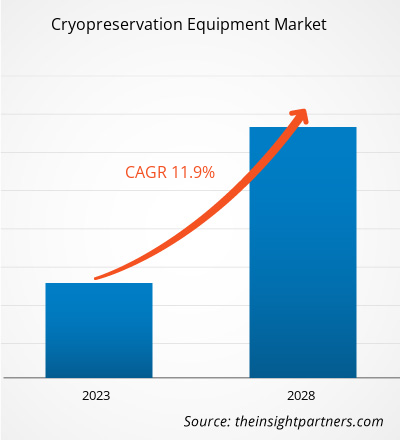

The cryopreservation equipment market is projected to reach US$ 12,489.84 million by 2028 from US$ 6,358.65 million in 2022; it is expected to grow at a CAGR of 11.9% from 2022 to 2028.

Cryopreservation is a technique employed to minimize cell damage caused during freezing and storage of biological materials such as tissue, bacteria, fungi, virus, and mammalian cells. Tissues and genetically stable living cells preserved via cryopreservation can be used in research and other biomedical applications. The equipment required for cryopreservation includes cryopreservation systems, cryoware, accessories, and cryogen.

The cryopreservation equipment market is segmented on the bases of type, cryogen type, application, end user, and geography. By geography, the market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The report offers insights and in-depth analysis of the market, emphasizing on parameters such as market trends, technological advancements, and market dynamics, along with the analysis of competitive landscape of the globally leading market players.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cryopreservation Equipment Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Growing Acceptance for Regenerative Medicine Drives Cryopreservation Equipment Market Growth

Cryopreservation plays an important part in the field of regenerative medicine as it facilitates stable and secure storage of cells and other related components for a prolonged time. Regenerative medicine enables replacing diseased or damaged cells, tissues, and organs by retrieving their normal function through stem cell therapy. Owing to the advancements in the medical technology, stem cell therapy is now being considered as an alternative to traditional drug therapies in the treatment of a wide range of chronic diseases, including diabetes and neurodegenerative diseases. Moreover, the US Food and Drug Administration (FDA) has approved blood-forming stem cells. The blood-forming stem cells are also known as hematopoietic progenitor cells that are derived from umbilical cord blood. The growing approvals for stem cell and gene therapies are eventually leading to the high demand for cryopreservation equipment. Following are a few instances of stem cell and gene therapies approved by the FDA and other regulatory bodies.

- In February 2021, Bristol Myers Squibb (Juno Therapeutics, Inc.) received an FDA approval for Breyanzi, a CD19-directed chimeric antigen receptor T-cell (CAR-T) therapy. The CAR-T cell therapy is used for treating relapsed or refractory large B-cell lymphoma in adults.

- In March 2021, Novartis AG received approval from the Health Sciences Authority of Singapore for the commercialization of the first CAR-T therapy named Kymriah, which is claimed as a one-time treatment procedure run individually for each patient. The therapy was approved under the new cell, tissue, and gene therapy products (CTGTP) regulatory framework.

- In July 2020, Kite, a Gilead Company, received an approval from the US FDA for its Tecartus (formerly known as KTE-X19) CAR-T cell therapy. The therapy is designed for the treatment of adult patients with relapsed or refractory mantle cell lymphoma (MCL).

- In May 2019, Vericel Corporation received an approval for its MACI (autologous cultured chondrocytes on porcine collagen membrane).

- In December 2017, Spark Therapeutics received an approval from the US FDA for Luxturna. It is a one-time gene therapy product for the treatment of patients with confirmed biallelic RPE65 mutation-associated retinal dystrophy.

Increasing Need of Biobanking Practices Contributes Significantly to Market Growth

Biobanks are developed extensively for the preservation of biological materials, including human biologics, plants, animals, and microbes, for medical research, drug development, agriculture, and ecology. The demand for cryopreservation equipment has increased among biotechnology and pharmaceutical manufacturers, contract research organizations, stem cell banks, and stem cell research laboratories in the past few years. These end users contribute to the development of biomarker detection, molecular diagnosis, translational medicine, and multidisciplinary disease research. In addition, biomaterials used to study the interactions between genetic and environmental or lifestyle factors can also be stored biobanks. They require cryopreservation equipment to store umbilical cord blood as a source of hematopoietic stem and progenitor cells; cancerous tissue samples; semen for artificial insemination; oocytes and embryos for in-vitro fertilization (IVF); and plant seeds/shoots for breeding. Furthermore, the COVID-19 pandemic has triggered the research and developments activities for effective diagnostics and therapeutic approaches, which is adding to the requirement of biobanks.

Biobank Graz, Shanghai Zhangjiang Biobank, “All of Us” Biobank, International Agency for Research on Cancer (IARC) Biobank (IBB), China Kadoorie Biobank, UK Biobank, FINNGEN biobanks, Canadian Partnership for Tomorrow Project Biobank, EuroBioBank network, and Qatar Biobank are among the leading biobanks across the world. They are part of national government-funded studies regarding population health. Apart from the listed biobanks, various other biobanks owned by private and public entities across all regions require cryopreservation equipment and accessories in large volumes.

