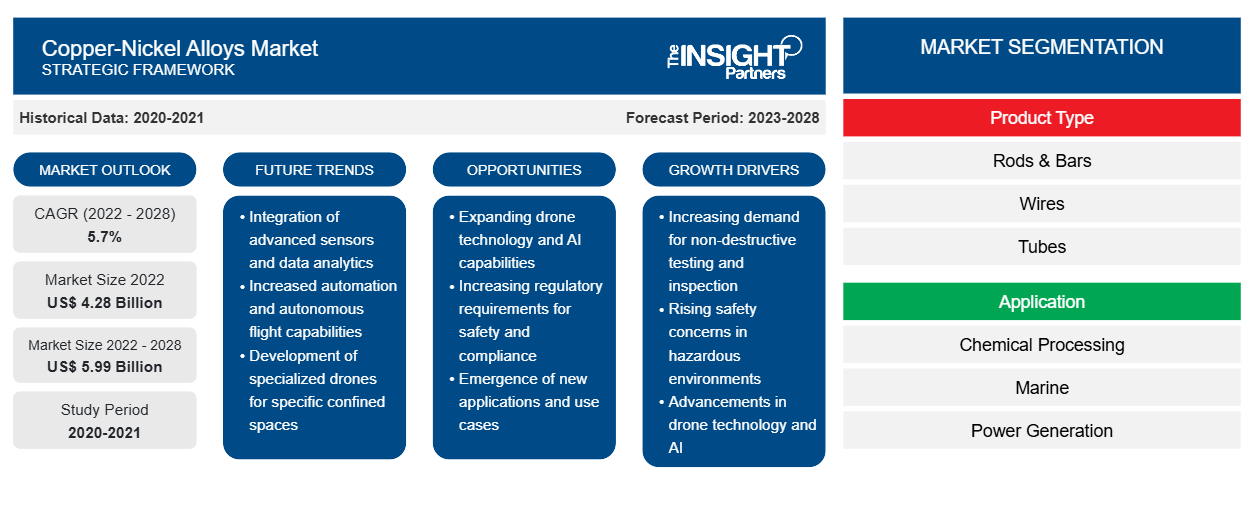

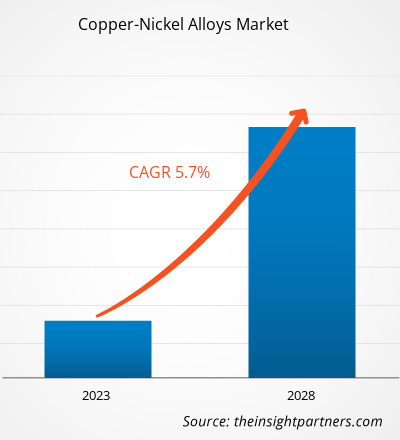

The copper-nickel alloys market size is projected US$ 5,989.37 million by 2028; it is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2022 to 2028.

Copper-nickel alloys have excellent corrosion resistance. They also exhibit resistance to macrofouling due to the formation of a protective oxide layer on their surfaces. Copper-nickel alloys usually come in two varieties: Cu-Ni (90-10) and Cu-Ni (70-30). The Cu-Ni (70-30) alloy is stronger and has greater resistance to corrosion (caused by seawater) and macrofouling than Cu-Ni (70-30). However, Cu-Ni- (90-10) is more affordable than Cu-Ni (70-30) and has a better service life in many end-use applications. Copper-nickel alloys are experiencing strong demand in the marine, chemical processing, power generation, and oil & gas industries, which is primarily driving the copper-nickel alloys market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Copper-Nickel Alloys Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Copper-Nickel Alloys Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on the Copper-Nickel Alloys Market

The social and commercial restrictions enforced by governments upon the onset of the COVID-19 pandemic led to a significant downfall in supply chains, including import–export operations, which impacted the prices of raw materials and hindered the operations of the shipbuilding industry. The oil & gas industry also experienced similar impacts of the pandemic as there was an unprecedented drop in the demand for crude oil in 2020, which resulted in a significant decline in its prices. According to the Bureau of Labor Statistics, in 2020, the oil demand decreased by 3 million barrels per day, which accounts for ~20% of the US’ overall oil consumption. Thus, the severe impact of the COVID-19 pandemic on the maritime and oil & gas industries adversely impacted the demand for copper-nickel alloys. Moreover, due to the shutdown of manufacturing units, the production of copper-nickel alloys was suspended, which hampered the profitability of small and large-scale manufacturers.

In 2021, governments of various countries announced relaxations in the previously imposed restrictions and permitted manufacturers to operate at full capacity. As a result, the manufacturers of copper-nickel alloys revised their strategies for ramping up their production, which is expected to overcome the production shortfall and demand–supply gap. This factor is expected to boost the global copper-nickel alloys market during the forecast period.

