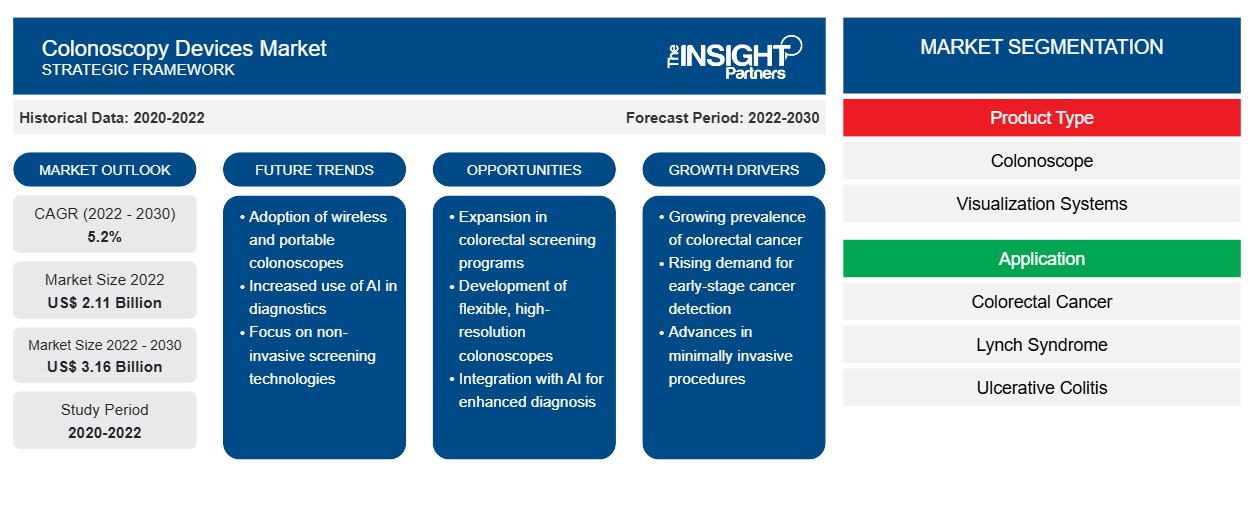

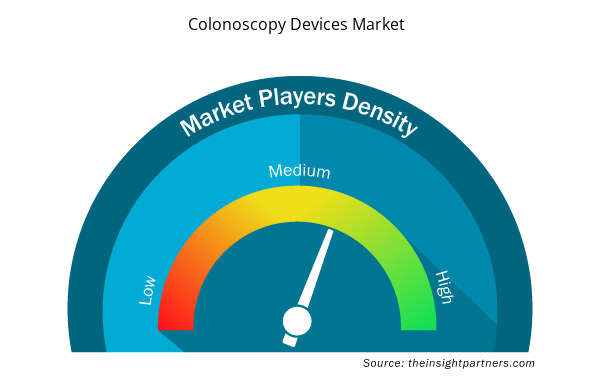

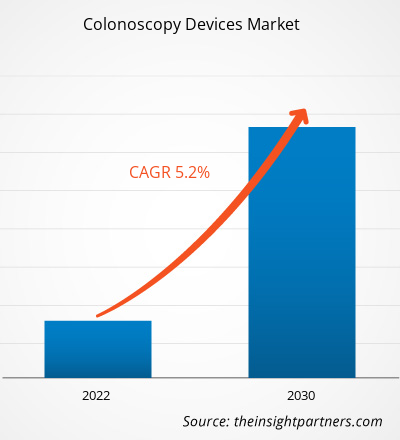

[Research Report] The colonoscopy devices market is projected to grow from US$ 2.11 billion in 2022 to US$ 3.16 billion by 2030, recording a CAGR of 5.2% during 2022–2030.

Market Insights and Analyst View:

The colonoscopy devices market forecast can help stakeholders in this marketplace plan their growth strategies. The report includes growth prospects, along with the colonoscopy devices market trends and their foreseeable impact during the forecast period.

