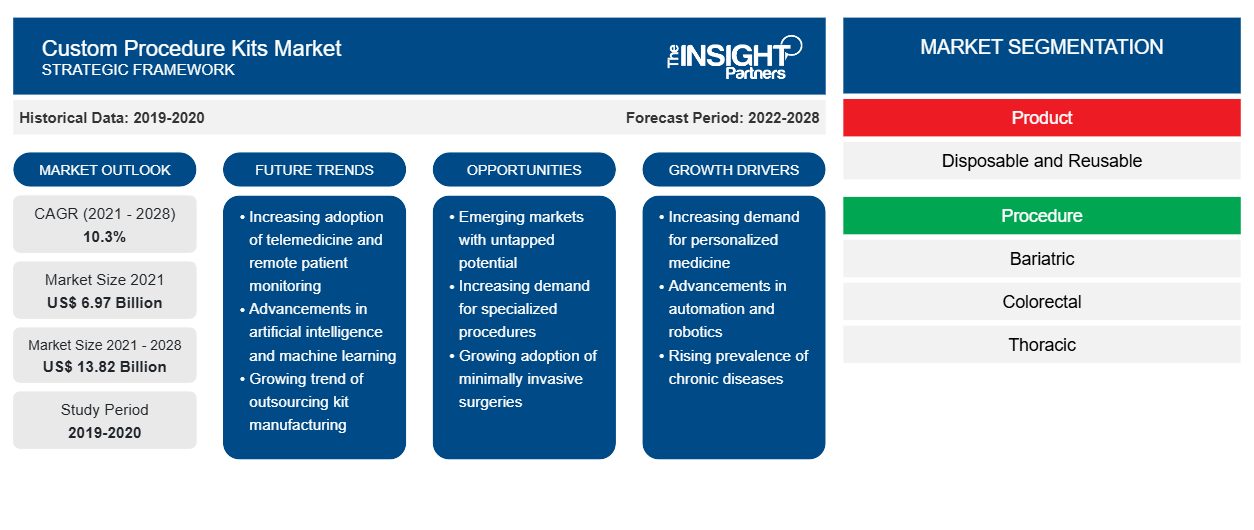

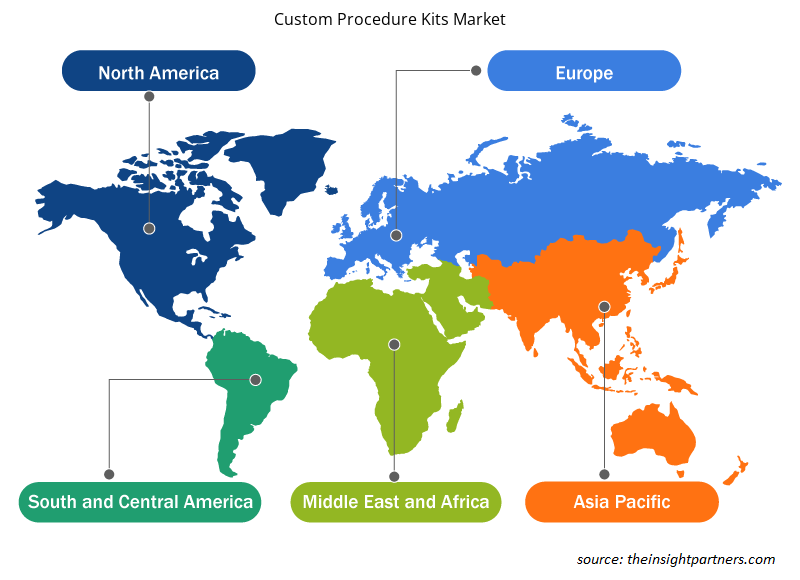

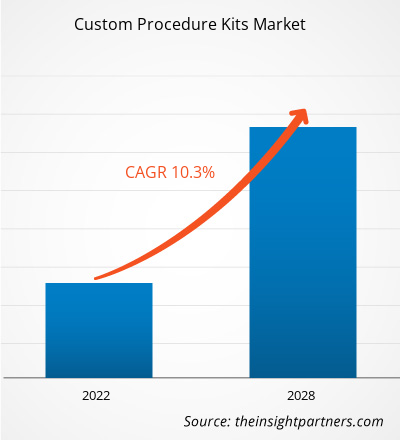

The custom procedure kits market is projected to reach US$ 13,816.53 million by 2028 from US$ 6,970.97 million in 2021. It is expected to grow at a CAGR of 10.3% from 2021 to 2028.

