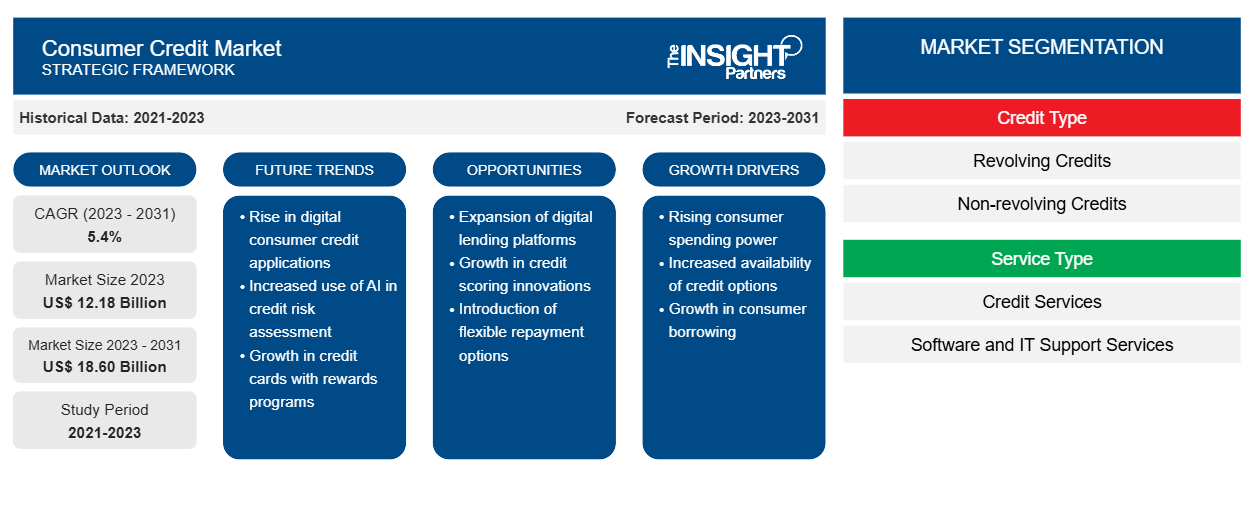

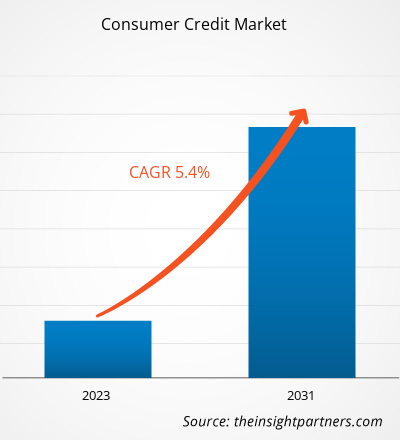

The Consumer Credit market size is expected to grow from US$ 12.18 billion in 2023 to US$ 18.60 billion by 2031; it is anticipated to expand at a CAGR of 5.4% from 2023 to 2031. Consumer credit, often known as consumer debt, is personal debt incurred in order to acquire goods or services. Although any sort of personal loan could be classified as consumer credit, the phrase is most commonly used to indicate unsecured debt in small sums. Consumer credit stats are a key index to monitor the health of an economy. It conveys the spending power of a consumer in a particular economy.

Consumer Credit Market Analysis

Credit is an important enabler of consumption for customers who would otherwise be unable to afford a particular product. As more people shop online, innovative digital solutions for point-of-sale finance, frequently designed by nimble technology businesses and seamlessly integrated into the customer journey, are gaining popularity among millennial shoppers who are cautious of incumbent banks' inadequate digital capabilities. Technological advancements and supportive regulation have made it easier for these new competitors to disrupt incumbents' control over the lending value chain and compete on the basis of faster, more personalized, and more efficient service delivery. The loyalty and inertia that formerly bound consumers to their banks are fading across Europe, as regulation has made it easier than ever to create partnerships with several financial service providers.

Consumer Credit

Industry Overview

- Some of the major factors driving the growth of the consumer credit market are changing urban lifestyles, the rapid proliferation of e-commerce in all regions of the world, technological advancements, and others. For instance, The introduction of artificial intelligence will change the fundamental process of consumer lending. AI technology is designed to improve and simplify administrative tasks, allowing bank workers to devote more time to customer connections. AI-driven interactions enable seamless customer onboarding and reduced turnaround times for risk and compliance duties. Positive consumer experiences can increase client loyalty and referrals.