Type Insights

Based on type, the global cryopreservation equipment market is segmented into freezers, sample preparation systems, and accessories. In 2020, the freezers segment held the largest share of the market, and it is further expected to register the highest CAGR during 2022–2028. In ultracold freezers, liquid nitrogen is used for the successful preservation of more complex biological structures by virtually seizing all biological activities.

Cryogen Type Insights

Based on cryogen type, the global cryopreservation equipment market is segmented into liquid nitrogen, oxygen, liquid helium, argon, and others. In 2020, the liquid nitrogen segment held the largest share of the market, and it is further expected to grow at the highest CAGR during 2022–2028. Liquid nitrogen is a nonmechanical method of cells preservation. Large thermos-like containers are used to house either racks or shelves that hold cryogenic vials.

Application Insights

Based on application, the global cryopreservation equipment market is segmented into cord blood stem cells, sperms, semen & testicular tissues, embryos and oocytes, cell and gene therapies, and others. In 2020, the cord blood stem cells segment held the largest share of the market. Moreover, the market for the sperms segment is expected to register the highest CAGR in the market during 2022–2028. In recent years, public cord banking has been promoted over private cord banking. Various centers across the world are performing cord blood stem cell transplantation as a part of the management of genetic, hematologic, immunologic, metabolic, and oncologic disorders, among others, which is bolstering the growth of the market for the public cord banking segment.

End User Insights

Based on end user, the cryopreservation equipment market is segmented into stem cell banks, biotechnology and pharmaceuticals organizations, stem cell research laboratories, and others. The biotechnology and pharmaceuticals organizations segment held the largest market share in 2020, and it is further expected to be the largest shareholder in the market by 2028. Cryopreservation has become an integral part of the manufacturing process of many cellular therapies as it is, sometimes, performed as a step preceding the cell culture (preservation of starting cellular material before beginning large-scale manufacturing) and generally follows cell expansion.

Product launches, and mergers and acquisitions are the highly adopted strategies by the players operating in the global cryopreservation equipment market. A few of the recent key product developments are listed below:

- In May 2021, Stirling Ultracold has been acquired by BioLife Solutions, Inc for cell and gene therapies and the broader biopharma market. In return for all of Stirling's outstanding shares, BioLife issued 6,646,870 shares of ordinary stock.

- In December 2019, PHC Corporation launched new ultralow-temperature MDF-DU901VHL (large 900 liters class) with newest cabinet design and intuitive LCD display control in ECO version.

The COVID-19 pandemic has had a mixed impact on the cryopreservation equipment market. Restricted access to family planning services as well as diverted focus of people due to economic uncertainties and recession, and disturbed work-life balance have led to rise in egg and embryo freezing activities at fertility clinics during the pandemic. As a result, the rising use of cryopreservation equipment is boosting the market growth. Furthermore, supply chain disruption caused due to congestion of ports and disturbances in other transport means has substantially affected the distribution of cryopreservation equipment and other accessories.

Cryopreservation Equipment Market Regional Insights

The regional trends and factors influencing the Cryopreservation Equipment Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Cryopreservation Equipment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Cryopreservation Equipment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 6.36 Billion |

| Market Size by 2028 | US$ 12.49 Billion |

| Global CAGR (2022 - 2028) | 11.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Cryopreservation Equipment Market Players Density: Understanding Its Impact on Business Dynamics

The Cryopreservation Equipment Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Cryopreservation Equipment Market top key players overview

Cryopreservation Equipment Market - Segmentation

By type, the cryopreservation equipment market is segmented into freezers, sample preparation systems, and accessories. The cryopreservation equipment market based on the cryogen type is segmented into liquid nitrogen, oxygen, liquid helium, argon, and others. Based on application, the cryopreservation equipment market is segmented into cord blood stem cells, sperms, semen & testicular tissues, embryos and oocytes, cell and gene therapies, and others. Based on end user, the cryopreservation equipment market is segmented into stem cell banks, biotechnology & pharmaceuticals organizations, stem cell research laboratories, and others. By geography, the market is segmented into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). Prominent players operating in the cryopreservation equipment market include Thermo Fisher Scientific Inc., Gold Sim Cellular Science LLC, Brooks Automation, Inc, Avantor, Inc., Hamilton Company, PHC Holdings Corporation, Danaher Corporation, Cryoport Systems, LLC., Antech Group Inc., Cryofab, BioLife Solutions, and ZhongkeMeiling Cryogenics Company Limited.

Frequently Asked Questions

What is the regional market scenario of cryopreservation equipment?

What are the driving factors for the cryopreservation equipment market across the globe?

What is cryopreservation equipment?

Which segment is dominating the cryopreservation equipment market?

Who are the major players in market the cryopreservation equipment market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For