Companion Animal Diagnostics Market Size and Growth 2031

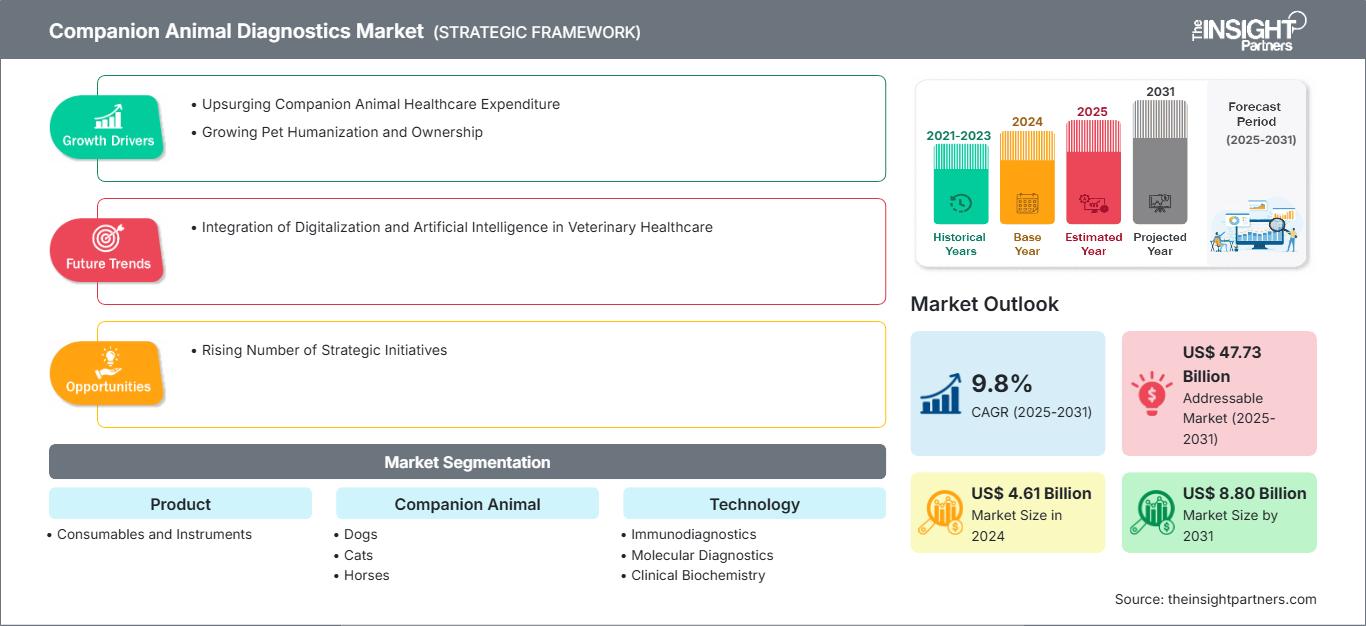

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031Companion Animal Diagnostics Market Size and Forecast (2021-2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: Product (Consumables and Instruments), Companion Animal (Dogs, Cats, Horses, and Others), Technology (Immunodiagnostics, Molecular Diagnostics, Clinical Biochemistry, Hematology, Urinalysis, and Others), Application (Clinical Pathology, Bacteriology, Parasitology, Virology, and Others), and End User (Diagnostic and Reference Laboratories, Veterinary Hospitals and Clinics, Research Institutes, and Others), and Geography

- Report Date : Jul 2025

- Report Code : TIPRE00004558

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 294

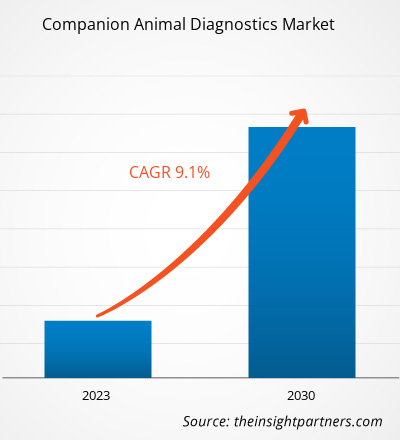

The companion animal diagnostics market size is projected to reach US$ 8.80 billion by 2031 from US$ 4.61 billion in 2024. The market is expected to register a CAGR of 9.8% during 2025–2031. Integration of digitalization and artificial intelligence in veterinary healthcare is likely to bring new market trends during the forecast period.