The increasing prevalence of chronic diseases and the rising incidence of cancers and leukemia worldwide have forced the medical industry to perform surgeries. Such factors are likely to drive the custom procedure kits market during the forecast period.

According to the statistics revealed by The Leukemia & Lymphoma Society (LLS), new cases associated with leukemia, lymphoma, and myeloma accounted for almost 9.8% of the estimated 1,898,160 new cancer cases that had been diagnosed in the US in 2021. Additionally, in 2021, 61,090 people were predicted to be diagnosed with leukemia. Furthermore, the Cancer Research UK report states that the proportion of cancer patients having surgery to remove their primary tumor is strongly influenced by the stage at diagnosis. For records, all stages of cancer account for almost 44.8%. Such factors mentioned above are highly responsible for accelerating the custom procedure kits market across the world.

Apart from these, rising cases of road and industrial accidents further drive the adoption of custom procedure kits among hospitals. Also, increasing medical tourism can act as an emerging trend responsible for accelerating the adoption of custom procedure kits at a large scale in the near future. Medical tourism contributes to a diverse landscape change in the healthcare industry as traveling to developing countries for performing surgeries at low rates has gained significant attention worldwide. For example, several patients from the United States travel abroad to receive healthcare services, with most procedures involved including weight loss surgery, dentistry, and cosmetic surgery. The reason more Americans experience medical tourism is simply because of less expensive healthcare. The number of US medical tourists and the number of medical tourists present worldwide is expected to increase by 25% every year as per the estimates by The American Journal of Medicine. Such trends are expected to fuel the sale of custom procedure kits over the next few years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Custom Procedure Kits Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Custom Procedure Kits Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

On the other hand, product recalls associated with custom procedure kits negatively impact the overall market growth. For example, in November 2021, the US Food and Drug Administration (USFDA) reported that Aligned Medical Solutions announced its custom procedure kits product recall. The FDA identified the recall as a Class 1 recall considered one of the most severe types of recall. Furthermore, Cardinal Health with the USFDA announced initiating two voluntary field actions for "Cardinal Health Presource Procedure Packs" in January 2020. These packs contain gowns called for product recalls and kept for voluntary hold. These factors are responsible for the sluggish growth of the custom procedure kits market over the coming years.

