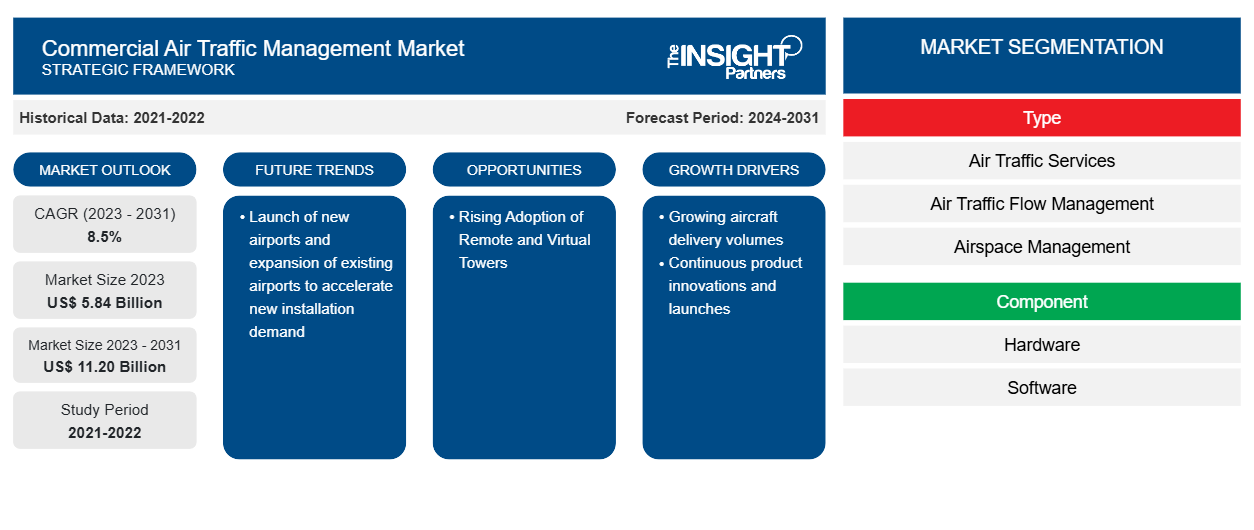

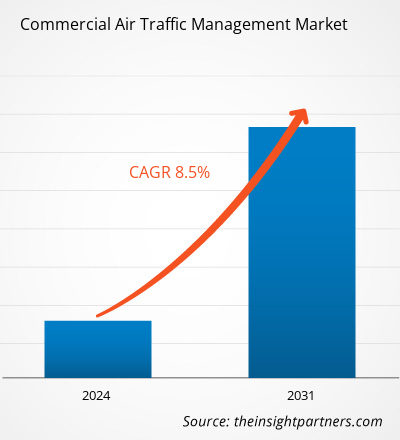

The commercial air traffic management market size is projected to reach US$ 11.20 billion by 2031 from US$ 5.84 billion in 2023. The market is expected to register a CAGR of 8.5% during 2023–2031. Launch of new airports and expansion of existing airports to accelerate new installation demand is likely to remain a key trend in the market.

Commercial Air Traffic Management Market Analysis

The buyers of the commercial air traffic management market include commercial airports and their authorities who are increasingly investing in the procurement of advanced air traffic management (ATM) solutions for efficient and safe airline operations. Presently the airport construction projects are in progress making the purchasing power of buyer moderate. However, reaching closer to the end of airport construction, the demand for ATM solutions will increase thereby increasing the bargaining power of the buyers. Additionally, the lifespan of commercial ATM systems is high thereby leading to low bargaining power of buyers presently. However, during the time of updation of new ATM systems across airports specially the existing ones are expected to increase the bargaining power of buyers in the coming years.

Commercial Air Traffic Management Market Overview

The major stakeholders in the global commercial air traffic management market ecosystem include component manufacturers, hardware manufacturers, software providers, government authorities, and end users. The component manufacturers operating in the global commercial air traffic management market offer transmitters, antennas, receivers, indicators, batteries, lights, sensors, and other equipment. The timely supply of all these components is crucial for efficient operation across air traffic management system manufacturing plants. If any operational impact on these component providers there will be delay in the production of air traffic management system, thus directly affecting the commercial air traffic management market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Commercial Air Traffic Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Commercial Air Traffic Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Commercial Air Traffic Management Market Drivers and Opportunities

Continuous Product Innovations and Launches

The global aviation industry is transforming in terms of new and innovative products. The stakeholders across industry verticals are continuously investing in R&D to innovate and develop robust solutions to simplify the industrial operations. The growing demand for air traffic management systems compelled the market players to invest in the development of new and innovative products in recent years. A few of the major product developments are mentioned below:

- In July 2022, EUROCONTROL released an updated air traffic management surveillance tracker and server (ARTAS). The new version (V 9.0.2) has several new community-sourced features, and the issues are reported to be addressed therein.

