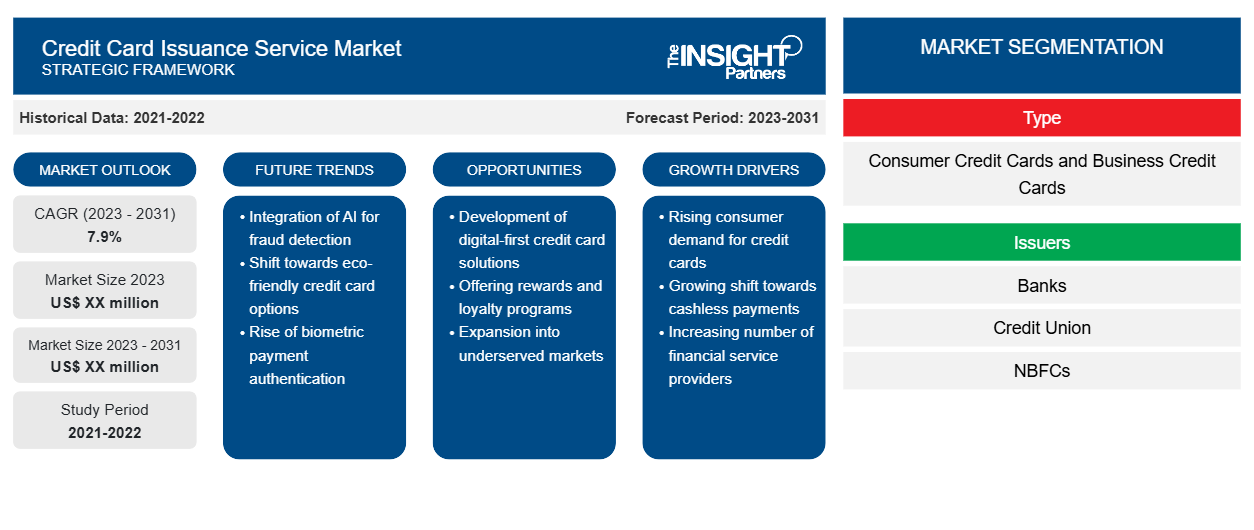

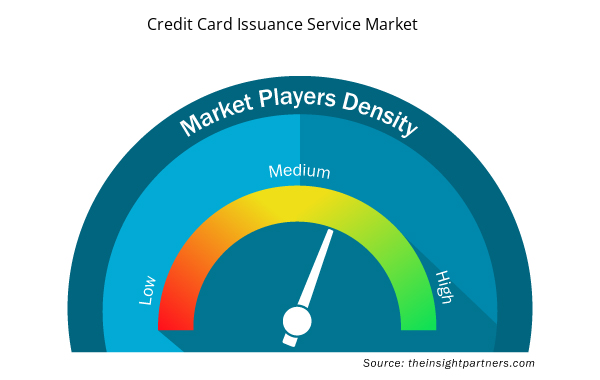

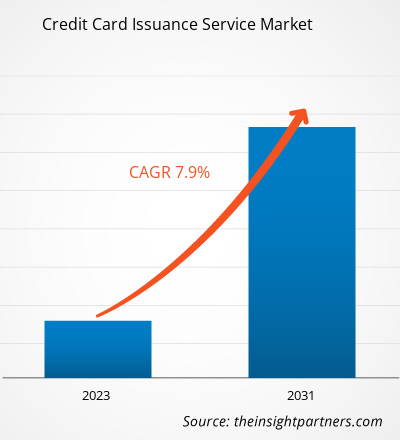

The Credit Card Issuance Service market is anticipated to expand at a CAGR of 7.9% from 2023 to 2031. Credit cards are becoming increasingly popular since they are convenient to carry and serve as a viable alternative to cash.

Credit Card Issuance Service Market Analysis

The rise in demand for credit card services in emerging countries is propelling the credit card issuing services industry forward. The credit card industry has also developed, with streamlined and online credit card applications, several types of credit cards tailored to specific needs, virtual cards with additional spending limitations, and personalized offers and rewards. In addition, contactless and digital credit card services are becoming more popular, as is the desire for cash alternatives and the availability of low-cost credit cards.

Credit Card Issuance Service Industry Overview

The credit card issuer issues a credit card to a customer when or after the credit provider approves the account, which does not have to be the same organization as the card issuer. Cardholders can then use it to make purchases at merchants that accept the card. Furthermore, a credit card is a payment card supplied to cardholders that allows them to pay a merchant for products and services based on their outstanding debt. Credit cards offer high-security features for moving funds from one account to another, increasing the demand for credit cards among users.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Credit Card Issuance Service Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Credit Card Issuance Service Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Credit Card Issuance Service Market Drivers and Opportunities

Increase in Contactless and Digital Credit Card Services to Drive the Credit Card Issuance Service Market Growth.

The biggest advantage of contactless is that it is rapid, which means no lines. Furthermore, clients often appreciate the convenience of not having to input their PIN. Contactless payments, often known as "tap and go" or "tap to pay," can be up to 10 times faster than traditional payment methods. Furthermore, many companies now provide credit card services that are linked to devices such as smartphones and give an alternate method of contactless payment utilizing the same technology as contactless credit cards. For example, Apple Pay securely keeps personal information and credit card data on an iPhone or Apple Watch, allowing consumers to touch and go to participating stores.

Credit Card Issuance Service Market Report Segmentation Analysis

- Based on type, the credit card issuance service market is segmented into consumer credit cards and business credit cards. The consumer credit cards segment is expected to hold a substantial credit card issuance service market share in 2023.