Companion Animal Diagnostics Market Analysis

The humanization of pets is growing, and the global population is reshaping the veterinary healthcare landscape. Pet owners are increasingly willing to pay for their pets’ health, boosting the demand for accurate and minimally invasive diagnostic solutions.

Companion animals are highly prone to infectious and chronic diseases. Several references highlight the growing adoption of dogs and their related expenditure on healthcare services. The pet industry is comprehensive, and the demand for companion animal diagnostic products is expected to increase during the forecast period. According to the American Pet Products Association's 2023–2024 National Pet Owners Survey, in 2023, over 46.5 and 65.1 million households in the US owned cats and dogs, respectively. According to HealthforAnimals' report, over two million people adopted pets during the UK’s pandemic lockdowns, while in Australia, over a million pets were adopted during the pandemic. Moreover, families in the US, EU, and China have adopted more than half a billion dogs and cats. Dogs are the most popular pets in around one in three homes. Nearly a quarter of pet owners have a cat. Increasing demographic changes, rising income levels, and growing preferences post-pandemic have increased the number of people adopting pets. Pet owners in well-developed economies seek protection against the escalating veterinary treatment costs by applying for a pet insurance policy. In countries such as Sweden and the UK, the penetration rate of pets in households is very high, usually at a rate that covers significant numbers of pets under insurance plans.

Thus, the growing pet ownership and their humanization boost the companion animal diagnostics market growth.

Companion Animal Diagnostics Market Overview

The companion animal diagnostics market is rapidly expanding due to the upsurging companion animal healthcare expenditure and the growing pet humanization and ownership. Prominent players operating in the market are focusing on innovation and collaboration for enhanced availability of products. However, the high cost of diagnostic products and infrastructure hinders the companion animal diagnostics market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Companion Animal Diagnostics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Companion Animal Diagnostics Market Drivers and Opportunities

Upsurging Companion Animal Healthcare Expenditure

The expenditure on veterinary healthcare is rising across the world. Spending on pet healthcare is surging dramatically, including purchasing pet food supplies, over-the-counter pharmaceuticals, veterinarian treatment, and pet insurance coverage. The considerable increase in pet care expenditure is leading to the growing demand for pet insurance, especially in major markets throughout North America and Europe. According to the American Pet Products Association 2023–2024, there is an upsurge in expenses in the pet industry in the US. Pet industry expenses in the US accounted for US$ 143.6 billion in 2023, compared to US$ 136.8 billion in 2018. This rise in pet expenditure accelerates the demand for their care products. According to the North American Pet Health Insurance Association Inc. data, the total US pet insurance volume in 2023 was US$ 3.2 billion. The total number of pets insured in the country at the end of 2022 was US$ 4.8 million, a 22% increase since 2021.

Pet owners in Europe are spending more on food, products, services, and veterinary care for their pets. For instance, France spends an average of 1,224 euros (US$ 1,411) per pet annually. These aim to expedite clinical decisions with greater confidence by offering enhanced insights and tailored assistance. Several pet owners spend significantly on animal healthcare, particularly veterinary care, diagnostics, and pharmaceuticals. Pet health and preventive diagnostic testing are still in their early stages.

Chronic ailments such as cancer, arthritis, and allergies are prevalent in animals similar to humans. In pets, chronic diseases have become more evident, which is eventually impacting people's spending on their pets' well-being and health. According to Animal Medicines Australia data, the six most common pet varieties account for ~US$ 22 billion in annual expenditure on pet-related goods and services in the country. Further, spending on veterinary services accounts for the second highest (14%) after food (51%), and veterinary services accounted for ~US$ 3.11 billion in 2022. According to HealthforAnimals globally, an estimated US$ 4.6 billion was spent on companion animal diagnostics in 2022.

