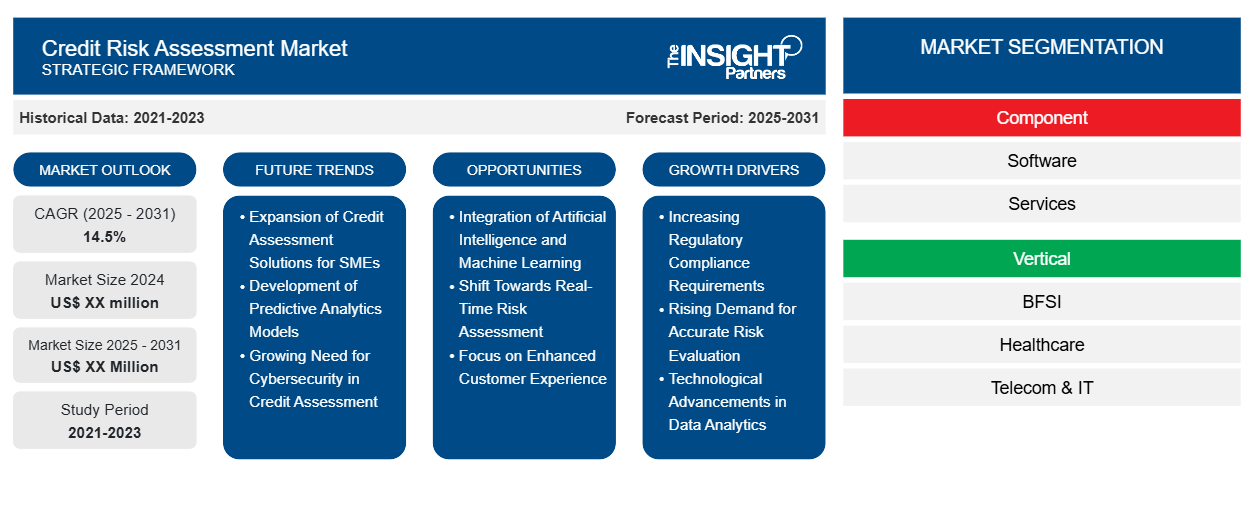

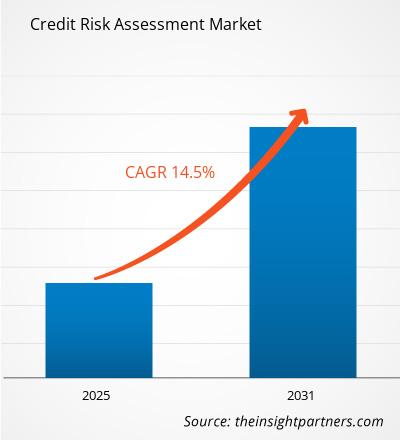

The Credit Risk Assessment Market is expected to register a CAGR of 14.5% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Component (Software and Services). The report further presents analysis based on the Vertical (BFSI, Healthcare, Telecom & IT, Government, Manufacturing, Retail, Others). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Credit Risk Assessment Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Credit Risk Assessment Market Segmentation

Component

- Software

- Services

Vertical

- BFSI

- Healthcare

- Telecom & IT

- Government

- Manufacturing

- Retail

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Credit Risk Assessment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Credit Risk Assessment Market Growth Drivers

- Increasing Regulatory Compliance Requirements: One of the primary drivers for the credit risk assessment market is the growing number of regulatory compliance requirements in the financial sector. Governments and regulatory bodies worldwide are implementing stringent regulations to ensure that lenders effectively assess and manage credit risk. These regulations often require institutions to adopt advanced credit risk assessment tools and methodologies to meet reporting obligations. As a result, financial institutions are compelled to invest in robust credit risk assessment solutions to remain compliant and avoid potential penalties.

- Rising Demand for Accurate Risk Evaluation: The increasing complexity of financial products and the evolving economic landscape have heightened the demand for accurate credit risk evaluation. Lenders are recognizing the importance of precise credit assessments in making informed lending decisions and minimizing potential losses. This demand is further driven by the need to tailor credit offerings to different segments of borrowers, such as individuals, small businesses, and corporations. Consequently, the credit risk assessment market is witnessing growth as institutions seek sophisticated models and analytics to enhance their risk evaluation processes.

- Technological Advancements in Data Analytics: Technological advancements in data analytics are significantly driving the credit risk assessment market. The availability of big data and advanced analytics tools enables financial institutions to analyze vast amounts of borrower data, including credit history, transaction patterns, and social media behavior. These insights allow lenders to develop more accurate credit scoring models and enhance their risk management practices. As technology continues to evolve, the credit risk assessment market is likely to see innovations that improve the efficiency and accuracy of risk assessments.

Credit Risk Assessment Market Future Trends

- Expansion of Credit Assessment Solutions for SMEs: There is a significant opportunity for the credit risk assessment market to expand solutions tailored specifically for small and medium-sized enterprises (SMEs). Many SMEs face challenges in obtaining credit due to a lack of comprehensive credit histories or insufficient data for traditional risk assessments. By developing innovative credit risk assessment models that cater to the unique characteristics of SMEs, financial institutions can tap into this underserved market segment, fostering growth and enabling increased access to financing for these businesses.

- Development of Predictive Analytics Models: The rise of predictive analytics presents a valuable opportunity in the credit risk assessment market. Financial institutions can leverage predictive models to anticipate potential defaults and assess creditworthiness more accurately. By harnessing various data sources, including alternative data such as payment histories and behavioral insights, lenders can create more sophisticated credit scoring systems. This not only enhances risk management practices but also enables institutions to offer personalized credit products that align with borrowers' needs and profiles.

