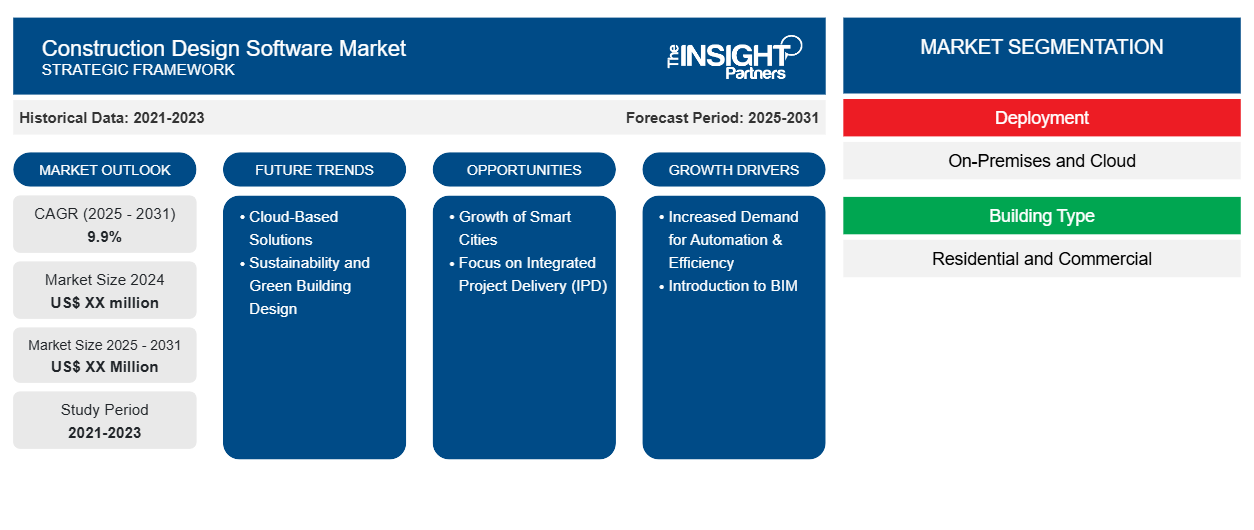

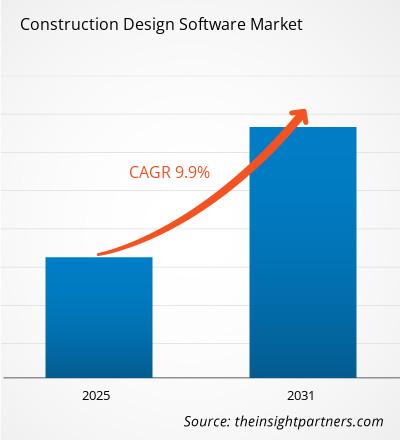

The Construction Design Software Market is expected to register a CAGR of 9.9% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Deployment (On-Premises and Cloud), Building Type (Residential and Commercial), End-user (Architects & Builders, Remodelers, Designers, Others). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Construction Design Software Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Construction Design Software Market Segmentation

Deployment

- On-Premises and Cloud

Building Type

- Residential and Commercial

End-user

- Architects & Builders

- Remodelers

- Designers

- Others

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Construction Design Software Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Construction Design Software Market Growth Drivers

- Increased Demand for Automation & Efficiency: As the construction industry becomes more competitive and complex, the need for automation in design processes is growing. Construction design software automates repetitive tasks such as structural analysis, model creation, and documentation. This reduces human error, speeds up the design process, and ensures higher precision in the final outcomes.

- Introduction to BIM: BIM is altering how construction projects are planned and designed. The construction of buildings using BIM-related design software enables better interaction between stakeholders, improved visualisation of projects, and co-ordination. This brings the possibility of reduced delays in the construction phase and possible omission of errors. This in turn makes it a principal motivator for adopting related software.

Construction Design Software Market Future Trends

- Cloud-Based Solutions: The construction design industry is witnessing a trend toward cloud-based software solutions. Cloud-based platforms offer flexibility, which enables real-time collaboration across different geographic locations. Teams can access project data, update models, and communicate with clients and contractors instantly, regardless of their location.

- Sustainability and Green Building Design: With growing environmental concerns, there is an increased focus on sustainable construction practices. Software that incorporates energy modeling, sustainable materials, and green building certifications like LEED is becoming a necessity. Designers are now using these tools to optimize the energy efficiency of their designs and to ensure that their buildings meet modern environmental standards.

Construction Design Software Market Opportunities

- Growth of Smart Cities: As urbanization continues to rise, the development of smart cities is a huge opportunity for construction design software. Tools that can integrate IoT and AI for smart infrastructure management will be critical in designing sustainable and efficient buildings and urban areas. Software that allows the simulation of smart systems, such as energy grids, water management, and transportation, will be in high demand.

- Focus on Integrated Project Delivery (IPD): The trend toward Integrated Project Delivery (IPD), which emphasizes collaboration among all stakeholders involved in a construction project, presents an opportunity for construction design software. IPD requires real-time sharing of project data, transparent communication, and collaboration between designers, engineers, contractors, and owners. Software solutions that enable seamless integration and real-time collaboration between these different parties will play a critical role in the success of IPD projects, opening new growth opportunities for the market.

Construction Design Software Market Regional Insights

The regional trends and factors influencing the Construction Design Software Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Construction Design Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Construction Design Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 9.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Deployment

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Construction Design Software Market Players Density: Understanding Its Impact on Business Dynamics

The Construction Design Software Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Construction Design Software Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Construction Design Software Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Construction Design Software Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

Frequently Asked Questions

What are the options available for the customization of this report?

What are the future trends of the construction design software market?

Which are the key players in the construction design software market?

What are the driving factors impacting the construction design software market?

1. Increased Demand for Automation & Efficiency.

2.Introduction to BIM

What is the expected CAGR of the ?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For