- A country's consumer credit business highly depends on the spending behavior of a consumer in the country. For instance, Consumer card spending climbed by only 4.1 percent year on year in 2023 in the UK, far lower than the growth observed in 2022 (10.6 percent), as Brits cut back on new clothes, dining out, and home improvements due to growing inflation and family costs. Consumers, on the other hand, continued to prioritize moments of delight and shared experiences, driving growth in travel, entertainment, and pubs and bars.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Consumer Credit Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Consumer Credit Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Consumer Credit Market Driver

Demand for Flexibility in Spending to Drive the Consumer Credit Market

- Offering consumer loans boosts conversion by giving the flexibility that today's customers want. According to the Foreign & Colonial Investment Trust's Millennial Money Survey, 16% of millennials do not save any money each month, and 7.8 million have no savings at all.

- Millennials frequently value experiences such as travel, dining out, and entertainment over traditional asset ownership such as homes and cars. As a result, individuals may rely more on credit cards and personal loans to fund these experiences, fuelling demand in the consumer credit market.

Consumer Credit

Market Report Segmentation Analysis

- Based on the credit type, the consumer credit market report is segmented into revolving credits and non-revolving credits.

- Revolving credit, which includes credit cards, can be used for any purchase. The credit is "revolving" in the sense that the line of credit remains open and can be utilized up to the full limit repeatedly as long as the borrower continues to make the minimum monthly payment on time.

Consumer Credit

Market Analysis by Geography

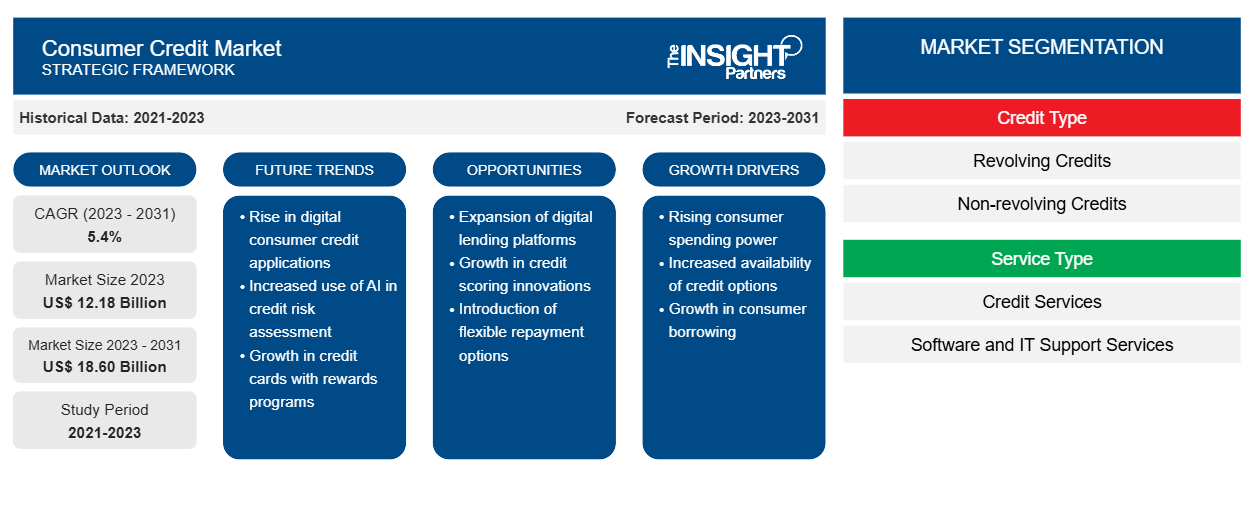

The scope of the consumer credit market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant consumer credit market share. The region's significant economic development, growing population, and increasing focus on risk management and insurance have contributed to this growth. North America is home to many developing countries like the US and Canada, driving the consumer credit market growth.

