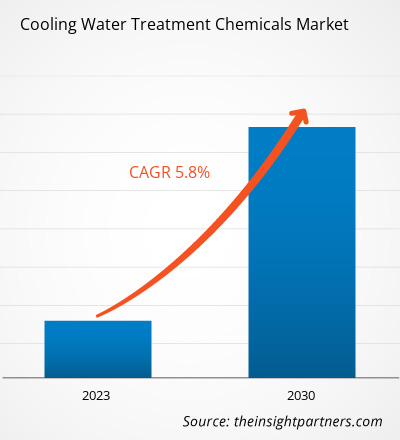

[Research Report] The cooling water treatment chemicals market size was valued at US$ 11.84 billion in 2022 and is expected to reach US$ 18.60 billion by 2030; it is estimated to register a CAGR of 5.8% from 2022 to 2030.

Market Insights and Analyst View:

Cooling water treatment chemicals are the chemical agents that help remove unwanted harmful bacteria from the cooling system. It is mainly used for protecting the system from damaging corrosion, controlling scale formation and fouling, and controlling the growth of harmful bacteria. These water treatment chemicals possess the excellent properties of increasing the efficiency and safety of the device. Furthermore, it reduces the energy consumption by increasing the pace of cleaning. A few examples of cooling water treatment chemicals are polyphosphates, chromates, nitrites, surfactants, zeolites, and orthophosphate. It is used in various industries such as power, oil & gas, steel & metal, sugar mills, and textile. Growing demand from these application sectors is leading to the increasing cooling water treatment chemicals market size.

Growth Drivers and Challenges:

The food & beverages, oil & gas, power, and textile industries are among the major end-use industries in the cooling water treatment chemicals market. These chemicals are the chemical agents that help remove harmful bacteria from cooling systems. It is mainly used to protect the systems from corrosion, prevent and slow down the processes of scale formation and fouling, and control the growth of harmful bacteria. These chemicals can contribute to the greater efficiency and safety of high-pressure boilers, turbines, and cooling towers. They also help reduce energy consumption by increasing the pace of cleaning. Prominent players such as Accepta, Albemarle Corporation, Buckman, and Chemtex Speciality Limited offer a large variety of These chemicals. There has been a growing trend toward the reuse and recycling of water, which is likely to offer new opportunities to water treatment chemicals manufacturers, further driving cooling water treatment chemicals market growth.

Increasing investment by various private companies and governments in the building and maintenance of energy infrastructure is also driving the cooling water treatment chemicals market share. The power industry, including thermal and atomic plants, requires water in huge quantities. These industries frequently use seawater or lake water for cooling the heat exchange equipment. The water is reused several times and returned to its source. ~99% of the water retrieved from the source is returned, and less than 1% of the water is squandered in dissipation. These water treatment chemicals are widely used in this industry to lower the dependency on freshwater resources. These chemicals are gaining attention, especially in open-recirculating, closed-loop, and once-through cooling frameworks, as they boost the heat transfer efficiency in heat-exchange equipment. The growing number of atomic energy plants across the world, combined with efforts being made to maintain existing plants, would further boost the use of cooling water treatment chemicals in the coming years. Thus, the continuous growth of the power generation industry, especially in developing countries such as India and China, is boosting the growth of the cooling water treatment chemicals market.

However, controlling viable microorganisms and macro-organisms is essential for the effective functioning of the cooling tower. Chlorine has long been considered a chemical of choice for cooling water treatment. However, its use is declining because of issues concerning the environment, safety, and performance. Chlorine is a poisonous gas, and guidelines for using chlorine are progressively attaining stringency. For example, the Environmental Protection Agency (EPA) has established an extreme contaminant level (MCL) of 0.080 ppm for total trihalomethanes (TTHMs). Instead of addressing the safety prerequisites of vaporous chlorine, many plant administrators are moving to its alternatives. Several halogenated organics are known or suspected carcinogenic agents, which further limits their use in water treatment. Consequently, these factors are influencing the cooling water treatment chemicals market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cooling Water Treatment Chemicals Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cooling Water Treatment Chemicals Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Global Cooling Water Treatment Chemicals Market Analysis to 2030" is a specialized and in-depth study with a major focus on market trends and growth opportunities across the globe. The cooling water treatment chemicals market report aims to provide an overview of the market with detailed market segmentation by type, end use, and geography. The market has witnessed high growth in recent years and is expected to continue this trend during the forecast period. The report provides key statistics on the cooling water treatment chemicals market forecast globally. In addition, the report provides a qualitative assessment of key factors affecting the cooling water treatment chemicals market performance. The report also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

The ecosystem analysis and Porter's five forces analysis provide a 360-degree view of the market, which helps understand the entire supply chain and factors affecting the global cooling water treatment chemicals market growth.

