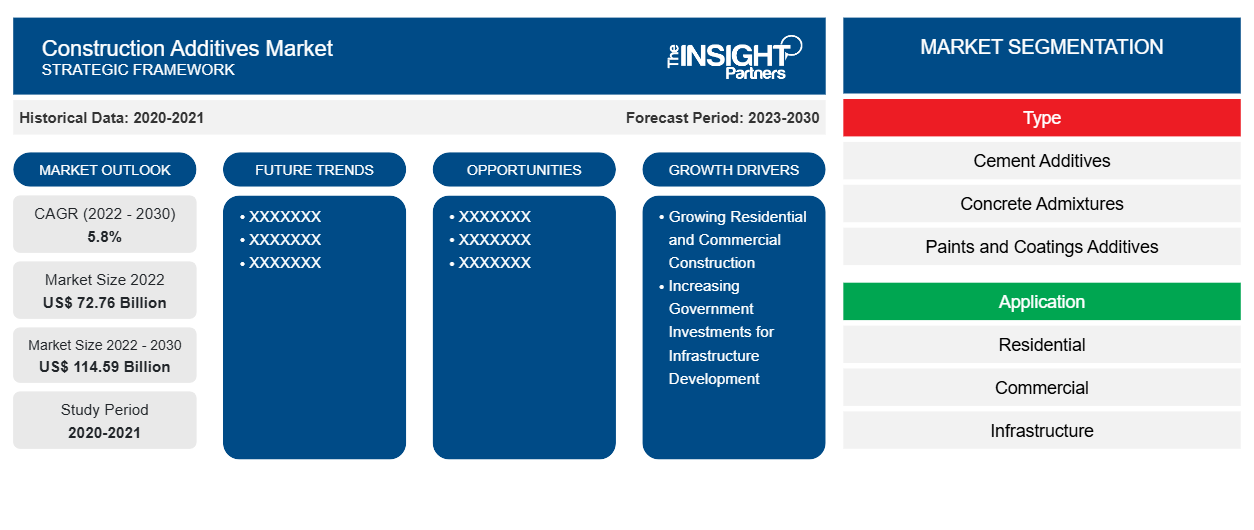

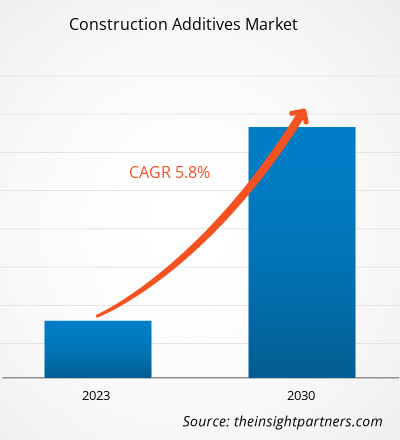

[Research Report] The construction additives market size was valued at US$ 72.76 billion in 2022 and is expected to reach US$ 114.59 billion by 2030; it is estimated to register a CAGR of 5.8% from 2022 to 2030.

Market Insights and Analyst View:

Construction additives include cement additives, concrete admixtures, plastic additives, bitumen additives, paints and coatings additives, adhesives & sealants additives, glass additives, and ceramic additives. These materials are used to improve the quality and performance of the construction products. They also help to achieve certain desirable properties, such as increased strength, durability, and workability. There are various powder and liquid construction additive products available in the market that enable the formulation of innovative products. The major factors driving the market growth are the growing residential and commercial construction and the increasing government investments in infrastructure developments. The government-supported infrastructure projects include roads, dams, bridges, tunnels, ports, airport pavements, and highways. All these factors are contributing to the construction additives market

Growth Drivers and Challenges:

Growing residential and commercial construction and increasing government investments in infrastructure development are among the key factors driving the market. According to the European Construction Industry Federation, the investment in nonresidential construction in France was estimated at US$ 58.49 billion in 2022. In 2023, DEEM Enterprises LLC announced its plans to spend US$ 2.7 billion to build a Formula 1-style racetrack, housing, and shopping complex on the site of a former airport in New Jersey, US. The growing investments from government organizations lead to a rise in infrastructure construction.

