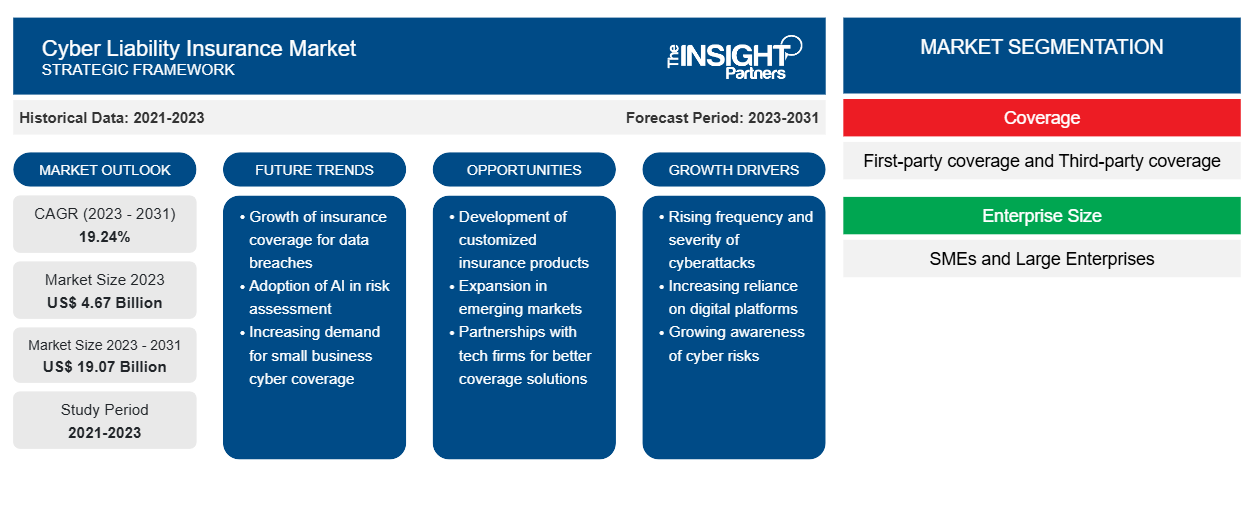

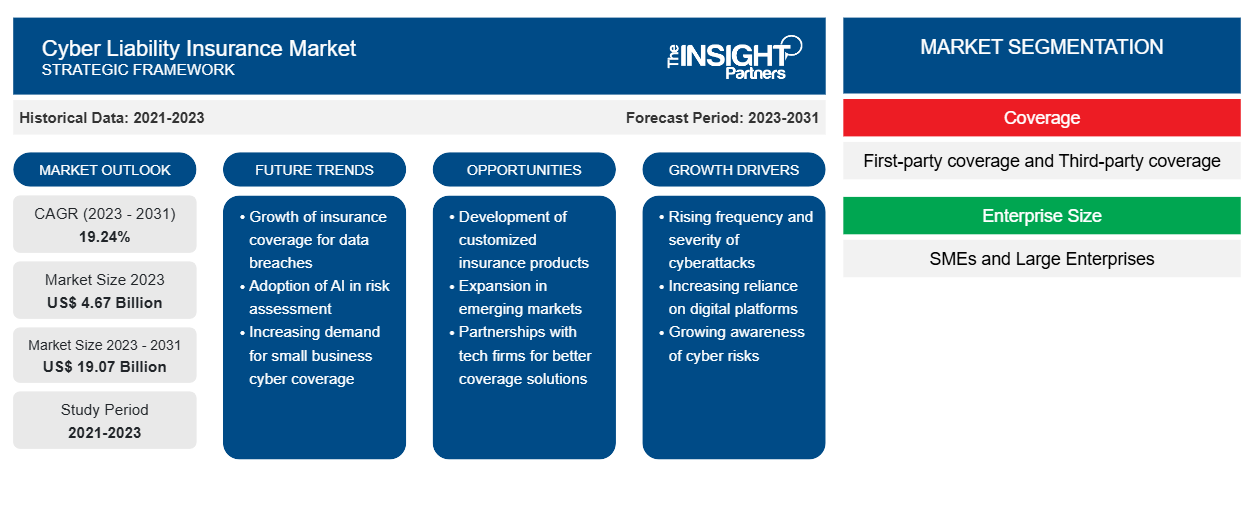

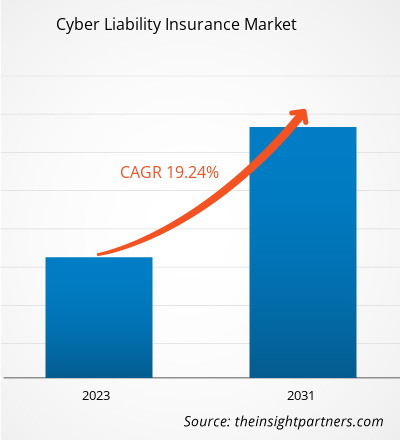

The cyber liability insurance market is expected to grow from US$ 4.67 billion in 2023 to US$ 19.07 billion by 2031; it is anticipated to expand at a CAGR of 19.24% from 2023 to 2031. Factors such as increasing cyber threats and regulatory compliance are driving the cyber liability insurance market growth.

Cyber Liability Insurance Market Analysis

The cyber liability insurance market is constantly evolving to address the rising challenges posed by cyber threats. As cyber threats become more widespread and sophisticated, there is a rising demand for cyber liability insurance coverage. Organizations across industries are recognizing the need to protect themselves from possible financial losses and reputational damage caused by cyberattacks. The rapid development of technology, such as artificial intelligence, the Internet of Things (IoT), and operational technology (OT), presents both opportunities and risks in the cyber liability insurance market growth. While these technologies offer great benefits, they also create new attack surfaces and vulnerabilities. Insurers have the opportunity to develop innovative coverage solutions to address these emerging risks.

Motor Insurance Market Overview

- Cyber liability insurance is a type of insurance coverage that helps safeguard businesses from financial losses and liabilities resulting from cyber incidents and data breaches. It provides coverage for expenses related to investigating and remediating cyberattacks, legal responsibilities, business interruption, loss of revenue, and data restoration, among other costs associated with cyber incidents.

- Insurers are focusing on providing comprehensive risk management and pre-breach services to their policyholders. These services help organizations assess their cyber risks, implement robust risk management strategies, and enhance their cyber resilience. For example, Spring Insure introduced a commercial cyber offering tailored for small and medium-sized enterprises (SMEs), which includes access to risk management and pre-breach services.

