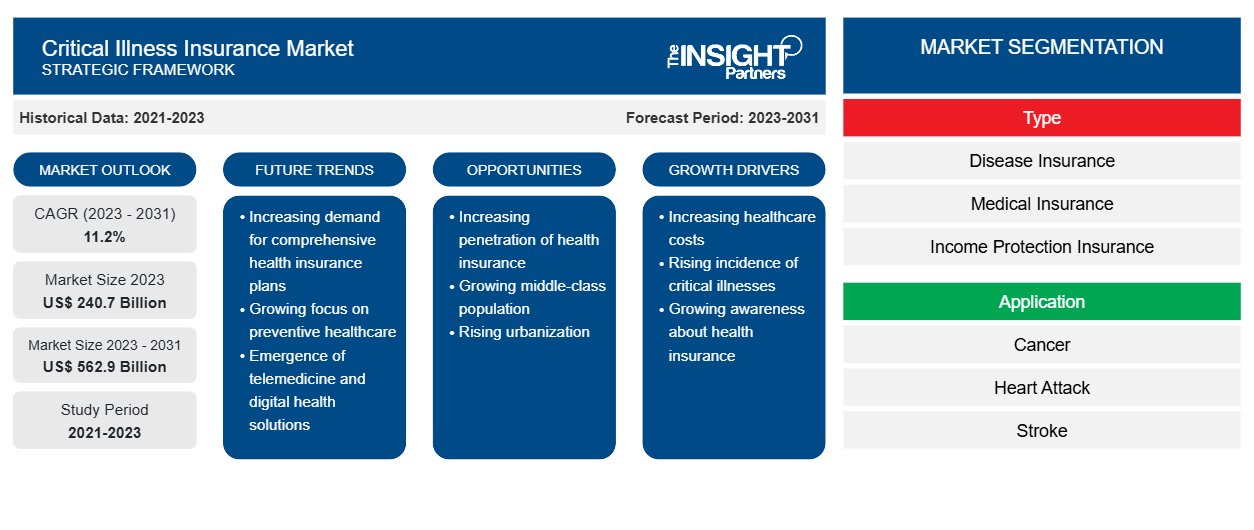

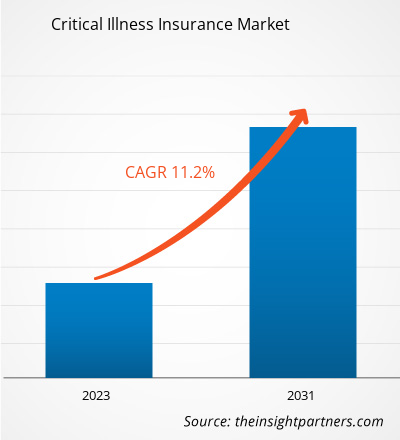

The critical illness insurance market size is expected to grow from US$ 240.7 billion in 2023 to US$ 562.9 billion by 2031; it is anticipated to expand at a CAGR of 11.2% from 2023 to 2031. The rising incidence of serious illnesses such as heart disease, cancer, and stroke is expected to boost the critical illness insurance market growth.

Critical Illness Insurance Market Analysis

Several key factors are driving the critical illness insurance market. Firstly, there is a growing awareness among people and patients concerning the benefits of critical illness insurance, leading to an increase in demand for coverage to alleviate the costs of treatment and recovery. The rising frequency of critical illnesses such as heart attacks, strokes, organ transplants, and cancer is also a significant driver for the market.

Critical Illness Insurance Market

Overview

- Critical illness insurance is a type of insurance plan that provides a lump-sum payment or monthly benefits in the event of a future major illness diagnosis. This type of insurance is designed to supplement existing health insurance coverage by providing extra funds to meet the demands that come with critical illness health emergencies.

- The coverage can help fund expenses not covered by other insurance, such as medical expenses, household bills, and everyday costs that may arise due to a critical illness diagnosis.

- Additionally, the growing geriatric population, advancements in medical technology, and improved survival rates for critical illnesses are contributing to market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Critical Illness Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Critical Illness Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Critical Illness Insurance Market Drivers and Opportunities

Rising Incidence of Critical Illnesses to Drive the Critical Illness Insurance Market Growth

- The rising occurrence of critical illnesses such as cancer, stroke, and heart disease is a significant driver for the market. As individuals become more aware of the fiscal burden associated with these illnesses, the demand for insurance coverage increases.

- According to a report from healthinsurance.org, most critical illness policies cover conditions such as heart attack, stroke, organ failure/transplant, and internal cancers, among others. The American Cancer Society also highlights that each year in the United States, more than 1.7 million people are diagnosed with cancer, making it the second leading cause of death.

- As the prevalence of these critical illnesses continues to rise, individuals are recognizing the need for financial protection, leading to an increased demand for critical illness insurance.

Critical Illness Insurance Market Report Segmentation Analysis

- Based on type, the market is segmented into disease insurance, medical insurance, and income protection insurance. The disease insurance segment is expected to hold a substantial critical illness insurance market share in 2023.

- Disease Insurance in the context of the critical illness insurance market refers to a policy that provides a direct lump-sum benefit upon the diagnosis of specific life-threatening illnesses such as heart attack, stroke, cancer, renal failure, paralysis, and other specified diseases.

