Contactless Payments Market Analysis and Opportunities by 2031

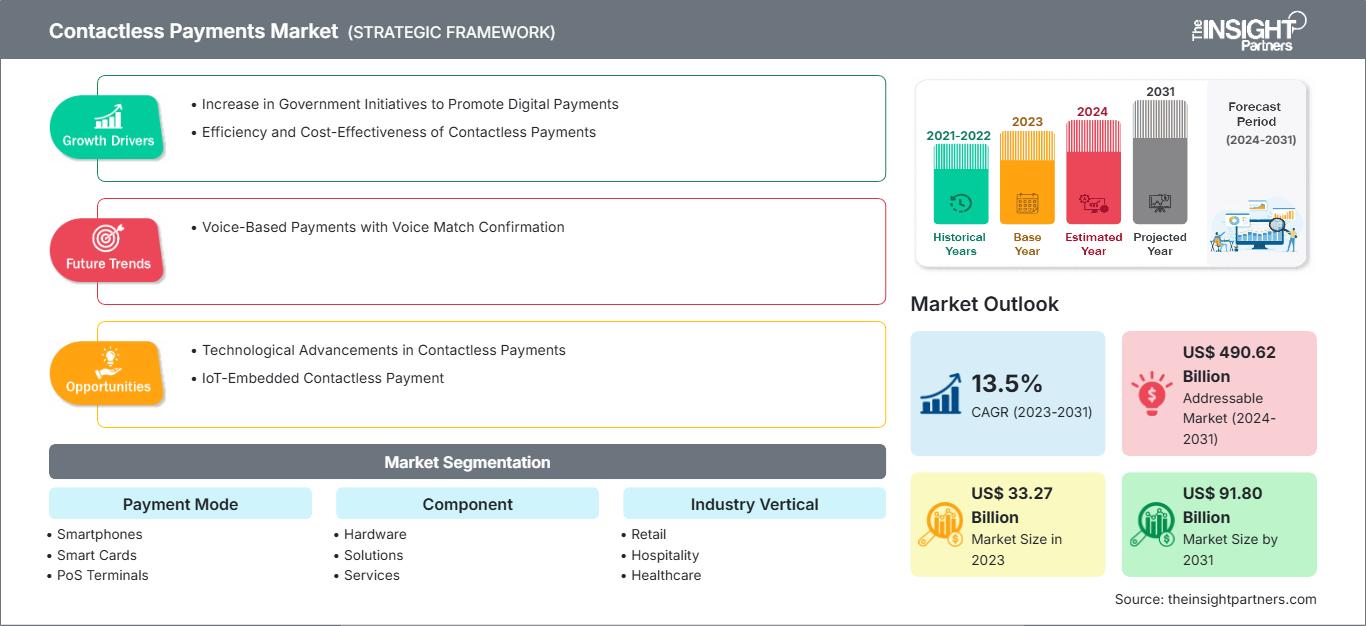

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031Contactless Payments Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Payment Mode (Smartphones, Smart Cards, PoS Terminals, and Others), Component (Hardware, Solutions, and Services), Industry Vertical (Retail, Hospitality, Healthcare, Transportation & Logistics, Media & Entertainment, and Others), and Geography

- Report Date : May 2024

- Report Code : TIPTE100000406

- Category : Banking, Financial Services, and Insurance

- Status : Published

- Available Report Formats :

- No. of Pages : 171

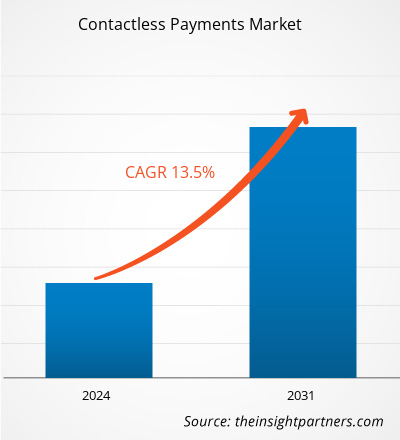

The contactless payments market size is projected to reach US$ 91.80 billion by 2031 from US$ 33.27 billion in 2023. The market is expected to register a CAGR of 13.5% during 2023–2031. Voice-based payment with voice match confirmation is likely to remain a key trend in the market.

Contactless Payments Market Analysis

Various governments across the globe are promoting the use of digital payments. Governments of various countries in Asia Pacific have been actively promoting digital payments and financial technology. They have implemented policies and initiatives to encourage the adoption of contactless payments. The IoT contains a vast network of interconnected devices, each embedded with sensors and software, capable of collecting and exchanging data over the Internet. Wearable devices, such as smartwatches, contactless payment cards, and mobile apps embedded with IoT technology, allow users to make payments with a simple tap or by holding their device near a point-of-sale (PoS) terminal. The elimination of physical cards or cash streamlines the transaction process and minimizes the risk of loss or theft. Security concerns have long been a central focus in financial transactions.

