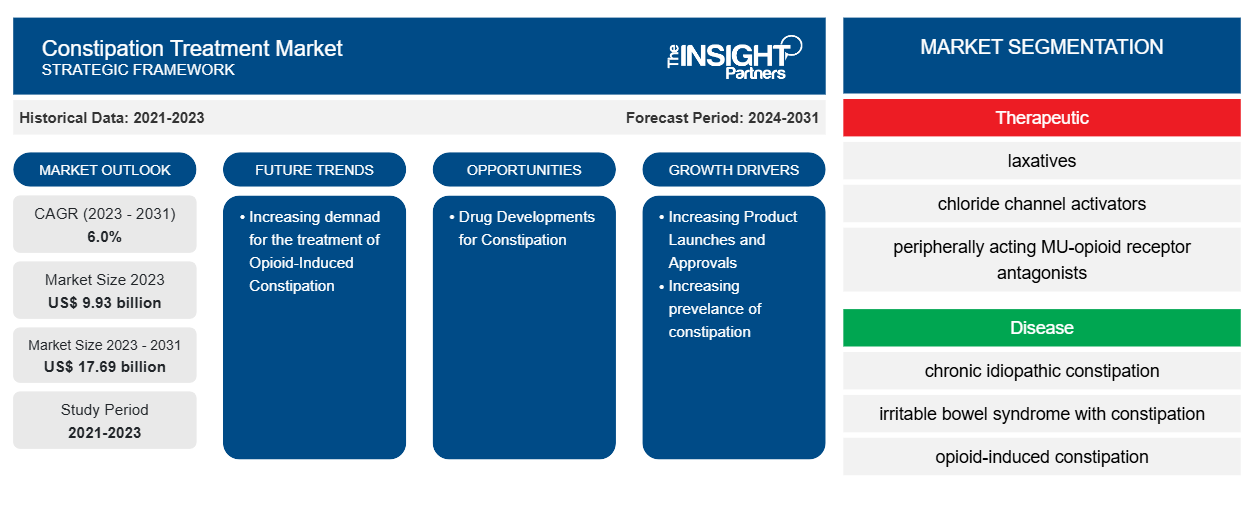

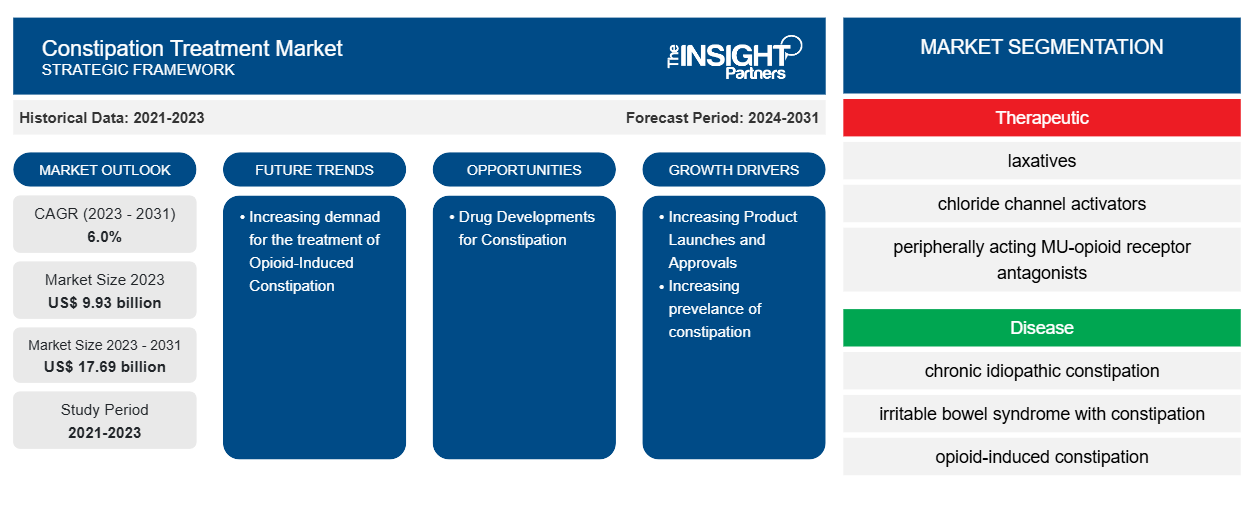

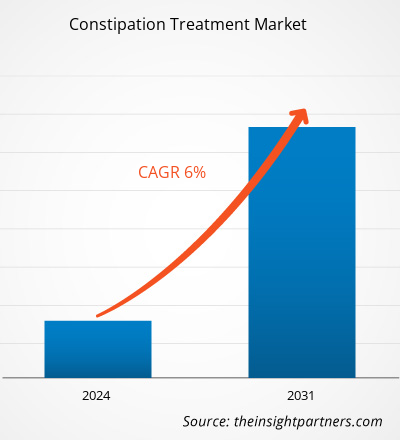

The Constipation Treatment Market size is projected to reach US$ 17.69 billion by 2031 from US$ 9.93 billion in 2022. The market is expected to register a CAGR of 6.0% in 2023–2031. The increasing demand for the treatment of Opioid-Induced constipation are likely to remain key Constipation Treatment Market trends.