- This is due to the recent surge in the consumer credit card category, as individuals prefer credit cards for daily transactions and personal credit needs.

Credit Card Issuance Service Market Share Analysis By Geography

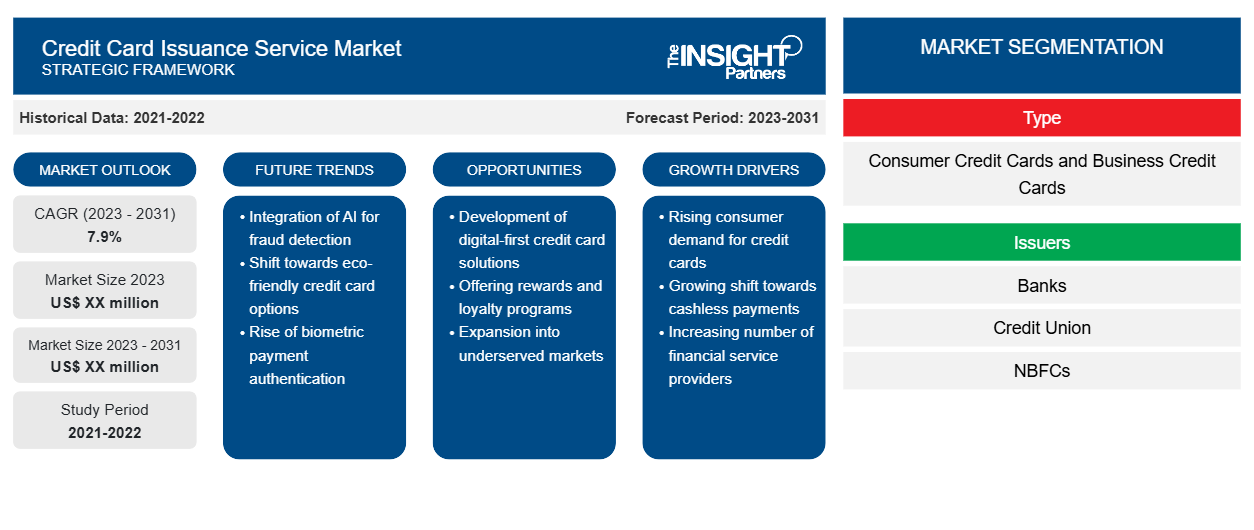

The scope of the credit card issuance service market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant credit card issuance service market share. The credit card sector is thriving in the region thanks to the presence of four main companies: Visa, MasterCard, American Express, and Discover. Furthermore, credit cards are extremely popular in the United States, with approximately 120 million individuals in debt. These factors drive market growth in the region.

Credit Card Issuance Service Market Regional Insights

Credit Card Issuance Service Market Regional Insights

The regional trends and factors influencing the Credit Card Issuance Service Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Credit Card Issuance Service Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Credit Card Issuance Service Market

Credit Card Issuance Service Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ XX million |

| Market Size by 2031 | US$ XX million |

| Global CAGR (2023 - 2031) | 7.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Credit Card Issuance Service Market Players Density: Understanding Its Impact on Business Dynamics

The Credit Card Issuance Service Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Credit Card Issuance Service Market are:

- Fiserv Inc.

- Marqeta Inc.

- Stripe Inc.

- Giesecke+Devrient GmbH

- Entrust Corporation

- GPUK LLP

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Credit Card Issuance Service Market top key players overview

The "Credit Card Issuance Service Market Analysis" was carried out based on type, issuers, end users, and geography. Based on the type, the credit card issuance service market is segmented into consumer credit cards and business credit cards. In terms of issuers, the market is segmented into banks, credit unions, and NBFCs. Based on end use, the market is segmented into personal, and business. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Credit Card Issuance Service Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the credit card issuance service market. The credit card issuance service market forecast can help stakeholders plan their growth strategies. A few recent key market developments are listed below:

- In March 2021, Mastercard Inc. purchased Nets Group's account-to-account services, including clearing, quick payment, and e-billing solutions, for roughly $3.12 billion (€2.8 billion). Mastercard's acquisition has increased its exposure to high-growth markets and e-commerce while refocusing its business model on merchant, issuer, and e-security services. Nets Group, established in Denmark, provides a full range of credit card issuing services.

[Source: Mastercard Inc., Company Website]

- In January 2020, Zuora, Inc. has teamed with SB Payment Service Corp., a Softbank Group entity. The agreement aimed to enable Japanese enterprises operating in a wide range of industries to handle credit card payments securely and conveniently on a subscription basis

[Source: Zuora, Inc., Company Website]

Credit Card Issuance Service Market Report Coverage & Deliverables

The market report on “Credit Card Issuance Service Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global credit card issuance service market is expected to grow at a CAGR of 7.9% during the forecast period 2023–2031.

The increase in contactless and digital credit card services and credit card demand continues to grow in emerging countries. and growth in e-commerce are the major factors that propel the global credit card issuance service market.

Technological advancements transforming credit card issuance services are anticipated to play a significant role in the global credit card issuance service market in the coming years.

The key players holding majority shares in the global credit card issuance service market are Fiserv Inc., Marqeta Inc., Stripe Inc., Giesecke+Devrient GmbH, and Entrust Corporation,

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Fiserv Inc.

- Marqeta Inc.

- Stripe Inc.

- Giesecke+Devrient GmbH

- Entrust Corporation

- GPUK LLP

- Nium Pte. Ltd

- fis

- Thales

- American Express Company

Get Free Sample For

Get Free Sample For