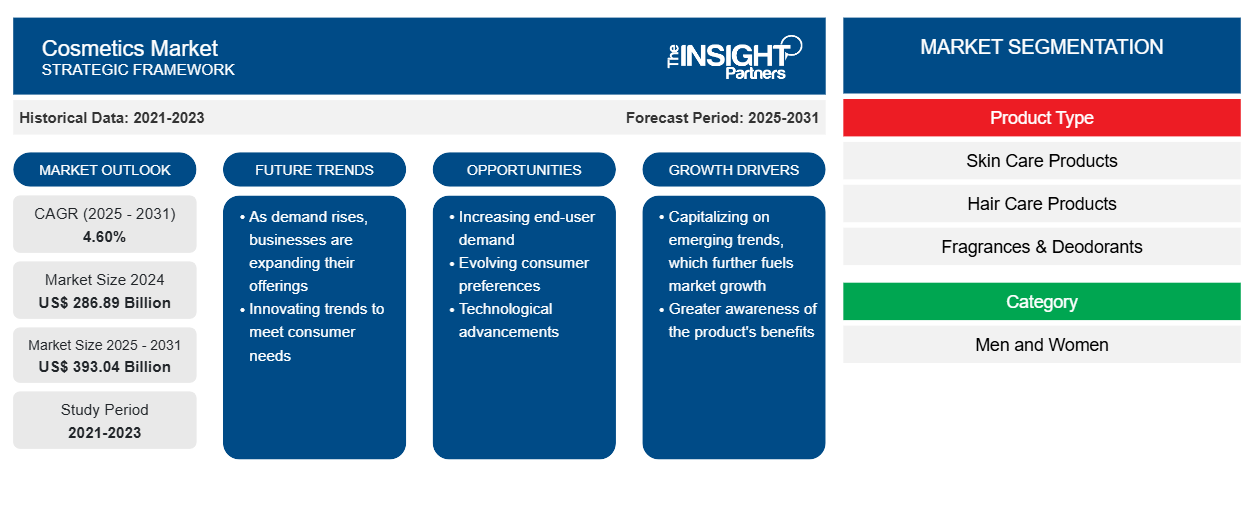

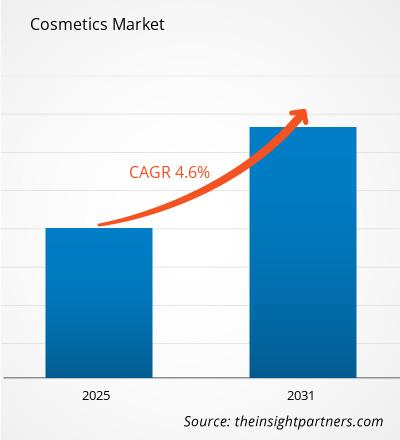

[Research Report] The Cosmetics market is expected to grow from US$ 262,210 million in 2022 to US$ 367,687 million by 2031; it is expected to record a CAGR of 4.6% from 2022 to 2031.

Market Insights and Analyst View:

Cosmetics are formulated to improve beauty and enhance physical appearance. They encompass various types, such as haircare, skincare, care, and color cosmetics. Traditionally, cosmetic products have been manufactured by using artificial ingredients. However, due to the growing consumer preference for natural and organic sources, manufacturers increasingly incorporate natural ingredients into cosmetics production to promote a more desirable aesthetic. Additionally, it is anticipated that the rising desire for natural and organic cosmetics products will also increase the demand for cosmetics and is expected to drive the cosmetics market growth.

Growth Drivers and Challenges:

In recent times, hair and skin care awareness has increased significantly among consumers across the globe. Consumers are seeking products that help them look youthful. Due to increased disposable income, consumers are willing to spend a tremendous amount on skincare and haircare products that make their skin appear healthy and radiant. People also spend extensively on cosmetics and personal care products as they are conscious about their appearance in social settings. Due to the increasing pressure to look good in an image-focused society, people are dedicated to researching the best products for their skin type. Per the data published in L'Oréal's 2021 annual report, the global beauty markets witnessed a growth rate of 8% in 2021. This shows the rising expenditure on personal care and beauty products globally, boosting the demand for cosmetics worldwide.

Moreover, the increasing adoption of organic ingredients in cosmetics boosts the demand for organic, natural, and clean-label cosmetics as consumers become more aware of the adverse effects of synthetic and chemical ingredients used in product formulation. Thus, consumer preference for organic cosmetics over chemically infused products is associated with growing knowledge about these products and their beneficial effects on the skin, which is further fuelling the cosmetics market expansion.