Market Insights

Surge in Adoption of Copper-Nickel Alloys in Renewable Energy Projects to Introduce New Growth Trends in Copper-Nickel Alloys Market

Governments of various countries are encouraging people to use renewable energy sources to reduce the overall environmental impact. Turbines, paddles, heat exchangers (in concentrated solar power CSP systems) wind energy turbines, and many components used in renewable energy generation are made of copper-nickel alloys. According to the International Energy Agency (IEA), the use of renewable energy increased by 3% globally in 2020. The share of global power generation through renewable energy sources reached 29% in 2020 from 27% in 2019. The US, the European Union (EU), China, and India, among other countries, are taking various initiatives to drive investments in the production of clean energy for environment conservation and sustainable economic development. For instance, in March 2022, the European Union devised the “REPowerEU Plan” to produce clean energy and save energy to avoid dependency on Russian fossil fuel sources. The RePowerEU Plan aims to achieve a total renewable energy output of 1,236 Giga Watt by 2030. The European Commission stated that the implementation of REPowerEU plan, during 2022–2027, would require an additional investment of US$ 208.91 billion, which it expects to source from the EU member states and private sectors. Such government initiatives in different countries are expected to boost the renewable energy sector in the future, in turn, bolstering the growth of the copper-nickel alloys market.

Product Type Insights

Based on product type, the global copper-nickel alloys market has been segmented into rods & bars, wires, tubes, and others. The rods and bars segment held the largest market share in the market in 2021. Copper-nickel round bars are used in power steering, brake lines, distiller tubes, condenser plates, and pressure vessels owing to their unique properties such as macrofouling resistance, good tensile strength, and corrosion resistance. Moreover, copper-nickel rods with 10% and 30% nickel are commonly employed in condensers, distillers, evaporators, heat exchanger tubes, machined and forged valves, and pump parts used for seawater services.

Corrotherm International Ltd, Fisk Alloy Inc, Lebronze Alloys SAS, Materion Corp, Aesteiron Steels LLP, Columbia Metals Ltd, American Elements Inc, Hexion Steel Ltd, Aviva Metals Inc, and Kalikund Steel and Engg Co are among the major players operating in the global copper-nickel alloys market. Companies in this market continuously focus on strategies such as investments in research and development activities and the launch of new products.

Copper-Nickel Alloys Market Regional Insights

Copper-Nickel Alloys Market Regional Insights

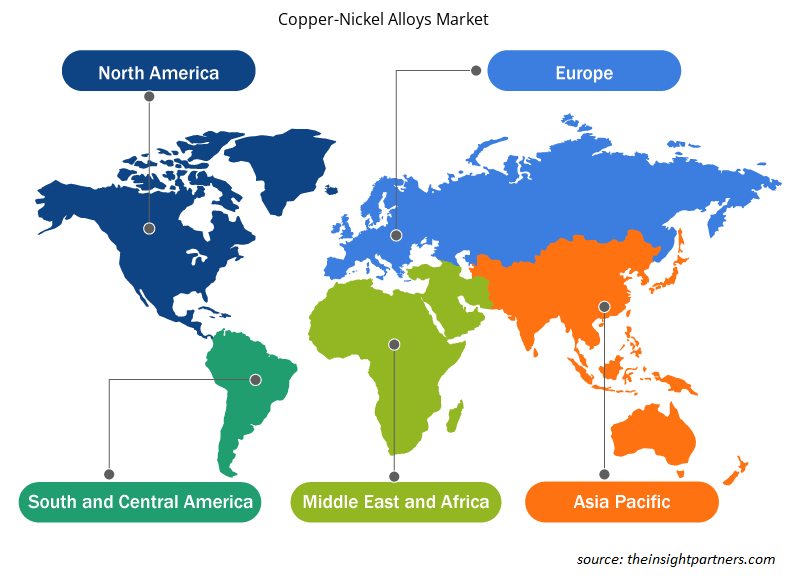

The regional trends and factors influencing the Copper-Nickel Alloys Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Copper-Nickel Alloys Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Copper-Nickel Alloys Market

Copper-Nickel Alloys Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4.28 Billion |

| Market Size by 2028 | US$ 5.99 Billion |

| Global CAGR (2022 - 2028) | 5.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Copper-Nickel Alloys Market Players Density: Understanding Its Impact on Business Dynamics

The Copper-Nickel Alloys Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Copper-Nickel Alloys Market are:

- Corrotherm International Ltd.

- Fisk Alloy Inc.

- Lebronze Alloys SAS

- Materion Corp.