In November 2021, the US government approved a US$ 1.2 trillion infrastructure bill to aid federal investments in various infrastructure projects. Also, construction spending was estimated to increase by 5.5% by 2023. Such initiatives generate demand for construction services, chemicals, and materials. The rising investments and efforts in infrastructure development by governments of various countries across the world drive the market. The growing construction and investments for infrastructure development are fueling the demand for different construction chemicals and materials, thereby driving the construction additives market.

The volatility in raw material prices can act as a deterrent for the market. Construction additives such as emulsifiers, rejuvenators, and anti-strip agents are indirectly derived from crude oil. Disruption in transportation and supply chain, rise in demand for crude oil, inflation in raw material prices, and limited supply of raw materials caused due to the COVID-19 pandemic raised petroleum product prices. The rise in crude oil prices due to fluctuating global economic conditions is further boosting the price of petroleum-derived additives. Price hikes in petroleum products and other raw materials can strain the profit margins on the products, which poses a challenge to the construction additives market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Construction Additives Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Construction Additives Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Global Construction Additives Market Analysis and Forecast to 2030" is a specialized and in-depth study with a significant focus on global market trends and growth opportunities. The report aims to provide an overview of the market with detailed market segmentation by type and application. The market has witnessed high growth in the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the consumption of construction additives globally. In addition, the global construction additives market report provides a qualitative assessment of various factors affecting the market performance globally. The report also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, construction additives market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

The construction additives market forecast is estimated on the basis of various secondary and primary research findings, such as key company publications, association data, and databases. Further, the ecosystem analysis and Porter's five forces analysis provide a 360-degree view of the market, which helps understand the entire supply chain and various factors affecting the market performance.

Segmental Analysis:

The global construction additives market is segmented on the basis of type and application. Based on type, the market is segmented into cement additives, concrete admixtures, paints and coatings additives, adhesives and sealants additives, plastic additives, bitumen additives, and others. The cement additives segment accounted for a significant construction additives market share in 2022. Cement additives include grinding aids, strength enhancers, and performance enhancers. Grinding aids are additives that come with several key benefits, such as boosting productivity and increased fineness. Various strength enhancers are added to cement that increases its mechanical strength, often through chemical activation that maintains the integrity of the cement’s structure and surface. The application of cement additives in infrastructure development is expected to boost the market.

Based on application, the market is segmented into residential, commercial, infrastructure, and others. The residential segment held a substantial construction additives market share in 2022. The increasing demand for residential construction owing to accelerated urbanization has surged the requirement for different types of construction additives from the residential sector. In India, the Housing for All Scheme, also known as Pradhan Mantri Awas Yojana (Urban) Mission, launched in 2015, intends to provide housing for all in urban areas by 2024. The growth in investments and development activities in the residential construction sector is attributed to the rising population and urbanization in different countries across the globe. Moreover, housing programs and favorable government policies in many countries have led to the establishment of residential buildings, which is expected to drive the demand for construction additives during the forecast period.

Regional Analysis:

