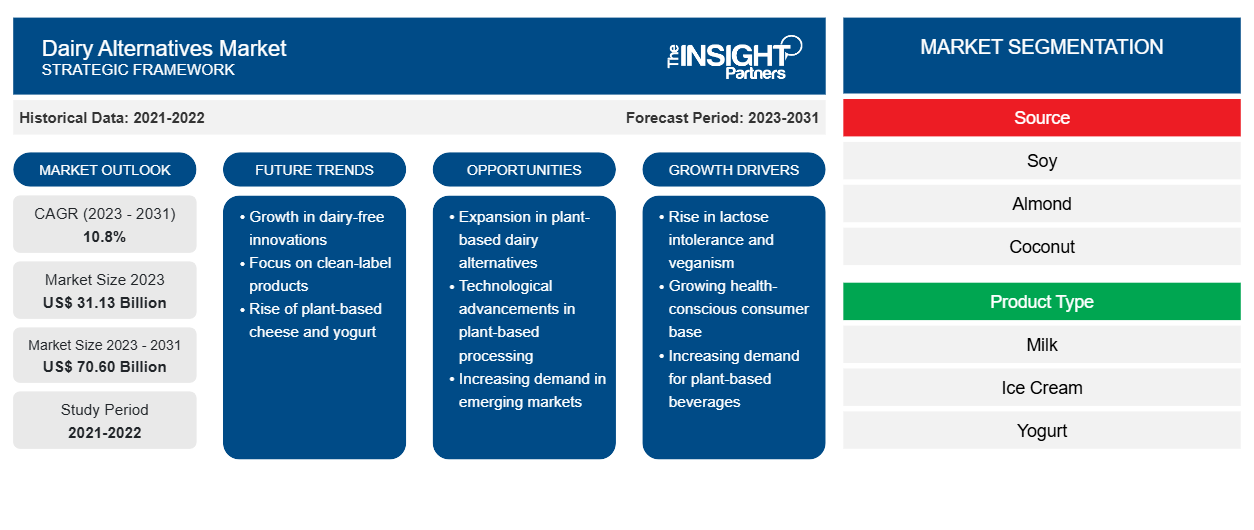

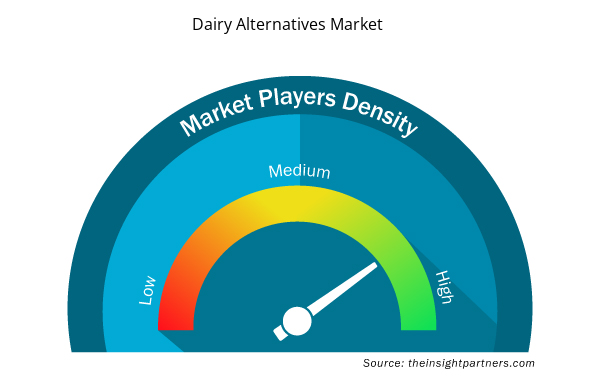

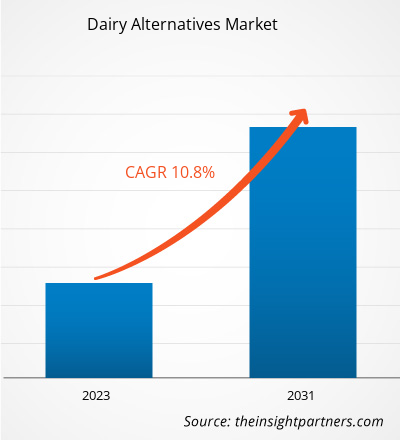

The dairy alternatives market size is projected to reach US$ 70.60 billion by 2031 from US$ 31.13 billion in 2023. The market is expected to register a CAGR of 10.8% during 2023–2031. Surging demand for functional dairy alternatives is likely to remain a key trend in the market.

Dairy Alternatives Market Analysis

The vegan population has grown significantly over the past few years. According to Veganuary (a non-profit organization that encourages individuals worldwide to go vegan for the entire month of January), more than 620,000 people registered for the Veganuary campaign in 2022, and the registrations increased by 200% in the last 3 years. People are increasingly switching to a vegan diet due to increased health and sustainability concerns. The livestock industry is one of the significant contributors to the total anthropogenic greenhouse gas emissions. According to the Food and Agriculture Organization (FAO), the worldwide livestock industry emits 7.1 gigatons of carbon dioxide per year, accounting for 14.5% of all human-caused greenhouse gas emissions. The dairy sector is responsible for 30% of the total livestock emissions.

