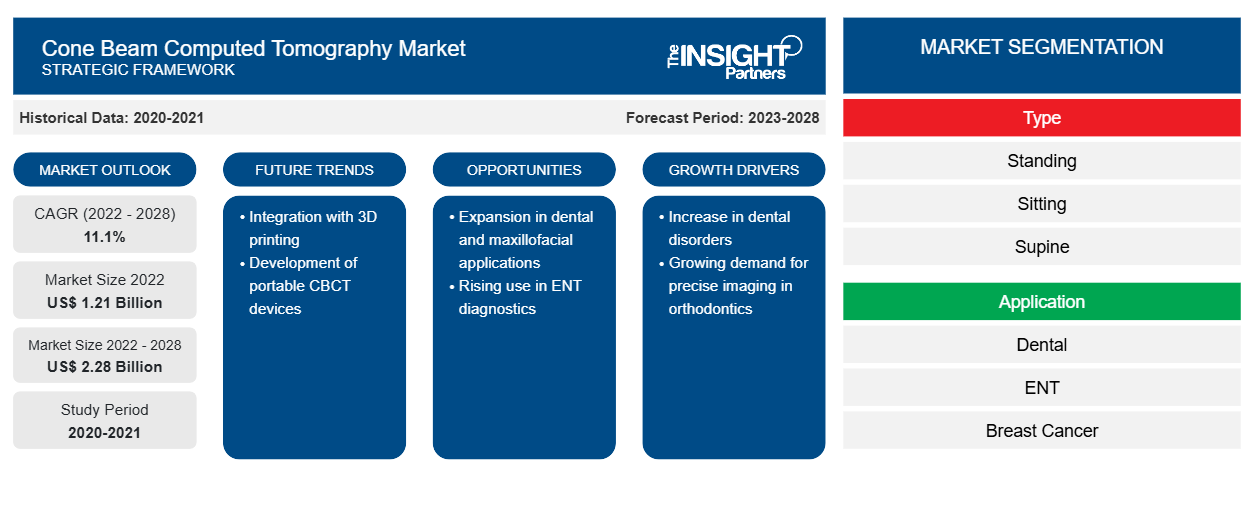

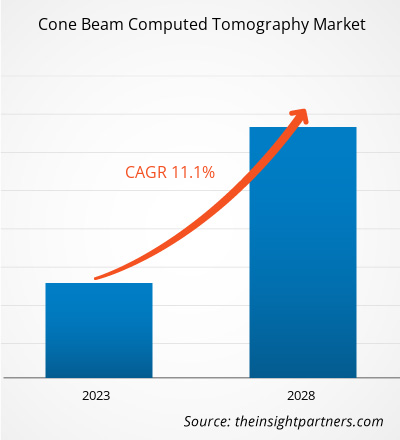

The cone beam computed tomography market is expected to reach US$ 2,278.41 million by 2028 from US$ 1,214.51 million in 2022; it is estimated to grow at a CAGR of 11.1% from 2022 to 2028.

Cone beam computed tomography is a modification of the traditional computed tomography (CT) system. The cone beam computed tomography systems used by dental professionals rotate around the patient, capturing data using a cone-shaped X-ray beam. These data are used to reconstruct a three-dimensional image of the dental (teeth); oral and maxillofacial region (mouth, jaw, and neck); and ears, nose, and throat.

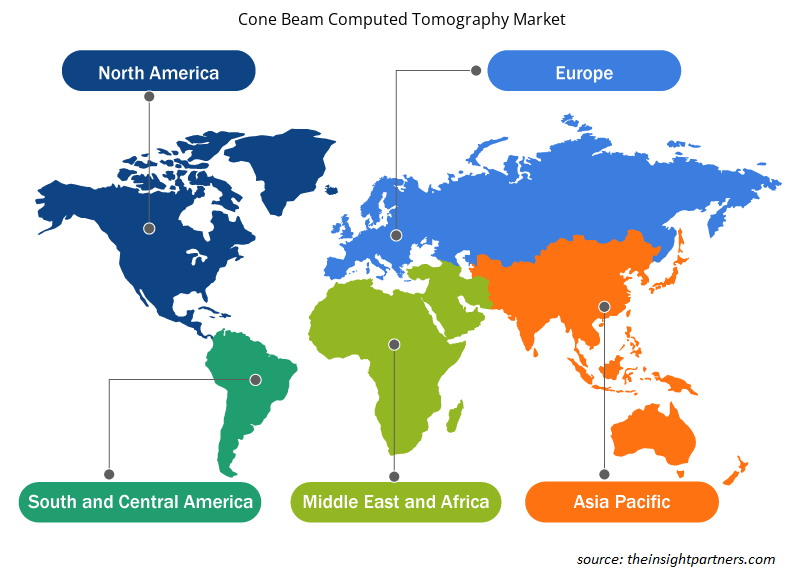

The cone beam computed tomography market is segmented based on type, application, end user, and geography. Based on geography, the market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The report offers insights and in-depth analysis of the market, emphasizing on market trends, technological advancements, and market dynamics. It also offers an analysis of the competitive landscape of the world's leading market players.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cone Beam Computed Tomography Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cone Beam Computed Tomography Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Integration of Software Tools into CBCT Devices Boosts Market Growth

