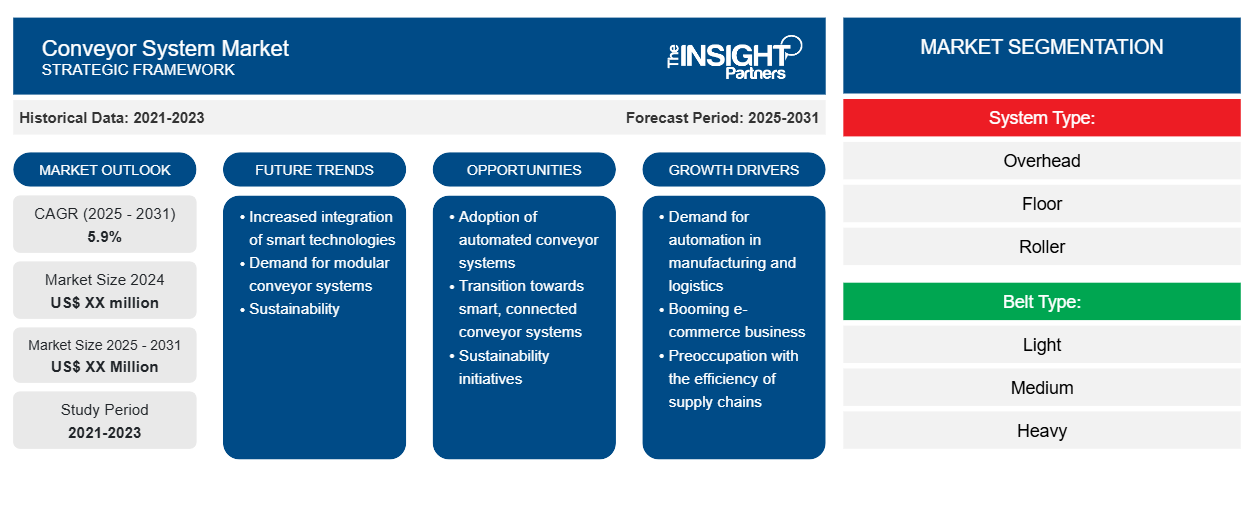

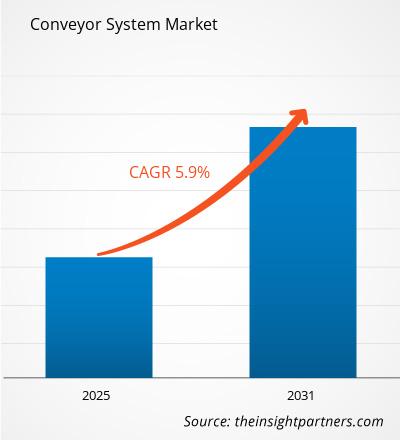

The Conveyor System Market is expected to register a CAGR of 5.9% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

This research report on the Conveyor System Market includes in-depth analyses of the status and outlook of this rather important industry, underlining trends and opportunities that would propel segments in the market forward. The report categorizes the market by system type, belt type, and end-user industry, thereby providing in-depth insight about market changeability, consumer preferences, and consumption patterns in various sectors.

This study looks into the trend of automation in manufacturing and logistics that defines demand for conveyor systems, which improve the efficiency and productivity of operations. It studies various conveyor types, including belt, roller, and modular systems applied in diversified industries such as automotive, food and beverage, warehousing, and distribution.

Further, the segmentation includes insight into industries by end-users, depicting how diversified requirements mold the adoption of conveyor solutions. Additionally, the document investigates the sale channels covering direct sales, distributors, and e-commerce platforms that would reveal effective strategies for market penetration and customer engagement.

