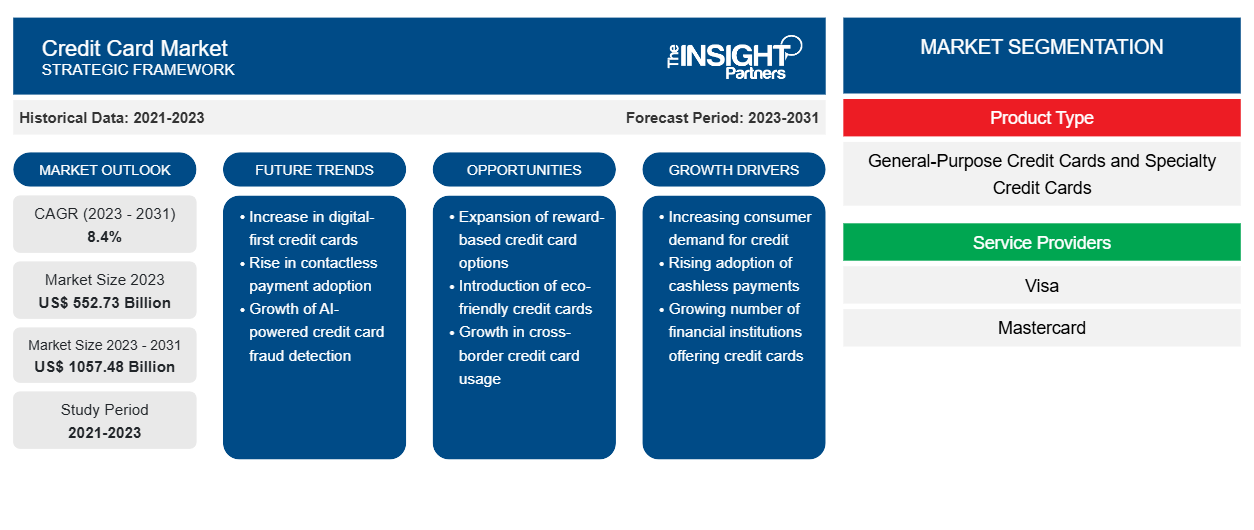

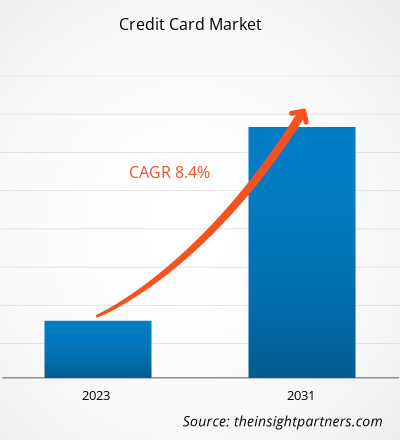

The credit card market size is expected to grow from US$ 552.73 billion in 2023 to US$ 1057.48 billion by 2031; it is anticipated to expand at a CAGR of 8.4% from 2023 to 2031. The growing demand for convenient cash alternatives is one of the major factors fueling the growth of the credit card market.

Credit Card Market Analysis

Credit cards have become more and more popular over time because of their many benefits, including better security than debit cards, quicker payment processing, the ability to make interest-free payments, and more. Additionally, the industry is expanding due to the end consumers' quick adoption of credit cards for EMI purchases and the rise in the purchase of various pricey goods. Additionally, it offers end consumers extended warranties and purchase protection, which further fuels the market's expansion. The fact that many credit cards also provide travel, rental vehicles, and return protection is fueling the expansion of the credit card market worldwide.

Credit Card Market Overview

- A credit card is a thin piece of plastic or metal card that is provided by banks or financial services companies.

- It enables cardholders to borrow money to make purchases from a variety of retailers.

- Additionally, credit cards offered by banks and other fintech companies enable customers to pay for various services using credit rather than cash at the point of sale.

- Furthermore, the card offers various benefits, one of which is that the user can also convert his purchase into EMI and pay accordingly, which further boosts the growth of the credit card market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Credit Card Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Credit Card Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Credit Card Market Driver

Rising Demand for Credit Cards To Drive the Credit Card Market Growth

- As credit card provides easy access to credit, EMI facilities, incentives, and various offers, their demand is increasing worldwide. According to the Consumer Financial Protection Bureau, at the end of 2021, around 190.6 million adults out of the 258.3 million in the US had a credit card account in their name. Also, as per CapitalOne, about 75% of US households have at least one general-use credit card.

- Not just developed countries various developing countries are also witnessing the rise in the demand for credit cards. According to the report by the Reserve Bank of India (RBI), India recorded around 25 crore credit card-based merchant payments in April 2023. In addition, the country has around 8.5 crore credit card users in 2023, which increased from 7.5 crore in 2022.

- Hence, because of all the above factors, the demand for credit cards is increasing worldwide is fueling the credit card market growth.

Credit Card Market Report Segmentation Analysis

- Based on product type, the market is segmented into general-purpose credit cards and specialty credit cards. The general-purpose credit card segment is expected to hold a substantial credit card market share in 2023.

- The general-purpose credit cards segment is also expected to hold the highest CAGR over the forecast period particularly because this card provides a large array of exclusive rewards, along with different perks to the users.