Constipation Treatment Market Analysis

Increasing prevalence of constipation among large population is one of the major factors driving the growth of constipation treatment market. It is one of the common conditions experienced by 16% of the global population with the prevalence of 33.5% in 2023. There are various factors associated with the increasing prevalence of constipation among adults include improper diet, lack of physical activity, reduced bowel movement due to age progression among others. Constipation can cause psychological morbidity which affects the quality of life. thus, surging prevalence of constipation is expected to anticipate the growth of constipation treatment market.

Constipation Treatment Market Overview

Constipation treatment market is mainly driven by the increasing prevalence of constipation caused due to various factors such as lifestyle, medication, and medical conditions followed by the increasing product development, launches and approval for the treatment of constipation. Additionally, surge in geriatric population prone to constipation along with changing dietary habits followed by the increasing prevalence of gastrointestinal disorders are expected to contribute the growth of constipation treatment market. Furthermore, increase in awareness campaign by various organization and manufacturers along with surge in research and development activities for the development of innovative treatment option for constipation anticipated the market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Constipation Treatment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Constipation Treatment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Constipation Treatment Market Drivers and Opportunities

Increasing Product Launches and Approvals to Favor Market

Increasing number of FDA approvals and drug development activities are likely to accelerate the market's growth during the forecast period. The majority of the established and new players are coming forward to manufacture drugs for constipation, which would lead to high availability of drugs in the market. This, in turn, is expected to boost the consumption of these drugs, thereby fuelling the growth of the constipation treatment market. For instance, in 2021, The US Food and Drug Administration (FDA) has approved the first generic drug linaclotide 145 mcg capsules, as well as 290 mcg capsules from Mylan Pharmaceuticals to treat irritable bowel syndrome with constipation (IBS-C) and chronic idiopathic constipation. Thus, the increasing number of product launches and approvals are expected anticipate the constipation treatment market growth during the forecast period.

Drug Developments for Constipation– An Opportunity for the Market Growth

Laxatives are highly recommended as a conventional treatment for acute and mild constipation. Developments in the pharmaceutical industry have received approvals for drugs, such as lubiprostone, linaclotide, and prucalopride. However, there are essential unmet needs to treat constipation among patients who do not respond to current therapies. The recent developments and product launch for 5-HT4 receptor modulators velusetrag, naronapride, the guanylate cyclase C agonist plecanatide, and the ileal bile acid transporter inhibitor elobixibat have been recognized as promising drugs. However, various studies are being conducted to analyze effectiveness of drugs that can offer substantial relief from constipation. For instance, in April 2022, Ardelyx, Inc. launched IBSRELA, the first and only NHE3 inhibitor for the treatment of irritable bowel syndrome with constipation (IBS-C) in adults. Additionally, in August 2022, FDA has approved the use of Vibrant a first-of-its-kind therapy manufactured by Vibrant Gastro for the treatment of chronic constipation. Therefore, the launch of such innovative products is expected to provide lucrative growth opportunities.

Constipation Treatment Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Constipation Treatment Market analysis are therapeutic, disease, distribution channel.

- Based on therapeutic, the Constipation Treatment Market is segmented into laxatives, chloride channel activators, peripherally acting MU-opioid receptor antagonists, GC-C agonists, and 5-HT4 receptor agonists. The laxatives segment held a larger market share in 2023.

- By disease, the market is segmented into chronic idiopathic constipation, irritable bowel syndrome with constipation, and opioid-induced constipation. The chronic idiopathic constipation segment held the largest share of the market in 2023.

- In terms of distribution channel, the market is classified into Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies. The retail pharmacies segment dominated the market in 2023.