- The market has seen changes in premiums and coverage. Insurance clients are opting for cyber coverage at an increasing rate, leading to adjustments in pricing and availability. Insurers are working to strike a balance between meeting the demand for coverage and maintaining profitability. They are also adapting their coverage offerings to address evolving cyber risks and uncertainties.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cyber Liability Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cyber Liability Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Cyber Liability Insurance Market Drivers and Opportunities

Increasing Cyber Threats to Drive the Cyber Liability Insurance Market

- The increasing number and complexity of cyber threats, such as data breaches, ransomware attacks, and hacking incidents, are driving the demand for cyber liability insurance in the market. Organizations are recognizing the need to protect themselves from financial losses and reputational damage caused by cyber incidents.

- Cyber threats have become more prevalent and advanced, posing significant risks to businesses. Data breaches, where sensitive information is compromised, can result in financial losses, legal liabilities, and damage to a company's reputation. Ransomware attacks, where hackers encrypt data and demand a ransom for its release, can disrupt business operations and lead to financial losses. Hacking incidents can compromise systems and networks, allowing unauthorized access to sensitive data.

Cyber Liability Insurance Market Report Segmentation Analysis

- Based on coverage, the market is segmented into first-party coverages and third-party coverages. The first-party coverage segment is expected to hold a substantial cyber liability insurance market share in 2023.

- The first-party coverage segment refers to the coverage provided by cyber liability insurance policies for the insured company's losses and expenses resulting from a cyber incident. This coverage is designed to lessen the financial impact on the company that purchased the insurance. This coverage helps cover the expenses incurred by the insured company in responding to a data breach. It may include costs such as forensic investigations to determine the cause and extent of the breach, notification of affected individuals, credit monitoring services, public relations efforts, and legal expenses.

