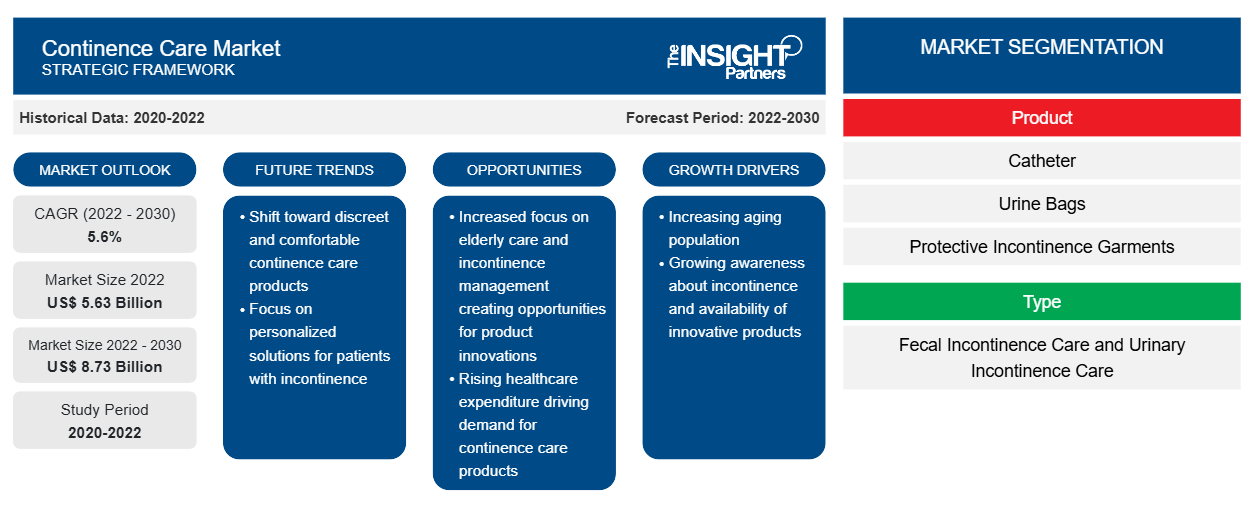

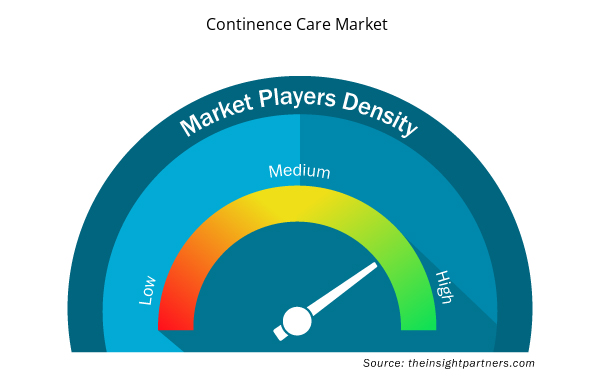

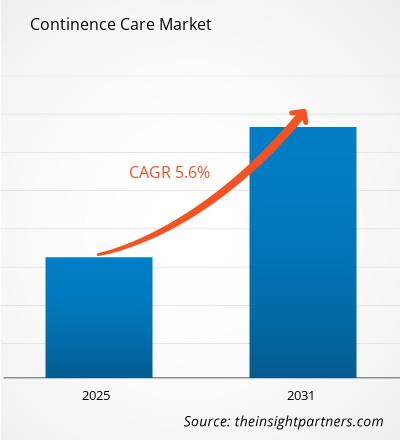

[Research Report] The continence care market size is projected to grow from US$ 5.63 billion in 2022 to US$ 8.73 billion by 2030; the market is estimated to record a CAGR of 5.6% during 2022–2030.

Market Insights and Analyst View:

The likelihood of developing incontinence problems rises with age, and conditions such as obesity, childbirth, or brain injury may also bring on the disorder. Innovation in product design and material and an increasing prevalence of urinary incontinence are anticipated to drive the continence care market growth. Moreover, the surge in demand for advanced solutions such as wearable devices and smart continence care products to enhance patient comfort and monitoring, as well as government initiatives to increase the healthcare infrastructure, will likely augment the market growth. The cutting-edge products frequently use sensor technologies and networking capabilities to provide data collection and real-time monitoring. It is anticipated that as technology develops, smart continence care products will also advance, offering even more advanced features to meet the specific needs of incontinence sufferers.

Growth Drivers:

Favorable Reimbursement Drives Continence Care Market

Purchasing absorbent products regularly to deal with medical conditions can be cost-intensive for patients and their caregivers. Certain situations allow for the reimbursement of continence products by public and private insurance programs. For those who use intermittent catheters, the Medicaid program usually reimburses the patient for 120 intermittent catheters per month. Medicaid covers the majority of brands of catheters with hydrophilic and antibacterial coatings, straight catheters, coude catheters, and catheter kits.

Medicare is the health insurance program the US government offers to individuals aged 65 years or older, those under 65 with specific disabilities, and individuals of any age with end-stage renal disease. A maximum of 200 sterile, single-use catheters are reimbursed monthly to intermittent catheter users under Medicare reimbursement coverage. If a member has chronic urine incontinence, Medicare pays for sterile intermittent catheters with insertion kits or closed-system intermittent catheters.