- Aesteiron Steels LLP

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Copper-Nickel Alloys Market top key players overview

Report Spotlights

- Progressive industry trends in the copper-nickel alloys market to help players develop effective long-term strategies

- Business growth strategies adopted by companies to proliferate in developed and developing markets

- Quantitative analysis of the copper-nickel alloys market from 2020 to 2028

- Estimation of global demand for copper-nickel alloys

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook, and drivers and restraints in the copper-nickel alloys market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest

- Size of the copper-nickel alloys market size at various nodes

- Detailed overview and segmentation of the market, as well as the copper-nickel alloys industry dynamics

- Size of the copper-nickel alloys market in various regions with promising growth opportunities

Company Profiles

- Corrotherm International Ltd

- Fisk Alloy Inc

- Lebronze Alloys SAS

- Materion Corp

- Aesteiron Steels LLP

- Columbia Metals Ltd

- American Elements Inc

- Hexion Steel Ltd

- Aviva Metals Inc

- Kalikund Steel and Engg Co

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Based on the application, marine segment is projected to register the highest CAGR over the forecast period. In recent years, the use of copper-nickel tubes has been extended to hydraulic and instrumentation systems, which have become increasingly important in the operations of ship and offshore platform control and monitoring systems. The copper-nickel alloys offer excellent resistance to saltwater corrosion, ensuring a highly reliable system.

Widespread applications of copper-nickel alloys is driving the copper-nickel alloys market growth. Copper-nickel alloys are used in various industries, including shipbuilding, oil & gas, aerospace, automotive, paper & pulp, and food & beverages. In the marine industry, the alloys are used to fabricate components and pipe fittings for ships and seagoing vessels. As copper-nickel alloys withstand high corrosion rates, they are extensively used as sheathing on oil and gas platforms. Moreover, the alloys are used in floating production storage and offloading (FPSO) vessels in the offshore oil & gas industry.

Asia Pacific accounted for the largest share of the global copper-nickel alloys market. The continued economic growth and urbanization of the region require developing reliable and affordable energy systems with significant additional electricity-generating capacity. According to the International Energy Agency, the installed electricity-generating capacity of the region is expected to rise by approximately 7% per annum, from 3,386 GW in 2019 to 6,113 GW by 2030. In addition, the amount of investment in renewable energy production across the region is expected to reach US$ 1.3 trillion per annum by 2030.

Based on product type, rods & bars segments mainly have the largest revenue share. Copper-nickel bars are an alloy of copper, nickel, and other strengthening elements such as manganese and iron. Copper-nickel round bars are used in power steering, brake lines, distiller tubes, condenser plates, and pressure vessels. Owing to their unique properties such as resistance to macro fouling, good tensile strength, and corrosion resistance, the round bars are specified for shipbuilding and repair, desalination plants, offshore oil and gas structures, power generation, and other marine engineering applications. Further, copper-nickel rods with 10% and 30% nickel are commonly employed for condensers, distillers, evaporators, heat exchanger tubes, machined and forged valves, and pump parts used for seawater services. The rods are highly corrosion-resistant to salt water, which is helpful for heat exchangers and condensers in seawater systems.

The major players operating in the global copper-nickel alloys market are Corrotherm International Ltd.; Fisk Alloy Inc.; Lebronze Alloys SAS; Materion Corp.; Aesteiron Steels LLP; Columbia Metals Ltd.; American Elements Inc.; Hexican Steel Ltd.; Aviva Metals Inc.; Kalikund Steel and Engg. Co.

Presence of large-desalination plants in the Middle East and Africa is anticipated to offer lucrative growth opportunities for the copper-nickel alloys market. Copper-nickel alloys have excellent corrosion resistance. Copper-nickel alloys are widely used in multi-stage flash distillation (MSF) and multiple-effect distillation (MED) desalination plants to provide high corrosion resistance to heat exchangers and other components, including tubeplate, water boxes, pipe fittings, and evaporator shells. When seawater is fed to the desalination system, it causes corrosion of metal components, which can reduce the lifespan of the total system. Therefore, copper-nickel alloys are used in desalination systems. Thus, the presence of a large number of desalination plants in the Middle East & Africa is expected to create huge demand for copper-nickel alloys, which would provide lucrative opportunities for the market during the forecast period.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Copper-Nickel Alloys Market

- Corrotherm International Ltd.

- Fisk Alloy Inc.

- Lebronze Alloys SAS

- Materion Corp.

- Aesteiron Steels LLP

- Columbia Metals Ltd.

- American Elements Inc.

- Hexican Steel Ltd.

- Aviva Metals Inc.

- Kalikund Steel and Engg Co.

Get Free Sample For

Get Free Sample For