Colonoscopies are performed with reusable scopes. They are flexible, fiber-optic instruments that are introduced into the anus and directed through the colon. The colonoscopes helps endoscopists detect chronic illnesses and check patients for malignant or precancerous diseases. People aged 50 years and above should get colonoscopies as part of a regular cancer screening regimen. In hospitals or ambulatory surgery center (ASCs), the procedures are carried out under mild sedation. Rising prevalence of colorectal cancer and increasing technological advancements in colonoscopy devices by manufacturers contribute to the growing colonoscopy devices market size. However, availability of alternative diagnostic tests for rectal diseases impedes the growth of the market.

Growth Drivers:

Rising Prevalence of Colorectal Cancer Drives Colonoscopy Devices Market Growth

Colorectal cancer is a malignant tumor formed in the tissues of rectum or colon. Rectal and colon cancer are often grouped due to the common features of both conditions. According to the World Health Organization (WHO), colon cancer ranks second in terms of cancer-related deaths worldwide. Globally, there were over 1.9 million new instances of colorectal cancer and over 930,000 deaths from the disease in 2020. There were significant regional differences in the incidence and mortality rates. Europe, Australia, and New Zealand reported the highest incidence rates, whereas Eastern Europe had the highest fatality rates. As per the data provided by European Cancer Information System, in EU-27 countries, colorectal cancer accounted for 12.7% of all new cancer diagnoses and 12.4% of total mortalities caused by the disease in 2020. High prevalence makes it the second most frequently occurring cancer, after breast cancer, and the second leading cause of death, after lung cancer in Europe. According to the WHO, in 2020, there were more than 1.9 million new cases of colorectal cancer, the annual burden of colorectal cancer is expected to rise to 3.2 million new cases (a 63% increase) and 1.6 million deaths (a 73% increase) by 2040.

In the US, colorectal cancer is the third most common cancer type (excluding skin cancer) detected every year. According to the American Cancer Society, in 2023, ~153,000 people were diagnosed with colorectal cancer in the country. These numbers include 106,950 new colon cancer cases (54,420 men and 52,550 women) and 46,050 new rectal cancer cases (27,440 men and 18,610 women). For colorectal cancer, colonoscopy is an important screening test and has become a part of routine cancer screening. Thus, the increasing prevalence of colorectal cancer propels the colonoscopy devices market growth.

Alternatives to colonoscopy include sigmoidoscopy, a less invasive form of colonoscopy, and stool sample testing, one of the noninvasive methods. From the beginning of the 21st century, physicians have been widely recommending colonoscopy to screen patients aged 50 and above for colon cancer. However, in the recent years, they have felt the need for a change in tactics. They are concerned about the cost and hassle of colonoscopy, which discourages people from undergoing these screening procedures. Moreover, equally effective tests are available that are less invasive and less of an ordeal than a colonoscopy. Thus, the availability of alternative diagnostic tests hinders the colonoscopy devices market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Colonoscopy Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Colonoscopy Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The colonoscopy devices market analysis has been carried out by considering the following segments: product type, application, and end user.

Segmental Analysis:

By product type, the colonoscopy devices market is segmented into colonoscope, visualization systems, and other. The colonoscope segment held the largest market share in 2022. However, the visualization systems segment is anticipated to register the highest CAGR during 2022– 2030.

The colonoscopy devices market, by application, is segmented into colorectal cancer, lynch syndrome, ulcerative colitis, Crohn's disease, and other. The colorectal cancer segment held the largest colonoscopy devices market share in 2022, and the same segment is anticipated to register the highest CAGR during 2022–2030. The colonoscopy can detect and remove malignant and pro-malignant lesions with high accuracy. It is a valuable diagnostic tool for colorectal cancer screening. Almost all national and international gastrointestinal and cancer societies advise using it as a first screening method.

The colonoscopy devices market, by end user, is segmented into hospitals, ambulatory surgery centers, and others. The hospital segment held the largest colonoscopy devices market share in 2022 and is anticipated to register the highest CAGR during 2022–2030, owing to the adoption of technological advancements in hospitals and the increasing number of screenings in hospital settings.