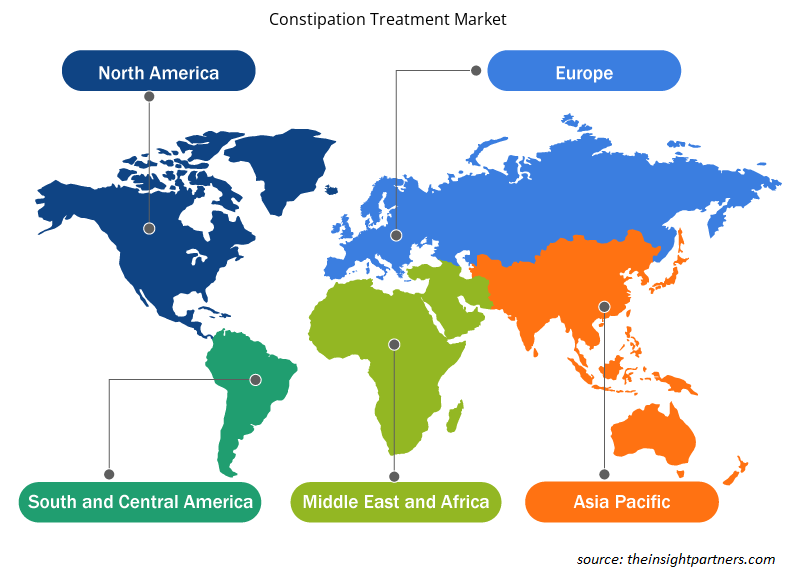

Constipation Treatment Market Share Analysis by Geography

The geographic scope of the Constipation Treatment Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the Constipation Treatment Market owing to the increasing prevalence of constipation among all groups. The significantly increasing geriatric population in North American countries is expected to contribute widely to its growth. Similarly, market players involved in developing drugs treating constipation are likely to foster market growth during the forecast period. Whereas, in Mexico, the pharmaceutical industry's developments and market players' involvement to enhance awareness regarding constipation and its treatment are expected to serve vital growth opportunities for the market's growth. Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

Constipation Treatment Market Regional Insights

The regional trends and factors influencing the Constipation Treatment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Constipation Treatment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Constipation Treatment Market

Constipation Treatment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 9.93 billion |

| Market Size by 2031 | US$ 17.69 billion |

| Global CAGR (2023 - 2031) | 6.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Therapeutic

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Constipation Treatment Market Players Density: Understanding Its Impact on Business Dynamics

The Constipation Treatment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Constipation Treatment Market are:

- AbbVie's Inc.

- Takeda Pharmaceutical Company Limited

- Bausch Health Companies Inc.

- Bayer AG

- Mallinckrodt Plc

- Sanofi

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Constipation Treatment Market top key players overview

Constipation Treatment Market News and Recent Developments

The Constipation Treatment Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for constipation and strategies:

- Lupin Life, the consumer healthcare business of global pharma major, Lupin Limited launched the Softovac Liquifibre, a 100% Ayurvedic liquid laxative. With this, the company enters the Indian liquid laxative market with this innovative product that is a formulation of Isabgol fibre in liquid form and natural actives such as Sonamukhi, Harad, Mulethi, Saunf, Amaltas and Gulab Dal. (Source: Lupin, Company Website, 2023)

- Ironwood Pharmaceuticals, Inc. a GI-focused healthcare company, received U.S. Food and Drug Administration (FDA) approval for LINZESS (linaclotide) as a once-daily treatment for pediatric patients ages 6-17 years-old with functional constipation. LINZESS is the first and only FDA-approved prescription therapy for functional constipation in this patient population. (Source: Ironwood, Company Website, 2023)

- EA Pharma’s parent company Eisai Co., Ltd. and Mochida Pharmaceutical Co., Ltd. launched MOVICOL HD for the treatment of chronic constipation in Japan. MOVICOL HD contains the same active ingredients in double the quantity of MOVICOL LD per sachet. It increases the water retention in the intestinal tract by osmolality of its main ingredient polyethylene glycol (macrogol 4000), which increases fecal moisture, softens feces, increases fecal volume and physiologically activates the peristaltic movement of the colon to promote bowel movement. (Source: Eisai Co., Ltd., Company Website, 2022)

- Ardelyx, Inc. launched IBSRELA, the first and only NHE3 inhibitor for the treatment of irritable bowel syndrome with constipation (IBS-C) in adults. It treats the abdominal pain, bloating, and discomfort, along with the constipation associated with this debilitating condition. (Source: Ardelyx, Inc., Newsletter, 2022)

Constipation Treatment Market Report Coverage and Deliverables

The “Constipation Treatment Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Aircraft MRO Market

- Webbing Market

- Pharmacovigilance and Drug Safety Software Market

- Analog-to-Digital Converter Market

- Cell Line Development Market

- Hot Melt Adhesives Market

- Visualization and 3D Rendering Software Market

- Enteral Nutrition Market

- Military Rubber Tracks Market

- Mail Order Pharmacy Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Therapeutic ; Disease ; Distribution Channel , and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For