- In June 2022, Indra Sistemas SA and Eurocontrol Maastricht Upper Area Control Centre (MUAC) announced the deployment of an Aeronautical Telecommunications Network (ATN) and Automatic Dependent Surveillance Contract system (ADS-C) enabling air traffic control systems to manage air traffic0 accurately.

- In June 2022, Thales SA announced the launch of HELIXVIEW, a C3-compliant scanner that combines X-ray nanotechnology-based electronic scanning and 3D imaging reconstruction, to provide higher security to airports and seamless travel facilities to passengers.

Such developments have been pushing the growth of commercial air traffic management market globally.

Rising Adoption of Remote and Virtual Towers

The remote and virtual towers help regulate and maintain air traffic operations remotely. Various airports worldwide have adopted these towers for faster and more secured airport operations. In June 2022, Brindisi Airport inaugurated its first ever remotely managed control tower in Italy. The new remote digital tower will help air traffic controllers to manage take-off, landing, and ground operations from a remote tower module. The module will also assist in air traffic management and enhance the safety and operational efficiency of the airport. In May 2022, it was announced that the airports at Braunschweig-Wolfsburg and Emden in Northern Germany commissioned DFS Aviation Services GmbH (DAS) and Frequentis for the construction of a remote tower center in the region, which is scheduled to commence operations by mid-2024. Thus, the rising adoption of and investment in remote and virtual towers for efficient air traffic management are expected to boost the growth of the commercial air traffic management market.

Commercial Air Traffic Management Market Report Segmentation Analysis

Key segments that contributed to the derivation of the commercial air traffic management market analysis are type, component, application, and airport class.

- Based on type, the commercial air traffic management market is segmented into air traffic services, air traffic flow management, and airspace management. The airspace management segment held a larger market share in 2023.

- Based on component, the commercial air traffic management market is divided into hardware and software. The hardware segment held a larger market share in 2023. The hardware segment is further sub-segmented into radars, antennas, display systems, and others.

- Based on application, the commercial air traffic management market is segmented into communication, navigation, surveillance, traffic control, and others. The surveillance segment held a larger market share in 2023. The navigation segment is further sub-segmented into CVOR, DVOR, DME, ILS, DF, and NDB. The surveillance segment is further sub-segmented into PSR, SSR, and MLAT.

- Based on airport class, the commercial air traffic management market is segmented into Class I, Class II, Class III, and Class IV. The Class I segment held a larger market share in 2023.

