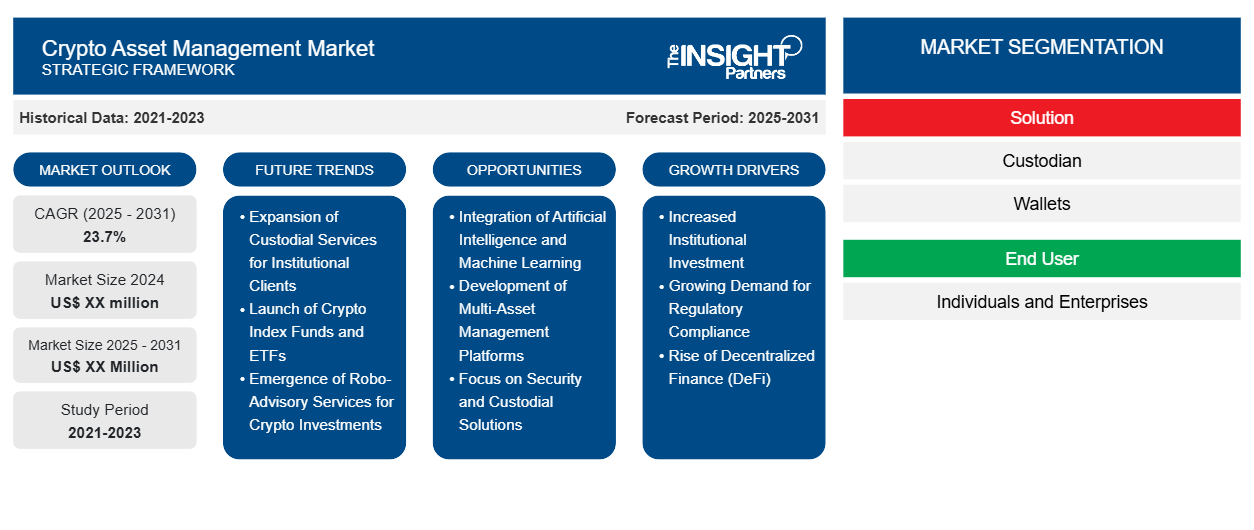

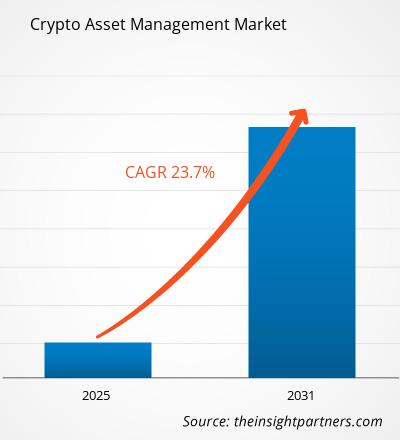

The Crypto Asset Management Market is expected to register a CAGR of 23.7% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Solution (Custodian and Wallets). The report further presents analysis based on the End User (Individuals and Enterprises). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Crypto Asset Management Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Crypto Asset Management Market Segmentation

Solution

- Custodian

- Wallets

End User

- Individuals and Enterprises

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Crypto Asset Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Crypto Asset Management Market Growth Drivers

- Increased Institutional Investment:

The entry of institutional investors into the crypto space is a significant driver for the crypto asset management market. Major financial institutions, hedge funds, and family offices are beginning to allocate a portion of their portfolios to cryptocurrencies, driven by the potential for high returns and diversification benefits. This influx of capital not only boosts market liquidity but also enhances legitimacy, encouraging more widespread adoption and driving innovation in asset management solutions tailored for crypto.

- Growing Demand for Regulatory Compliance:

As the crypto market matures, there is an increasing demand for regulatory compliance among asset managers. Governments around the world are establishing clearer frameworks for financial transactions involving cryptocurrencies, which necessitates the development of management solutions that adhere to these regulations. Asset management firms that can offer compliant solutions, including reporting and auditing features, will be positioned well to attract clients seeking to navigate the regulatory landscape and mitigate legal risks.

- Rise of Decentralized Finance (DeFi):

The rapid growth of decentralized finance (DeFi) platforms is driving interest in crypto asset management. DeFi offers innovative financial services without traditional intermediaries, allowing users to lend, borrow, and earn interest on their crypto assets. This shift is creating a demand for management tools that can help users track and optimize their DeFi investments. As more investors engage with DeFi, asset management solutions that provide insights and strategies will become increasingly valuable, fueling market growth.

Crypto Asset Management Market Future Trends

- Expansion of Custodial Services for Institutional Clients:

The growing interest from institutional investors presents a significant opportunity for custodial services within the crypto asset management market. Many institutions are seeking secure and compliant ways to hold their digital assets, which creates a demand for specialized custodians equipped with robust security measures. Firms that can provide comprehensive custodial solutions, including insurance coverage and regulatory compliance, will attract institutional clients, facilitating their entry into the crypto market and enhancing overall market growth.