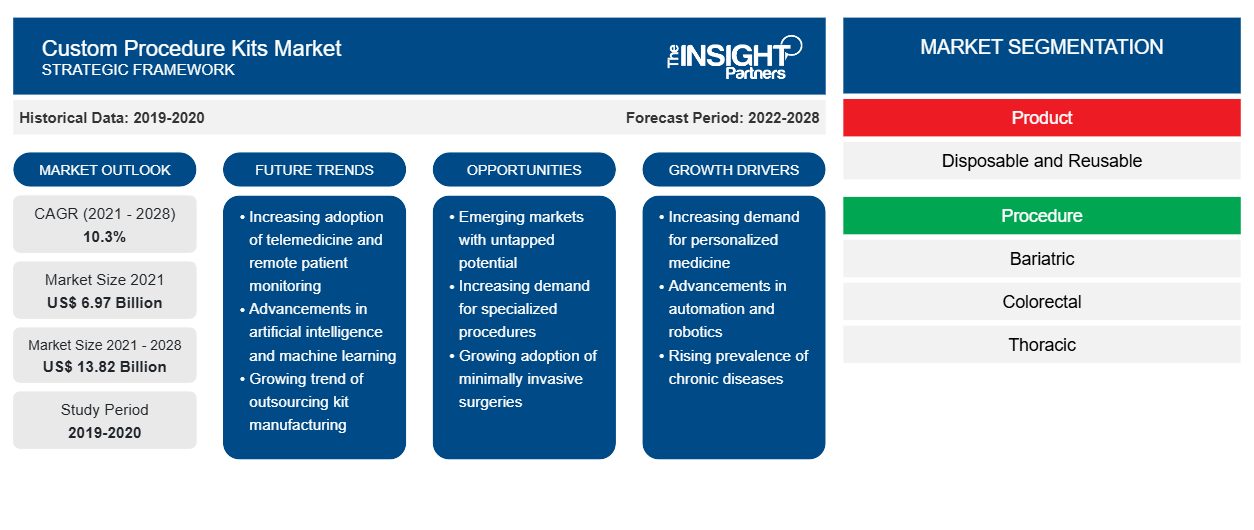

North America is likely to continue its dominance in the custom procedure kits market between 2021 and 2028. The US held the largest market share in this region in 2021, owing mainly to the growing awareness of aesthetic appearance and cosmetic surgeries performed at a larger scale in the US alone. For records, the International Society of Aesthetic Plastic Surgery (ISAPS) reported that breast procedures, body & extremities procedures, and face & head procedures accounted for 40.2%, 37.8%, and 22.0%, respectively, of the overall aesthetic surgeries performed in the US in 2020. Moreover, the same year, the US gained the first position in the total number of aesthetic procedures performed, accounting for 19.0%.

On the other hand, Asia Pacific is expected to witness lucrative growth over the forecast period. Advanced designs of custom graphic trays and sterilization trays to optimize operation theatre workflows in hospital settings and clinics have resulted in a higher demand for custom procedure kits in the regional market, and this trend is expected to continue over the coming years.

Market Insights

Sustainability and Green Management Across the Healthcare Sector Creates New Avenues for the Growth of Custom Procedure Kits Market

The custom procedure kits can save hospital time before, during, and after surgery by cutting preparation time and making it easier to remove waste. Additionally, custom procedure packs can reduce the amount of waste generated in units. For example, the Kingston Hospital witnessed the number of clinical waste bags reducing by 50%, and an initiative taken by the Royal Liverpool and Broadgreen University Hospitals found that utilizing custom procedure kits allows them to eliminate one load of waste per procedure. The Practice Greenhealth report states that a number of mechanisms can be used to reduce waste creation. Examples include strategies for streamlining supply, standardizing custom procedure kits supply, and others. Also, using custom procedure packs allows healthcare providers to work more efficiently and potentially deliver higher quality healthcare and maintain sustainability and green management across the overall healthcare sector. These factors are boosting the uptake of custom procedure kits at a large scale, ultimately stimulating the overall market growth during the forecast period.

Product Type Insights

Based on product type, the custom procedure kits market has been divided into disposable and reusable. The disposable segment is estimated to account for a larger market share from 2021 to 2028. The rising need for cost-efficiency has led to an increased focus on utilizing single-use and disposable products. Disposable items are majorly packaged in the custom procedure packs as it eliminates the need for the problems of sterilization units at hospitals. Additionally, all healthcare-related providers are responsible for preventing and controlling Healthcare-Associated Infections (HAIs). Adopting disposable items in custom procedure kits is a huge step in the right direction, straightforward, cost-effective, and time-effective for handling infection transmission and prevention among the hospital patient population. These factors are expected to positively influence the segment, eventually contributing to the custom procedure kits market over the forthcoming years.

Companies operating in the custom procedure kits market adopt the product innovation strategy to meet the evolving customer demands worldwide, permitting them to maintain their brand name in the global market.

Custom Procedure Kits Market Regional Insights

Custom Procedure Kits Market Regional Insights

The regional trends and factors influencing the Custom Procedure Kits Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Custom Procedure Kits Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Custom Procedure Kits Market

Custom Procedure Kits Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 6.97 Billion |

| Market Size by 2028 | US$ 13.82 Billion |

| Global CAGR (2021 - 2028) | 10.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

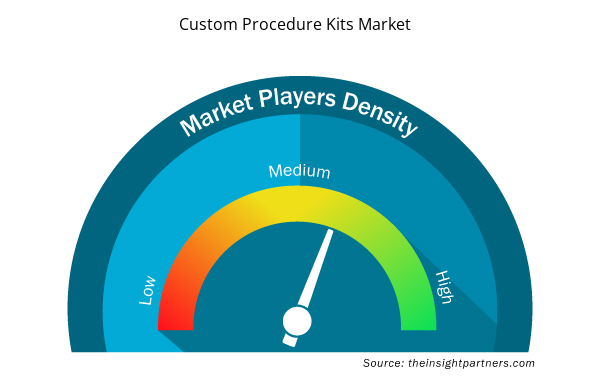

Custom Procedure Kits Market Players Density: Understanding Its Impact on Business Dynamics

The Custom Procedure Kits Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Custom Procedure Kits Market are:

- Medline Industries, Inc.

