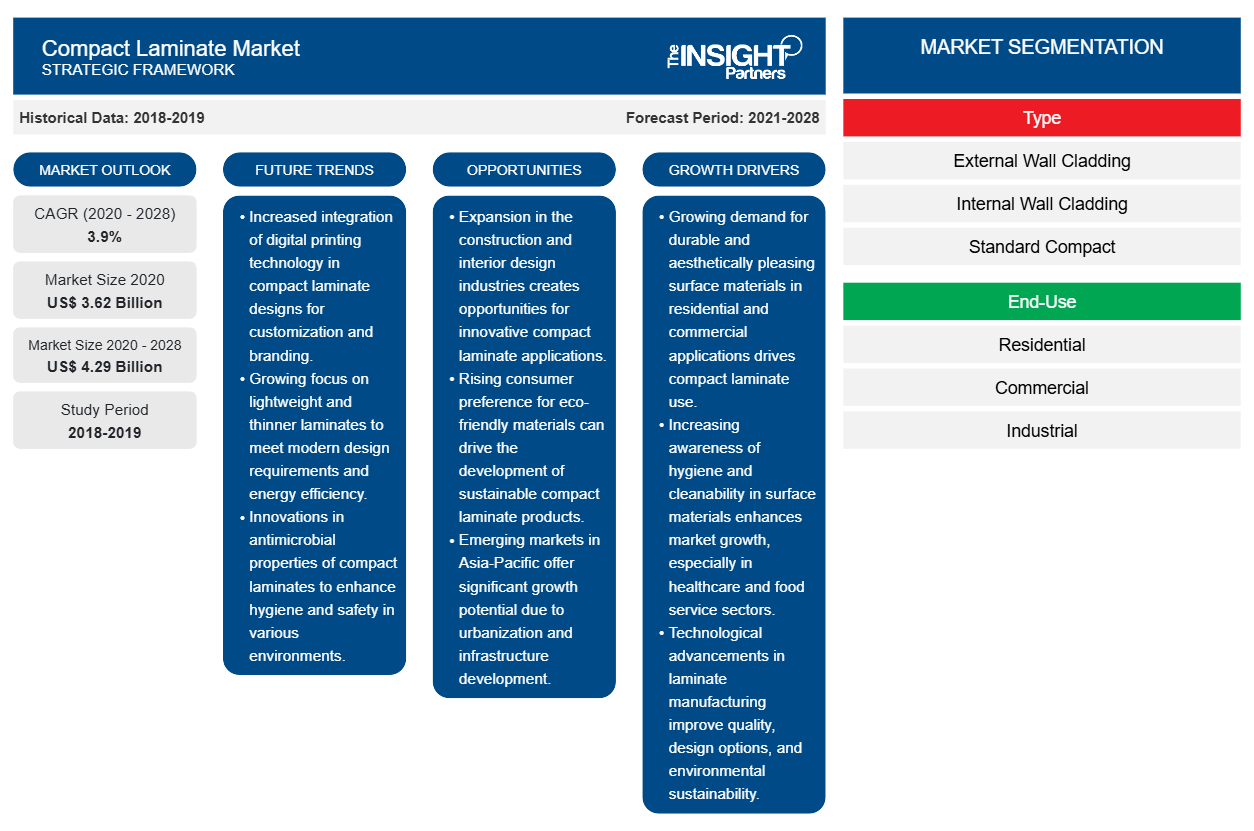

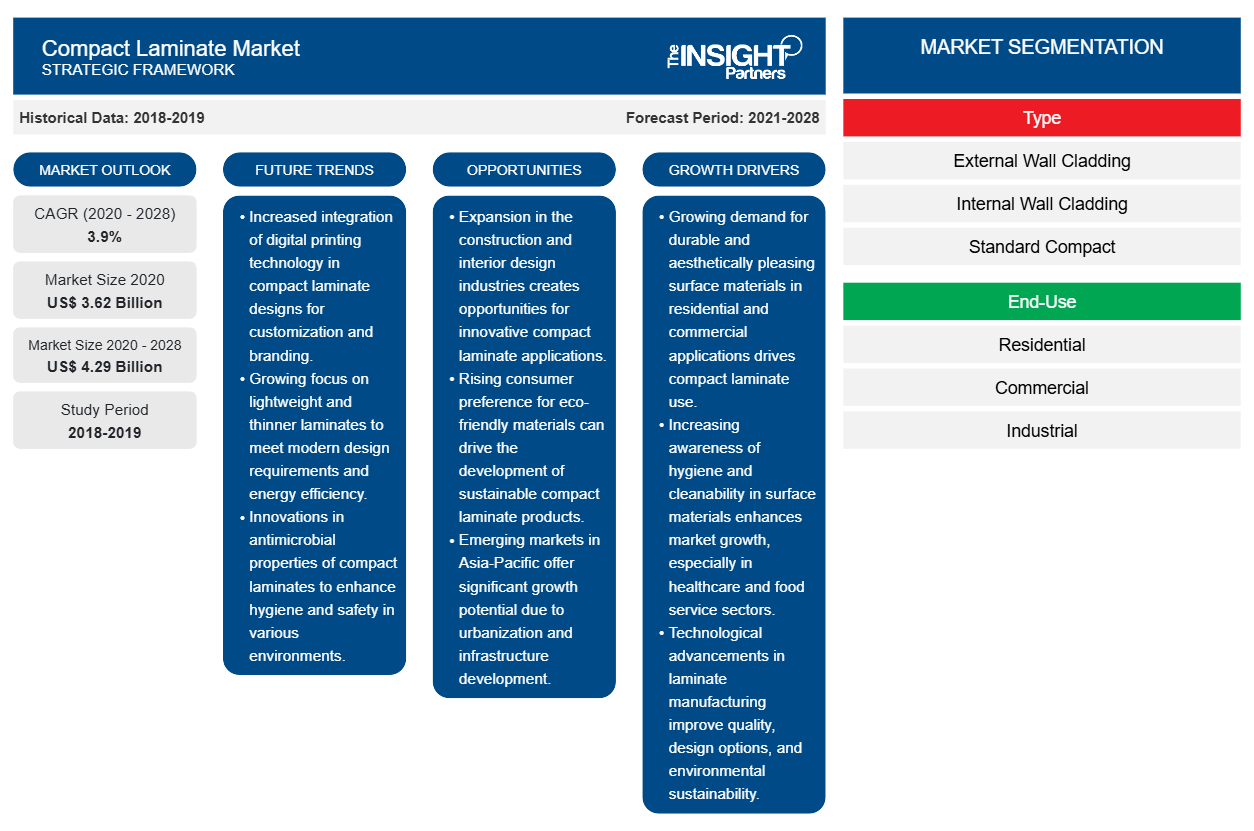

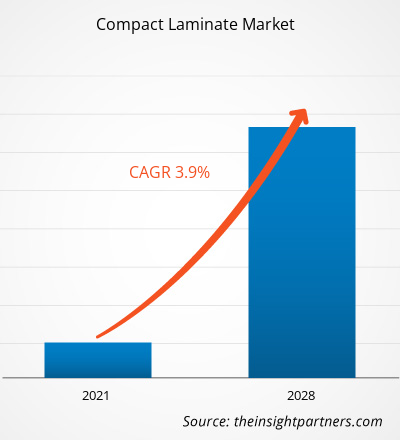

The compact laminate market was valued at US$ 3,619.18 million in 2020 and is projected to reach US$ 4,286.13 million by 2028; it is expected to grow at a CAGR of 3.9% from 2021 to 2028.

Compact Laminate is a material which is used for interior design, wall cladding, restroom partitions, and various other applications. Compact laminate is made up of kraft paper which is impregnated with phenolic resin as well as with decorative surface paper, which is impregnated with melamine resin. After drying the layers, they are stacked and sandwiched between laminate before being compressed at high temperature. The high temperature activates the resins and permanently fuses the layer into a panel. The appearance of the compact laminate depends upon the decorative surface paper whereas the core of kraft paper provides a distinctive edge to the compact laminate.

In 2020, Asia Pacific was dominating as well as the fastest growing region for compact laminate market over the forecast period. This region is the centre for major manufacturers of compact laminate such as Aica Kogyo Co. Ltd, Greenlam Industries Ltd, Merino Laminates Ltd. among others which is going to provide various growth opportunities for the compact laminate market in Asia Pacific. The increase in demand of compact laminates for countertops that can be used in the kitchen as well as in the bathrooms are driving the growth of compact laminate market in Asia Pacific. Along with this, an increase in FDI and the penetration of international brands has led to an increase construction of commercial spaces in countries such as India, which has provided growth opportunities for the compact laminate to be used in various commercial space construction activities. The increase in disposable income along with rapid urbanization in the region is driving the compact laminate market in Asia Pacific. The consumer preference toward interior design and home décor has led to the increase demand for compact laminates which is providing various lucrative opportunities for the compact laminate market in Asia Pacific.

