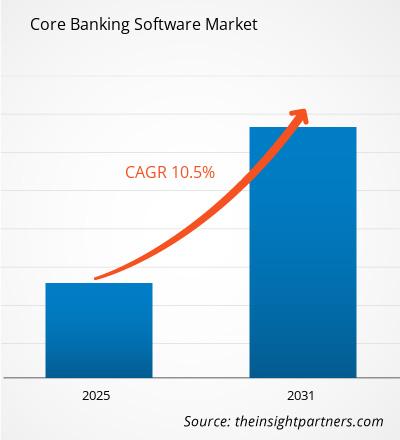

The core banking software market size is expected to grow at a CAGR of 10.5% from 2025 to 2031. The core banking software market includes growth prospects owing to the current core banking software market trends and their foreseeable impact during the forecast period. The core banking software market is growing due to digitization in the banking industry, the rise in the adoption of cloud-based solutions, and improved customer relationships.

Core Banking Software Market Analysis

Core banking software is the central system used by banks to manage their most fundamental operations, like deposits, loans, and transactions. Its benefits include streamlining operations, enhancing customer service, improving efficiency, and ensuring regulatory compliance. Banks use core banking software to handle everyday banking tasks, such as opening accounts, transaction processing, and managing customer information. It helps banks operate smoothly and provide better services to customers.

Core Banking Software Market Industry Overview

- The core banking software market is all about the technology that banks use to manage their essential operations.

- This includes handling deposits, loans, and transactions. Almost every bank needs this core banking software to run smoothly.

- The core banking software market is highly competitive, with different companies offering their solutions. The goal is to provide banks with software that helps them serve their customers better and operate more efficiently.

Core Banking Software Market Driver

Digitization in The Banking Industry To Drive The Core Banking Software Market

- Digitization in the banking industry, like online banking and mobile apps, is pushing the growth of the core banking software market. As more people choose to do their banking online, banks need better technology to handle the increased demand.

- Core banking software allows banks to manage digital transactions, open accounts online, and offer services through mobile apps. This shift towards digital banking is driving banks to invest in advanced core banking software solutions to keep up with customer expectations and stay competitive in the market.

- Moreover, digitization enables banks to streamline operations, reduce costs, and improve efficiency. Core banking software automates many processes, such as transaction processing and customer service, leading to faster and more accurate service delivery. Additionally, digital banking provides customers with greater convenience and accessibility, allowing them to manage their finances anytime, anywhere. This increased convenience and efficiency ultimately lead to higher customer satisfaction and loyalty, further driving the growth of the core banking software market.

Core Banking Software Market Report Segmentation Analysis

- Based on component, the core banking software market is segmented into software and services. The software segment is expected to hold a substantial core banking software market share in 2023.

Core Banking Software Market Share Analysis By Geography

The scope of the core banking software market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant core banking software market share. With the advancement of technology and the increasing demand for digital banking services, banks in North America are investing heavily in upgrading their core banking systems. Moreover, North American banks are focusing on enhancing customer experience, improving operational efficiency, and ensuring regulatory compliance through the implementation of robust core banking software. This has led to a growing demand for innovative solutions that can integrate seamlessly with existing banking infrastructure while providing scalability and flexibility to meet future requirements. Additionally, the presence of major players in the core banking software market, coupled with the strong financial sector in North America, further contributes to the growth of the market in North America.

Core Banking Software Market Report Scope

The "Core Banking Software Market Analysis" was carried out based on component, deployment, end-use, and geography. On the basis of component, the market is segmented into software and services. On the basis of deployment, the market is segmented into cloud and on-premise. On the basis of end-use, the market is segmented into banks, financial institutions, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Core Banking Software Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the core banking software market. A few recent key market developments are listed below:

- In January 2024, Temenos and Deloitte today announced a partnership agreement to provide technology solutions to help US financial institutions accelerate core banking and payments modernization in the cloud. Through this agreement, Temenos and Deloitte Consulting LLP aim to help financial institutions deliver modern digital experiences faster and at lower cost and take advantage of new business models and market opportunities such as Instant Payments and Banking-as-a-Service (BaaS).

[Source: Temenos, Press Release]

- In October 2023, Sopra Banking Software (SBS) announced the launch of a next-generation, modular, real-time, fully cloud-native core banking platform. The SBP Core Platform is offered as a Software-as-a-Service (SaaS) solution. It comes with a completely pre-configured Model Bank, allowing customers to adopt the solution very quickly and benefit from significantly lower TCO (Total Cost of Ownership).

[Source: Sopra Banking Software, Press Release]

Core Banking Software Market Report Coverage & Deliverables

The core banking software market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Core Banking Software Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

Core Banking Software Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 10.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Digital Language Learning Market

- Greens Powder Market

- Electronic Data Interchange Market

- Excimer & Femtosecond Ophthalmic Lasers Market

- Dairy Flavors Market

- Drain Cleaning Equipment Market

- 3D Mapping and Modelling Market

- Batter and Breader Premixes Market

- Educational Furniture Market

- Small Satellite Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Get Free Sample For

Get Free Sample For