By integrating software tools into CBCT systems, users can automate and standardize complex diagnostic procedures, improve patient experience and diagnostic outcomes, and reduce the cost of care, along with improving the functionality of CBCT systems. Analyzing and interpreting CBCT scan data can be challenging, even for experienced clinical professionals. The software systems have been developed to offer dental laboratories, dentists, implant specialists, and surgeons maximum flexibility and precision. Software integration with CBCT would help physicians expand the scope of diagnosis and improve visibility into patients’ underlying anatomical structures during treatment planning. The integration of picture archiving and communication systems (PACS) with CBCT systems helps capture and edit camera images, share images via the cloud, and provide efficient treatment planning. PACS is a medical imaging technology primarily used for storing and securely transmitting digital electronic images. It allows doctors in different locations to review the same data simultaneously. Digital health companies are investing in developing software for CBCT systems. Therefore, the integration of CBCT devices with software tools to simplify data analysis, interpretation, and archival is contributing to the growth of the cone beam computed tomography market.

Technological Advancements and R&D to Bring New Trends in CBCT Market

Technological advancements, particularly in digital imaging systems, have led to improvements in diagnostic and surgical procedures. This can be attributed to the ability of advanced imaging systems to provide detailed information to healthcare providers while reducing patients’ exposure to radiation. With CBCT techniques, dentists have gained the ability to collect more data with lower doses of radiation. Earlier, physicians relied on two-dimensional imaging for diagnosis and treatment planning. However, 2D technology often requires multiple exposures. Therefore, 3D scanning has gained greater popularity in diagnostics.

A few of the advancements related to the CBCT market are mentioned below:

- In March 2019, Planmeca Oy introduced an advanced Planmeca Viso G5 into their Planmeca Viso family, which offers high CBCT image quality.

- In December 2021, RaySearch Laboratories AB introduced new features to Ray Station 11B for adaptive workflows, brachytherapy, and radiation therapy with ions. Ray Station 11B operates with the improved accuracy of dose calculation on daily images for photon therapy. Daily CBCTs provide a better representation of the patient’s anatomy at the time of treatment than any conventional CT, which is taken early in the process and used to plan the complete treatment.

- In April 2022, Carestream Dental launched the Neo Edition of CS 8200 3D Family, which made the CBCT scanning heavily intuitive. The Neo Edition is an evolved version of the CS 8200 3D, equipped with an optional Scan Ceph module that ensures ease of use, contributes to a better clinical experience, and leads to more successful outcomes. Practitioners that are already using the CS 8200 3D can easily upgrade to the new Neo Edition.

- In June 2022, Xoran Technologies received a patent for a modular cone beam computed tomography system assembly.

Thus, such technological advancements by various market players are likely to bring new trends to the cone beam computed tomography market in the coming years.

End user Insights

Based on end user, the cone beam computed tomography market is divided into hospitals & clinics, diagnostic centers, and others. The hospitals & clinics segment held the largest share of the market in 2021, and the diagnostic centers segment is expected to register the highest CAGR during the forecast period. Diagnostic laboratories are equipped with full-service imaging facilities that provide the highest quality, comprehensive screening and diagnostics services to patients. Diagnostic centers have all the modern imaging modalities, such as CT scans, ultrasound, X-ray, and mammography. On-site radiologists in these facilities provide patients with a complete examination, followed by handing over reports to them within a few hours. Advances in imaging technologies, leading to quick and accurate results in low turnaround time, and a surge in the demand for early disease diagnosis are the factors favoring the growth of the cone beam computed tomography market for the diagnostic laboratories segment.

Product launches and mergers and acquisitions are the highly adopted strategies by the players in the global cone beam computed tomography market. A few of the recent key product developments are listed below:

- In May 2021, the PreXion Corporation launched the latest model the PreXion 3D Explorer PRO. This iteration of the machine features an integrated cephalometric X-ray arm.

- In February 2021, Brainlab received an FDA clearance for the Loop-X Mobile Imaging Robot and the Cirq robotic surgical system. Following the CE mark approvals, Brainlab also received FDA clearance to launch these products into the US market. The Cirq is a robotic alignment module for spine procedures, and Loop-X is the first fully robotic intraoperative imaging device.

- In November 2022, Canon strengthened its medical business with the establishment of Canon Healthcare USA, INC. By strengthening its presence in the highly influential American medical market, Canon aims to accelerate the growth of its medical business.

In Asia Pacific, the COVID-19 pandemic severely affected China and India. These countries already have many patients suffering from chronic disorders. Healthcare professionals in these countries canceled elective procedures to combat the pandemic situation. Moreover, patients and their family members avoided visiting hospitals protect themselves from infections—instead, they opted for online consultation. This resulted in a tremendous decrease in diagnostic procedures performed for chronic disorders. On the other hand, a surge in COVID-19 cases triggered the demand for X-rays and cone beam computed tomography systems, which were in use for checking the spread of infection into the lungs. CBCT imaging is used in thoracic radiotherapy daily to check changes in patient positioning and anatomy prior to treatment through a qualitative assessment of the appearance of lungs by radiographers. Considering this, various market players from Asia Pacific have launched new and innovative products to ease the overall diagnostic procedures. Thus, the COVID-19 pandemic has had a moderately positive impact on the cone beam computed tomography market.