The ongoing pandemic has drastically altered the status of the chemical and materials sector and negatively impacted the growth of the compact laminates market. The implementation of measures to combat the spread of the virus has aggravated the situation and affected the growth of several industrial sectors. The market has been negatively impacted by the sudden distortion in operational efficiencies and disruptions in the value chains attributable to the sudden closure of national and international boundaries. Disruptions in terms of sourcing of raw materials from suppliers and temporarily closures of manufacturing bases due to indefinite lockdowns and temporary quarantines have impacted the growth of the building and construction industry. As per an article published by land Berger GmbH, in June 2020, the International Monetary Fund (IMF) forecasted a decline in real gross domestic product (GDP) of ~3% worldwide, with current growth rate at 5.9% points lesser to 2.9% growth witnessed in 2019. The article further stated the building and construction activities in the US and Europe have relatively shrunk, negatively impacting the GDP contributed by construction sector. The commercial construction sector is likely to face more disruptions in comparison to residential construction sector during the pandemic period. Similarly, the pandemic has negatively impacted the growth of furniture market due to reduced demand, financial stress, and disruptions to the supply chain. The significant decline in the growth of the several industrial sectors negatively impacted the demand for compact laminates in the global market. Further, as the economies are planning to revive their operations, the demand for compact laminates is expected to rise globally. Additionally, new product development and launches is expected to stimulate the demand for compact laminates in post-pandemic times. For instance, in November 2020, Greenlam Industries Ltd., which is ranked amongst the top 3 laminate manufacturers globally and the largest in Asia, launched revolutionary laminates, which have been proven to be effective against SARS-CoV-2, with 99% efficacy within 30 minutes of exposure to the laminate surface and completely eradicates the virus in 45 minutes. The test for efficacy was conducted by Ministry of Science & technology (Government of India). The expanding demand for compact laminates across residential, commercial, and industrial sectors, along with significant investment by prominent manufacturers, is expected to drive the growth of the compact laminates market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Compact Laminate Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Compact Laminate Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Increase Usage of Compact Laminate for Interior Design

Interior design is a combination of art and science to enhance the interior of a building to achieve a healthier and aesthetically pleasing environment. Compact laminates are an ideal choice for interior design as the laminates can bear high stress as well as help maintain hygiene and cleanliness. Cladding is an application that is applied to the interior as well as the exterior walls of a building to showcase a particular design. In interior design of residential and commercial buildings, compact laminates are used for external cladding as these laminates are tougher and durable compared to normal laminates. The compact laminates provide protection against dust and rain. Cladding provides a new as well as an aesthetic look to the building. High-pressure compact laminates have their core made up of resin-impregnated cellulose sheets and are covered on both sides with a decorative melamine resin surface. These are used in creative furniture and interior concepts. Also, manufacturers such as Greenlam are manufacturing compact laminates with the latest style and design sensibilities along with a wide variety of designs. The increasing availability of such compact laminates in the market will increase the demand for these laminates in interior designing and propel the market growth.

Product Insights

Based on product, the compact laminate market is segmented into external wall cladding, internal wall cladding, standard compact, and others. In 2020, internal wall cladding dominated the compact laminate market. Compact laminates are used in interior designs or internal wall cladding as it helps transform the house or the internal walls of the building and provide an aesthetic look. The compact laminates are used to create stylish wall panels with the use of designs, which include high gloss sheets, patterned laminates, and realistic-looking laminate wood. The design element of compact laminates adds warmth and a unique feel to the room. The compact laminates are also used for protecting the internal walls of a building from various kinds of damages such as water, scratch, soiling, graffiti, impact, minor burn markets, and fading along with enhancing the aesthetics of the interior.

A few of the key market players operating in the compact laminate market are AICA Kogyo Co., Ltd.; EGGER Group; Greenlam Industries Ltd.; Wilsonart LLC; Merino Laminates Ltd.; Swiss Krono Group; Trespa International B.V.; Lamitech; Kronoplus Limited; and Royal Crown. Major players in the market are focusing on strategies such as mergers and acquisitions and product launches to expand the geographic presence and consumer base.