Purpose of the Report

The report Conveyor System Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Conveyor System Market Segmentation

System Type:

- Overhead

- Floor

- Roller

- Belt

- Others

Belt Type:

- Light

- Medium

- Heavy

Industry:

- Food & Beverages

- Automotive

- Airports

- Logistics

- Metals & Mining

- Others

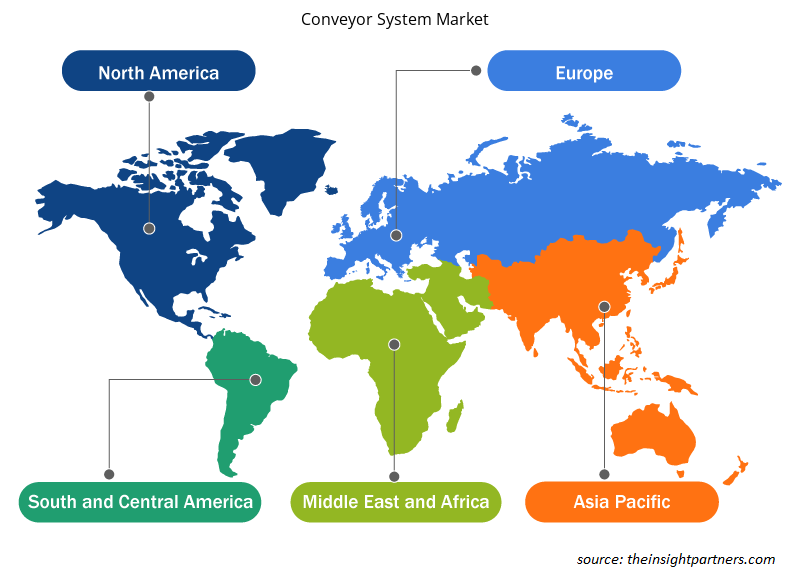

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Conveyor System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Conveyor System Market Growth Drivers

- Demand for automation in manufacturing and logistics: There is an increasing demand for automation in manufacturing and logistics. Automated conveyor systems have become imperative aspects in companies' efforts to increase their operational efficiency and reduce labour costs. This aspect can be more clearly seen in industries like automotive, food and beverage, and pharmaceuticals, where streamlined processes are crucial.

- Booming e-commerce business: The growth of online purchases has seen companies invest heavily in warehouse automation as a means of keeping control of the volumes of orders that have been growing, while at the same time meeting the expectations of higher delivery times. In this regard, conveyor systems form part of the very core of the logistics chain, enabling enterprises to sort through orders much quicker and with a greater degree of accuracy in order to keep up with consumer satisfaction amidst stiff competition.

- Preoccupation with the efficiency of supply chains: Preoccupation contribute to the widespread adoption of conveyor systems. The ever-growth in demand from consumers has made industries aware that they have to work on smoothing production workflows. Therefore, companies are in a position to enhance their material handling, reduce operational bottlenecks, and boost productivity with the use of conveyor solutions.

- Advanced Technologies: The advancements in technology encourage more market growth. Smart technologies are integrated into the processes of IoT and AI for real-time monitoring of conveyor systems and predictive maintenance. It also improves the operability for less downtime and allows smooth and effective business operations.

Conveyor System Market Future Trends

- Increased integration of smart technologies: Technologies such as IoT and AI probably constitutes one of the most active trends in recent years. These all enable real-time monitoring, predictive maintenance, and improvements in operational efficiency that will allow companies to achieve process optimization with less downtime.

- Demand for modular conveyor systems: Such modular conveyor systems facilitate flexibility and scalability, allowing companies to easily and quickly adapt to changes in production needs and scale their operations without resorting to major revamps. Therefore, such scalability is particularly all embraced in industries like e-commerce and manufacturing, where requirements can fluctuate at a moment's notice.

- Sustainability: Sustainability also turns out to be a critical focus; more firms seek energy-efficient conveyor solutions. Manufacturers are working out eco-friendly designs that will reduce energy consumption and carbon emissions, hence coinciding with the wider corporate sustainability objectives.

