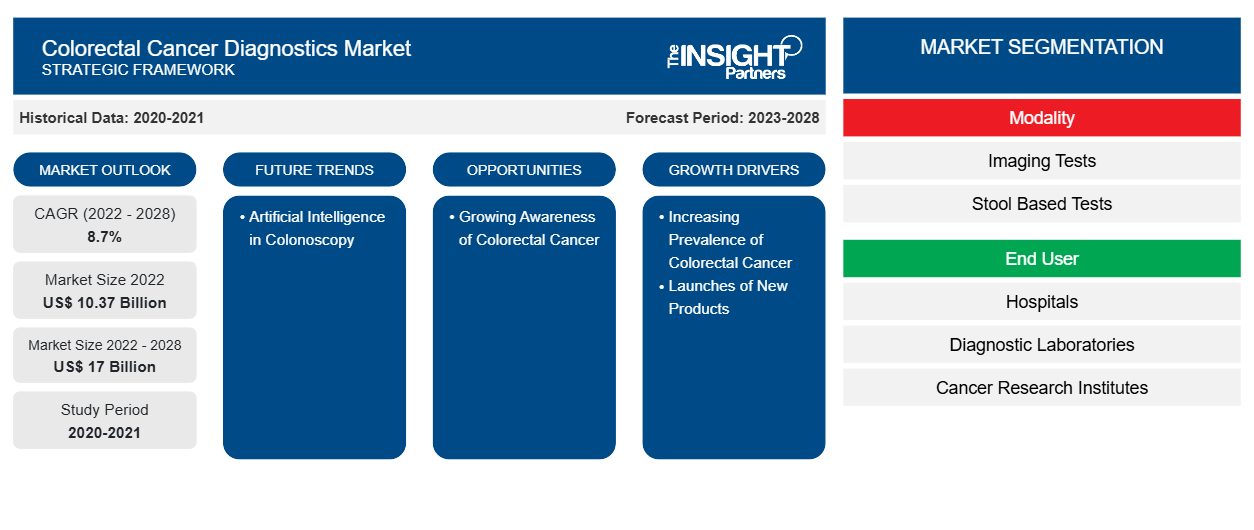

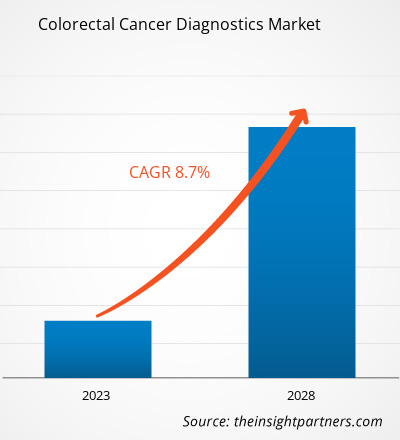

[Research Report] The colorectal cancer diagnostics market size is expected to grow from US$ 10,374.68 million in 2022 to US$ 16,996.48 million by 2028; it is estimated to record a CAGR of 8.7% from 2023 to 2028.

The colorectal cancer diagnostics market is segmented based on modality, end user, and geography. The report offers insights and in-depth market analysis, emphasizing parameters such as drivers, trends, opportunities, and competitive landscape analysis of leading market players across various regions. It also includes analyses of the impact of the COVID-19 pandemic across major regions.

Market Insights

Launches of New Products Drives Colorectal

Major players in the colorectal cancer diagnostics market manufacture a wide range of devices that help reduce the burden of colorectal cancer and other associated indications such as colon polyps, Crohn’s disease, colitis, and irritable bowel syndrome. In July 2022, US Digestive Health (USDH), a network of top-rated gastrointestinal (GI) practices, announced the commercialization of AI-assisted colonoscopy screenings with the country’s largest installation of Genious Intelligent GI endoscopy modules. These modules are expected to help physicians identify hard-to-detect and potentially cancerous polyps in real time. With the launch of this device, patients throughout southeastern, southwestern, and central Pennsylvania can now access AI-assisted colonoscopy with enhanced capabilities. In September 2020, Olympus Corporation announced the launch of ENDO-AID, a cutting-edge platform powered by artificial intelligence (AI). The platform includes ENDO-AID CADe application (app), a computer-aided endoscopic method for the detection of different conditions of the colon. This new AI platform enables the real-time display of automatically detected suspicious lesions and works in combination with its EVIS X1. Thus, the frequent developments and new product launches drive the colorectal cancer diagnostics market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Colorectal Cancer Diagnostics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Colorectal Cancer Diagnostics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Modality-Based Insights