Cone Beam Computed Tomography Market Regional Insights

Cone Beam Computed Tomography Market Regional Insights

The regional trends and factors influencing the Cone Beam Computed Tomography Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Cone Beam Computed Tomography Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Cone Beam Computed Tomography Market

Cone Beam Computed Tomography Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.21 Billion |

| Market Size by 2028 | US$ 2.28 Billion |

| Global CAGR (2022 - 2028) | 11.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

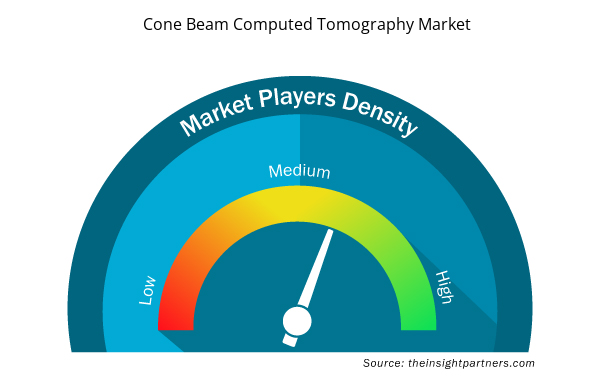

Cone Beam Computed Tomography Market Players Density: Understanding Its Impact on Business Dynamics

The Cone Beam Computed Tomography Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Cone Beam Computed Tomography Market are:

- Dentsply Sirona Inc

- Newtom

- Carestream Dental LLC

- Fussen Group

- PreXion

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Cone Beam Computed Tomography Market top key players overview

Cone Beam Computed Tomography – Market Segmentation

Based on patient positioning, the cone beam computed tomography market is segmented into standing, sitting, and supine. By application, the market is segmented into dental, ENT, breast cancer, skull base, orthopedic, and others. In terms of end user, the cone beam computed tomography market is divided into hospitals & clinics, diagnostic centers, and others. Based on geography, the market is segmented into North America (US, Canada, and Mexico), Europe (France, Germany, UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, India, Japan, Australia, South Korea, and Rest of APAC), Middle East & Africa (Saudi Arabia, UAE, South Africa, and Rest of MEA), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Company Profiles

- Dentsply Sirona Inc

- Newtom

- Carestream Dental LLC

- Fussen Group

- PreXion

- Brainlab AG

- IDETEC MEDICAL IMAGING

- Vatech Co., Ltd

- Planmeca Oy

- Canon Medical Systems

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Vision Guided Robotics Software Market

- Online Exam Proctoring Market

- Glycomics Market

- Frozen Potato Market

- Batter and Breader Premixes Market

- Lyophilization Services for Biopharmaceuticals Market

- Aerospace Forging Market

- Nuclear Decommissioning Services Market

- Water Pipeline Leak Detection System Market

- Aquaculture Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The dental segment held the largest share of the market in 2022. The ENT segment is estimated to register the highest CAGR in the market during the forecast period.

The Asia Pacific is expected to be the fastest-growing region in the cone beam computed tomography market over the forecast period due to the various advantages offered by CBCT devices such as short processing time, better image quality, and high conversion efficiency.

The Biosimilars market is estimated to be valued at US$ 1,214.51 million in 2022.

The Biosimilars market is expected to be valued at US$ 2,278.41 million in 2028.

The CAGR value of the cone beam computed tomography market during the forecasted period of 2022-2028 is 11.1%.

The cone beam computed tomography market majorly consists of the players, such as Dentsply Sirona Inc, Newtom, Carestream Dental LLC.; Fussen Group, PreXion, Brainlab AG, IDETEC MEDICAL IMAGING, Vatech Co., Ltd.; Planmeca Oy, and Canon Medical Systems.

The factors that are driving the growth of the cone beam computed tomography market are the driving factors the growth of the standing segment are various advantages offered by CBCT devices such as short processing time, better image quality, and high conversion efficiency. Also, the increasing cases of dental disorders. These are some of the major factors contributing to the growth of the cone beam computed tomography industry.

Cone beam computed tomography (CBCT) is a radiographic imaging modality that provides accurate, three-dimensional (3D) imaging of hard tissue structures. CBCT is the most significant medical diagnostic imaging modality to emerge. This imaging modality can provide submillimeter resolution images of higher diagnostic quality with shorter scan times. Cone beam computed tomography provides endodontists with three-dimensional patient views. In certain cases, CBCT improves the physician's ability to diagnose, evaluate, treat, and care for patients.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Cone Beam Computed Tomography (CBCT) Market

- Dentsply Sirona Inc

- Newtom

- Carestream Dental LLC

- Fussen Group

- PreXion

- Brainlab AG

- IDETEC MEDICAL IMAGING

- Vatech Co., Ltd.

- Planmeca Oy

- Canon Medical Systems

Get Free Sample For

Get Free Sample For