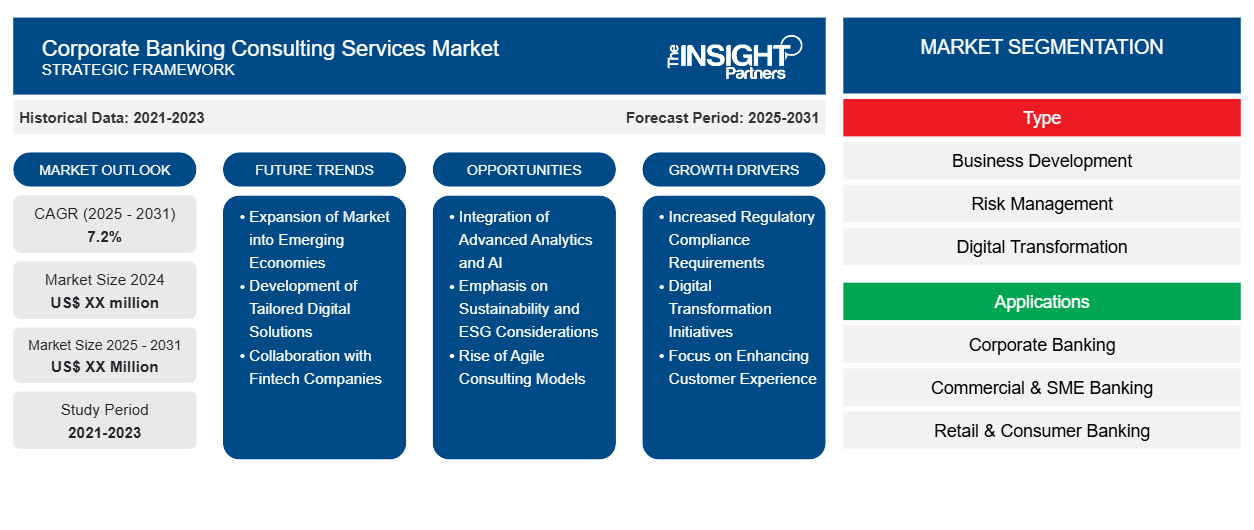

The Corporate Banking Consulting Services Market is expected to register a CAGR of 7.2% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Type (Business Development, Risk Management, Digital Transformation, and Training). The report further presents analysis based on the Applications (Corporate Banking, Commercial & SME Banking, and Retail & Consumer Banking). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Corporate Banking Consulting Services Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Corporate Banking Consulting Services Market Segmentation

Type

- Business Development

- Risk Management

- Digital Transformation

- Training

Applications

- Corporate Banking

- Commercial & SME Banking

- Retail & Consumer Banking

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Corporate Banking Consulting Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Corporate Banking Consulting Services Market Growth Drivers

- Increased Regulatory Compliance Requirements: The corporate banking sector is facing a growing array of regulatory requirements, which mandates that banks comply with stringent guidelines. This regulatory landscape creates a significant demand for consulting services that can help financial institutions navigate complex compliance frameworks. Consulting firms provide expertise in risk management, regulatory reporting, and governance structures, enabling banks to not only meet compliance requirements but also enhance their operational efficiency. The need for specialized knowledge in this area is a strong driver for corporate banking consulting services.

- Digital Transformation Initiatives: The rapid pace of digital transformation in the banking industry is a critical driver for consulting services. As banks seek to innovate and improve customer experiences, they are increasingly investing in technology solutions such as fintech partnerships, cloud computing, and data analytics. Consulting firms play a vital role in guiding these transformation initiatives, offering insights into best practices, technology selection, and implementation strategies. This necessity for digital expertise is propelling the demand for consulting services in the corporate banking sector.

- Focus on Enhancing Customer Experience: With the rise of competition from fintech firms and changing customer expectations, corporate banks are prioritizing the enhancement of customer experience. Consulting services are essential in this regard, as they help banks identify and implement strategies to improve customer engagement, streamline processes, and tailor products to meet client needs. By leveraging data-driven insights and customer feedback, consulting firms assist banks in creating a more personalized and responsive banking experience, driving demand for their services.

Corporate Banking Consulting Services Market Future Trends

- Expansion of Market into Emerging Economies: As corporate banks expand their operations into emerging markets, there is a significant opportunity for consulting firms to offer their expertise in navigating these complex environments. Emerging markets present unique challenges regarding regulatory compliance, market entry strategies, and cultural differences. Consulting services can provide valuable insights into local market dynamics, helping banks establish a successful presence while mitigating risks. This expansion into new territories represents a growth opportunity for consulting firms focused on corporate banking.

- Development of Tailored Digital Solutions: The increasing demand for customized digital solutions presents an opportunity for consulting firms to develop specialized services for corporate banks. By understanding the unique needs of different banking segments, consulting firms can design tailored digital transformation strategies that enhance operational efficiency and customer engagement. This includes creating bespoke technology solutions, developing digital platforms, and advising on fintech collaborations. The focus on personalized digital experiences opens up a new avenue for growth within the consulting services market.

- Collaboration with Fintech Companies: The rise of fintech companies offers a unique opportunity for corporate banking consulting services to forge strategic partnerships. Fintech firms often bring innovative solutions that can enhance traditional banking operations, and consulting firms can act as intermediaries to facilitate these collaborations. By helping banks integrate fintech solutions into their services, consulting firms can drive innovation and improve the overall customer experience. This synergy between traditional banks and fintech presents a significant growth opportunity for consulting services in the corporate banking sector.

