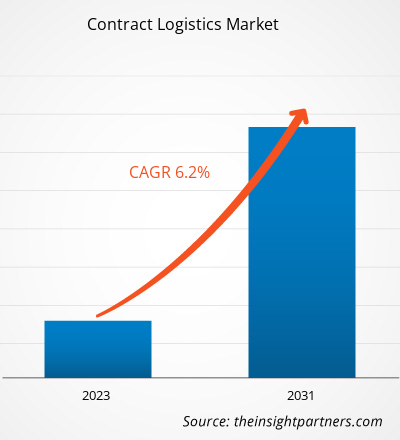

The Contract Logistics Market size is projected to reach US$ 475.28 billion by 2031 from US$ 294.42 billion in 2023. The market is expected to register a CAGR of 6.2% in 2023–2031. The growing e-commerce industry at a rapid pace with a surge in the online shopping trend is fuelling the contract logistics market growth. Contract logistics companies play a vital role in offering diversified arrays of delivery options. Online shopping in North American countries such as the US and Canada has increased in popularity in recent years. The total e-commerce industry sales in the US reached US$ 1.03 trillion in 2022, increased from US$ 518.5 billion compared to 2018. Many logistics companies, such as USPS, UPS, XPO Logistics, FedEx, and Amazon, are offering contract logistics and parcel delivery services. Also, the market players are making partnerships to enhance business growth to acquire significant market share. For instance, in June 2021, FedEx Corp. partnered with Nuro to test and implement Nuro's next-generation autonomous delivery vehicles.

Contract Logistics Market Analysis

Contract logistics is a third-party logistics service where the companies outsource different aspects of the supply chain operations. The contract logistics provider manages all aspects of the company’s supply chain, such as storage, distribution, transportation, and other activities.

The objective of contract logistics services is to optimize the supply chain operations, reduce overall costs, and improve efficiency. Contract logistics providers are adopting advanced technologies such as AI, IoT, and robotics to manage and outsource their logistics operations. The warehousing segment in contract logistics has the largest share in 2023, owing to increasing demand from e-commerce companies to store parcels and other goods.

Contract Logistics Market Overview

Increasing government initiatives for economic diversification with rapid infrastructure development, increasing digitization, and rapid industrialization are the major driving factors for the market growth. The e-commerce sector is producing significant demand for the global contract logistics market. Also, increasing foreign direct investments across developing countries such as India, Mexico, and Brazil are major to contribute for the contract logistics market growth.

Additionally, the rapid expansion of the manufacturing sector and increasing focus on core competencies, the growth in demand for achieving cost efficiency, job optimization, and technology adoption in the supply chain drives the market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Contract Logistics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Contract Logistics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Contract Logistics Market Drivers and Opportunities

Rising E-Commerce Sector Growth Owing to the Surge in Online Shopping Trends is Expected to be the Prime Driver for Market Growth

Contract logistics covers a much broader scope than warehousing and distribution. The growing number of online shoppers with the surge in Internet users in North American countries such as the US, Canada, and Mexico are the major factors driving the growth of the contract logistics market growth during the forecast period. Increasing the e-commerce industry at a rapid pace with a significant boost in online shopping trends is a major driving factor for the market growth during the forecast period. Revenues from retail e-commerce sales in the US in 2022 increased to US$ 1.03 trillion. Contract logistics is the third-party logistics that is able to handle several activities such as designing, distribution, planning, warehousing, transportation, and distributing goods. The contract logistics sector helps to simplify logistics operations.

The rising Integration of AI and Robotics in Logistics and Warehousing Sectors is Expected to Drive Market Growth.

The integration of advanced telematics and IoT solutions to improve logistics capabilities drives market growth. Contract logistics companies are developing the supply chain capabilities for enhancing the warehousing, transportation and distribution capabilities. For instance, in February 2024, GXO Logistics, Inc. contract logistics provider, partnered with a US-based Dexterity robotics company to implement AI and robotics capabilities in a warehouse operation for beauty brands. The rising integration of automation into warehousing and supply chain helps to grow and meet the company’s strategic objectives.

Contract Logistics Market Report Segmentation Analysis

Key segments that contributed to the derivation of the contract logistics market analysis are type, services, and end-user.

- Based on type, the market is divided into outsourcing and insourcing.

- Based on services, the global contract logistics market is divided into transportation, warehousing, packaging processes and solutions, distribution, production logistics, and aftermarket logistics.

- Depending upon the end-users, the global market is divided into aerospace, automotive, consumer, high-tech, industrial, pharmaceutical & healthcare, e-commerce and retail, and others.

Contract Logistics Market Share Analysis by Geography

The geographic scope of the contract logistics market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North American contract logistics market has the largest share in 2023. This is primarily owing to rapid growth in online shopping trends with surge in the e-commerce sector. The US and Canada play a significant share in the overall market. Further, the major countries include Germany, the UK, France, Italy, India, Spain, South Korea, China, Australia, Japan, and Brazil.

The Asia Pacific region has the highest CAGR during the forecast period owing to the increasing middle-class population across China and India. Increasing urbanization with the surge in smartphone penetration has created a massive demand for the Asia Pacific contract logistics market growth during the forecast period.

Contract Logistics Market Regional Insights

The regional trends and factors influencing the Contract Logistics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Contract Logistics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Contract Logistics Market

Contract Logistics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 294.42 Billion |

| Market Size by 2031 | US$ 475.28 Billion |

| Global CAGR (2023 - 2031) | 6.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

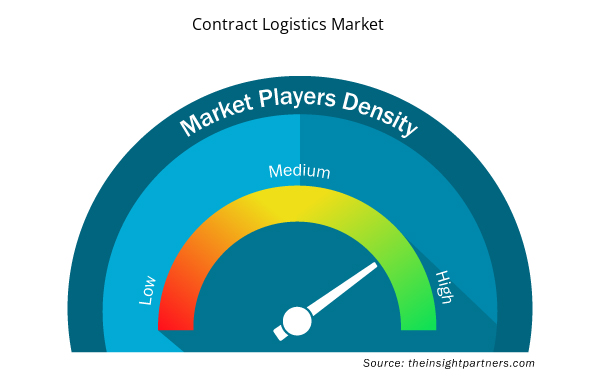

Contract Logistics Market Players Density: Understanding Its Impact on Business Dynamics

The Contract Logistics Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Contract Logistics Market are:

- CEVA Logistics

- Kuhne Nagel

- United Parcel Service

- DB Schenker

- Agility

- DSV

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Contract Logistics Market top key players overview

Contract Logistics Market News and Recent Developments

The Contract Logistics Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for Contract Logistics market and strategies:

- In August 2023, CEVA Logistics acquired 96% of Stellar Mumbai India-based Value Chain Solutions. CEVA Logistics expanded contract logistics nationwide to improve cold chain logistics capabilities. (Source: DJI, Press Release/Company Website/Newsletter)

- In March 2024, Rhenus launched integrated logistics services to improve its supply chain capabilities in India. Rhenus India introduced this new product across all business units, added new business units, and enhanced its capabilities in the logistics sector. (Source: Flyability, Press Release/Company Website/Newsletter)

Contract Logistics Market Report Coverage and Deliverables

The “Contract Logistics Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type ; Services ; and End-user

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Get Free Sample For

Get Free Sample For