV Rheinland Group, an internationally leading independent third-party testing, inspection, and certification organization, issued the CE Machinery Directive and Functional Safety Compliance Certificate for ESS (ESTUN Safety Solution) products to ESTUN Automation Co., Ltd. This marks that ESTUN has made rapid progress in building a comprehensive robot functional safety product system. This certification not only demonstrates ESTUN's innovative strength and professional level in the field of robotics technology but also reflects its strict control and commitment to product safety and quality and will further enhance ESTUN's service quality and efficiency in the global market. (Source: ESTUN Robotics, Press Release, April 2024)

Collaborative Robots Market Report Coverage and Deliverables

The "Collaborative Robots Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Collaborative robots market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Collaborative robots market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Collaborative robots market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the collaborative robots market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Vertical Farming Crops Market

- Joint Pain Injection Market

- Environmental Consulting Service Market

- Underwater Connector Market

- Formwork System Market

- Adaptive Traffic Control System Market

- Advanced Planning and Scheduling Software Market

- Small Satellite Market

- Microcatheters Market

- Lymphedema Treatment Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Payload, Application, Type, and End-User Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Teradyne Inc., Kuka AG, Yaskawa America Inc., Fanuc Corp, and ABB Ltd. are major players in the market.

The market is expected to reach a value of US$ 14.7 billion by 2031.

The market is anticipated to expand at a CAGR of 32.7% during 2023-2031.

Government support for the development & deployment of robotics and rapid expansion in the manufacturing industry are driving the market growth.

Advancements in the robotics industry and mobile collaborative robots are major trends in the market.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Collaborative Robots Market

- Kuka AG

- Yaskawa America Inc

- Aubo (Beijing) Robotics Technology Co Ltd

- Doosan Robotics Inc

- Fanuc Corp

- ABB Ltd

- Rethink Robotics GmbH

- Techman Robot Inc

- Kawasaki Heavy Industries Ltd

- Bosch Rexroth AG

- Teradyne Inc

- Denso Corp

- Comau SpA

- SIASUN Robot & Automation CO., Ltd

- Agile Robots SE

- Azenta, Inc.

- Svaya Robotics Pvt. Ltd.

- Productive Robotics, LLC

- ESTUN AUTOMATION CO., LTD

- OMRON Corp

Get Free Sample For

Get Free Sample For