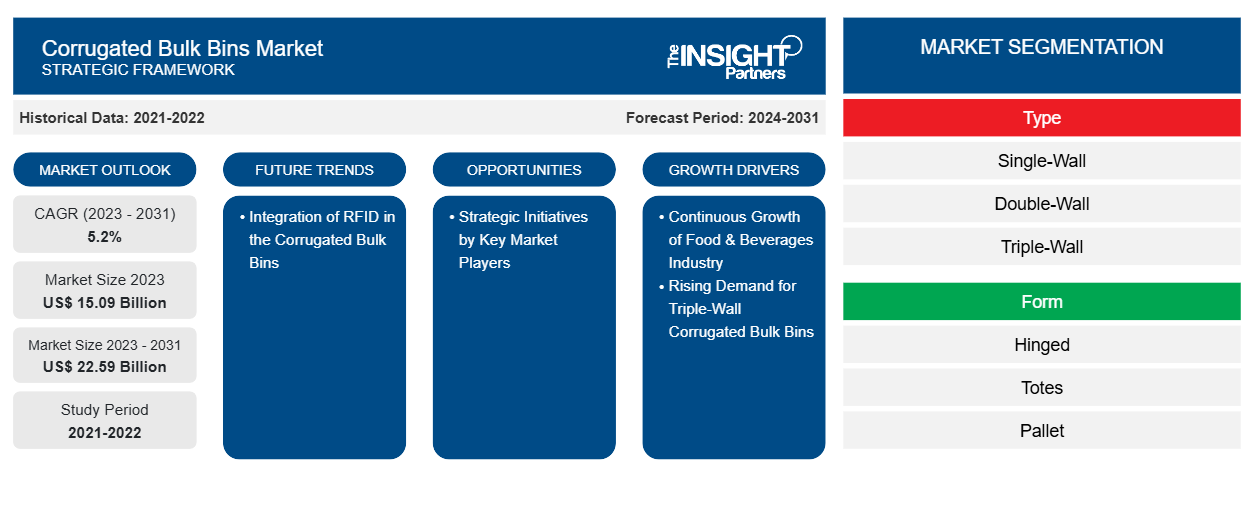

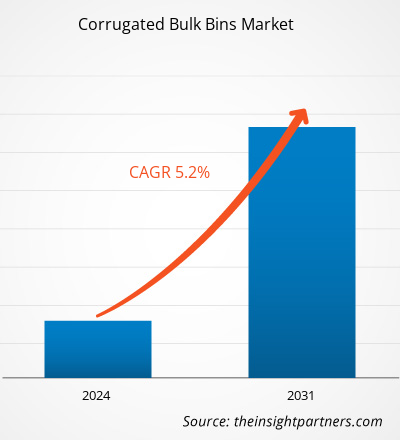

The corrugated bulk bins market is projected to grow from US$ 15.09 billion in 2023 to US$ 22.59 billion by 2031; the market is expected to register a CAGR of 5.2% from 2023 to 2031. The increasing need for durable packaging solutions with the continuously evolving packaging and supply chain management processes in various industries, and the growing demand for convenience food owing to busy lifestyles and disposable incomes are likely to remain key trends driving the growth of the corrugated bulk bins market

Corrugated Bulk Bins Market Analysis

The food & beverages industry generates a huge demand for efficient and cost-effective packaging solutions. Corrugated bulk bins are collapsible containers, which makes storage applications more efficient. The food & beverages industry often deals with large quantities of products that need to be transported and stored efficiently. Corrugated bulk bins hold a significant volume of goods, making them ideal for mass transportation and storage. These containers are made from recyclable materials, which makes them an environment-friendly option compared to containers made from plastics. As the food & beverages industry faces increasing pressure to adopt sustainable practices, the demand for recyclable storage and transportation products such as corrugated bulk bins is on the rise in this industry. Thus, the flourishing food & beverages industry drives the corrugated bulk bins market growth.