People increasingly prefer online retail platforms for purchasing cosmetics such as moisturizers, creams and lotions, cleansers, makeup products, fragrances, etc. Consumers across the globe are becoming confident about purchasing these products online, moving from the traditional try-and-buy purchasing model to a buy-and-try model. Moreover, online sales of cosmetics and personal care products grew significantly during the COVID-19 outbreak due to the closure of brick-and-mortar stores and the government's imposition of social restrictions. As lockdowns constrained people's movement and people were compelled to work from their homes, there was a substantial shift to online shopping. Thus, growing online shopping preferences are expected to drive the cosmetics market growth across the globe.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cosmetics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cosmetics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Global Cosmetics Market" is segmented based on product type, category, distribution channel, and geography. Based on product type, the cosmetics market is segmented into skincare products, hair care products, fragrances & deodorants, makeup and color cosmetics, and others. based on category, the market is bifurcated into men and women. In terms of distribution channels, the market is classified into supermarkets and hypermarkets, specialty stores, online retail, and others. The cosmetics market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis:

The cosmetics market is segmented based on product type into skin care products, hair care products, fragrances & deodorants, makeup and color cosmetics, and others. The skincare segment holds a significant market share and is projected to register a significant CAGR in the cosmetics market during the forecast period. Consumers are using skincare products earlier as they become more aware of skin issues and treatments, helping the cosmetics market grow. The rising skin diseases among both men and women population and growing awareness about anti-aging are expected to fuel the demand for skin care products. Moreover, an increasing number of women are opting for anti-aging products like L'Oreal Revitalift, Avon Anew Sensitive+, Caudalie Premier Cru anti-aging cream moisturizer with hyaluronic acid, and many more, which make up a significant sector of the skincare products. These factors are expected to drive the segment's share in the forecast period.

Moreover, the hair care segment also holds a significant share of the cosmetics market. Dry and itchy scalp, dandruff, hair loss, and damaged hair are some of the primary concerns that trigger any individual. According to the report of the American Academy of Dermatology, approximately 30 million women in the US suffer from hereditary hair loss problems and increasingly spend on hair care products. Furthermore, the rising demand for natural/organic products for personal grooming purposes has become one of the major concerns for individuals. Thus, manufacturers are launching hair care products infused with organic ingredients. For instance, in May 2021, AVA Group's flagship brand, Medimix, launched a shampoo with natural ingredients, Total Care Shampoo, as part of its reputable line of beauty products. These factors are expected to boost the demand for hair care products and are anticipated to propel the cosmetics market size.

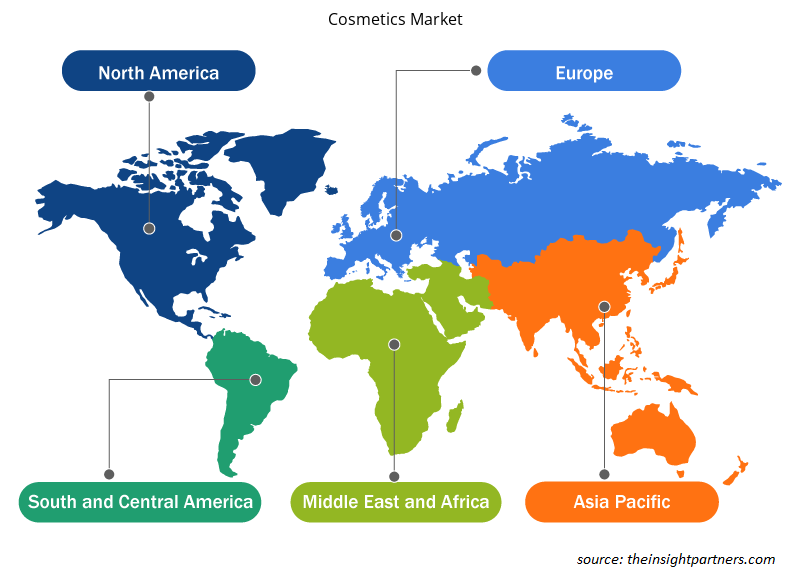

Regional Analysis:

Based on geography, the cosmetics market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. The cosmetics market in North America is significantly growing with the thriving personal care & cosmetic industry. Further, there is a growing trend of using natural, vegan, and organic cosmetic products amongst consumers in the region due to a growing preference for chemical-free products, which tends to increase the sales of natural and organic cosmetics. Increasing cases of graying hair and early aging among the youth population due to lack of nutrition increases the sales of hair care and skin care products. The Estee Lauder Companies Inc., L'Oréal S.A., and Johnson & Johnson Services Inc. are some of the well-established players in cosmetic products in North America. These factors are expected to generate lucrative opportunities for the cosmetics market growth in the region.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the cosmetics market are listed below:

1. In December 2019, L'Oréal S.A. signed an agreement to acquire 'Youth to the People,' a California-based skincare company. Youth to the People develops and sells high-performance skincare products comprising premium vegan superfood extracts and science blends.