Segmental Analysis:

Based on type, the cooling water treatment chemicals market is bifurcated into scale inhibitors, corrosion inhibitors, biocides, and others. In terms of end use, the market is divided into power; steel, mining, and metallurgy; petrochemicals, oil, and gas; food and beverages; textile; and others. The biocide segment registered a significant cooling water treatment chemicals market share in 2022. Biocides are used to control microbial development. Problems caused by uncontrolled microbial growth can range from health hazards, biofilm advancements through chemical inhibitors breakdown, prompting limitation of a stream, and under deposit corrosion. It is thus imperative to ensure that microbial loads are leveled out in various systems, including drinking water systems, down water administrations, process waters, shut circuits, recreational waters, and open cooling systems. The microbial development is generally controlled by ensuring system cleanup while starting it, as well as whenever required, forestalling contamination of systems, and dosing with biocides, either on a continuous basis or by means of a program of shock dosing.

Oxidizing and nonoxidizing are the two major types of biocides. Oxidizing biocides eliminates microscopic organisms through the electrochemical procedure of oxidation. They commonly comprise chlorine or bromine and are best suited for systems with high water usage. These halogens are the oxidizing operators disturbing the natural cell. Chlorine, bromine, hydrogen peroxide, chlorine dioxide, and ozone are commonly used oxidizing biocides. Nonoxidizing agents are prescribed for addressing challenges with water due to biological growth, water quality, pH, discharge limits/toxicity, metallurgy, and chemical safety. This class incorporates a mix of quaternary ammonium compounds, isothiazoline, bronopol, THPS, DBNPA, and glutaraldehyde. With diminishing freshwater resources, coupled with stringent government rules and growing demand for consumable water, the importance of biocides in cooling water treatment chemicals market has remained high in 2022.

Regional Analysis:

Based on geography, the cooling water treatment chemicals market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. The market was dominated by Asia Pacific, which accounted for ~US$ 5 billion in 2022. Many small- and large-scale manufacturing companies have a presence in India, China, and Japan. China accounted for the largest market for cooling water treatment chemicals, which can be attributed to the vast power industry in the country. The manufacturing sector in Asia Pacific is rapidly adopting innovation accelerators such as advanced technologies and processes. Over the past few years, manufacturing spending has grown significantly in the region. Government initiatives and policies such as Make-in-India encourage the setup of different manufacturing plants in India. Such developments in the manufacturing sector are favoring the cooling water treatment chemicals market growth in Asia Pacific.

Europe is expected to register a CAGR of over 5% from 2022 to 2030. Europe is one of the prominent consumers of these water treatment chemicals owing to the prominent activity of industries such as power, steel, mining and metallurgy, petrochemicals, oil & gas, food & beverages, and textiles, which require huge quantities of water. A few of the most commonly used cooling water treatment chemicals in Europe are corrosion inhibitors, scale inhibitors, and biocides. Regulations developed by the European Industrial Emission Directive (IED) regulate the emission of pollutants from the industrial sector, thereby playing a crucial role in the progress of the cooling water treatment chemicals market. As a result, the proper treatment of industrial water before its disposal has become one of the priorities of industries in European countries, which favors the cooling water treatment chemicals market in the region. Further, North America is expected to reach ~US$ 5 billion in 2030.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the cooling water treatment chemicals market are listed below:

- In January 2022, State Industrial Products, a leading chemical manufacturer and distributor of water treatment chemicals, disinfectants, and other products that help customers enhance building environments and improve equipment productivity, launched StaWatch, its new IoT solution for the Institutional and Industrial markets.

COVID-19 Impact:

Lockdowns, travel restrictions, and business shutdowns due to the COVID-19 pandemic adversely affected economies and industries in various countries across the globe. The crisis disturbed supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. These disruptions restricted the availability of cooling water treatment chemicals. It caused delays in production and increased costs, negatively impacting the overall supply of cooling water treatment chemicals. Many manufacturing facilities were temporarily halted or scaled back during the COVID-19 pandemic to comply with lockdown measures and ensure the safety of workers. In addition, the pandemic impacted the global economy, leading to fluctuations in commodity prices and reduced demand for cooling water treatment chemicals. All these factors negatively affected to the growth of the cooling water treatment chemicals market.

However, in 2021, the global marketplace started recovering from the losses as governments of different countries announced the relaxation of the restrictions. Manufacturing activities are rebounding as countries gradually recover from the pandemic and vaccination efforts continue. Manufacturers are permitted to operate at full capacity to overcome the supply gap. Thus, the global cooling water treatment chemicals market is anticipated to grow significantly during the forecast period.