Many studies have shown that shifting to a vegan diet can significantly lower carbon dioxide emissions. According to Dr. Fredrik Hedenus, a professor at the Chalmers University of Technology, Sweden, and the co-author of a research paper on meat and dairy consumption, published in the journal 'Climate Change,' reducing the consumption of meat and dairy products can be crucial to bringing agricultural climate pollution down to acceptable levels.

Moreover, many organizations, such as the United Nations, PETA, and Good Food Institute, believe that veganism can help save the planet from the climate crisis. The awareness regarding the harmful effects of the livestock industry on the environment is increasing among consumers. The consumption of plant-based dairy products helps minimize carbon footprints, save water and other natural resources, and reduce the overall environmental impacts. Therefore, consumers are rapidly switching to plant-based dairy and meat products. This factor is significantly driving the dairy alternatives market.

Dairy Alternatives Market Overview

Dairy alternatives such as milk, yogurt, ice cream, cheese, and butter are made from soymilk, pea milk, , and coconut milk. Soymilk is more affordable than other plant milk, and it provides a similar amount of protein as whole milk. Consumers are highly inclined toward plant-based or vegan-friendly products due to increasing health concerns and growing awareness of animal welfare. Plant-based products are generally perceived to be healthier alternatives. Moreover, dairy farming is negatively impacting the overall environment leading to climate change. This factor is also influencing the growth of the dairy alternatives market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Dairy Alternatives Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Dairy Alternatives Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Dairy Alternatives Market Drivers and Opportunities

Rising Incidences of Lactose Intolerance to Favor Market

According to the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), an average of 68% of the world’s population has lactose intolerance. According to the National Institute of Health (NIH), lactose intolerance is quite common in the adult population in East Asia, affecting 75–95% of the people in these communities. Moreover, congenital lactose deficiency is largely observed across Asia Pacific and Africa. Thus, countries such as China, Japan, South Korea, and Taiwan are potential markets for dairy alternatives.

Plant-based dairy products have similar texture, creaminess, and consistency to conventional dairy products. They are fortified with nutrients, such as protein and calcium, to meet the daily nutrient requirements of consumers. Thus, the increasing prevalence of lactose intolerance and milk allergies among consumers is driving the dairy alternatives market.

Increasing Number of New Product Launches to Provide Massive Growth Opportunities

Manufacturers of dairy alternatives are making significant investments in product innovation to appeal to a large group of consumers. Product innovation strategy offers a competitive edge to the players operating in the market, boosting their profitability. The manufacturers of dairy alternatives offer certified organic, non-GMO, gluten-free, clean-label, and allergen-free products to cater to emerging customer requirements. Moreover, as consumers have become health-conscious, they prefer low-calorie and low-fat products. Therefore, manufacturers of plant-based dairy offer unsweetened and low-sugar products. For instance, in February 2021, Hasla Foods launched zero-sugar oat milk yogurt in a 24 oz family size. The product contains only 90 calories per serving and has no added sugar. In June 2021, the same company expanded its retail footprint by making its products available across 160 National Grocers by Vitamin Cottage stores in the US.

Further, manufacturers are experimenting with different sources of plant-based milk, such as barley, peas, hemp, chia seeds, bananas, and cashews. For instance, Take Two Foods, one of the key manufacturers of plant-based milk, offers nutrient-enriched barley milk, which has a complete portfolio of nutrients, such as protein, fiber, calcium, and unsaturated fats. Such strategies are expected to provide lucrative opportunities to the dairy alternatives market during the forecast period.

Dairy Alternatives Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Dairy Alternatives Market analysis are source, product type, and distribution channel.

- Based on source, the dairy alternatives market is divided into soy, almond, coconut, oats, and others. The soy segment held the largest market share in 2023. Soy is projected to gain popularity among the elderly and female consumers in the US, as it includes isoflavones, which are claimed to lower the risk of heart disease and breast cancer. Soy also contains phytoestrogen, a hormone that works similarly to estrogen in women. Consuming soy-based dairy alternatives is popular among women as an alternative therapy for raising estrogen levels. Soy is rich in nutrients and has a high protein content compared to other dairy alternatives; therefore, the popularity of soy for its benefits culminates in driving the market for the segment during the forecast period.

In terms of distribution channel, the market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. The supermarkets and hypermarkets segment dominated the market in 2023. Supermarkets and hypermarkets are large retail establishments that offer a wide range of groceries, foodstuffs, beverages, and other household goods. Products from various brands are available at reasonable prices in these stores, allowing shoppers to find the right product quickly. Moreover, these stores offer attractive discounts, multiple payment options, and a pleasant customer experience. Supermarkets and hypermarkets focus on maximizing product sales to increase their profit margins. Manufacturers of plant-based dairy products usually prefer to sell their products through supermarkets and hypermarkets owing to the high footfall received by these stores. Increasing urbanization, rising working-class population, and competitive pricing boost the popularity of supermarkets and hypermarkets in developed and developing regions.