Conveyor System Market Opportunities

- Adoption of automated conveyor systems: With businesses trying to increase efficiencies and minimize operational costs. This becomes particularly evident in areas such as e-commerce and manufacturing, where the need for order fulfilment is very fast, and the processes must be as smooth as possible. With a projection for e-commerce sales to break $6 trillion by 2024, the need for efficient means of material handling solutions cannot be stronger.

- Transition towards smart, connected conveyor systems: With integrated technologies such as the Internet of Things and artificial intelligence that will enable real-time monitoring and predictive maintenance. This can sharply improve companies' operational efficiency and reduce their levels of downtime. The market for IoT in conveyor systems is supposed to grow at a substantial rate-a feature reflecting strong investor interest in these innovations.

- Sustainability initiatives: Since industries increasingly focus on reducing their environmental footprint, energy-efficient conveyor solutions have started gaining importance. Eco-friendly systems that save energy consumption result in huge cost savings, and such solutions are attractive to businesses aiming to improve their sustainability profiles.

Conveyor System Market Regional Insights

The regional trends and factors influencing the Conveyor System Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Conveyor System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Conveyor System Market

Conveyor System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 5.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By System Type:

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

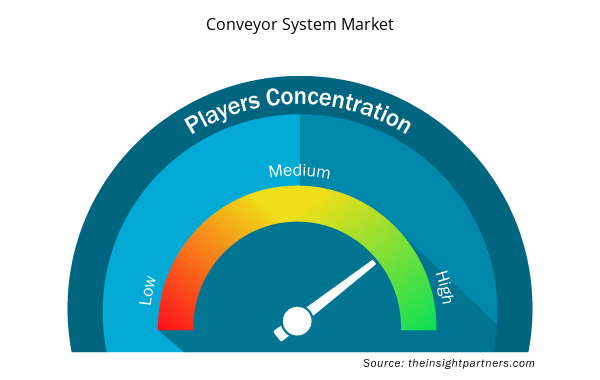

Conveyor System Market Players Density: Understanding Its Impact on Business Dynamics

The Conveyor System Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Conveyor System Market are:

- Daifuku Co., Ltd.

- Dematic

- Emerson Electric Co

- Honeywell Intelligrated

- Interroll Holding GmbH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Conveyor System Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Conveyor System Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Conveyor System Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Animal Genetics Market

- Neurovascular Devices Market

- Sexual Wellness Market

- Architecture Software Market

- Rugged Servers Market

- Oxy-fuel Combustion Technology Market

- Electronic Data Interchange Market

- Adaptive Traffic Control System Market

- Medical and Research Grade Collagen Market

- Intraoperative Neuromonitoring Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

System Type, Belt Type, and Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

Some of the customization options available based on request are additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The market is expected to register a CAGR of 5.9% during 2023-2031

In a nutshell, the driving forces of the Conveyor System Market include demand from automation, growth in e-commerce, efficiency in supply chains, technological advancement, and environmental concerns. These factors together create a dynamic landscape that positions the market for continued growth in the coming years.

Increased automation of warehouses and distribution centers, therefore, drives investment in advanced conveyor technologies. Also, automated systems will be unavoidable to handle the increased volume of orders and for improving the efficiency of overall logistics. As these trends continue to evolve, the Conveyor System Market is poised for sustained growth, meeting the demands of a rapidly changing industrial landscape.

The key players in conveyor system market are - Daifuku Co Ltd, Dematic, Emerson Electric Co, Honeywell Intelligrated, Interroll Holding GmbH, Siemens AG, SSI Schafer, Swisslog Holding AG, TGW Logistics Group

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - Conveyor System Market

- Daifuku Co., Ltd.

- Dematic

- Emerson Electric Co

- Honeywell Intelligrated

- Interroll Holding GmbH

- Siemens AG

- SSI Schafer

- Swisslog Holding AG

- TGW Logistics Group

- Vanderlande Industries B.V

Get Free Sample For

Get Free Sample For