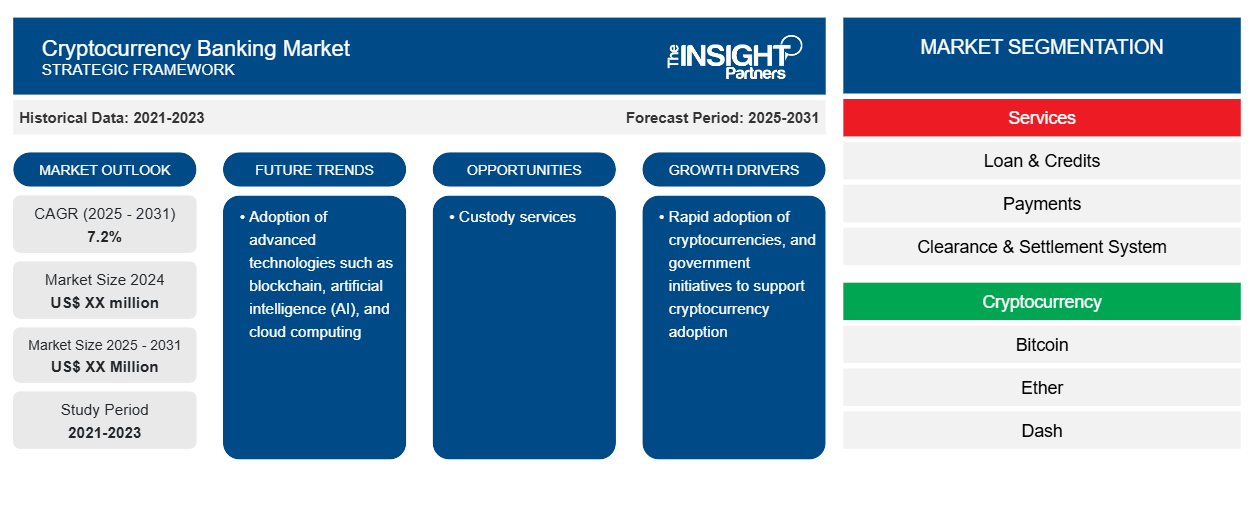

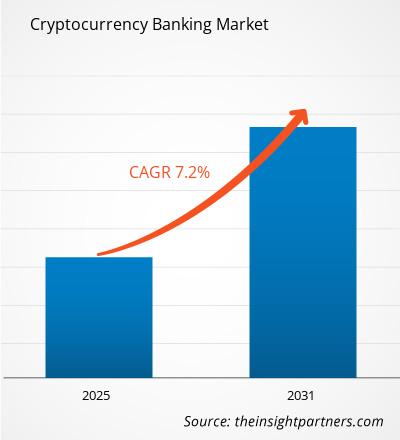

The cryptocurrency banking market size is expected to register a CAGR of 7.2% during 2023–2031. Adoption of advanced technologies such as blockchain, artificial intelligence (AI), and cloud computing is likely to remain a key trend in the market.

Cryptocurrency Banking Market Analysis

The cryptocurrency banking market includes growth prospects owing to the current market trends and their foreseeable impact during the forecast period. The cryptocurrency banking market is growing due to rapid adoption of cryptocurrencies, and government initiatives to support cryptocurrency adoption. Custody services provides lucrative opportunities for cryptocurrency banking market growth.

Cryptocurrency Banking Market Overview

A cryptocurrency bank is a type of financial institution that uses cryptocurrencies rather than conventional money like dollars to provide the same financial services as regular banks (like loans). To make transactions faster, safer, and more convenient, cryptocurrency banks combine the greatest features of digital banks with cryptocurrencies. Traditional banks with cryptocurrency licenses and digital asset platforms with cryptocurrency bank features are two examples of the various sorts of cryptocurrency banks.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cryptocurrency Banking Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cryptocurrency Banking Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Cryptocurrency Banking Market Drivers and Opportunities

Rapid Adoption Of Cryptocurrencies to Favor Market

The cryptocurreny industry is growing in popularity and constantly expanding. Cryptocurrencies have brought transformative changes to the global economic landscape. Cryptocurrency adoption has been significantly increasing as more and more people are turning to digital assets as a viable form of payment. For instance, according to Gitnux, there were over 13,000 cryptocurrencies in existence as of October 2021. Bitcoin is the world’s first cryptocurrency, used by ~101 million users as of Q3 of 2021. With more people embracing digital currencies like Bitcoin, Ethereum, and others, the demand for convenient ways to buy and sell these assets is increasing rapidly.

Custody Services

With numerous applications in digital asset services, Banks may decide to provide commercial banking services to companies that hold cryptocurrency assets, facilitate payment processing and settlements for digital transactions, and transition from traditional custody services (safekeeping, depositary, and settlement services) to next-generation secure digital asset custody services. Other opportunities include running cryptocurrency-based ATMs, wallets and rewards, and merchant processing services utilizing cryptocurrency assets.

Cryptocurrency Banking Market Report Segmentation Analysis

Key segments that contributed to the derivation of the cryptocurrency banking market analysis are services, cryptocurrency, and application.

- Based on services, the cryptocurrency banking market is divided into loan & credits, payments, clearance & settlement system, fundraising, securities, and trade finance.

- By cryptocurrency, the market is segmented into bitcoin, ether, dash, monero, ripple, litecoin, and others.

- By application, the market is segmented into trading, payment, and remittance.