- This type of insurance is designed to supplement existing health insurance coverage by offering financial support for expenses not covered by standard health insurance, including medical bills, household expenses, and other costs associated with critical illness.

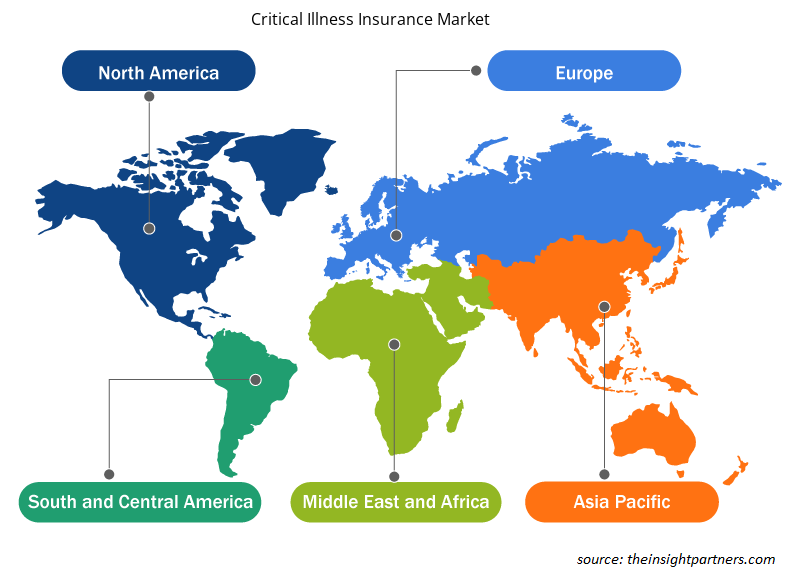

Critical Illness Insurance Market Share Analysis by Geography

The scope of the critical illness insurance market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant critical illness insurance market share. The US holds the largest market share, while Canada's critical illness insurance market is the fastest-growing in the region. The market is observing an increasing focus on cancer-specific coverage, aligning with the high cancer incidence rates in the region. Additionally, insurers are offering more customizable policies to cater to individual needs and preferences.

Critical Illness Insurance Market Regional Insights

Critical Illness Insurance Market Regional Insights

The regional trends and factors influencing the Critical Illness Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Critical Illness Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Critical Illness Insurance Market

Critical Illness Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 240.7 Billion |

| Market Size by 2031 | US$ 562.9 Billion |

| Global CAGR (2023 - 2031) | 11.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

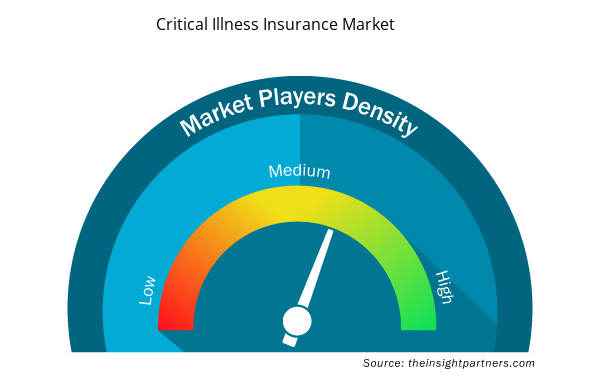

Critical Illness Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Critical Illness Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Critical Illness Insurance Market are:

- The List of Companies

- Aegon N.V.

- Allianz SE

- Aviva plc

- Axa S.A.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Critical Illness Insurance Market top key players overview

The "Critical Illness Insurance Market Analysis" was carried out based on type, mode application, and geography. In terms of type, the market is segmented into disease insurance, medical insurance, and income protection insurance. Based on application, the market is segmented into cancer, heart attack, stroke, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Critical Illness Insurance Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the market. The critical illness insurance market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. A few recent key market developments are listed below:

- In October 2023, AXA Hong Kong and Macau (AXA) announced the launch of its new critical illness plan, CareForAll Critical Illness Plan (“CareForAll”), bringing peace of mind to the underserved communities facing health risks. With relaxed underwriting requirements, CareForAll aims to serve customers living with chronic disease, the silver-haired segment, and critical illness survivors, enabling them to access critical illness insurance as needed.

[Source: AXA Hong Kong, Company Website]

Critical Illness Insurance Market Report Coverage & Deliverables

The market report on “Critical Illness Insurance Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The rising incidence of critical illnesses and the growing awareness among people are the major factors that propel the market.

The market was estimated to be US$ 240.7 billion in 2023 and is expected to grow at a CAGR of 11.2% during the forecast period 2023 - 2031.

The growing geriatric population is anticipated to play a significant role in the market in the coming years.

The key players holding majority shares in the market are Aegon N.V.; Allianz SE; Aviva plc; Axa S.A.; and China Life Insurance.

The market is expected to reach US$ 562.9 billion by 2031.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies

- Aegon N.V.

- Allianz SE

- Aviva plc

- Axa S.A.

- China Life Insurance

- China Pacific Insurance Co., Ltd.

- Legal and General Group plc

- SBI General Insurance Company Limited

- Ping An Insurance

- Prudential plc

Get Free Sample For

Get Free Sample For