Table: Medicare Local Coverage Determinations (LCD)

|

|

A4310 | Insert tray without drainage bag and without catheter (accessories only) |

A4332 | Lubricant, individual sterile packet, each |

A4349 | Male external catheter, with or without adhesive, disposable, each |

A4351 | Intermittent urinary catheter; straight tip, with or without coating (Teflon, silicone, silicone elastomer, or hydrophilic, etc.), each |

A4352 | Intermittent urinary catheter; Coudé (curved) tip, with or without coating (Teflon, silicone, silicone elastomer, or hydrophilic, etc.) each |

A4353 | Intermittent urinary catheter, with insertion supplies |

A4357 | Bedside drainage bag, day or night, with or without anti-reflux device, with or without tube, each |

A4358 | Urinary drainage bag, leg or abdomen, vinyl, with or without tube, with straps, each |

Thus, favorable reimbursement policies drive the continence care market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Continence Care Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Continence Care Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “continence care market analysis” has been carried out by considering the following segments: product, type, and end user.

Segmental Analysis:

By product, the continence care market is segmented into catheters, urine bags, protective incontinence garments, and others. The catheter segment held the largest continence care market share in 2022 and is anticipated to register a CAGR of 5.7% during the forecast period.

Enhanced treatment uptake using intermittent catheters as a substitute for indwelling or permanent catheters will likely drive the demand. Thus, key players are developing and introducing new products to drive the segment growth. For instance, in March 2021, the Infyna Chic intermittent catheter was introduced to the US market by Hollister Incorporated.

The continence care market, by type, is divided into fecal incontinence care and urinary incontinence care. The urinary incontinence care segment held a larger market share in 2022 and is anticipated to register a higher CAGR of 5.8% during the forecast period.

The continence care market, by end user, is categorized into hospitals and specialty clinics, homecare, and others. The hospitals and specialty clinics end user segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 6.0% during the forecast period.

Regional Analysis:

The scope of the global continence care market report includes the assessment of the market performance in North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2022, Europe held the largest continence care market share. The market growth in this region is driven by government initiatives to increase awareness and improve product access by encouraging product promotion strategies. For instance, in February 2023, by purchasing Clinisupplies from Healthium, KKR is strengthening its position in the medical device industry.

Further, the National Bladder and Bowel Health Project was launched by NHS England to enhance continence care throughout the public health and care system. Healthcare providers—including the National Health Service (NHS) in the UK—are essential to provide continence care services. This covers diagnosis, assessment, and the application of suitable management techniques.

Continence Care Market Regional Insights

Continence Care Market Regional Insights

The regional trends and factors influencing the Continence Care Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Continence Care Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Continence Care Market

Continence Care Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 5.63 Billion |

| Market Size by 2030 | US$ 8.73 Billion |

| Global CAGR (2022 - 2030) | 5.6% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Continence Care Market Players Density: Understanding Its Impact on Business Dynamics

The Continence Care Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Continence Care Market are:

- Hollister Incorporated

- Coloplast

- Alcare Co., Ltd.

- B. Braun SE

- Convatec Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Continence Care Market top key players overview

Future Opportunities:

The healthcare industry is constantly developing due to the increasing demand for continence care products from a large population globally, which has increased new product development, product launches, and approvals worldwide. Additionally, major market players are involved in research and development activities to ensure the innovation and development of efficient products. In recent years, various developments, in terms of product launches and approvals, have taken place in the market and are likely to create ample opportunities. For instance, in February 2021, Ontex (a leading global personal hygiene company) created a clever way to help incontinent patients by spurring innovation in adult care—a market steadily expanding in recent years.

The creative solution from Ontex consists of a premium diaper with a printed sensor, a transmitter that clips onto the diaper, and a mobile application. This combination notifies caregivers when a diaper needs to be changed and accurately measures the diaper's saturation level and leak risk. This helps patients receive personalized, individualized continence support, improving the well-being of users, families, and caregivers.

Thus, increasing product development and launches among market players will likely create ample opportunities and drive market growth in the coming years.

Competitive Landscape and Key Companies:

The continence care market forecast can help stakeholders in this marketplace plan their growth strategies. Hollister Incorporated, Coloplast, Alcare Co., Ltd., B. Braun SE, Convatec Inc, Cardinal Health, Boston Scientific Corporation, Essity, PAUL HARTMANN AG, and Kimberly-Clark Corporation are among the prominent companies profiled in the continence care market report. These companies focus on developing new technologies, upgrading existing products, and expanding their geographic presence to meet the growing consumer demand worldwide.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Type, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Using products for continence helps control the symptoms of insufficient bladder and bowel control. They might be applied briefly while receiving treatment. They can also be used if there is no long-term solution for poor bladder and bowel control. Many products are available to help with issues with bladder or bowel control.

Key factors driving the growth of this market are favorable reimbursement and an increase in the prevalence of spinal cord injuries; urinary incontinence is expected to boost the market growth for continence care over the years.

The CAGR value of the continence care market during the forecasted period of 2022-2030 is 5.6%.

The catheter segment held the largest share of the market in the global continence care market and held the largest market share in 2022.

The urinary incontinence care segment dominated the global continence care market and held the largest market share in 2022.

Global continence care market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa and South & Central America. North America held the largest market share of the continence care market in 2022.

Hollister Incorporated and Coloplast are the top two companies that hold huge market shares in the continence care market.

The continence care market majorly consists of players such Hollister Incorporated, Coloplast, Alcare Co., Ltd., B. Braun SE, Convatec Inc, Cardinal Health, Boston Scientific Corporation, Essit, PAUL HARTMANN AG, Kimberly-Clark Corporation, and amongst others.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Continence Care Market

- Hollister Incorporated

- Coloplast

- Alcare Co., Ltd.

- B. Braun SE

- Convatec Inc

- Cardinal Health

- Boston Scientific Corporation

- Essity

- PAUL HARTMANN AG

- Kimberly-Clark Corporation

Get Free Sample For

Get Free Sample For