Based on modality, the colorectal cancer diagnostics market is bifurcated into stool-based tests and imaging tests. In 2022, the imaging tests segment held a larger share of the colorectal cancer diagnostics market and is anticipated to register a higher CAGR during the forecast period. The use of imaging tests in colorectal cancer diagnostics has evolved over the last few years. Imaging results are instrumental in surveillance, diagnosis, staging, treatment selection, and follow-up scheduling. Imaging tests involve looking at the structure of the colon and rectum for the presence of any abnormal areas. Imaging examinations use scopes, tube-like instruments with a light and tiny video camera at their end, inserted into the rectum. These tests scan the inside of the colon and rectum for any abnormal areas that might be cancer or polyps. These tests are used less often than stool-based tests and require more preparation beforehand and have some associated risks, unlike stool-based tests. The imaging tests is further classified into colonoscopy, CT colonography, flexible sigmoidoscopy, capsule endoscopy, and others.

Colonoscopy segment held the largest share of the market in 2022. However, CT colonography is expected to grow at a faster pace during the forecast period. CT colonography aids in the morphological analysis of wall deformities, providing information required for the preoperative assessment of T staging in colorectal cancer. As per the guidelines of Response Evaluation Criteria in Solid Tumors (RECIST), CT is the most widely used modality for assessing treatment response in patients with metastasized colon and rectal tumors. The common advantages of CT colonography are as follows: it is quick and safe, it helps to visualize the entire colon, and no sedation is required to perform the test. This test is recommended to be performed every five years in asymptomatic patients with average risk.

End User-Based Insights

Based on end user, the colorectal cancer diagnostics market is segmented into hospitals, diagnostic laboratories, cancer research institutes, and others. The hospitals segment accounted for the largest market share in 2022 and is anticipated to register the highest CAGR during the forecast period.

The colorectal cancer diagnostics market players adopt organic strategies such as product launch and expansion to expand their geographic footprint and product portfolios and meet the growing demands. Inorganic growth strategies adopted by market players allow them to expand their businesses and enhance their geographic presence. Additionally, these growth strategies help companies strengthen their clientele and enlarge their product portfolios.

- In December 2022, Epigenomics licenses protein biomarker technology for blood-based colorectal cancer test. The company has licensed from The University of Texas MD Anderson Cancer Center certain patent and technology rights to biomarkers associated with colorectal cancer detection.

- In August 2021, Illumina Acquired GRAIL to Accelerate Patient Access to Life-Saving Multi-Cancer Early-Detection Test. GRAIL's Galleri blood test detects 50 different cancers before they are symptomatic. Illumina's acquisition of GRAIL will accelerate access and adoption of this life-saving test worldwide.

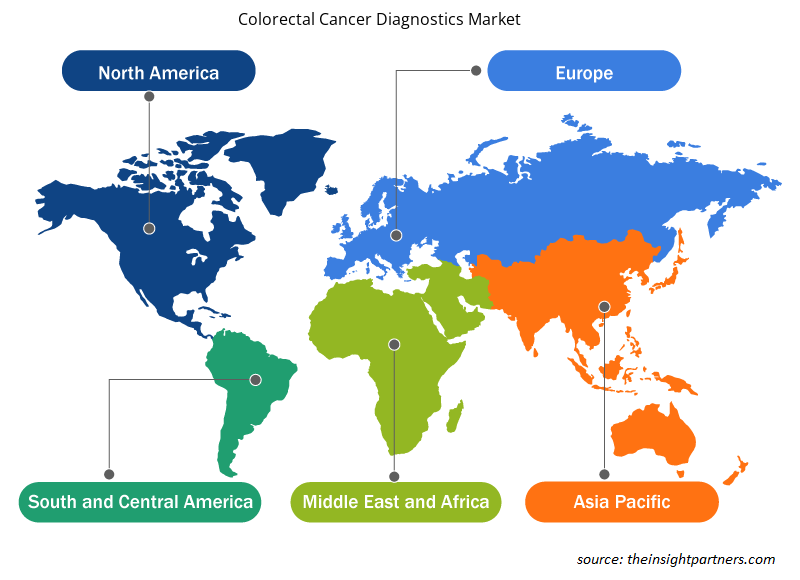

Colorectal Cancer Diagnostics Market Regional Insights

Colorectal Cancer Diagnostics Market Regional Insights

The regional trends and factors influencing the Colorectal Cancer Diagnostics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Colorectal Cancer Diagnostics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Colorectal Cancer Diagnostics Market