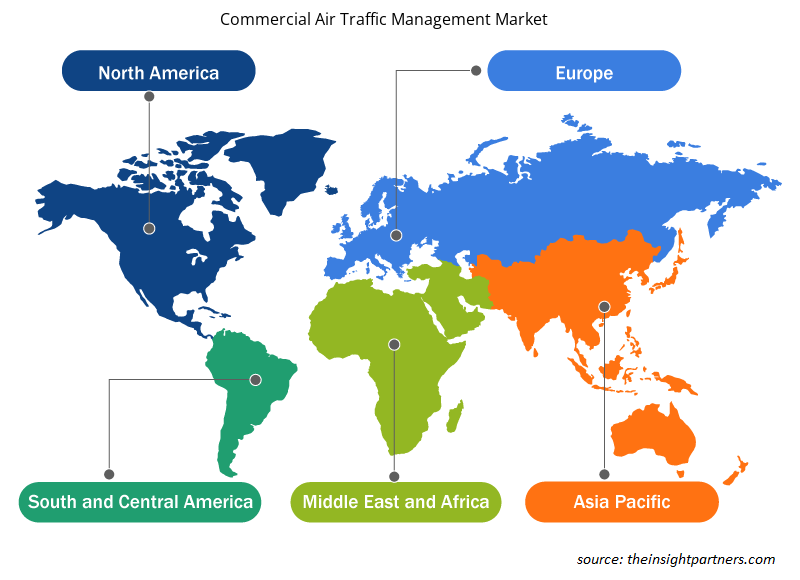

Commercial Air Traffic Management Market Share Analysis by Geography

The geographic scope of the commercial air traffic management market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the market in 2023 followed by Europe and Asia Pacific regions. Further, Asia Pacific is likely to surpass the North America market along with the highest CAGR in the coming years. The US dominated the North American commercial air traffic management market in 2023. This is mainly due to The US aviation industry is one of the major countries in the global aviation sector. The country has largest number of aircraft fleet that caters to millions of passengers per year. For instance, the US airline companies more than 862 million passengers in 2023. The rise in passenger traffic is leading to procurement of a larger number of aircraft fleet across the US carriers and generating more requirement for the ATM operations. Moreover, the upgrading of existing ATC towers across different US airports and commissioning of new ATC towers across different airports in the US is catalyzing the commercial air traffic management market growth across the country. Several airports across the country have gone through different expansion processes that also include the construction of new terminals, ATC towers, and upgrades of other sectors across the airports. For instance, in August 2022, the Phoenix-Mesa Gateway Airport commercialized a ATC tower for handling the growing air traffic across the airport in Arizona. Similarly, the Federal Aviation Administration (FAA) is implementing several airport plans to upgrade its air traffic management systems for the transformation of the US airspace thereby enhancing its safety, efficiency, and environmental responsibilities. Such factors have been pushing the growth of the US commercial air traffic management market in the North America region.

Commercial Air Traffic Management Market Regional Insights

The regional trends and factors influencing the Commercial Air Traffic Management Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Commercial Air Traffic Management Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Commercial Air Traffic Management Market

Commercial Air Traffic Management Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5.84 Billion |

| Market Size by 2031 | US$ 11.20 Billion |

| Global CAGR (2023 - 2031) | 8.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

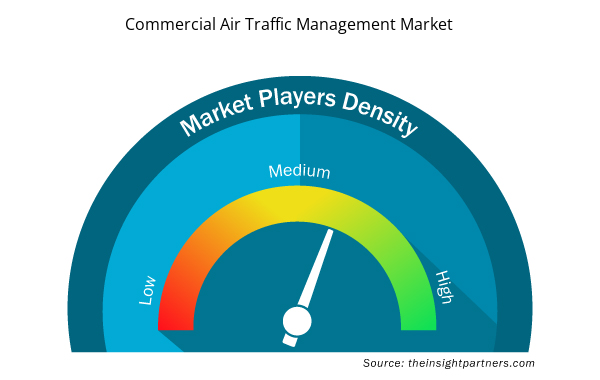

Commercial Air Traffic Management Market Players Density: Understanding Its Impact on Business Dynamics

The Commercial Air Traffic Management Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Commercial Air Traffic Management Market are:

- Thales SA

- BAE Systems Plc

- Indra Sistemas SA

- L3Harris Technologies Inc

- Raytheon Technologies Corp

- Honeywell International Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Commercial Air Traffic Management Market top key players overview

Commercial Air Traffic Management Market News and Recent Developments

The commercial air traffic management market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the commercial air traffic management market are listed below:

- Following the contract signed in 2014 with Zambia Airports Corporation Limited(ZACL), Thales is modernising the ATC (air traffic control) centres at Lusaka and Livingstone international airports in Zambia. (Source: Thales, Press Release, Oct 2023)

- EUROCONTROL MUAC and Indra have implemented an innovative ATN Automatic Dependent Surveillance Contract system (ADS-C) for automated data exchanges with aircraft in flight to increase the accuracy with which traffic is managed. It will boost predictability, facilitate early conflict detection and it will be the first step towards Trajectory Based Operations (TBO). It will also optimize aircraft climbs and descents, keeping them at optimal flight levels for longer and minimizing fuel consumption (Source: Indra, Press Release, Jun 2022)

Commercial Air Traffic Management Market Report Coverage and Deliverables

The “Commercial Air Traffic Management Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Commercial air traffic management market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Commercial air traffic management market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed porter’s five forces analysis

- Commercial air traffic management market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the commercial air traffic management market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Component, Application, Airport Class, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America region dominated the commercial air traffic management market in 2023.

Growing aircraft delivery volumes and continuous product innovations and launches are some of the factors driving the growth for commercial air traffic management market.

Launch of new airports and expansion of existing airports to accelerate new installation demand is one of the major trends of the market.

Thales SA, BAE Systems Plc, Indra Sistemas SA, L3Harris Technologies Inc, Raytheon Technologies Corporation, Honeywell International Inc, SAAB AB, SITA SC, NEC Corp, Nita LLC, JSC VNIIRA, Azimut JSC, and Leonardo SpA are some of the key players profiled under the report.

The estimated value of the commercial air traffic management market by 2031 would be around US$ 11.20 billion.

The commercial air traffic management market is likely to register of 8.5% during 2023-2031.

Get Free Sample For

Get Free Sample For