Increased awareness of veterinary health reflects how preventive medicine, advanced treatments, and veterinary point-of-care diagnosis can assist in safeguarding their well-being. Pet owners in mature economies seek protection against the escalating veterinary treatment costs by applying for a pet insurance policy. In countries such as Sweden and the UK, the penetration rate is very high, usually at a rate that covers significant numbers of pets under insurance plans.

Although the penetration rate in the US and Canada is lower compared to some European countries, its growth is progressive and fueled by increased awareness of the benefits of pet insurance, coupled with humanization. This is increasingly the case in diagnostics, thus allowing a veterinarian to make prompt decisions on treatment. Regular checkups and the early detection of possible health issues have become standard practice, increasing the demand for companion animal diagnostic tools applied during routine visits for early-stage condition detection. Therefore, the rising expenditure on companion animal healthcare drives the companion animal diagnostics market growth.

Rising Number of Strategic Initiatives

Small and big companies operating in the companion animal diagnostics market are increasingly adopting strategies such as geographic expansion, product development, and technological advancements for their revenue growth. A few recent developments in the companion animal diagnostics market are mentioned below:

- In March 2025, Antech launched truRapid FOUR, an exhaustive in-house canine vector-borne disease (CVBD) screening test. truRapid FOUR is a lateral flow test used to detect canine antibodies to Anaplasma spp., Ehrlichia spp., and Lyme C6 (Borrelia burgdorferi), as well as heartworm (Dirofilaria immitis) antigen, using whole blood, serum, or plasma.

- In December 2024, Zoetis Inc. introduced its new screenless point-of-care hematology analyzer, Vetscan OptiCell. It is the foremost cartridge-based, AI-powered diagnostic tool for veterinary hematology. It provides complete blood count (CBC) analysis for precise insights.

- In July 2024, EKF Diagnostics launched the Biosen C-Line, the latest glucose and lactate analyzer invented for improved usability. It features a touch screen and enhanced connectivity choices to incorporate seamlessly with hospital and lab IT systems via EKF Link. This benchtop analyzer provides exact glucose and lactate measurements, used in clinical settings for diabetes management and by elite sports teams for tracking lactate production in training.

- In February 2024, MiDOG Animal Diagnostics launched a breakthrough all-in-one diagnostic test capable of rapidly diagnosing fungal and bacterial infections, including antibiotic resistance, across various animal species. The test aims to replace traditional testing procedures with efficient molecular-based diagnostics and subsidize extensive treatment strategies for diverse animals.

- In April 2023, Mars Incorporated acquired Heska Corporation, a global leader in state-of-the-art veterinary diagnostic and specialty products.

- In September 2022, Zomedica (a veterinary health company) launched its newest assay—Free T4 (fT4)—for the TRUFORMA In-Clinic Biosensor Testing Platform.

- In August 2022, PepiPets launched its latest mobile diagnostic testing service, which allows clients to receive diagnostic testing for their pets at home.

- In June 2022, Mars Petcare initiated an innovative initiative, the MARS PETCARE BIOBANKTM. It is a 10-year endeavor to revolutionize pet health by uniting genetic, clinical, and lifestyle information from 20,000 cats and dogs within the US.

- In March 2022, Companion Animal Health, a division of DJO and a global animal health company specializing in laser and rehabilitation therapies and on-site diagnostics in veterinary markets, entered into a strategic agreement with HT Bioimaging to be a co-brand and exclusively market the HTVet product in the US and Canada.

Therefore, the active participation of market players in product launches, expansions, partnerships, and mergers & acquisitions is expected to create lucrative growth opportunities in the companion animal diagnostics market in the coming years.

Companion Animal Diagnostics Market Report Segmentation Analysis

Key segments that contributed to the derivation of the companion animal diagnostics market analysis are product, companion animal, technology, application, and end user.

- Based on product, the companion animal diagnostics market is bifurcated into consumables and instruments. The consumables segment held a larger share of the market in 2024.

- By companion animal, the companion animal diagnostics market is segmented into dogs, cats, horses, and others. The dogs segment held the largest share of the market in 2024.

- In terms of technology, the companion animal diagnostics market is segmented into immunodiagnostics, molecular diagnostics, clinical biochemistry, hematology, urinalysis, and others. The immunodiagnostics segment held the largest share of the market in 2024.