- Teleflex Incorporated

- Owens & Minor Inc.

- Medtronic

- Cardinal Health Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Custom Procedure Kits Market top key players overview

Custom Procedure Kits Market – Segmentation

Based on product type, the custom procedure kits market has been bifurcated into disposable and reusable. By procedure, the market has been segmented into bariatric, colorectal, thoracic, orthopedic, ophthalmology, spine surgery, cardiac surgery, and others. Based on type, the market has been bifurcated into sterile and non-sterile. Based on geography, the market has been primarily segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America (SCAM). The market in North America has been further segmented into the US, Canada, and Mexico. The European custom procedure kits market has been segmented into France, Germany, the UK, Spain, Italy, and the Rest of Europe. The market in Asia Pacific has been segmented into China, India, Japan, Australia, South Korea, and the Rest of APAC. The custom procedure kits market in the MEA has been segmented into Saudi Arabia, the UAE, South Africa, and the Rest of MEA. The market in South and Central America has been segmented into Brazil, Argentina, and the Rest of South and Central America.

Some leading companies operating in the custom procedure kits market are Medline Industries, Inc.; Teleflex Incorporated; Owens & Minor Inc.; Medtronic; Cardinal Health Inc.; McKesson Corporation; Smith's Medical; Terumo Cardiovascular Systems Corporation; CPT Medical; and OneMed.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Fish Protein Hydrolysate Market

- Diaper Packaging Machine Market

- Automotive Fabric Market

- Semiconductor Metrology and Inspection Market

- Rare Neurological Disease Treatment Market

- Cling Films Market

- Sleep Apnea Diagnostics Market

- Foot Orthotic Insoles Market

- Blood Collection Devices Market

- Hand Sanitizer Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Procedure, and Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Global custom procedure kits market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. In North America, the US holds the largest size of the market in this region. According to the American Society for Aesthetic Plastic Surgery (ASAPS), in 2018, there were 10.2 million treatments performed in the US. The country has well-developed healthcare facilities equipped with highly advanced equipment and instruments. Moreover, the number of surgical and nonsurgical procedures carried out in the United States increased significantly from 1997 to 2020. As per the Health Resource & Service Administration, ~36,528 transplants were performed in 2018, and as of July 2019, more than 113,000 people have been added to the waiting list for organ transplant procedures. Furthermore, the expenditures on the surgical procedures are rising significantly; approximately US$ 8.4 billion were spent by the U.S. government in 2019. Therefore, factors such as growing geriatric population, growing concerns regarding aesthetic appearance that in turn increases the number of cosmetic surgeries, rising number of surgical procedures ,and increasing healthcare expenditures boosts the custom procedure kits market growth.

The custom procedure kits market majorly consists of players such Medline Industries, Inc.; Teleflex Incorporated; Owens & Minor Inc.; Medtronic; Cardinal Health Inc; McKESSON CORPORATION; Smiths Medical; Terumo Cardiovascular Systems Corporation; CPT Medical; and OneMed among others.

The custom procedure kits are a mixture of disposable medical devices put together on specific needs of the medical staff to meet the requirements of the surgery protocols. A custom procedure pack delivers to a hospital or surgeon a specific set of disposable medical products provided in a single packed sterile tray format.

Key factors such as an increase in number of surgeries globally coupled with growing preference of healthcare providers towards procedure specific packs and increase in geriatric population are expected to boost the market growth for the custom procedure kits over the years.

The disposable segment dominated the global custom procedure kits market and held the largest revenue share of 74.08% in 2021.

The orthopedic segment dominated the global custom procedure kits market and held the largest revenue share of 44.86% in 2021.

The sterile segment dominated the global custom procedure kits market and accounted for the largest revenue share of 91.01% in 2021

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Custom Procedure Kits Market

- Medline Industries, Inc.

- Teleflex Incorporated

- Owens & Minor Inc.

- Medtronic

- Cardinal Health Inc

- McKESSON CORPORATION

- Smiths Medical

- Terumo Cardiovascular Systems Corporation

- CPT Medical

- OneMed

Get Free Sample For

Get Free Sample For