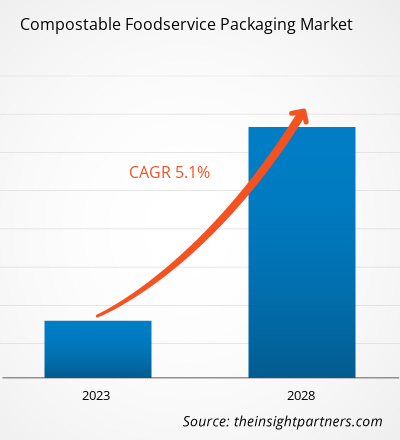

The compostable foodservice packaging market size is expected to grow from US$ 17,291.24 million in 2022 to US$ 23,272.61 million by 2028; it is estimated to register a CAGR of 5.1% from 2022 to 2028.

Packaging the food materials ensures smooth logistics. It also provides adequate product protection and significantly influences consumer purchasing behavior. Packaging, therefore, fulfills many different functions, and it also meets an endless diversity of customer requirements. The recent increase in incomes in developed countries has led to a rise in living standards that includes significantly higher consumption of packaged foods. As a result, food safety guidelines have been more stringent than ever. Since packaging first became a “thing” on the internet of things, its role in the customer journey has extended far beyond the shelf. This has had a transformative effect in several ways, including smart packaging, which helps cut down food waste in complex, global supply chains. Technology is also improving the packaging industry. Advancements in plastic and paper chemistry now allow recycling to be more comfortable and more convenient than ever. Thus, advancement and development in the packaging industry have boosted the global compostable foodservice packaging market growth.

In 2022, Asia Pacific held the largest share of the compostable foodservice packaging market and is estimated to register the highest CAGR during the forecast period. Companies in the region are continuously enhancing the overall business processes to meet customers' demand for high-quality products and services in the best possible way. Asia Pacific continues to complement market growth due to the wide acceptance of certified compostable foodservice ware that meets regulatory requirements. The Asia Pacific compostable foodservice packaging market is primarily driven by factors such as a significant shift of consumers toward convenience food and on-the-go lifestyles. Moreover, increasing preference for ready-to-eat food and changing consumer demand patterns regarding food packaging drive the demand for compostable foodservice packaging in the region.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Compostable Foodservice Packaging Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Compostable Foodservice Packaging Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Compostable Foodservice Packaging Market

Lockdowns, travel restrictions, and business shutdowns due to the COVID-19 pandemic adversely affected economies and industries in various countries in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA). The crisis disturbed global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. Various companies announced possible delays in product deliveries and a slump in future sales of their products in 2020. Further, the international travel bans imposed by various governments in Europe, Asia Pacific, and North America forced several companies to discontinue their collaboration and partnership plans. All these factors hampered the packaging industry in 2020 and early 2021, thereby restraining the growth of various markets related to this packaging industry, including the compostable foodservice packaging market.

Before the COVID-19 outbreak, the compostable foodservice packaging market was mainly driven by the rising demand from the hotel industry. However, in 2020, various industries had to slow down their operations due to disruptions in value chains caused by the shutdown of national and international boundaries. The COVID-19 pandemic disrupted the supply chain of key raw materials and disturbed manufacturing processes due to restrictions imposed by government authorities in various countries. Such factors reduced the production of sustainable packaging products, including compostable packaging.

Market Insights

Strategic Developments by Key Players Favor Compostable Foodservice Packaging Market Growth

Key market players are adopting various marketing strategies such as product launches, mergers & acquisitions, and collaborations. Such strategic developments by key players in the market are expected to fuel the growth of the compostable foodservice packaging market.

Product Type Insights

Based on product type, the compostable foodservice packaging market is segmented into trays, cups and plates, cutlery, clamshell, bowls, pouches and sachets, and others. The cups and plates segment held the largest market share in 2022, and the bowls segment is expected to register the highest CAGR during the forecast period. Bowls are highly popular as a convenient and cost-effective biodegradable packaging solution for the compostable food services packaging market. Apart from functional attributes such as low costs and food hygiene, easy stackability and grab-and-go feature of bowls also contribute to their increasing demand across the globe.

Genpak, LLC; Good Start Packaging; Dart Container Corporation, Graphic Packaging International, LLC; WestRock Company; Be Green Packaging; Pactiv LLC; Anchor Packaging; Biogas Americas Inc.; and ECO PRODUCTS INC. are among the major players operating in the compostable foodservice packaging market. These companies mainly focus on product innovation to expand their market size and follow emerging market trends.

Compostable Foodservice Packaging Market Regional Insights

Compostable Foodservice Packaging Market Regional Insights

The regional trends and factors influencing the Compostable Foodservice Packaging Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Compostable Foodservice Packaging Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Compostable Foodservice Packaging Market

Compostable Foodservice Packaging Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 17.29 Billion |

| Market Size by 2028 | US$ 23.27 Billion |

| Global CAGR (2022 - 2028) | 5.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Compostable Foodservice Packaging Market Players Density: Understanding Its Impact on Business Dynamics

The Compostable Foodservice Packaging Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Compostable Foodservice Packaging Market are:

- Genpak LLC

- Good Start Packaging

- Dart Container Corporation

- Graphic Packaging International LLC

- WestRock Company

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Compostable Foodservice Packaging Market top key players overview

Report Spotlights

- Progressive industry trends in the compostable foodservice packaging market to help companies develop effective long-term strategies

- Business growth strategies adopted by the compostable foodservice packaging market players in developed and developing countries

- Quantitative analysis of the market from 2020 to 2028

- Estimation of global demand for compostable foodservice packaging

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers in the compostable foodservice packaging market

- Recent developments to understand the competitive market scenario

- Market trends and outlook, as well as factors driving and restraining the growth of the compostable foodservice packaging market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest

- Size of the compostable foodservice packaging market at various nodes

- Detailed overview and segmentation of the market and growth dynamics of the compostable foodservice packaging industry

- Size of the compostable foodservice packaging market in various regions with promising growth opportunities

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, and Material

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Based on material, compostable plastic (bio-plastic) is the fastest-growing segment. Compostable or biodegradable bioplastics, most commonly used for utensils, are marketed as a sustainable alternative to single-use plastic. Therefore, a large number of retailers and foodservice industries are focusing on the environmentally compatible packaging, which in turn is driving the segment’s growth.

Asia Pacific compostable foodservice packaging market is expected to surge due to the rising consumer preference for ready-to-eat food and takeaway. This can be attributed to changing lifestyles, increasing disposable incomes, and rapid urbanization, mainly in emerging economies. Therefore, Asia Pacific accounts for the largest share of the global compostable foodservice packaging market.

Cups and plates are leak-proof disposables and eco-friendly, which are made out of recycled paper. The rising demand for eco-friendly, sustainable, and safe cutlery, owing to increasing restaurants, fast food joints, and cafeterias, drives the need for compostable plates and cups.

Some of the major players operating in the global compostable foodservice packaging market are Genpak, LLC; Dart Container Corporation; Graphic Packaging International, LLC; WestRock Company; Be Green Packaging; amongst others.

The focus on sustainable packaging as well as rising number of foodservice establishments offering delivery and catering options, is expected to create lucrative opportunities to the global compostable foodservice packaging market during the forecast period.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Compostable Foodservice Packaging Market

- Genpak LLC

- Good Start Packaging

- Dart Container Corporation

- Graphic Packaging International LLC

- WestRock Company

- Be Green Packaging

- Pactiv LLC

- Anchor Packaging

- Biobag Americas Inc

- ECO PRODUCTS INC

Get Free Sample For

Get Free Sample For