Cooling Water Treatment Chemicals Market Regional Insights

Cooling Water Treatment Chemicals Market Regional Insights

The regional trends and factors influencing the Cooling Water Treatment Chemicals Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Cooling Water Treatment Chemicals Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Cooling Water Treatment Chemicals Market

Cooling Water Treatment Chemicals Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 11.84 Billion |

| Market Size by 2030 | US$ 18.6 Billion |

| Global CAGR (2022 - 2030) | 5.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

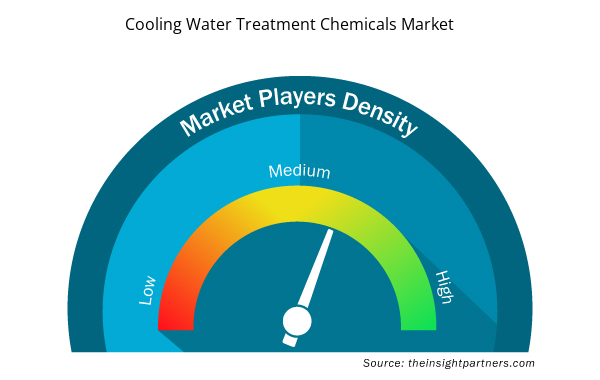

Cooling Water Treatment Chemicals Market Players Density: Understanding Its Impact on Business Dynamics

The Cooling Water Treatment Chemicals Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Cooling Water Treatment Chemicals Market are:

- ChemTreat Inc

- DuBois Chemicals Inc

- Chemtex Speciality Ltd

- Kurita Water Industries Ltd

- Kemira Oyj

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Cooling Water Treatment Chemicals Market top key players overview

Competitive Landscape and Key Companies:

ChemTreat Inc, DuBois Chemicals Inc, Chemtex Speciality Ltd, Kurita Water Industries Ltd, Kemira Oyj, Ecolab Inc, Buckman Laboratories lnternational Inc, Albemarle Corp, Accepta Ltd, and Veolia Water Solutions & Technologies SA are among the key players operating in the global cooling water treatment chemicals market. The global market players focus on providing high-quality products to fulfill customer demand.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type (Scale Inhibitor, Corrosion Inhibitor, Biocide, and Others) and End Use (Power; Steel, Mining, and Metallurgy; Petrochemicals, Oil, and Gas; Food and Beverages; Textile; and Others)

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Scale inhibitors are specially designed to control the deposition of polyvalent metal ions in industrial and wastewater systems. They offer halogen stability and control calcium, iron, manganese, and other metal salts to prevent precipitation on heat transfer surfaces. The selection of a scale control agent depends on the precipitating species and its degree of supersaturation. Sequestering agents and chelating agents used in cooling water treatments can form soluble complexes with metal ions to control scaling effectively. The stringent regulations by the government on water conservation and wastewater management, coupled with the increased use of cooling water treatment in industrial applications, have led to the dominance of the scale inhibitors segment. These factors led to the dominance of the scale inhibitor segment in 2022.

The power segment held the largest share of the global cooling water treatment chemicals market in 2022. The power industry is the largest consumer of cooling water treatment chemicals owing to the high water requirement of the industry and the need to preserve freshwater resources. Water is utilized in high-pressure boilers, turbines, and cooling towers to generate power. Water treatment for the power industry is a crucial procedure that requires reliable innovation. High-virtue water guarantees legitimate activity of the steam age framework and lessens blowdown recurrence and utilization of heater synthetic substances. Effective cooling water treatment is necessary for ensuring maximum profitability and nonstop activity of the power industry. Moreover, power industries involving nuclear and thermal plants often use seawater for cooling and are equipped with anti-corrosion heat exchange equipment. The increasing number of nuclear plants across the world, coupled with the need to maintain the existing plants, is expected to propel the demand for cooling water treatment chemicals.

Growing demand from the power industry and growing emphasis on water recycling and reuse are drivers of the cooling water treatment chemicals market. Cooling water treatment chemicals are the chemical agents that help in removing unwanted harmful bacteria from the cooling system. It is mainly used to protect the system from damaging corrosion, controlling the scale formation & fouling, and controlling the growth of harmful bacteria.

The major players operating in the global cooling water treatment chemicals market are ChemTreat Inc, DuBois Chemicals Inc, Chemtex Speciality Ltd, Kurita Water Industries Ltd, Kemira Oyj, Ecolab Inc, Buckman Laboratories lnternational Inc, Albemarle Corp, Accepta Ltd, and Veolia Water Solutions & Technologies SA.

In 2022, Asia Pacific accounted for the largest share of the global cooling water treatment chemicals market. Many small- and large-scale manufacturing companies have a presence in India, China, and Japan. China accounted for the largest market for cooling water treatment chemicals, which can be attributed to the vast power industry in the country. The manufacturing sector in Asia Pacific is rapidly adopting innovation accelerators such as advanced technologies and processes.

Based on the type, the corrosion inhibitors segment is expected to be the fastest-growing segment from 2022 to 2030. Corrosion inhibitors help prevent the system from fouling to ensure the safe operation of cooling systems. They are normally classified as anodic, cathodic, film-forming, and oxygen-absorbing agents, depending on their mode of action.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Cooling Water Treatment Chemicals Market

- ChemTreat Inc

- DuBois Chemicals Inc

- Chemtex Speciality Ltd

- Kurita Water Industries Ltd

- Kemira Oyj

- Ecolab Inc

- Buckman Laboratories lnternational Inc

- Albemarle Corp

- Accepta Ltd

- Veolia Water Solutions & Technologies SA

Get Free Sample For

Get Free Sample For