Corporate Banking Consulting Services Market Opportunities

- Integration of Advanced Analytics and AI: A notable trend in the corporate banking consulting services market is the integration of advanced analytics and artificial intelligence (AI) into consulting solutions. Banks are increasingly leveraging data analytics to gain insights into customer behavior, risk management, and operational performance. Consulting firms are adopting AI-driven tools to enhance their service offerings, enabling banks to make data-informed decisions and optimize their processes. This trend is transforming how corporate banks operate and interact with clients, making consulting services more valuable.

- Emphasis on Sustainability and ESG Considerations: As environmental, social, and governance (ESG) concerns gain prominence, corporate banks are increasingly focused on sustainable practices. Consulting firms are responding by offering specialized services that help banks develop and implement ESG strategies, assess risk exposure related to sustainability, and comply with evolving regulations. This trend reflects a broader move toward responsible banking, and consulting services that can guide banks in aligning their operations with sustainability goals are becoming increasingly sought after.

- Rise of Agile Consulting Models: The corporate banking consulting landscape is witnessing a shift toward agile consulting models, where firms adopt flexible and adaptive approaches to meet the rapidly changing needs of banks. This trend is driven by the need for faster decision-making, iterative project development, and real-time feedback in an ever-evolving market. Consulting firms are restructuring their service delivery, enabling them to collaborate more effectively with banking clients and respond swiftly to emerging challenges and opportunities.

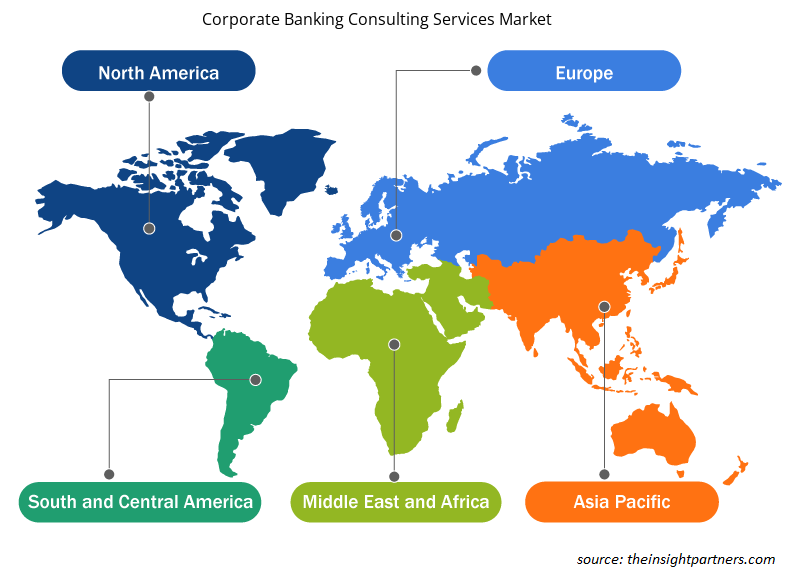

Corporate Banking Consulting Services Market Regional Insights

The regional trends and factors influencing the Corporate Banking Consulting Services Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Corporate Banking Consulting Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Corporate Banking Consulting Services Market

Corporate Banking Consulting Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 7.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

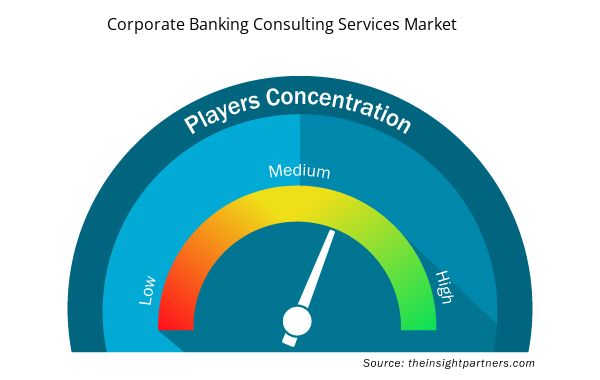

Corporate Banking Consulting Services Market Players Density: Understanding Its Impact on Business Dynamics

The Corporate Banking Consulting Services Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Corporate Banking Consulting Services Market are:

- McKinsey & Company

- Boston Consulting Group

- Emirates NBD

- Oliver Wyman

- Bain & Company

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Corporate Banking Consulting Services Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Corporate Banking Consulting Services Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Corporate Banking Consulting Services Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

Some of the customization options available based on the request are an additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The leading players operating in the Corporate Banking Consulting Services Market include McKinsey & Company, Boston Consulting Group, Emirates NBD, Oliver Wyman, Bain & Company, AlixPartners, Ally, Finastra, Deloitte, Accenture

The global Corporate Banking Consulting Services Market is expected to grow at a CAGR of 7.2% during the forecast period 2024 - 2031.

The major factors driving the Corporate Banking Consulting Services Market are: Increased Regulatory Compliance Requirements, Digital Transformation Initiatives, and Focus on Enhancing Customer Experience.

Integration of Advanced Analytics and AI, Emphasis on Sustainability and ESG Considerations, and Rise of Agile Consulting Models are the key future trends of the Corporate Banking Consulting Services Market

Get Free Sample For

Get Free Sample For