Consumer Credit

Consumer Credit Market Regional Insights

The regional trends and factors influencing the Consumer Credit Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Consumer Credit Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Consumer Credit Market

Consumer Credit Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 12.18 Billion |

| Market Size by 2031 | US$ 18.60 Billion |

| Global CAGR (2023 - 2031) | 5.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Credit Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

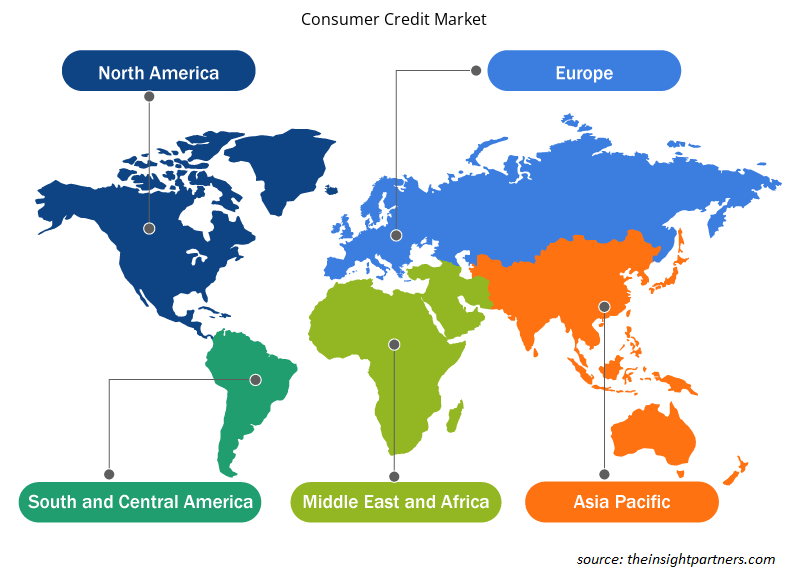

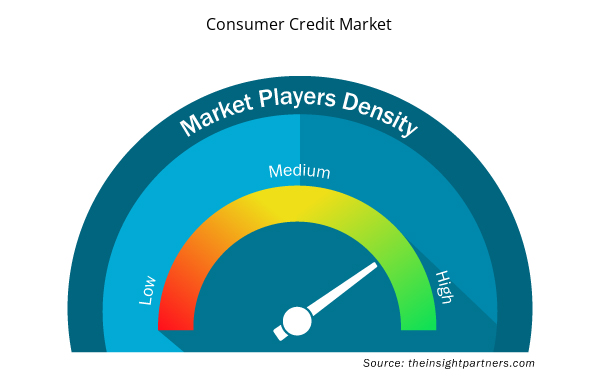

Consumer Credit Market Players Density: Understanding Its Impact on Business Dynamics

The Consumer Credit Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Consumer Credit Market are:

- American Express

- U.S. Bank

- Citi

- Wells Fargo Bank

- Capital One Bank

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Consumer Credit Market top key players overview

The "Consumer Credit Market Analysis" was carried out based on core investment strategies and geography. In terms of credit type, the market is segmented into revolving credits and non-revolving credits. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Consumer Credit

Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the consumer credit market. A few recent key market developments are listed below:

- In February 2024, Barclays PLC and Blackstone Credit & Insurance today announced that Barclays Bank Delaware has entered into an agreement with insurance accounts managed by Blackstone’s Asset Based Finance group to sell approximately US$1.1 billion of currently outstanding credit card receivables in relation to a defined set of Barclays-branded credit card accounts in the United States of America. This is the first in a series of activities Barclays plans to conduct to reduce its risk-weighted assets (RWAs) and create additional lending capacity for BBDE.

[Source: Barclays PLC, Company Website]

Consumer Credit

Market Report Coverage & Deliverables

The market report "Consumer Credit Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Credit Type, Service Type, Issuer, Payment Method, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global consumer credit market was estimated to be US$ 12.18 billion in 2023 and is expected to grow at a CAGR of 5.4% during the forecast period 2023 - 2031.

The use of AI and data analytics is impacting consumer credit, which is anticipated to bring new consumer credit market trends in the coming years.

The key players holding majority shares in the global Consumer Credit market are American Express, U.S. Bank, Citi, and Wells Fargo Bank.

The global consumer credit market is expected to reach US$ 18.60 billion by 2031.

Demand for flexibility in spending and rapid urbanization are the major factors that propel the global consumer credit market growth.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- American Express

- U.S. Bank

- Citi

- Wells Fargo Bank

- Capital One Bank

- Revolut

- Barclays

- Discover

- Finastra

- Affirm

Get Free Sample For

Get Free Sample For