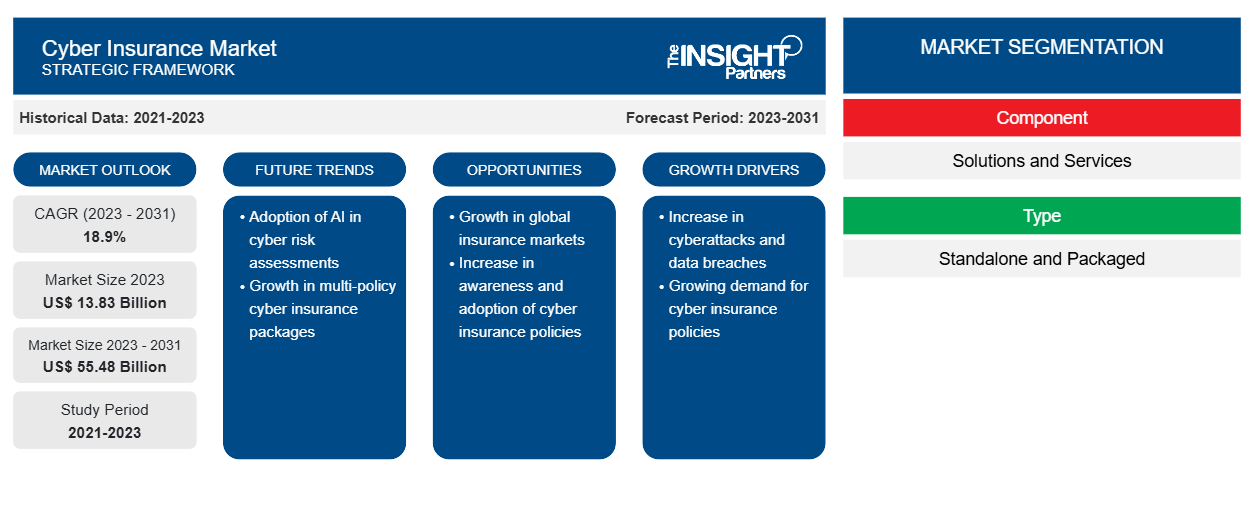

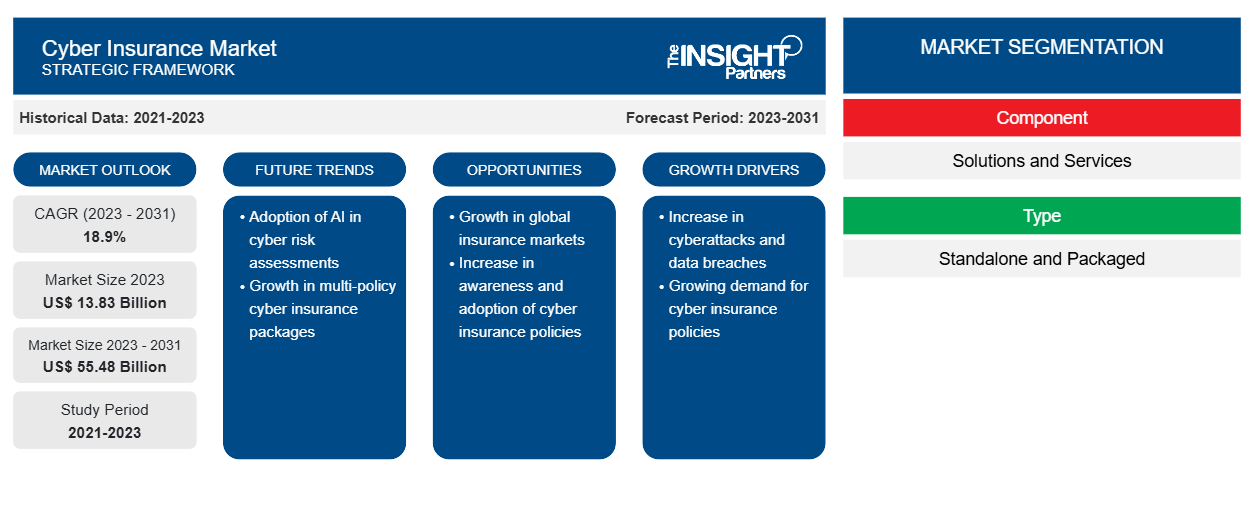

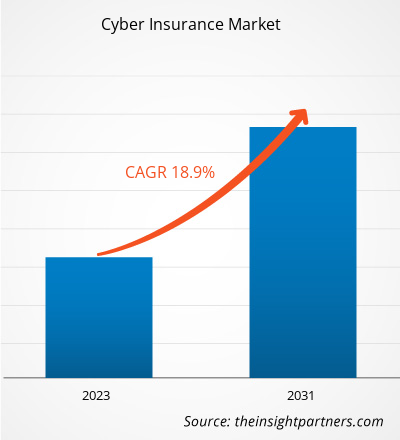

The Cyber Insurance market size is expected to grow from US$ 13.83 billion in 2023 to US$ 55.48 billion by 2031; it is anticipated to expand at a CAGR of 18.9% from 2023 to 2031. Cyber insurance, also known as cyber liability insurance or cybersecurity insurance, is a contract that an organization can purchase to assist in decreasing the financial risks involved with conducting business online. In exchange for a monthly or quarterly charge, the insurance policy transfers some of the risk to the insurer.

