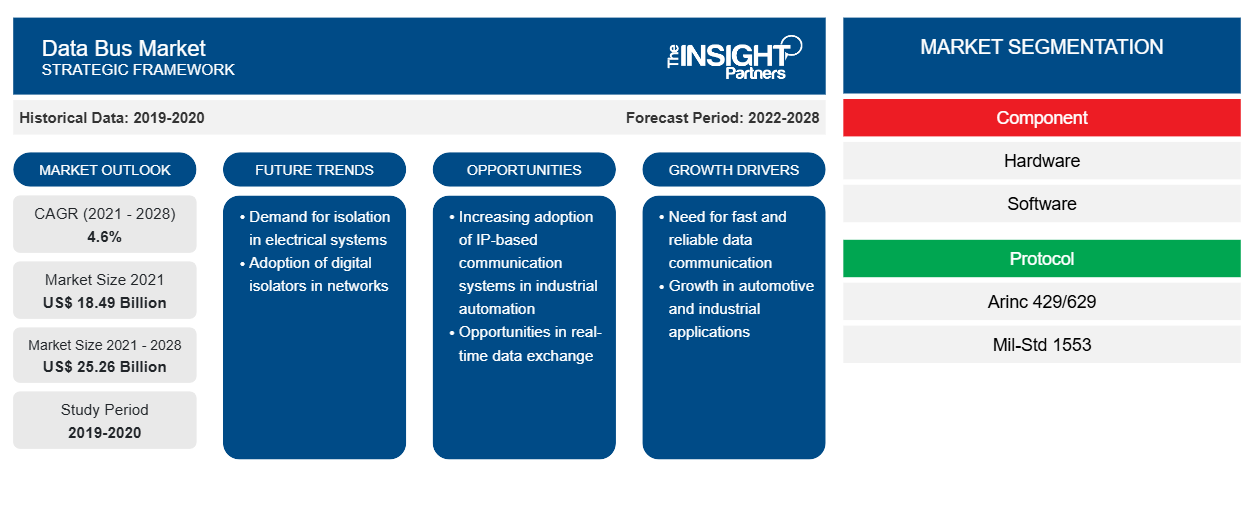

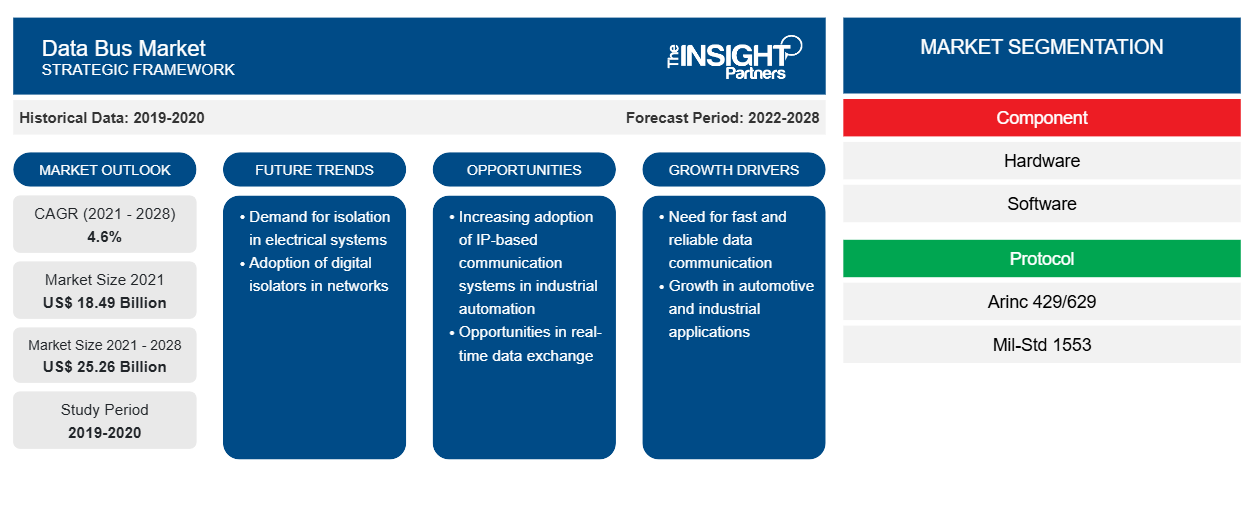

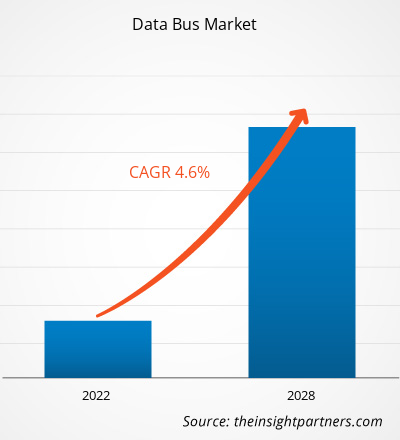

The Data Bus Market is expected to grow from US$ 18,488.9 million in 2021 to US$ 25,258.0 million by 2028; it is estimated to grow at a CAGR of 4.6% during 2021-2028.