2. In January 2022, Galderma, the well-established dermatology company, completed the acquisition of Alastin Skincare Inc., a specialty aesthetics company dedicated to developing innovative skincare products that are clinically tested physician-dispensed.

3. in June 2022, Biologi, an Australian clean cosmeceutical business, unveiled an anti-pollution serum with a wild-harvested extract containing vitamin C, niacinamide, and salicylic acid.

4. In September 2021, Symerise Cosmetic Ingredients partnered strategically with Kobo to expand the cosmetic business.

5. Beiersdorf AG's NX NIVEA Accelerator expanded its presence in China and selected the top five startups for a new program in Shanghai in July 2021. The brand signed a partnership agreement with China's leading e-commerce platform, Tmall, and is focusing on collaborating with beauty startups from the areas of indie brands, beauty technology, personalization, and platform business models with a high degree of digitalization.

6. In June 2022, Absolutely Ayur launched a hair color shampoo. The brand claims that the shampoo would make hair coloring easier as it takes less than 10 minutes to color it.

7. In March 2021, Colorbar launches a customizable makeup palette which includes 12 custom-designed cases and a selection of eyeshadow, highlighters, and blushers. The company aims to increase profitability and provide more options for consumers.

COVID-19 Impact:

The COVID-19 pandemic affected almost all industries in various countries. Lockdowns, business closures, and travel restrictions in North America (NA), Europe (EU), Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) restrict the growth of several industries, including the personal care and cosmetic industries. The shutdown of production units negatively impacted the global supply chains, delivery schedules, manufacturing activities, and nonessential and essential product sales. In 2021, various manufacturing companies witnessed delays in deliveries and a slump in sales of end products.

Moreover, bans imposed by governments of various European countries, Asia Pacific, and North America on international travel compelled companies to temporarily discontinue their partnership and collaboration plans. All these factors impede various industries in 2021 and early 2021, thereby hampering the growth of cosmetics market growth. However, by the end of 2021, many countries were fully vaccinated, and governments announced relaxations in certain regulations, including lockdowns and travel bans. The relaxation of trade restrictions aided in import and export operations, positively impacting the cosmetics market growth.

Competitive Landscape and Key Companies:

A few of the prominent players operating in the global cosmetics market include L'Oréal Paris, Procter & Gamble, Unilever, SHISEIDO PROFESSIONAL INC, LVMH, AMOREPACIFIC US, INC, Beiersdorf, Estée Lauder Inc., Kao Corporation, Revlon among others. These market players are adopting strategic development initiatives to expand, further driving the cosmetics market growth. Report Scope

Cosmetics Market Regional Insights

The regional trends and factors influencing the Cosmetics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Cosmetics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Cosmetics Market

Cosmetics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 286.89 Billion |

| Market Size by 2031 | US$ 393.04 Billion |

| Global CAGR (2025 - 2031) | 4.60% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

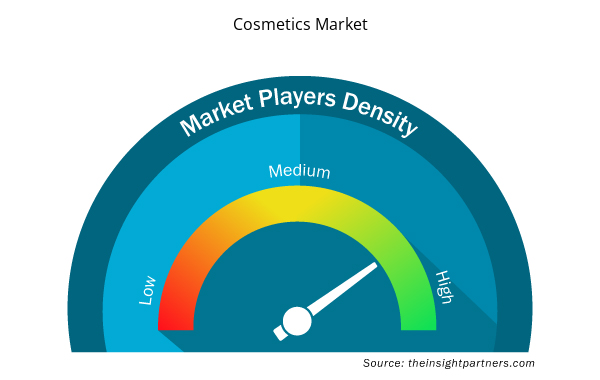

Cosmetics Market Players Density: Understanding Its Impact on Business Dynamics

The Cosmetics Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Cosmetics Market are:

- L'Oréal Paris

- Procter & Gamble

- Unilever

- SHISEIDO PROFESSIONAL INC

- LVMH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Cosmetics Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Emergency Department Information System (EDIS) Market

- Dropshipping Market

- Lymphedema Treatment Market

- Architecture Software Market

- Enteral Nutrition Market

- Underwater Connector Market

- Hair Wig Market

- Pharmacovigilance and Drug Safety Software Market

- Sexual Wellness Market

- Embolization Devices Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Consumer Goods : READ MORE..

1.L'Oréal Paris

2.Procter & Gamble

3.Unilever

4.SHISEIDO PROFESSIONAL INC

5.LVMH

6.AMOREPACIFIC US INC

7.Beiersdorf

8.Estée Lauder Inc

9.Kao Corporation

10.Revlon

Get Free Sample For

Get Free Sample For