- Launch of Crypto Index Funds and ETFs:

There is a growing opportunity for the launch of crypto index funds and exchange-traded funds (ETFs) as investors seek diversified exposure to the crypto market. These investment vehicles allow individuals and institutions to gain broad exposure to a basket of cryptocurrencies without needing to manage individual assets. The development of regulated crypto index funds and ETFs will appeal to a wider audience, including risk-averse investors, and could lead to increased capital inflow into the crypto asset management sector.

- Emergence of Robo-Advisory Services for Crypto Investments:

The rise of robo-advisory services tailored to crypto investments is an exciting opportunity within the market. These automated platforms can offer personalized investment strategies based on individual risk tolerance and financial goals, making crypto investing more accessible to retail investors. As the demand for low-cost, automated investment solutions grows, robo-advisors focusing on crypto assets can capitalize on this trend, democratizing access to digital asset management and fostering greater participation in the crypto economy.

Crypto Asset Management Market Opportunities

- Integration of Artificial Intelligence and Machine Learning:

The integration of artificial intelligence (AI) and machine learning (ML) technologies in crypto asset management is a notable trend. These technologies enable asset managers to analyze vast amounts of data, identify patterns, and make informed investment decisions in real-time. AI-driven algorithms can enhance portfolio management strategies, risk assessment, and market prediction, providing a competitive edge. As the complexity of the crypto market increases, the reliance on AI and ML for data-driven insights will likely grow.

- Development of Multi-Asset Management Platforms:

There is a trend toward the development of multi-asset management platforms that allow investors to manage a diverse range of assets, including cryptocurrencies alongside traditional assets. These platforms facilitate seamless portfolio diversification and provide users with a holistic view of their investments. By catering to the needs of both crypto and traditional investors, asset management firms can attract a broader clientele and offer solutions that align with modern investment strategies focused on risk management and performance optimization.

- Focus on Security and Custodial Solutions:

As the crypto asset management market expands, there is a heightened focus on security and custodial solutions to protect digital assets from theft and fraud. Investors are increasingly aware of the risks associated with holding cryptocurrencies, prompting demand for secure storage options and robust insurance policies. Asset management firms that prioritize security and compliance, offering advanced custodial solutions, will gain the trust of clients and establish themselves as reliable partners in the management of digital assets.

Crypto Asset Management Market Regional Insights

The regional trends and factors influencing the Crypto Asset Management Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Crypto Asset Management Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Crypto Asset Management Market

Crypto Asset Management Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 23.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Solution

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

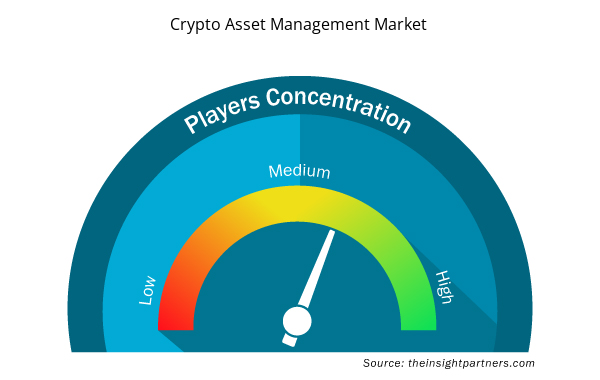

Crypto Asset Management Market Players Density: Understanding Its Impact on Business Dynamics

The Crypto Asset Management Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Crypto Asset Management Market are:

- Gemini Trust Company, LLC

- BitGo

- Ripple

- CRYPTO FINANCE AG

- Coinbase

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Crypto Asset Management Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Crypto Asset Management Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Crypto Asset Management Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Integrated Platform Management System Market

- Industrial Valves Market

- Microplate Reader Market

- Biopharmaceutical Tubing Market

- EMC Testing Market

- Emergency Department Information System (EDIS) Market

- Social Employee Recognition System Market

- Dealer Management System Market

- Point of Care Diagnostics Market

- Portable Power Station Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The leading players operating in the Crypto Asset Management Market include Gemini Trust Company, LLC, BitGo, Ripple, CRYPTO FINANCE AG, Coinbase, Fidelity Digital Assets, Bakkt, Paxos Trust Company, LLC, Ledger SAS, Anchorage Digital

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

Some of the customization options available based on the request are an additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The global Crypto Asset Management Market is expected to grow at a CAGR of 23.7% during the forecast period 2024 - 2031.

Integration of Artificial Intelligence and Machine Learning, Development of Multi-Asset Management Platforms, and Focus on Security and Custodial Solutions are the key future trends of the Crypto Asset Management Market.

The major factors driving the Crypto Asset Management Market are: Increased Institutional Investment, Growing Demand for Regulatory Compliance, Rise of Decentralized Finance (DeFi).

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Coinbase

- CRYPTO FINANCE AG

- METACO

- Ledger SAS

- Xapo Holdings Limited

- BitGo

- BAKKT

- ICONOMI LIMITED

- GEMINI TRUST COMPANY

- LLC

- PAXOS TRUST COMPANY

- LLC

Get Free Sample For

Get Free Sample For