Compact Laminate Market Regional Insights

The regional trends and factors influencing the Compact Laminate Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Compact Laminate Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Compact Laminate Market

Compact Laminate Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 3.62 Billion |

| Market Size by 2028 | US$ 4.29 Billion |

| Global CAGR (2020 - 2028) | 3.9% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

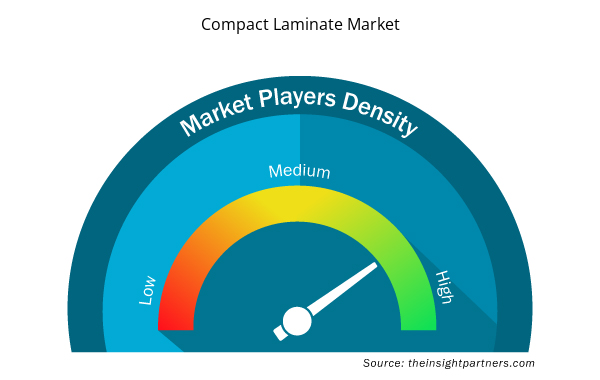

Compact Laminate Market Players Density: Understanding Its Impact on Business Dynamics

The Compact Laminate Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Compact Laminate Market are:

- AICA Kogyo Co., Ltd.

- EGGER Group

- Greenlam Industries Ltd.

- Swiss Krono Group

- Trespa International B.V.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Compact Laminate Market top key players overview

Report Spotlights

- Progressive trends in the compact laminate industry to help players develop effective long-term strategies

- Business growth strategies adopted by companies to secure growth in developed and developing markets

- Quantitative analysis of the global compact laminate market from 2019 to 2028

- Estimation of the demand for compact laminate across various industries

- Porter analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict market growth

- Recent developments to understand the competitive market scenario and the demand for compact laminate

- Market trends and outlook coupled with factors driving and restraining the growth of the compact laminate market

- Understanding regarding the strategies that underpin commercial interest with regard to global compact laminate market growth, aiding in the decision-making process

- Compact laminate market size at various nodes of market

- Detailed overview and segmentation of the global compact laminate market as well as its industry dynamics

- Compact laminate market size in various regions with promising growth opportunities

Compact Laminate Market, by Product

- External Wall Cladding

- Internal Wall Cladding

- Standard Compact

- Others

Compact Laminate Market, by End-Use

- Residential

- Commercial

- Industrial

Company Profiles

- AICA Kogyo Co., Ltd.

- EGGER Group

- Greenlam Industries Ltd.

- Wilsonart LLC

- Merino Laminates Ltd.

- Swiss Krono Group

- Trespa International B.V.

- Lamitech

- Kronoplus Limited

- Royal Crown

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type and End-Use

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Commercial segment dominated the compact laminate market in 2020. Compact Laminate has various applications in the commercial sector and one of the major applications is using the compact laminate for restrooms and bathrooms. The compact laminates are an ideal choice for bathroom partitions as they are durable and water-resistant.

In 2020, Asia Pacific was dominating as well as the fastest growing region for compact laminate market over the forecast period. This region is the centre for major manufacturers of compact laminate such as Aica Kogyo Co. Ltd, Greenlam Industries Ltd, Merino Laminates Ltd. among others which is going to provide various growth opportunities for the compact laminate market in Asia Pacific. The increase in demand of compact laminates for countertops that can be used in the kitchen as well as in the bathrooms are driving the growth of compact laminate market in Asia Pacific.

The major players operating in the global compact laminate market are AICA Kogyo Co., Ltd.; EGGER Group; Greenlam Industries Ltd.; Wilsonart LLC; Merino Laminates Ltd.; Swiss Krono Group; Trespa International B.V.; Lamitech; Kronoplus Limited; and Royal Crown among many others.

In 2020, internal wall cladding dominated the compact laminate market. Compact laminates are used in interior designs or internal wall cladding as it helps transform the house or the internal walls of the building and provide an aesthetic look. The compact laminates are used to create stylish wall panels with the use of designs, which include high gloss sheets, patterned laminates, and realistic-looking laminate wood. The design element of compact laminates adds warmth and a unique feel to the room. The compact laminates are also used for protecting the internal walls of a building from various kinds of damages such as water, scratch, soiling, graffiti, impact, minor burn markets, and fading along with enhancing the aesthetics of the interior.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Compact Laminate Market

- AICA Kogyo Co., Ltd.

- EGGER Group

- Greenlam Industries Ltd.

- Swiss Krono Group

- Trespa International B.V.

- Lamitech

- Kronoplus Limited

- Merino Laminates Ltd.

- Royal Crown

- Wilsonart LLC

Get Free Sample For

Get Free Sample For