Colorectal Cancer Diagnostics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 10.37 Billion |

| Market Size by 2028 | US$ 17 Billion |

| Global CAGR (2022 - 2028) | 8.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Modality

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

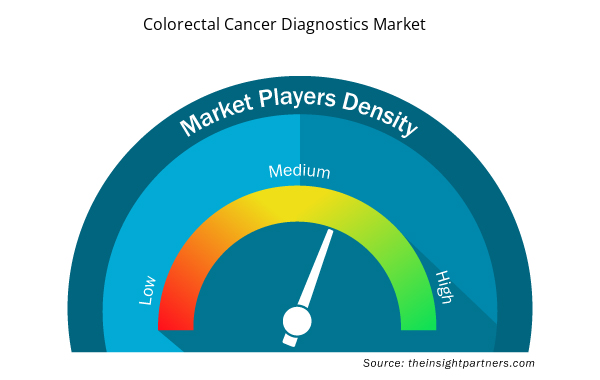

Colorectal Cancer Diagnostics Market Players Density: Understanding Its Impact on Business Dynamics

The Colorectal Cancer Diagnostics Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Colorectal Cancer Diagnostics Market are:

- Medtronic Plc

- Illumina Inc

- Clinical Genomics Technologies Pty Ltd

- EDP Biotech Corp

- Epigenomics AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Colorectal Cancer Diagnostics Market top key players overview

Company Profiles

- Medtronic Plc

- Illumina Inc

- Clinical Genomics Technologies Pty Ltd

- EDP Biotech Corp

- Epigenomics AG

- F. Hoffmann-La Roche Ltd

- Quest Diagnostics Inc

- Novigenix SA

- Siemens Healthineers AG

- Bruker Corp

- Eiken Chemical Co., Ltd.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Modality, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Colorectal cancer diagnostics refers to the tools, kits and test performed on an individual to diagnose colorectal cancer in an individual. This involves series of non-invasive and invasive test to confirm the cancer and its stage based on that treatment will be provided to the patient.

Asia Pacific is expected to be the fastest growing region in the colorectal cancer diagnostics market. Asia Pacific registered as the fastest-growing region in the global colorectal cancer diagnostics market. The market in this region is driven due to rising incidences of colorectal cancer, easy access to the diagnosis for colorectal cancer, and proposing guidelines for the procedures. Also, increasing government funding for research activities in colorectal cancer is expected to propel the growth of the market for colorectal cancer diagnostics in Asia Pacific.

The colorectal cancer diagnostics market, based on modality, is bifurcated into imaging tests and stool based tests. In 2022, the imaging tests segment held the larger share and is expected to grow at a CAGR of 8.8% during the forecast period. Screening and imaging play a vital role in the diagnostics of colorectal cancer to understand the extent of tumor-affected area, that act as a major driving factor for the growth of the imaging tests segment.

The factors that are driving growth of the market are increasing prevalence of colorectal cancer and launches of new products.

The US holds the largest market share in colorectal cancer diagnostics market. The growth of the market in the country is because in 2022, more than 600,000 surgeries are performed annually in the US to treat colon diseases. According to the American Cancer Society, the 5-year survival rate for localized colon cancer is 91% and for localized rectal cancer is 90%.

The colorectal cancer diagnostics market majorly consists of the players such as Medtronic Plc, Illumina Inc, Clinical Genomics Technologies Pty Ltd, EDP Biotech Corp, Epigenomics AG, F Hoffmann-La Roche Ltd, Quest Diagnostics Inc, Novigenix SA, Siemens Healthineers AG, Bruker Corp, and Eiken Chemical Co Ltd.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Colorectal Cancer Diagnostics Market

- Medtronic Plc

- Illumina Inc

- Clinical Genomics Technologies Pty Ltd

- EDP Biotech Corp

- Epigenomics AG

- F. Hoffmann-La Roche Ltd

- Quest Diagnostics Inc

- Novigenix SA

- Siemens Healthineers AG

- Bruker Corp

- Eiken Chemical Co., Ltd.

Get Free Sample For

Get Free Sample For