The term "data bus" refers to an internal pathway built for data transmission amid processors or memory. Over the years, numerous types of data buses have evolved to comply with various hardware devices such as data storage units and processors. Diverse types of data bus systems in personal computers and other hardware have evolved. Data bus systems are used in various applications, including marine, automotive, commercial aviation, and military applications. The continuous modernization of military aircraft can decrease the possibilities of mishaps resulting from errors introduced by pilots, enhance mission capacities, and increase comprehension of circumstances. The growth of the data bus market is attributed to the increase in passenger car orders, rise in the number of aircraft deliveries, upgrade of naval and airborne programs, and a need to decrease swap specifications. The average life of a data bus ranges from 35 to 45 years, and after that, the systems need an upgrade. The long-life hampers the growth of the Data Bus Market as it reduces the chances of replacing the systems that are currently in use with the new ones.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Data Bus Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Data Bus Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Data Bus Market

The COVID–19 outbreak has significantly affected the world and is continuing to shatter several countries. Until the outbreak of COVID–19, the aerospace industry was experiencing substantial growth in terms of production, despite huge backlogs from the aircraft manufacturers. The global aviation industry witnessed a significant rise in the number of passengers count and an increase in aircraft procurement.

Unfortunately, the COVID–19 outbreak decimated the demand for aircraft globally, which reflected significantly lower volumes of orders among the aircraft manufacturers, which resulted in a lower number of productions. The decline in production volumes adversely affected the businesses of various component manufacturers and associated technologies. Thus, the Data Bus Market players' businesses have been severely affected by destabilization in aircraft production.

According to the Electronic Components Industry Association (ECIA), the emergence of COVID-19 has highlighted delays in product releases, disruption in supply chain events, and other industrial activities. Several manufacturers have temporarily halted the manufacturing units, owing to lesser demand for the products as a result of lockdown measures and limited manufacturing resources. Additionally, the manufacturers of various electronic and semiconductor products, including data cables, have been experiencing a substantial delay in lead times, which has weakened the supply chain. This has had a negative impact on the Data Bus Market.

During the pandemic, the entire data bus market came to a halt with minimal resources to foresee the future. Several production units in the US, France, Russia, and China were temporarily halted to adhere to the government rules regarding lockdown and physical distancing. The aircraft manufacturers witnessed a 14–15% general aviation market revenue reduction. This resulted in the decline of Data Bus Market revenue.

Data Bus Market Insights

Ongoing Modernization in Military Aviation

Increasing military spending in emerging economies is driving investments in modernizing existing equipment in aging aircraft. Due to technical problems with various constructions, and issues with propulsion, connection, and other systems, there is a growing demand for technologically superior military aircraft to replace conventional military aircraft. To address the continuously rising number of threats and completely new mission requirements. Fully connected airlines, on the ground and in the air, may use real-time data to improve flight deck operations, reduce future timelines, and enhance customer experience. Thus, many aircraft manufacturers have upgraded their aircraft to include network capabilities that provide in-flight connectivity, which has propelled the demand for data bus. The expansion of the aerospace & military sector is further likely to boost the global market growth in the coming years. The adoption of FlexRay protocols and organic and inorganic growth tactics in military aviation is expected to boost the growth of the global data bus market. The expansion of the global data bus market is further driven by commercial and military aircraft. The need for integration of full-duplex switching ethernet, monitoring systems, cockpit systems, flight control, navigation systems, air data systems, communications systems, and central maintenance systems into single modular avionics systems is also driving the Data Bus Market.

Component-Based Market Insights

Based on component, the Data Bus Market is segmented into hardware and software. The hardware segment further comprises cables and connectors, assemblies/terminators, data bus couplers, interface cards/boards, and others.

Protocol-Based Market Insights

Based on protocol, the Data Bus Market is segmented as Arinc 429/629, Mil-Std 1553, and others. The protocol is the language that is utilized on an aviation data bus. Protocols are a set of formal rules and norms that regulate data exchange between systems. The protocol specifies the transmission and receipt of data on a bus. Also governed by protocol and its accompanying components are data collision prevention, integrity, and bus speed. The electrical and physical standards are defined via low-level protocols. Data formatting, including message syntax and format, is dealt with by high-level protocols.