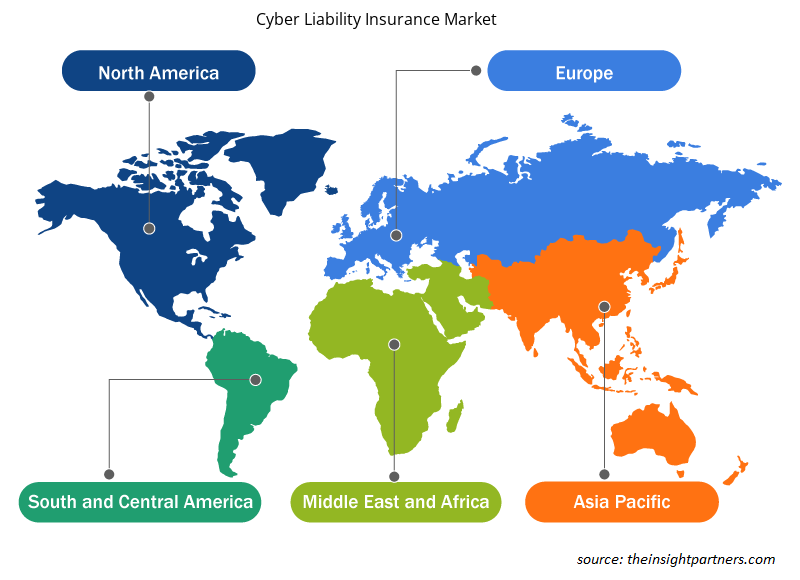

Cyber Liability Insurance Market Regional Analysis

The scope of the cyber liability insurance market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant cyber liability insurance market share. The North American region, particularly the US, dominates the North America market. North America benefits from advanced technological infrastructure and a high level of cyber technology adoption. This creates a greater need for cyber liability insurance as organizations strive to protect themselves from financial losses and reputational damage affected by cyber incidents. The US, in particular, exhibits significant opportunities for cybersecurity insurance solution providers due to its strict regulations and the presence of a diverse range of industries. Cyberattacks have a sizable financial impact on enterprises of all sizes, including critical infrastructure sectors. As a result, organizations in North America are increasingly recognizing the importance of cyber liability insurance.

Cyber Liability Insurance Market Regional Insights

Cyber Liability Insurance Market Regional Insights

The regional trends and factors influencing the Cyber Liability Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Cyber Liability Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Cyber Liability Insurance Market

Cyber Liability Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.67 Billion |

| Market Size by 2031 | US$ 19.07 Billion |

| Global CAGR (2023 - 2031) | 19.24% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Coverage

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Cyber Liability Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Cyber Liability Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Cyber Liability Insurance Market are:

- AIG

- AmTrust Financial

- AXA SA

- Chubb

- GEICO

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Cyber Liability Insurance Market top key players overview

The "Cyber Liability Insurance Market Analysis" was carried out based on coverage, vehicle type, application, and geography. In terms of coverage, the market is segmented into first-party coverage and third-party coverage. Based on Enterprise Size, the market is segmented into SMEs and large enterprises. Based on end user, the market is segmented into BFSI, IT and ITES, retail and e-commerce, travel and tourism, hospitality, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Cyber Liability Insurance Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the market. The cyber liability insurance market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. A few recent key market developments are listed below:

- In February 2024, RT Specialty, the wholesale distribution division of Ryan Specialty, a leading international specialty insurance firm, announced the addition of Cyber Liability to its proprietary digital platform, RT Connector.

[Source: Ryan Specialty, LLC, Company Website]

- In July 2023, Risk Strategies, an insurance brokerage, and risk management company, introduced its Cyber Risk Management Platform (RMP), a novel service offering focused on cyber risk management. This platform goes beyond traditional external vulnerability scans by providing clients with practical recommendations to strengthen their cyber defenses.

[Source: Risk Strategies, Company Website]

Cyber Liability Insurance Market Report Coverage & Deliverables

The market report “Cyber Liability Insurance Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas: -

- Market size & forecast at global, regional, and country level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Coverage, Enterprise Size, End user, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the market are AIG; AmTrust Financial; AXA SA; Chubb; and GEICO.

The market is expected to reach US$ 19.07 billion by 2031.

The market was estimated to be US$ 4.67 billion in 2023 and is expected to grow at a CAGR of 19.24% during the forecast period 2023 - 2031.

Integration with cybersecurity solutions is anticipated to play a significant role in the market in the coming years.

Increasing cyber threats and regulatory compliance are the major factors that propel the market.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- AIG

- AmTrust Financial

- AXA SA

- Chubb

- GEICO

- Hiscox Inc.

- Nationwide Mutual Insurance Company

- Progressive Casualty Insurance Company

- The Hartford

- Zurich American Insurance Company

Get Free Sample For

Get Free Sample For