Cyber Insurance Market Analysis

The Cyber Insurance market forecast is estimated on the basis of various secondary and primary research findings, such as key company publications, association data, and databases. Cyber insurance is becoming increasingly important for all businesses as the threat of cyberattacks on applications, devices, networks, and users escalates. That is because data compromise, loss, or theft can have a substantial impact on a business, ranging from customer loss to reputational and economic damage. Enterprises may also be held accountable for damages caused by the loss or theft of third-party data. A cyber insurance policy can protect the organization from cyber events, such as cyber terrorism, and assist with the resolution of security incidents. For instance, according to a 2024 report by ASTRA IT, Inc., Cybersecurity statistics show that there are 2,200 cyber attacks every day, with one occurring every 39 seconds on average. In the United States, a data breach costs an average of US$ 9.44 million, with cybercrime costs reaching up to US$ 8 trillion in 2023.

Cyber Insurance

Industry Overview

- Cyberattacks and the number of compromised digital assets increased concurrently. Ransomware and supply chain assaults have dominated the cyber risk landscape over the last few years. Future cyberattacks will be hastened by important technology trends such as artificial intelligence (AI) like ChatGPT, the so-called "metaverse," and the expanding worlds of IT, IoT, and operational technology (OT).

- Malware incidences increased in 2022, hitting 5.5 billion attacks, a 2% increase year on year, according to the SonicWall Cyber Threat Report for 2023. Malware is malicious software that infects a computer and is intended to disrupt, damage, or gain unauthorized access to the computer system.

- In addition to the increasing sophistication of cyber-criminal operations, companies globally are more vulnerable than ever to geopolitical crises, which are already having an unprecedented influence on cybersecurity. In today's digital age, cyber risk management is essential. Demand for cyber insurance is high because it is such an important aspect of this. Creating a robust cyber insurance market is a critical task for the insurance industry.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cyber Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cyber Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Cyber Insurance Market Driver

Increased Awareness of Cyber Risks to Drive the Cyber Insurance Market

- A surge in cyberattacks, combined with growing knowledge of such crimes, has led to an increase in demand for cyber insurance plans. The increase in such instances has also resulted in a surge in claims for insurance firms, forcing them to tighten their underwriting criteria.

- In the US since 2004, October has been celebrated as Cyber Security Awareness Month. Every year in this month public and private sectors work together in dedication to raise awareness about the importance of cybersecurity. Over time, it has evolved into a collaborative effort between government and industry to raise cybersecurity awareness, inspire public action to reduce online risk and generate national and worldwide discussion about cyber dangers. October 2023 was the twentieth Cybersecurity Awareness Month.

- In 2023, the Cybersecurity and Infrastructure Security Agency (CISA) in the US launched a cybersecurity awareness program name Secure Our World. This will be the enduring theme for all the upcoming cybersecurity awareness months.

- Similarly, many countries across the world have been initiating programs to create cyber security awareness among the netizens. For instance, Poland's Cybersecurity Strategy for 2019-2024 aims to improve resistance to cyber threats and strengthen data protection. This includes raising awareness about cybersecurity. Portugal's Cybersecurity Strategy 2019-2023 focuses on "prevention, education, and awareness". It includes specific action points such as promoting cross-cutting cybersecurity training programs for organizations and citizens, strengthening cyberspace security skills in education, and promoting digital literacy.

Cyber Insurance

Market Report Segmentation Analysis

- Based on the end user, the cyber insurance market report is segmented into healthcare, retail, BFSI, it & telecom, manufacturing, and others.

- The BFSI segment is expected to hold a significant cyber insurance market share in 2023. With increased cyber risk, banks and financial institutions are putting more emphasis on strengthening their cyber resilience. Financial institutions have broad operational scopes across numerous business lines and require a comprehensive cyber insurance plan to manage cyberattacks and business disruption.

Cyber Insurance

Market Analysis by Geography

The scope of the cyber insurance market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant cyber insurance market share. This supremacy is due to the region's superior technological infrastructure, the presence of big multinational firms, and increased awareness of cyber risks.

Cyber Insurance

Cyber Insurance Market Regional Insights

The regional trends and factors influencing the Cyber Insurance Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Cyber Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Cyber Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 13.83 Billion |

| Market Size by 2031 | US$ 55.48 Billion |

| Global CAGR (2023 - 2031) | 18.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Cyber Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Cyber Insurance Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Cyber Insurance Market top key players overview

The "Cyber Insurance Market Analysis" was carried out based on core investment strategies and geography. In terms of type, the market is segmented into standalone and packaged. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Cyber Insurance

Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the Cyber Insurance market. A few recent key market developments are listed below:

- In February 2023, Munich Re Specialty Insurance (MRSI) announced the launch of Reflex, a tailored cyber risk management program. Reflex is a white-glove program run by a team of Munich Re program specialists. Insured individuals will have guided access to services customized to their changing requirements. A team of industry professionals in privacy, network security, and cyber training and awareness delivers program services.

[Source: Munich Re, Company Website]

Cyber Insurance

Market Report Coverage & Deliverables

The market report "Cyber Insurance Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

Frequently Asked Questions

What are the future trends of the Global Cyber Insurance market?

Which are the key players holding the major market share of the global Cyber Insurance market?

What are the driving factors impacting the global Cyber Insurance market?

What will be the market size of the global Cyber Insurance market by 2031?

What is the estimated market size for the global Cyber Insurance market in 2023?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we'll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report's scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we'll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

Get Free Sample For

Get Free Sample For