Players operating in the Data Bus Market adopt strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key players are listed below:

- In 2021, Astronics Corporation announced the launch of new protocol models for its Ballard ME1000 family of mPCIe avionics interface cards for embedded aerospace applications. The new models provide interfacing capability for ARINC 429 and ARINC 717 databus protocols, and join models for MIL-STD-1553 that were previously released.

Data Bus Market Regional Insights

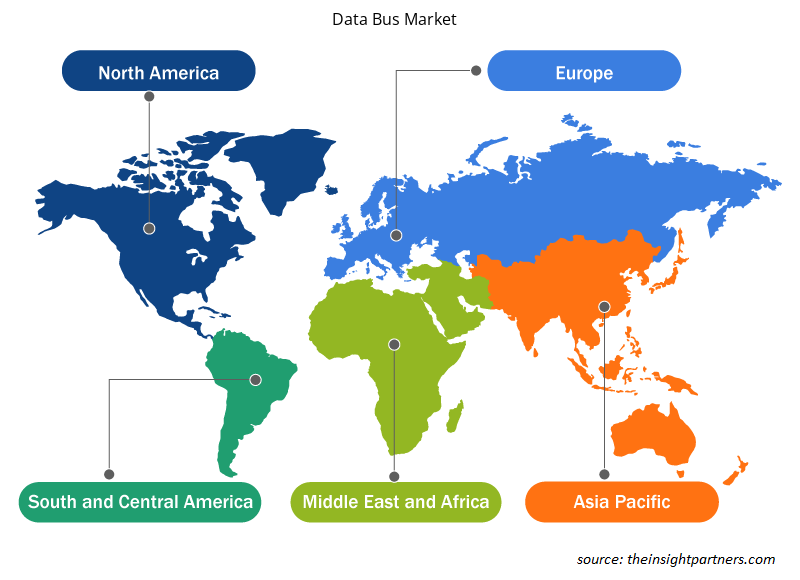

The regional trends and factors influencing the Data Bus Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Data Bus Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Data Bus Market

Data Bus Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 18.49 Billion |

| Market Size by 2028 | US$ 25.26 Billion |

| Global CAGR (2021 - 2028) | 4.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

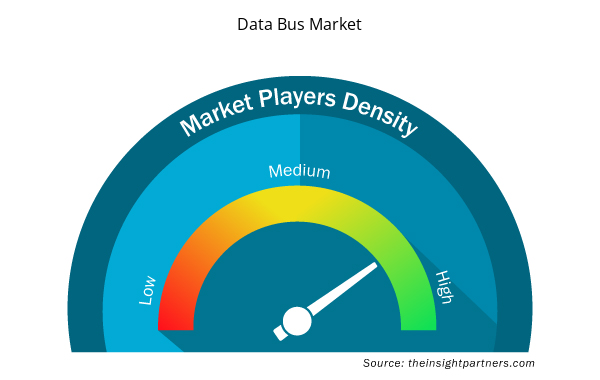

Data Bus Market Players Density: Understanding Its Impact on Business Dynamics

The Data Bus Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Data Bus Market are:

- Astronics Corporation

- Amphenol Ltd.

- Collins Aerospace

- Data Device Corporation

- Data Bus Products Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Data Bus Market top key players overview

The Data Bus Market has been segmented and analyzed based on component, protocol, and application. Based on component, the Data Bus Market is further segmented into hardware and software. In terms of protocol, the Data Bus Market is segmented into ARINC 429/629, MIL–STD-1553, and others. Based on application, the Data Bus Market is further segmented into automotive, marine, commercial aviation, and military aviation.

Astronics Corporation, Collins Aerospace, Fujikura Ltd., HUBER+SUHNER, Nexans, TE Connectivity Corporation, Amphenol Ltd., Data Device Corporation, Data Bus Corporation, and OCC are the key Data Bus Market players considered for the research study. In addition, several other significant Data Bus Market players have been studied and analyzed in this research report to get a holistic view of the global Data Bus Market and its ecosystem.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Protocol, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