Dairy Alternatives Market Share Analysis by Geography

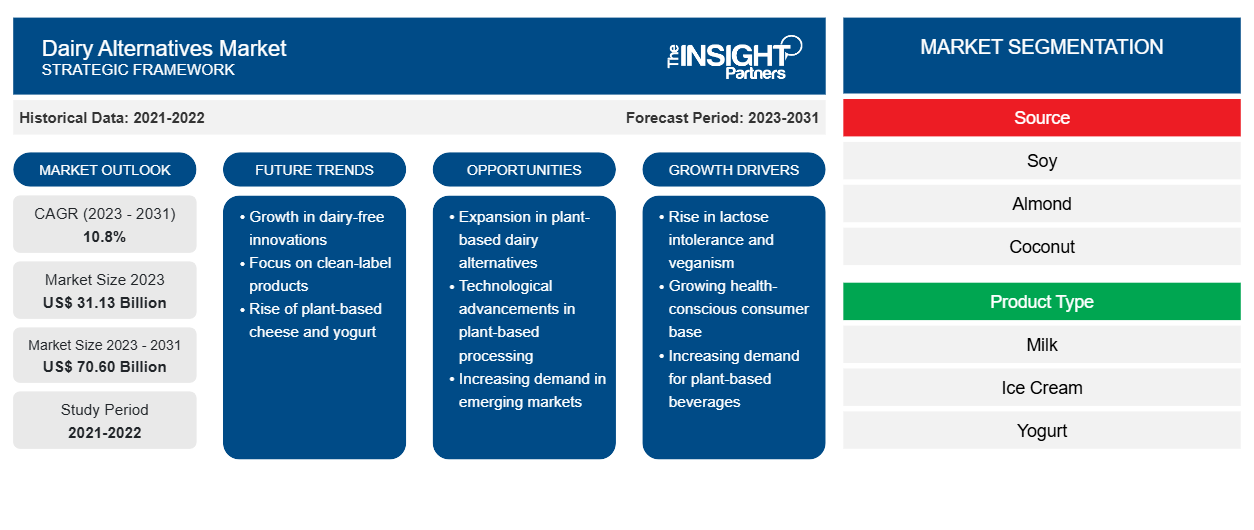

The geographic scope of the dairy alternatives market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

The Asia Pacific dairy alternatives market held the largest market share in 2023. In recent years, the consumption of milk alternatives has steadily increased due to the growing number of lactose-intolerant people and health concerns about antibiotics and growth hormones that are often found in cow's milk. The research conducted by Rakuten in 2021 showed that 87% of consumers in China had tried plant-based milk, 50% had tried other dairy substitutes, 42% had tried plant-based meat, and 32% had tried vegan egg replacements. Furthermore, the same research found that 3% of respondents only consume plant-based foods. Thus, the dairy alternatives market is growing due to the increasing demand for plant-based dairy products due to the increasing prevalence of lactose intolerance across Asia Pacific.

Dairy Alternatives Market Regional Insights

The regional trends and factors influencing the Dairy Alternatives Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Dairy Alternatives Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Dairy Alternatives Market

Dairy Alternatives Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 31.13 Billion |

| Market Size by 2031 | US$ 70.60 Billion |

| Global CAGR (2023 - 2031) | 10.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Source

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Dairy Alternatives Market Players Density: Understanding Its Impact on Business Dynamics

The Dairy Alternatives Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Dairy Alternatives Market are:

- SunOpta

- Blue Diamond Growers

- Nestle SA

- Danone S.A.

- Oatly Inc

- Califia Farms, LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Dairy Alternatives Market top key players overview

Dairy Alternatives Market News and Recent Developments

The dairy alternatives market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for speech and language disorders:

- Plant-based milk brand milkadamia moves into the refrigerated set and proves “less is more” with the debut of its organic Artisan macadamia milk and blends line that skips the fillers and gums common in many non-dairy beverages and responds to a growing demand for more homemade-like options. (Source: Dairy Alternatives – Milkadamia, Press Release/Company Website/Newsletter, 2024)

- Califia Farms launched Califia Farms Complete, a creamy plant milk with nine essential nutrients, eight grams of protein, all nine essential amino acids, and half the sugar of dairy milk, the company stated. (Source: Dairy Alternatives Califia Farms LLC, Press Release/Company Website/Newsletter, 2024)

Dairy Alternatives Market Report Coverage and Deliverables

The “Dairy Alternatives Market Size and Forecast (2023–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Source, Product Type, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For