- Based on application, the companion animal diagnostics market is segmented into clinical pathology, bacteriology, parasitology, virology, and others. The clinical pathology segment held the largest share of the market in 2024.

- In terms of end user, the companion animal diagnostics market is categorized into diagnostic and reference laboratories, veterinary hospitals and clinics, research institutes, and others. The veterinary hospitals and clinics segment dominated the market in 2024.

Companion Animal Diagnostics Market Share Analysis by Geography

The geographic scope of the companion animal diagnostics market report mainly focuses on five regions: North America, Asia Pacific, Europe, South and Central America, and the Middle East and Africa. In terms of revenue, North America dominated the market in 2024. It is expected to continue its dominance in the global market during the forecast period. The US is the largest market for companion animal diagnostics in the world. The US companion animal diagnostics market is growing, driven by increasing pet ownership, rising veterinary healthcare expenditures, and advancements in diagnostic technologies. Consumables, such as reagents and test kits, maintain a higher market share due to the rising prevalence of various diseases in companion animals.

A surge in pet ownership has been observed in the US. According to the National Pet Owners Survey 2021–2022 by The American Pet Products Association, the pet population in the US has reached an exceptional high, with ~70% of households (~91 million homes) currently owning a pet. Similarly, according to NielsenIQ data, pet owners in the US spent US$ 66 billion on their pets in 2022. Moreover, as per the data of the American Pet Product Association in 2023, pet ownership is rising, with 90 million dogs in the US. This surge in pet ownership is driven by increasing societal dynamics and more understanding of pet companionship's emotional and health benefits. This has led to a substantial increase in the demand for advanced diagnostic services to detect, monitor, and manage the growing spectrum of chronic diseases affecting companion animals. The rise in the pet population and the increasing incidence of pet diseases, which require various diagnostic procedures for accurate diagnosis and treatment of chronic and acute diseases, drive the companion animal diagnostics market growth in the US.

Companion Animal Diagnostics Market Regional Insights

The regional trends and factors influencing the Companion Animal Diagnostics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Companion Animal Diagnostics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Companion Animal Diagnostics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 4.61 Billion |

| Market Size by 2031 | US$ 8.80 Billion |

| Global CAGR (2025 - 2031) | 9.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Companion Animal Diagnostics Market Players Density: Understanding Its Impact on Business Dynamics

The Companion Animal Diagnostics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Companion Animal Diagnostics Market top key players overview

Companion Animal Diagnostics Market News and Recent Developments

The companion animal diagnostics market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. Below are a few of the key developments witnessed in the companion animal diagnostics market:

- Zoetis Inc., the world’s leading animal health company, will launch its new screenless point-of-care hematology analyzer, Vetscan OptiCell, to the global market at the Veterinary Meeting & Expo (VMX) in Orlando, Florida, in January. It is the first cartridge-based, artificial intelligence (AI) powered diagnostic tool for veterinary hematology, providing complete blood count (CBC) analysis for accurate insights in minutes. (Source: Zoetis Inc., Press Release, December 2024)

- MiDOG Animal Diagnostics LLC, a prominent leader in microbiome-based veterinary diagnostic solutions employing Next Generation DNA Sequencing analysis, has unveiled a revamped branding strategy in 2024. The updated branding emphasizes the adaptability of MiDOG's technology across all animal species, departing from its previous emphasis on canine diagnostics. (Source: MiDOG Animal Diagnostics LLC, Press Release, February 2024)

Companion Animal Diagnostics Market Report Coverage and Deliverables

The "Companion Animal Diagnostics Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Companion animal diagnostics market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Companion animal diagnostics market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Companion animal diagnostics market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the companion animal diagnostics market

- Detailed company profiles

Frequently Asked Questions

Which region dominated the companion animal diagnostics market in 2024?

What are the factors driving the companion animal diagnostics market growth?

What is the expected CAGR of the companion animal diagnostics market?

What would be the estimated value of the companion animal diagnostics market by 2031?

Which are the leading players operating in the companion animal diagnostics market?

What are the future trends in the companion animal diagnostics market?

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For