- Growing Need for Cybersecurity in Credit Assessment: As credit risk assessment processes become increasingly digitized, there is a growing need for robust cybersecurity measures to protect sensitive borrower information. Financial institutions are presented with an opportunity to enhance their credit risk assessment solutions with integrated cybersecurity features. By prioritizing data protection and compliance with privacy regulations, lenders can build trust with their customers and safeguard their reputations. This focus on cybersecurity will be crucial in ensuring the integrity of credit assessments and maintaining customer confidence in the lending process.

Credit Risk Assessment Market Opportunities

- Integration of Artificial Intelligence and Machine Learning: A prominent trend in the credit risk assessment market is the integration of artificial intelligence (AI) and machine learning (ML) technologies. These advanced algorithms can analyze complex data sets to identify patterns and predict credit risk more effectively than traditional methods. Financial institutions are increasingly adopting AI and ML solutions to enhance their credit scoring models, automate decision-making processes, and improve overall risk management. This trend is likely to shape the future of credit risk assessment by providing more accurate and dynamic evaluations.

- Shift Towards Real-Time Risk Assessment: There is a notable trend towards real-time credit risk assessment, driven by the need for timely decision-making in lending processes. Financial institutions are recognizing that traditional risk assessment methods, which rely on historical data and lengthy evaluations, may not adequately capture the current risk profile of borrowers. As a result, many are investing in technologies that enable continuous monitoring of credit risk, allowing them to respond swiftly to changes in borrowers' circumstances and adjust credit limits accordingly.

- Focus on Enhanced Customer Experience: The credit risk assessment market is also witnessing a trend focused on enhancing customer experience. Lenders are increasingly aware that the credit assessment process can significantly impact customer satisfaction. As a result, financial institutions are adopting streamlined and user-friendly credit assessment processes, often leveraging digital platforms to facilitate quicker evaluations. By minimizing the friction in the application process and providing transparent communication, lenders can improve customer relationships while maintaining robust risk assessment practices.

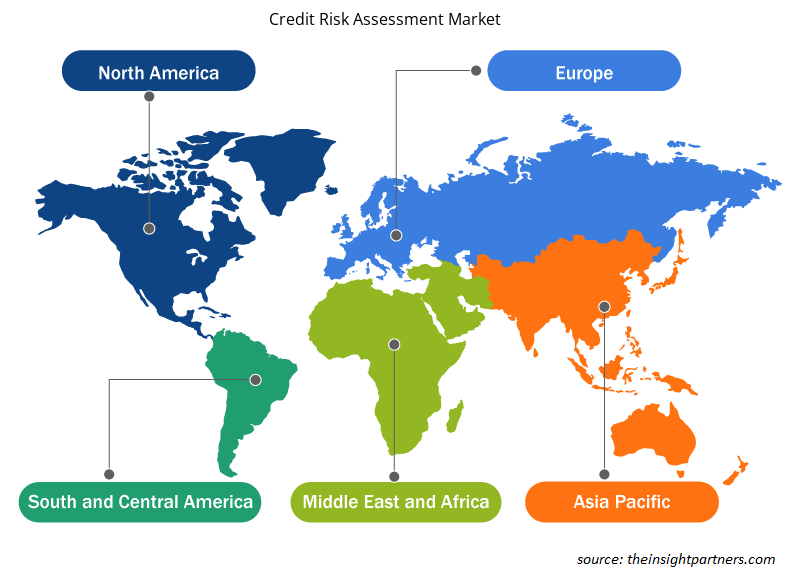

Credit Risk Assessment Market Regional Insights

The regional trends and factors influencing the Credit Risk Assessment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Credit Risk Assessment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Credit Risk Assessment Market

Credit Risk Assessment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 14.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

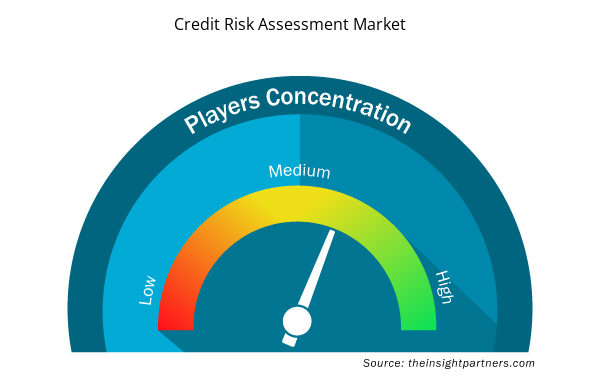

Credit Risk Assessment Market Players Density: Understanding Its Impact on Business Dynamics

The Credit Risk Assessment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Credit Risk Assessment Market are:

- Experian

- Equifax

- Trans Union

- Moody's Analytics

- FICO

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Credit Risk Assessment Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Credit Risk Assessment Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Credit Risk Assessment Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on the request are an additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The leading players operating in the Credit Risk Assessment Market include Experian, Equifax, Trans Union, Moody's Analytics, FICO, S & P Global Market Intelligence, Morningstar Credit Ratings, DBRS Morningstar, Credit Benchmark, Kroll Bond Rating Agency

The global Credit Risk Assessment Market is expected to grow at a CAGR of 14.5% during the forecast period 2024 - 2031.

Integration of Artificial Intelligence and Machine Learning, Shift Towards Real-Time Risk Assessment, and Focus on Enhanced Customer Experience are the key future trends of the Credit Risk Assessment Market

The major factors driving the Credit Risk Assessment Market are: Increasing Regulatory Compliance Requirements, Rising Demand for Accurate Risk Evaluation, and Technological Advancements in Data Analytics.

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

Get Free Sample For

Get Free Sample For