Corrugated Bulk Bins Market Overview

Corrugated bulk bins are containers whose sides are made from an outer layer, inside layer, and middle layer of a certain raw material. The middle layer of the corrugated bulk bin is fluted in wave-shaped rigid arches to provide support and cushioning for heavy products placed in the bin. These bins are widely used to store and transport bulk quantities of food products and beverages, industrial equipment, pharmaceuticals, construction and building materials, and others.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Corrugated Bulk Bins Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Corrugated Bulk Bins Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Corrugated Bulk Bins Market Drivers and Opportunities

Rising Demand for Triple-Wall Corrugated Bulk Bins Drives Market Growth

Triple-wall corrugated bulk bins are made with three layers of corrugated cardboard. As a result, they offer superior strength, durability, and protection compared to single- or double-wall bins. Moreover, with such high structural integrity, these bins can withstand heavy loads and extreme handling conditions compared to other types of corrugated bulk bins. Fast-moving consumer goods are subject to various stresses during long-distance transportation, where utilization of triple-wall bins is necessary to provide robustness to prevent damage. Triple-wall bins ensure safe and secure transportation of bulky and heavy components used or produced in the automotive and industrial sectors, reducing the risk of damage. Triple-wall corrugated bins also exhibit superior stacking strength, allowing for more efficient use of warehouse space. Thus, this type is also preferred in industries such as food & beverages, electronics, agriculture, and pharmaceuticals.

Strategic Initiatives by Key Market Players to Create Opportunities in Corrugated Bulk Bins Market

Key manufacturers operating in the corrugated bulk bins market are investing significantly in strategic development initiatives such as product innovation, R&D, mergers and acquisitions, and business expansions to enhance their market position by attracting a broad customer base. Expanding into new geographic locations allows market players to reach untapped customer bases, further increasing their market share and revenue streams. The expansion strategy also allows them to achieve economies of scale by increasing production volumes. In April 2024, Greif Inc announced the construction of a manufacturing facility in Texas, US. With this facility, Greif intends to significantly expand its corrugated bulk bins manufacturing capacity and create opportunities in the South and Southwest regions of the US and in Mexico. In February 2024, Jamestown Container Companies acquired the packaging business of Midwest Box Company Inc in the US. In 2023, Smurfit Kappa opened an integrated corrugated plant in Rabat, Morocco, with an investment of US$ 37.5 million. This manufacturing facility signifies its geographic expansion and efforts to boost customer support in North Africa.

Corrugated Bulk Bins Market Report Segmentation Analysis

Key segments that contributed to the derivation of the corrugated bulk bins market analysis are type, form, and application.

- The corrugated bulk bins market, based on type, is segmented into single-wall, double-wall, and triple-wall. The triple-wall segment held the largest market share in 2023.

- By form, the market is segmented into hinged, totes, pallet, and others. The pallet segment accounted for the largest share of the corrugated bulk bins market in 2023.

- In terms of application, the corrugated bulk bins market is segmented into food and beverage, industrial equipment and parts, construction, electrical and electronics, chemicals, pharmaceuticals, and others. The food and beverage segment led the market in 2023 with the largest revenue share.

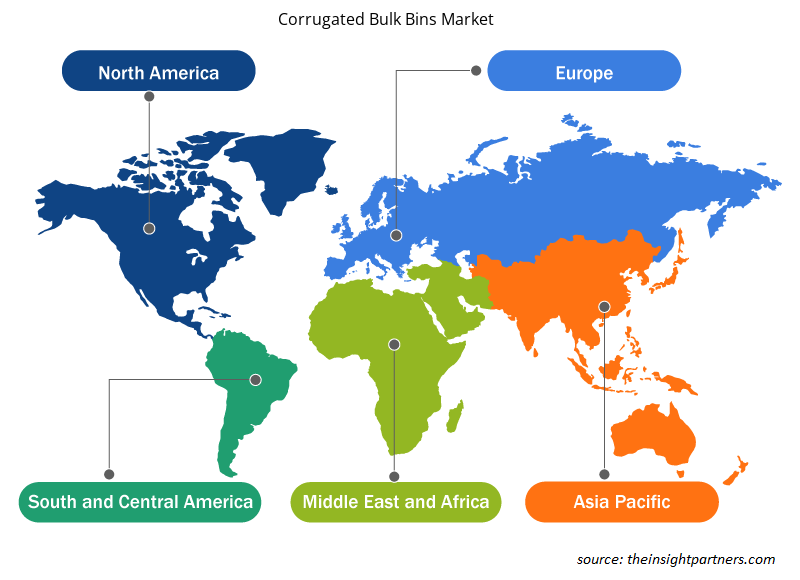

Corrugated Bulk Bins Market Share Analysis by Geography

In terms of geography, the corrugated bulk bins market is primarily segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. Asia Pacific held the largest market share in 2023 and is expected to register the highest CAGR during the forecast period. Market growth in the region is attributed to the increased demand for these bins from the food & beverages industry. The region is the largest producer and exporter of rice and grain crops. According to the US Department of Agriculture, the US imports vast volumes of rice from Asian countries. For instance, in 2023, Australia exported 38,600 tons of short-grain and medium-grain milled rice to the US. With the growing food & beverages industry in Asia Pacific, the demand for corrugated bulk bins is also growing for packaging purposes.

