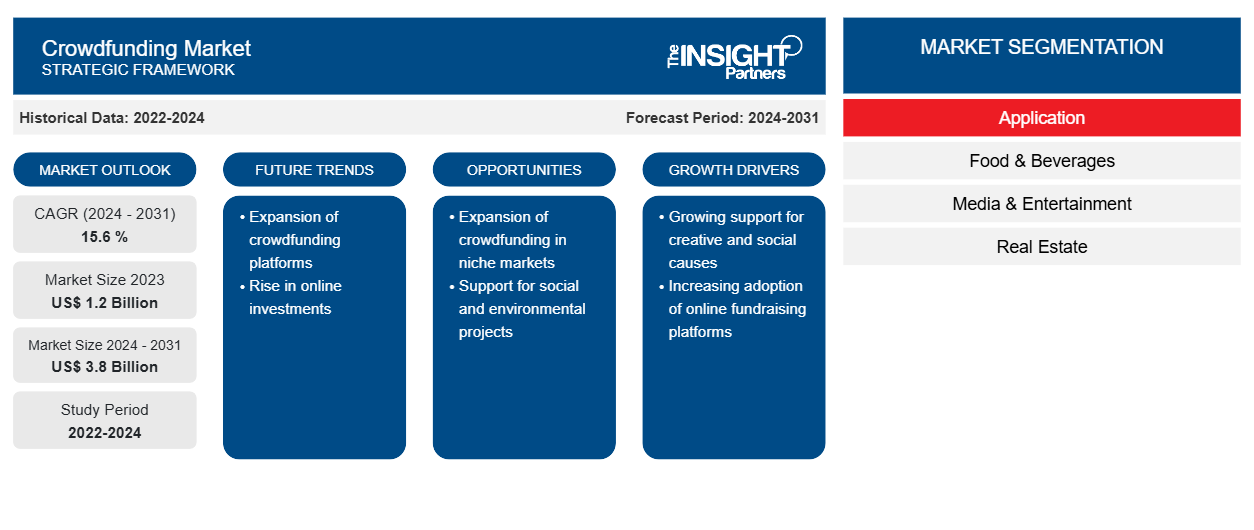

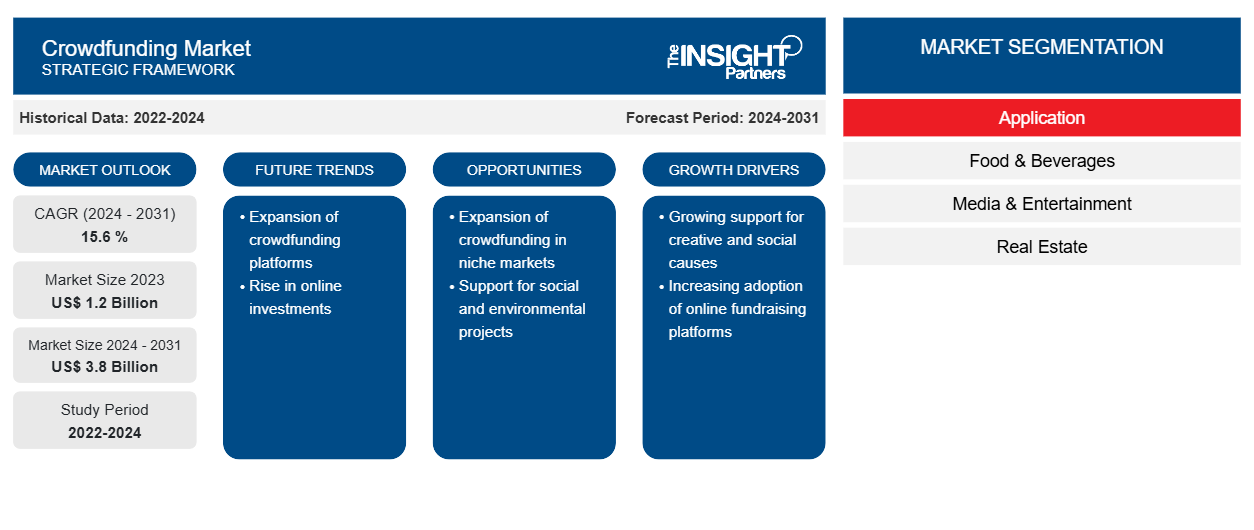

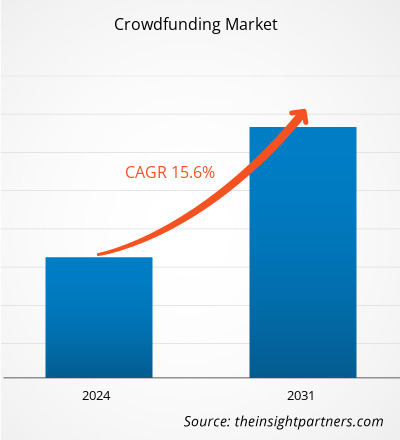

The crowdfunding market size is expected to grow from US$ 1.2 billion in 2023 to US$ 3.8 billion by 2031; it is anticipated to expand at a CAGR of 15.6 % from 2024 to 2031. The rapid growth in technological advancements and innovations in crowdfunding platforms, such as the integration of artificial intelligence and machine learning, is a major driver of the crowdfunding market growth. These advancements have made it easier for startup companies to raise funds from investors.

Crowdfunding Market Analysis

The crowdfunding market is witnessing a substantial impact due to the increasing number of crowdfunding service providers across the globe, which is also driving the growth of the market. These service providers help startup companies connect with investors and raise funds. This has created more opportunities for crowdfunding market growth.

Crowdfunding Industry Overview

- In the realm of business, crowdfunding serves as a means for entrepreneurs, businessmen, and creators such as filmmakers, musicians, and artists to secure funding for their ventures, enterprises, and projects. This is achieved by directly engaging with the general public and appealing for their support.

- Online platforms facilitate the collection of funds from a wide pool of individual investors. Notably, startup firms and growing companies often leverage crowdfunding as a viable avenue for accessing alternative capital.

- Crowdfunding platforms have significantly streamlined the process for entrepreneurs, artists, and other creative individuals to secure project funding, eliminating the need to rely solely on traditional channels like banks or venture capitalists. This democratization of funding has particularly benefited individuals and small businesses, as it has leveled the playing field and enabled access to funds irrespective of geographical location, credit score, or net worth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Crowdfunding Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Crowdfunding Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Crowdfunding Market Drivers and Opportunities