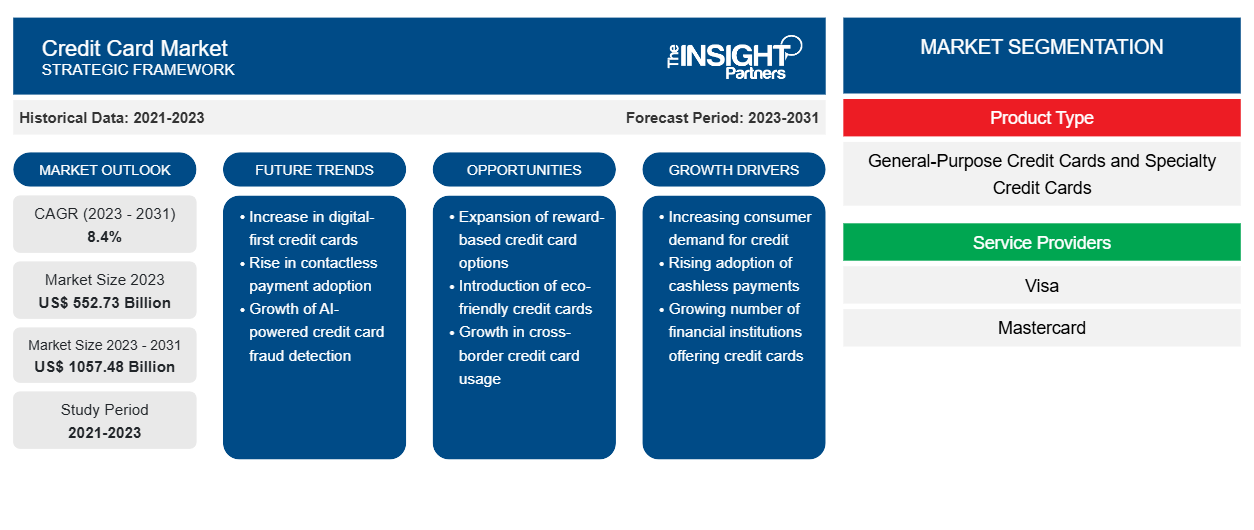

Credit Card Market Share Analysis By Geography

The scope of the credit card market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant credit card market share. The region consists of a large number of market players, including Bank of America Corporation, American Express, JPMorgan Chase & Co, and many more. Furthermore, the region is witnessing the rapid adoption of credit cards. According to the Federal Reserve Bank of Atlanta, 77% of adults in the US have at least one credit card. Also, as per the American Bankers Association, around 441 million people opened credit card accounts in the US in Q3 2022. Thus, all the above factors are fueling the growth of the market in the region.

Credit Card Market Regional Insights

The regional trends and factors influencing the Credit Card Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Credit Card Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Credit Card Market

Credit Card Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 552.73 Billion |

| Market Size by 2031 | US$ 1057.48 Billion |

| Global CAGR (2023 - 2031) | 8.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Credit Card Market Players Density: Understanding Its Impact on Business Dynamics

The Credit Card Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Credit Card Market are:

- Bank of America Corporation

- American Express, Citigroup Inc.

- Barclays

- HSBC

- Capital One

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Credit Card Market top key players overview

The "Credit Card Market Analysis" was carried out based on product type, service providers, application, and geography. On the basis of product type, the market is segmented into general-purpose credit cards and specialty credit cards. Based on service providers, the credit card market is segmented into Visa, Mastercard, and others. Based on application, the market is segmented into food and groceries, consumer electronics, health and pharmacy, restaurants and bars, media and entertainment, travel and tourism, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Credit Card Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the Credit Card Market. A few recent key market developments are listed below:

- In August 2023, Citi Global Wealth unveiled the ULTIMA Mastercard credit card, which targeted Citi Private Bank clients across Asia, including Hong Kong and Singapore. Leveraging Citi’s full wealth continuum, the card delivers the best of the bank’s leading credit card franchise to serve better potential and existing ultra-high net worth clients in Asia

[Source: Citi, Company Website]

- In July 2021, Bank of America announced the launch of the Bank of America Unlimited Cash Rewards credit card, which allows clients to earn unlimited 1.5% cash back on all purchases. This new credit card is the latest among Bank of America’s suite of rewards cards, each designed to fit a variety of clients’ needs.

[Source: Bank of America, Company Website]

Credit Card Market Report Coverage & Deliverables

The Credit Card Market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Credit Card Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Service Providers, Application and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global Credit Card Market is expected to reach US$ 1057.48 billion by 2031.

Rising demand for credit cards is the major factors that propel the global credit card market.

The key players holding majority shares in the global Credit Card Market are Bank of America Corporation, American Express, Citigroup Inc., Mastercard, and JPMorgan Chase & Co.

The growing adoption of digital payment solutions is anticipated to play a significant role in the global credit card market in the coming years.

The global Credit Card Market was estimated to be US$ 552.73 billion in 2023 and is expected to grow at a CAGR of 8.4 % during the forecast period 2023 - 2031.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Bank of America Corporation

- American Express, Citigroup Inc.

- Barclays

- HSBC

- Capital One

- JPMorgan Chase & Co

- Mastercard

- USAA

- SBI Cards and Payment Services Limited

Get Free Sample For

Get Free Sample For