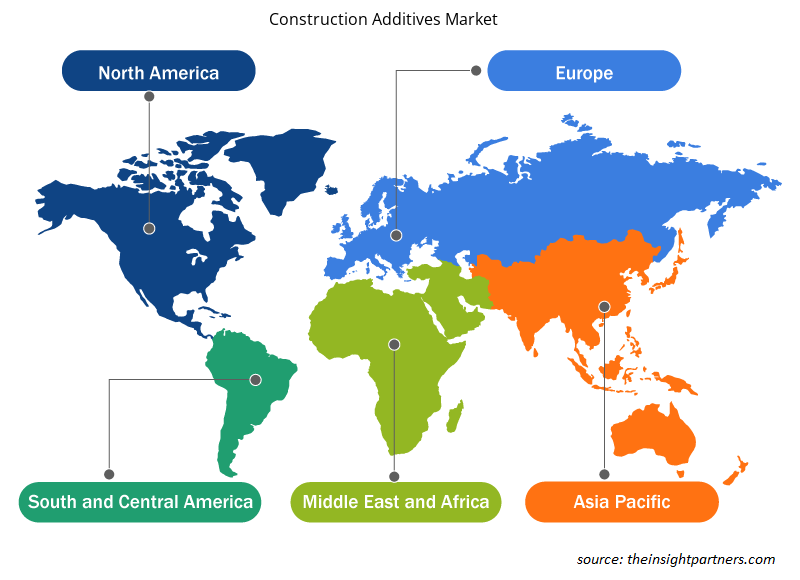

The report provides a detailed overview of the market concerning five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. In terms of revenue, Asia Pacific dominated the construction additives market and was valued at more than US$ 35 billion in 2022. According to the International Trade Administration, total investment in China’s infrastructure during the 14th Five-Year Plan period (2021–2025) is estimated to reach ~US$ 4.2 trillion. In 2022, the National Development and Reform Commission (NDRC) and the Ministry of Transport (China) unveiled the National Highway Network Planning document aimed at the construction of a functional, efficient, green, intelligent, and safe modern highway network by 2035. The plan also encompasses the construction of a 461,000 km highway, which includes 162,000 km of expressways. Infrastructure development and growing housing projects in several Asian economies, such as India and China, are projected to boost the construction additives market during the forecast period.

Europe construction additives market is expected to reach ~US$ 24 billion by 2030. Europe is one of the largest producers of construction materials, operated by small and medium-sized businesses (SMEs) that supply construction materials to local and regional markets. The increasing utilization of sustainable construction additives for infrastructure development in Europe is projected to fuel the construction additives market growth. The Middle East & Africa is expected to record a CAGR of ~6% from 2022 to 2030. A rise in demand for construction materials due to a surge in infrastructural projects, sustainable construction, and industrialization in the Middle East & Africa drives the demand for construction and building materials. The construction of commercial infrastructure has also upsurged in the region due to the growing tourism industry and the rising immigrant population. The rising urban population has surged the demand for private residential buildings in semi-urban and urban cities, prompting governments to invest in the building & construction industry.

Construction Additives Market Regional Insights

Construction Additives Market Regional Insights

The regional trends and factors influencing the Construction Additives Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Construction Additives Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Construction Additives Market

Construction Additives Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 72.76 Billion |

| Market Size by 2030 | US$ 114.59 Billion |

| Global CAGR (2022 - 2030) | 5.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Construction Additives Market Players Density: Understanding Its Impact on Business Dynamics

The Construction Additives Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Construction Additives Market are:

- W. R. Grace & Co

- Chryso SAS

- Dow Inc

- BASF SE

- Cemex SAB de CV

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Construction Additives Market top key players overview

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the construction additives market are listed below:

- In April 2021, Dow Construction Chemicals expanded its territory with JNS SmithChem LLC as an authorized Southeast region distributor, covering Maine, Vermont, New Hampshire, Massachusetts, Rhode Island, Connecticut, New York, and Pennsylvania states.

- In July 2023, Heidelberg Materials celebrated the opening of the second-largest cement plant in North America.

- In July 2023, Sika AG invested in macro fibers for the fast-growing demand for sustainable concrete in the US.

Competitive Landscape and Key Companies:

Sumitomo Seika Chemicals Co Ltd, Nippon Shokubai Co Ltd, Sanyo Chemical Industries Ltd, BASF SE, Evonik Industries AG, LG Chem Ltd, Satellite Chemical Co Ltd, Kao Corporation, Yixing Danson Technology, and Songwon Industrial Group are among the key players profiled in the construction additives market report. The global market players focus on providing high-quality products to fulfill customer demand.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Growing residential and commercial construction, and increasing government investments for infrastructure development, are some of the key driving factors for the construction additives market.

The strategic development initiatives by key market players offer lucrative growth opportunities to the global construction additives market during the forecast period.

Based on application, infrastructure is the fastest-growing segment. The surging investments in the infrastructure sector and growing expenditure on transport infrastructure are mainly driving the demand for construction additives.

Asia Pacific construction additives market is expected to surge due to government investments in infrastructure development, including roadways, highways, bridges and airport. Low labor costs, availability of specialized building materials, and research & development cost in the Asian countries, is fueling the demand for construction additives.

Based on the type, the cement additives segment accounted for the largest revenue share. In the cement manufacturing process, adding cement additives helps improve cement grinding efficiency and narrow particle size distributions. The growing demand for cement used in infrastructure development across the globe drives the construction additives market.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Construction Additives Market

- W. R. Grace & Co

- Chryso SAS

- Dow Inc

- BASF SE

- Cemex SAB de CV

- Fosroc International Ltd

- CICO Technologies Ltd

- Sika AG

- Evonik Industries AG

- Mapei SpA

Get Free Sample For

Get Free Sample For