Corrugated Bulk Bins Market Regional Insights

The regional trends and factors influencing the Corrugated Bulk Bins Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Corrugated Bulk Bins Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Corrugated Bulk Bins Market

Corrugated Bulk Bins Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 15.09 Billion |

| Market Size by 2031 | US$ 22.59 Billion |

| Global CAGR (2023 - 2031) | 5.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

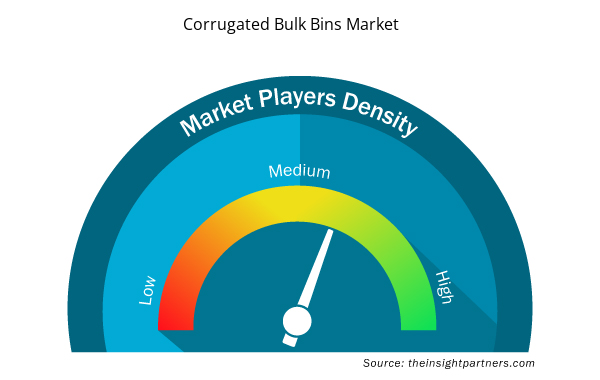

Corrugated Bulk Bins Market Players Density: Understanding Its Impact on Business Dynamics

The Corrugated Bulk Bins Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Corrugated Bulk Bins Market are:

- DS Smith Plc

- WestRock Co

- Smurfit Kappa Group Plc

- Mondi plc

- Packaging Corp of America

- Monte Package Company LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Corrugated Bulk Bins Market top key players overview

Corrugated Bulk Bins Market News and Recent Developments

The corrugated bulk bins market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- Cartocor SA introduced the bliss format, which is an eco-friendly solution for the packaging of milk and yogurt sachets. This container is designed to contain 18 sachets, meeting the demand for closed containers and generating significant savings in logistics and materials. (Source: Cartocor, Press Release, September 2023)

- Greif Inc. is in the process of finalizing the construction of its new bulk corrugated manufacturing facility in Dallas, Texas. The new facility will significantly expand Greif’s capacity in the bulk corrugated business and create opportunities in the South and Southwest regions of the US, as well as in Mexico. (Source: Greif, Press Release, April 2024)

Corrugated Bulk Bins Market Report Coverage and Deliverables

The “Corrugated Bulk Bins Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Corrugated bulk bins market size and forecast for all the key market segments covered under the scope

- Corrugated bulk bins market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter’s Five Forces and SWOT analysis

- Corrugated bulk bins market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the corrugated bulk bins market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Playout Solutions Market

- Small Internal Combustion Engine Market

- Social Employee Recognition System Market

- Smart Parking Market

- Fish Protein Hydrolysate Market

- Precast Concrete Market

- Procedure Trays Market

- GNSS Chip Market

- Vessel Monitoring System Market

- Emergency Department Information System (EDIS) Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The continuous growth of the food & beverages industry and rising demand for triple-wall corrugated bulk bins fuel the market growth.

The integration of RFID in corrugated bulk bins is expected to emerge as a future trend in the market.

DS Smith Plc, WestRock Co, Smurfit Kappa Group Plc, Mondi plc, Packaging Corp of America, Monte Package Company LLC, Atlantic Packaging Products Ltd., Greif Inc, Georgia-Pacific LLC, Elsons International, Cartocor SA, Hobbs Container Co, Indevco Paper Containers, International Paper Co, Napco National, Reusable Transport Packaging, The Cary Company, and Tri-Wall Limited are among the leading market players.

The market is expected to register a CAGR of 5.2% during 2023–2031.

The pallet segment held the largest share in the global corrugated bulk bins market in 2023.

The triple-walled segment held the largest share in the global corrugated bulk bins market in 2023.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Corrugated Bulk Bins Market

- DS Smith Plc

- WestRock Co

- Smurfit Kappa Group Plc

- Mondi plc

- Packaging Corp of America

- Monte Package Company LLC

- Atlantic Packaging Products Ltd.

- Greif Inc

- Georgia-Pacific LLC

- Elsons International

Get Free Sample For

Get Free Sample For