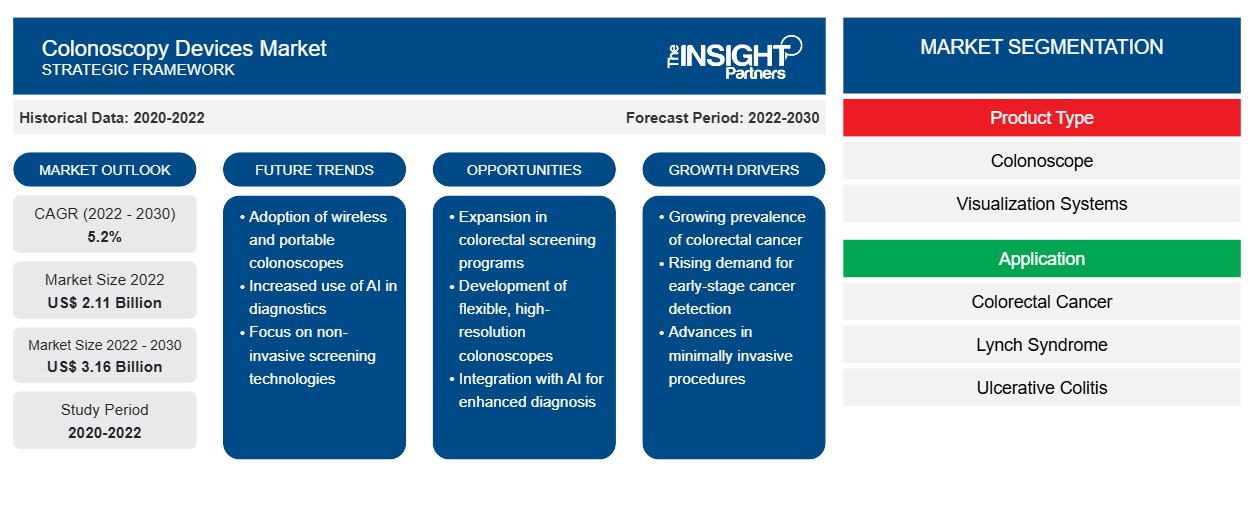

Regional Analysis:

The geographic scope of the colonoscopy devices market report includes North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America held the largest market share in 2022. The market growth in North America is driven by increasing burden of aging population, rising number of product launches, and R&D activities to develop advanced colonoscopy devices.

Colonoscopy Devices Market Regional Insights

Colonoscopy Devices Market Regional Insights

The regional trends and factors influencing the Colonoscopy Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Colonoscopy Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Colonoscopy Devices Market

Colonoscopy Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2.11 Billion |

| Market Size by 2030 | US$ 3.16 Billion |

| Global CAGR (2022 - 2030) | 5.2% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

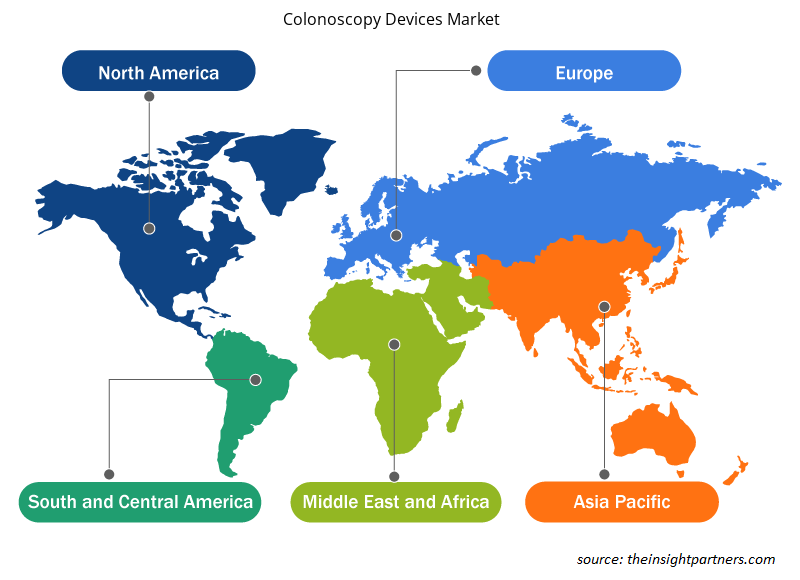

Colonoscopy Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Colonoscopy Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Colonoscopy Devices Market are:

- AMBU AS

- Fujifilm

- Endomed systems gmbh

- Olympus

- Pentax

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Colonoscopy Devices Market top key players overview

Competitive Landscape and Key Companies:

AMBU AS, Fujifilm, Endomed systems gmbh, Olympus, Steris PLC, GI View, Boston Scientific Corporation, PENTAX Medical, Avantis Medical Systems, and SonoScape Medical Corp are among the prominent companies profiled in the colonoscopy devices market report. These companies focus on developing new technologies, upgrading existing products, and expanding their geographic presence to meet the growing consumer demand worldwide. As per company press releases, below are a few recent key developments:

- In April 2021, FUJIFILM Medical Systems launched the G-EYE 700 Series Colonoscope. G-EYE, a technology developed by Smart Medical, assists during routine examinations. The G-EYE 700 series colonoscopes expanded Fujifilm’s innovative colonoscope portfolio offering. G-EYE will be offered as an extension to the 700-series colonoscope family that is compatible with Fujifilm’s ELUXEO endoscopic video imaging system.

- In October 2020, Olympus received 510(k) clearance and market availability of its two colonoscopes—PCF-H190T and PCF-HQ190. The products provided an addition to the present capabilities for physicians to diagnose and treat gastrointestinal tract disorders.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Maritime Analytics Market

- Underwater Connector Market

- Hummus Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Hair Extensions Market

- Adaptive Traffic Control System Market

- GMP Cytokines Market

- Smart Water Metering Market

- Lyophilization Services for Biopharmaceuticals Market

- Non-Emergency Medical Transportation Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The colonoscopy devices market majorly consists of players such as AMBU AS, Fujifilm, Endomed systems gmbh, Olympus, Steris PLC, GI View, Boston Scientific Corporation, PENTAX Medical, Avantis Medical Systems, and SonoScape Medical Corp among others.

US holds the largest market share in colonoscopy devices market due to the increasing public awareness of colon cancer through media campaigns initiated by cancer awareness groups and government agencies, and an aging population who are encouraged to have regular checkups. According to the American Cancer Society, an estimated 104,610 new colon cancer cases and 43,340 rectal cancer cases were diagnosed in the US in 2020.

The factors that are driving the growth of the market are the rising prevalence of colorectal cancer and increasing technological advancements in colonoscopy devices by manufacturers.

Asia Pacific is expected to be the fastest-growing region in the colonoscopy devices market. The colonoscopy devices market in the region is driven by factors such as an increasing number of R&D activities, adoption of innovative technology and products, and upsurging prevalence of chronic diseases in this region.

Colonoscopies are performed with reusable scopes. They are flexible, fiber-optic instruments that are introduced into the anus and directed through the colon. The colonoscopes helps endoscopists detect chronic illnesses and check patients for malignant or precancerous diseases. People aged 50 years and above should get colonoscopies as part of a regular cancer screening regimen. In hospitals or ambulatory surgery center (ASCs), the procedures are carried out under mild sedation.

The colonoscopy devices market, based on end user, is segmented hospitals, ambulatory surgery centers, and others. The hospital segment held the largest colonoscopy devices market share in 2022 and is anticipated to register the highest CAGR during 2022–2030.

The colonoscopy devices market, based on product type, is segmented into colonoscope visualization systems, and others. The colonoscope segment held the largest market share in 2022. However, the visualization systems segment is anticipated to register the highest CAGR during 2022– 2030.

The colonoscopy devices market, based on application, is segmented into colorectal cancer, lynch syndrome, ulcerative colitis, Crohn's disease, and other. The colorectal cancer segment held the largest colonoscopy devices market share in 2022, and the same segment is anticipated to register the highest CAGR during 2022–2030.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Colonoscopy Devices Market

- AMBU AS

- Fujifilm

- Endomed systems gmbh

- Olympus

- Pentax

- GI View

- Boston Scientific Corporation

- Steris PLC

- Avantis Medical Systems

- SonoScape Medical Corp

Get Free Sample For

Get Free Sample For