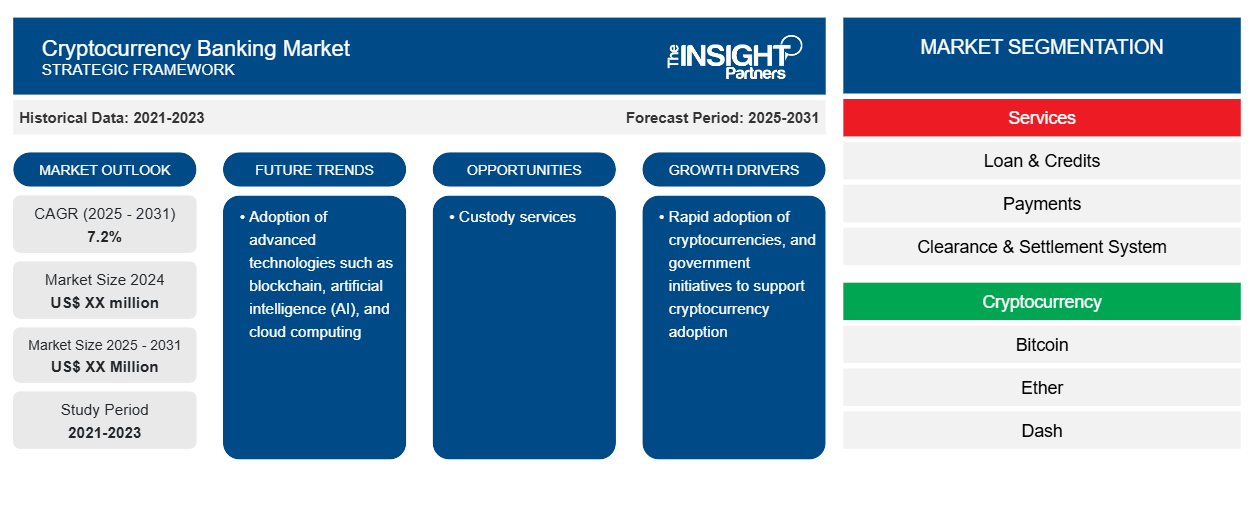

Cryptocurrency Banking Market Share Analysis by Geography

The geographic scope of the cryptocurrency banking market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Cryptocurrency is growing in popularity and usage with Bitcoin and Ethereum being the most preferred among North American users. According to a survey by Coinbase, 20% of American own crypto and 13% of Canadians currently own crypto assets or crypto funds according toa study by Ontario Securities Commission in 2022. Moreover, large banks such as JPMorgan Chase, Goldman Sachs and Bank of America have launched crypto trading desks, and wealth management firms, such as Morgan Stanley and Wells Fargo.

Cryptocurrency Banking Market Regional Insights

The regional trends and factors influencing the Cryptocurrency Banking Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Cryptocurrency Banking Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Cryptocurrency Banking Market

Cryptocurrency Banking Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 7.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Services

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Cryptocurrency Banking Market Players Density: Understanding Its Impact on Business Dynamics

The Cryptocurrency Banking Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Cryptocurrency Banking Market are:

- Bitex International C.V

- Coinbase

- CoolBitX

- Xapo Holdings Limited

- Solidi Ltd

- Safello AB

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Cryptocurrency Banking Market top key players overview

Cryptocurrency Banking Market News and Recent Developments

The cryptocurrency banking market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the cryptocurrency banking market are listed below:

- N26 launches new cryptocurrency trading product, N26 Crypto, for the French market. N26 customers in France will be able to invest in crypto assets directly in their N26 App with the launch of N26 Crypto in France. (Source: N26, Press Release, March 2024)

- PostFinance, one of Switzerland’s leading financial institutions and largest retail banks, launches an innovative crypto offering in partnership with Sygnum, a global digital asset banking group, to offer digital asset services via Sygnum’s B2B banking platform. (Source: Sygnum, Press Release, February 2024)

Cryptocurrency Banking Market Report Coverage and Deliverables

The “Cryptocurrency Banking Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Cryptocurrency banking market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Cryptocurrency banking market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Cryptocurrency banking market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the cryptocurrency banking market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Military Rubber Tracks Market

- Ceramic Injection Molding Market

- Underwater Connector Market

- Legal Case Management Software Market

- Maritime Analytics Market

- Semiconductor Metrology and Inspection Market

- Sodium Bicarbonate Market

- Industrial Inkjet Printers Market

- Social Employee Recognition System Market

- Cut Flowers Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

Some of the customization options available based on the request are additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The leading players operating in the cryptocurrency banking market are Bitex International C.V., Coinbase, CoolBitX, Xapo Holdings Limited, Solidi Ltd, Safello AB, Digital Asset Services Ltd, BitMain Technologies Holding Company, Advanced Micro Devices, Inc, Bitfury Group Limited, N26, PostFinanace, AMINA Bank AG, CB Worldwide Inc, Openware Inc, Mastercard, Ripple, BCB Payments Limited, Antiersolutions, and NerdWallet

Adoption of advanced technologies such as blockchain, artificial intelligence (AI), and cloud computing is anticipated to play a significant role in the global cryptocurrency banking market in the coming years.

The global cryptocurrency banking market is expected to grow at a CAGR of 7.2% during the forecast period 2024 - 2031.

The major factors driving the cryptocurrency banking market are rapid adoption of cryptocurrencies, and government initiatives to support cryptocurrency adoption.

Get Free Sample For

Get Free Sample For