Contactless Payments Market Overview

Contactless payment is a secure and convenient way of paying for goods and services with a smartphone, debit card, or credit card that uses radio frequency identification (RFID) technology and near-field communication (NFC). Contactless payment works by tapping or waving the payment device over a point-of-sale terminal that has contactless payment technology. Contactless payment has several benefits, such as reduced transaction time and friction, as customers do not have to enter their PIN or handle cash at the checkout. It improves customer experience and trust, as contactless payment is safe and encrypted to prevent any fraudulent purchases. It offers flexibility for payment devices, as customers can use their NFC-enabled smartphone, wearable device, or contactless card to make payments. It provides loyalty benefits, as some contactless payment systems are integrated with loyalty programs that offer discounts and rewards to customers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Contactless Payments Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Contactless Payments Market Drivers and Opportunities

Efficiency and Cost-Effectiveness of Contactless Payments to Favor Market

Contactless payment technologies enable transactions through contactless chips embedded in payment cards, tags, wearables, and mobile phones. The contactless payment offers quick approvals from banks, and the money is transferred to the account instantly. This reduces the waiting time and hassle for both consumers and merchants and improves the efficiency and convenience of payments. The contactless payment allows the automation of monthly payments to save time and effort and get cashback. Also, the contactless payment option has low processing fees.

Technological Advancements in Contactless Payments

NFC is used for contactless payments. The process of holding a chipped card or smartphone directly against the reader provides an extra layer of security, making contactless payments safe and secure. NFC is the technology used by smartphones that have enabled mobile wallets, such as ApplePay. Contactless payment enables faster transactions and increased customer satisfaction and loyalty, as well as the adoption of new payment technologies, such as NFC and others, which facilitate machine-to-machine communication and IoT integration.

Contactless Payments Market Report Segmentation Analysis

Key segments that contributed to the derivation of the contactless payments market analysis are payment mode, component, and industry vertical.

- Based on payment mode, the contactless payments market is divided into smartphones, smart cards, PoS terminals, and others. The smartphones segment held the largest market share in 2023. Contactless payment with smartphones involves utilizing a mobile device, such as a smartphone, to securely store credit and debit card information. This allows users to make purchases by tapping their device on a compatible card reader, eliminating the need for cash or physical card swiping.

- By component, the market is segmented into hardware, solutions, and services. The hardware segment held the largest share of the market in 2023. Contactless payment hardware encompasses the physical devices and technology utilized to facilitate secure transactions without requiring physical contact between the payment device and the point-of-sale (POS) terminal.

- In terms of industry vertical, the market is segmented into retail, hospitality, healthcare, transportation & logistics, and media & entertainment, and others. The retail segment held a significant share of the market in 2023. Contactless payment in retail refers to a secure and convenient payment method that enables customers to conduct transactions by tapping a payment card or another device near a point-of-sale terminal equipped with contactless payment technology.

Contactless Payments Market Share Analysis by Geography

The geographic scope of the contactless payments market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Contactless payments are already increasing in popularity in the US. The COVID-19 pandemic has significantly boosted the use of various touch-free payment methods among Americans. In November 2023, as reported by the Mastercard Contactless Consumer Polling, more than half (51%) of Americans were utilizing some form of contactless payment, such as tap-to-go credit cards and mobile wallets, such as Apple Pay. The rising popularity of contactless payments can be attributed, at least in part, to the growing apprehension about the hygiene of signing at the point of sale (PoS) or using cash. According to the survey, 50% of US consumers have concerns about the cleanliness of signature touchpads, and 72% of US consumers opt to forgo signatures entirely.

The European Central Bank (ECB) oversees the euro area payments market to ensure the smooth operation of payment systems and the availability of diverse payment methods. By examining payment statistics, the ECB tracks current trends, such as the increasing usage of contactless card payments. This data has been gathered since the first half of 2022 and has recently been made public. In the second half of 2022, 53.8% of all card-based payments in the euro area were contactless. Furthermore, in 13 out of the 19 euro area countries at that time, over half of all card payments were contactless, indicating a strong demand for this technology throughout the euro area. These stats highlight the emergence of contactless payments in Europe.

Contactless Payments Market Regional Insights

The regional trends and factors influencing the Contactless Payments Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Contactless Payments Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Contactless Payments Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 33.27 Billion |

| Market Size by 2031 | US$ 91.80 Billion |

| Global CAGR (2023 - 2031) | 13.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Payment Mode

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Contactless Payments Market Players Density: Understanding Its Impact on Business Dynamics

The Contactless Payments Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Contactless Payments Market top key players overview

Contactless Payments Market News and Recent Developments

The contactless payments market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the contactless payments market are listed below:

- Ingenico, a global leader in payment acceptance and services, has announced a strategic partnership with Cybersource, Visa's agnostic global payment and fraud management platform. The partnership will create a global unified commerce solution for use in Asia Pacific first, followed by other regions.

(Source: Ingenico, Press Release, January 2024)

- Mastercard and AF Payments, Inc. (AFPI), the company behind Beep cards, have announced a strategic partnership to enable contactless acceptance of Mastercard cards in the Metro Rail Transit Line 3 (MRT-3 Line) and buses for the first time in the Philippines. In support of the government's goal to accelerate the digitization of payments, and in line with the Bangko Sentral ng Pilipinas' Digital Payments Transformation Roadmap, the 'Mastercard-Beep EMV Contactless Acceptance in Transport Partnership' aims to broaden contactless payments acceptance in the Philippines. This initiative will bring greater convenience to the consumer commuting experience, simplifying access and enabling travelers to tap in and tap out with their Mastercard.

(Source: Mastercard, Press Release, February 2024)

Contactless Payments Market Report Coverage and Deliverables

The "Contactless Payments Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Contactless payments market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Contactless payments market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Contactless payments market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the contactless payments market

- Detailed company profiles

Frequently Asked Questions

Which are the leading players operating in the contactless payments market?

What would be the estimated value of the contactless payments market by 2031?

What are the future trends of the contactless payments market?

What is the expected CAGR of the contactless payments market?

Which region dominated the contactless payments market in 2023?

What are the driving factors impacting the contactless payments market?

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For