Easier Access to Funding to Drive the Crowdfunding

Market Growth

- Crowdfunding platforms have revolutionized the funding landscape for entrepreneurs, artists, and other creatives by providing an alternative to traditional channels like banks and venture capitalists. This shift has opened up opportunities for individuals and small businesses, regardless of their location, credit score, or net worth.

- In addition to the accessibility of funding, crowdfunding platforms offer a platform for entrepreneurs and project owners to pitch their ideas, connect with potential investors and backers, and raise awareness for their projects. This exposure to a wide audience enhances the prospects of successful funding.

- Furthermore, the introduction of different crowdfunding models, such as rewards-based, donation-based, equity-based, and debt-based, has broadened the scope of projects and entrepreneurs that can access funding. This diversity of funding models has significantly contributed to the growth and expansion of the crowdfunding industry.

Crowdfunding Market Report Segmentation Analysis

- Based on type, the crowdfunding market forecast is segmented into reward-based crowdfunding, equity-based crowdfunding, debt-based crowdfunding, donation-based crowdfunding, and others.

- The debt-based crowdfunding segment is expected to hold a substantial crowdfunding market share in 2023. The key factors strongly influence the growth of the third-party liability coverage segment. Debt-based crowdfunding provides startup companies with an alternative financing option that offers advantages similar to traditional bank loans. It allows borrowers to access funds at a lower cost and without the extensive requirements and procedures associated with traditional banking.

- Moreover, debt-based crowdfunding also benefits investors by providing them with better interest rates for funding projects in regular monthly installments; such features are anticipated to bring new crowdfunding market trends.