On the onboard bus, there is an upsurge in traffic. Remote terminals expect improved services from the onboard bus as they become more "intelligent." They expect to access the bus on demand to transfer data packets. Many current software architectures are built around messaging capabilities, in which programs communicate via variable-length messages generated asynchronously. Because of the growing "intelligence" of remote terminals, their expectations for more complete communication services, and the necessity to support increasingly sophisticated, multi-bus designs, higher-level protocols are being used more frequently on the onboard bus. This, in turn, may increase traffic volume, particularly asynchronous traffic, but it also emphasizes the necessity for the onboard bus to provide asymmetric medium access service. While asynchronous packet traffic on spacecraft buses has been steadily increasing, the number of basic sensors and actuators that must be serviced through the bus has remained constant. In reality, there is strong evidence that such low-cost gadgets are increasing. The MIL-STD-1553B command and control bus is the most frequent aboard a spacecraft, and the additions in ECSS-E-ST-50-13C cover it for future European space use. However, as processing power grows and sub-systems become more complex, there is a growing demand for data networks that meet MIL-STD-1553B requirements while also being compatible with the miniaturized low-power devices they connect. Pin counts, connector sizes, and harness bulk can all be reduced in this way. The awareness that the building block method demands standardization above the basic bus protocols goes hand in hand with the requirement to improve connectivity. Future data system innovations include, among other things, the adoption of the CAN bus as a complement to MIL-STD-1553B, the creation and usage of higher-layer protocols, and the standardization of digital sensor buses as the most efficient means to decrease harness and integration costs.

North America is expected to hold the largest share of the Data Bus Market in the coming years as it includes a few of the world's fastest growing and leading economies. The North American Data Bus Market is segmented into the US, Canada, and Mexico. The growth of the Data Bus Market in North America can be attributed to the flourishing electric vehicles (EV) industry, in line with the increasing number of environmental regulations and green initiatives.

Based on Protocol, the Data Bus Market is segmented as Arinc 429/629, Mil-Std 1553, and others. The protocol is the language that is utilized on an aviation data bus. Protocols are a set of formal rules and norms that regulate data exchange between systems. The protocol specifies the transmission and receipt of data on a bus. Also governed by protocol and its accompanying components are data collision prevention, integrity, and bus speed. The electrical and physical standards are defined via low-level protocols. Data formatting, including message syntax and format, is dealt with by high-level protocols. The Mil-Std 1553 segment led the Data Bus Market with a market share of 47.5% in 2020. It is expected to account for 47.8% of the total market in 2028.

The hardware segment led the Data Bus Market with a market share of 65.9% in 2020. It is expected to account for 62.2% of the total market in 2028. The hardware segment for data bus further comprises of cables and connectors, assemblies/terminators, data bus couplers, interface cards/boards, and others.

The data bus systems are used in various applications, including marine, automotive, commercial aviation, and military applications. The continuous modernization of military aircraft can decrease the possibilities of mishaps resulting due to errors introduced by pilots, enhance mission capacities, and increase comprehension of circumstances. The growth of the Data Bus Market is attributed to the increase in passenger car orders, rise in the number of aircraft deliveries, upgrading of naval and airborne programs, and a need to decrease swap specifications. The average life of a data bus ranges from 35 to 45 years, and after that, the systems need an upgrade. The long life hampers the growth of the Data Bus Market as it reduces the chances of replacing the systems that are currently in use with the new ones.

The demand for new military aircraft is increasing as countries attempt to update their fleets and expand their capabilities, especially in Asia-Pacific. The Australian Army received the first two of four new Boeing CH-47F Chinook transport helicopters in July 2021. The contract is worth USD 441 million and would add 14 CH-47F heavy-lift helicopters to the Army's fleet. The third and fourth helicopters are expected to arrive in mid-2022. The Royal Australian Air Force (RAAF) has placed another order for 2 P-8As, bringing the total number of P-8As under contract to 14. The P-8As are land-based antisubmarine and anti-surface ship planes built for intelligence, surveillance, and reconnaissance missions. Further, Indian government authorized the proposal for procuring 56 C295 transport aircraft from Airbus Defence and Space, Spain, in September 2021; Airbus Defence and Space, Spain has been awarded a contract for Rs 22,000 crore for the acquisition of the C 295MW cargo aircraft. 14 of the planes will be produced in Spain, with the remainder 40 being built in India as part of a joint venture between Airbus and Tata Group. In the last five years, China has added numerous new military aircraft to its inventory. As a result of these purchases, the demand for data bus is increasing in Asia Pacific as most new aircraft units are built upon data bus protocols.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Data Bus Market

- Astronics Corporation

- Amphenol Ltd.

- Collins Aerospace

- Data Device Corporation

- Data Bus Products Corporation

- Fujikura Ltd.

- HUBER+SUHNER

- Nexans

- TE Connectivity

- OCC

Get Free Sample For

Get Free Sample For