Crowdfunding Market Share Analysis by Geography

The scope of the Crowdfunding Market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant crowdfunding market share in 2023. The debt-based crowdfunding segment in the crowdfunding market has experienced significant growth due to intensified competition among platforms, leading to continuous innovation and enhancements in the crowdfunding experience for users. This has been further fueled by substantial funding amounts raised in North America, reaching billions of dollars in recent years. The region has witnessed a surge in crowdfunding popularity, resulting in a higher number of successful projects and campaigns.

Crowdfunding Market Regional Insights

Crowdfunding Market Regional Insights

The regional trends and factors influencing the Crowdfunding Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Crowdfunding Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Crowdfunding Market

Crowdfunding Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.2 Billion |

| Market Size by 2031 | US$ 3.8 Billion |

| Global CAGR (2024 - 2031) | 15.6 % |

| Historical Data | 2022-2024 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Crowdfunding Market Players Density: Understanding Its Impact on Business Dynamics

The Crowdfunding Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Crowdfunding Market are:

- Kickstarter

- PBC

- Wefunder Inc.

- Indiegogo, Inc.

- Fundable

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Crowdfunding Market top key players overview

The "Crowdfunding Market Analysis" was carried out based on type, investment size, application, and geography. Based on type, the market is segmented into reward-based crowdfunding, equity-based crowdfunding, debt-based crowdfunding, donation-based crowdfunding, and others. Based on investment size, the market is segmented into small & medium investment and large investment. Based on application, the market is segmented into food & beverages, media & entertainment, real estate, healthcare, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Crowdfunding Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the crowdfunding market. A few recent key market developments are listed below:

- In March 2023, Enabot, an emerging family robotics company, launched a Kickstarter crowdfunding campaign for their latest product, the EBO X family robot companion. The company aims to position the EBO X as the first commercially available household robot in the industry. Interested backers can now pre-order the EBO X on Kickstarter, with early backers enjoying a special price of USD 569, saving up to 43% off the retail price of US$ 999. The campaign has garnered attention and recognition, with the EBO X being named a CES 2023 "Innovation Awards Honoree" in both the Smart Home and Robotics product categories. The EBO X is equipped with advanced features such as a 4K stabilized camera, AI face recognition, and auto navigation capabilities. The Kickstarter orders are expected to be shipped starting in May.

[Source: Enabot, Company Website]

- In April 2022, Crowdcube, a prominent platform for crowdsourcing securities in the UK and Europe, expanded its reach by launching a dedicated website for France in April 2022. This strategic move comes as recent regulatory changes have made it easier for Crowdcube to support issuers in raising up to Euro 5 million (USD 5.27 million) across European member states. The platform's established presence in Europe, coupled with the regulatory developments, positions Crowdcube to facilitate fundraising for businesses and entrepreneurs in a larger market. This expansion aligns with Crowdcube's mission to empower high-growth businesses and provide investment opportunities for a diverse range of investors.

[Source: Crowdcube, Company Website]

Crowdfunding Market Report Coverage & Deliverables

The market report on “Crowdfunding Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Investment Size, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding the majority of shares in the global crowdfunding market are Kickstarter, PBC, Wefunder Inc., Indiegogo, Inc., and Fundable.

The reward-based crowdfunding, where backers receive non-financial rewards in exchange for their support, is anticipated to play a significant role in the global crowdfunding market in the coming years.

The global crowdfunding market is expected to reach US$ 3.8 billion by 2031.

The increasing number of crowdfunding service providers across the globe is also driving the growth of the market. These service providers help startup companies connect with investors and raise funds. This has created more opportunities for crowdfunding activities, which are among the major factors that propel the global crowdfunding market.

The crowdfunding market size is expected to grow from US$ 1.2 billion in 2023 to US$ 3.8 billion by 2031; it is anticipated to expand at a CAGR of 15.6 % from 2024 to 2031.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies

- Kickstarter

- PBC

- Wefunder Inc.

- Indiegogo, Inc.

- Fundable

- Fundly

- ConnectionPoint Systems Inc. (CPSI) (FundRazr)

- GoFundMe

- StartSomeGood

- Crowdcube Capital Ltd

Get Free Sample For

Get Free Sample For