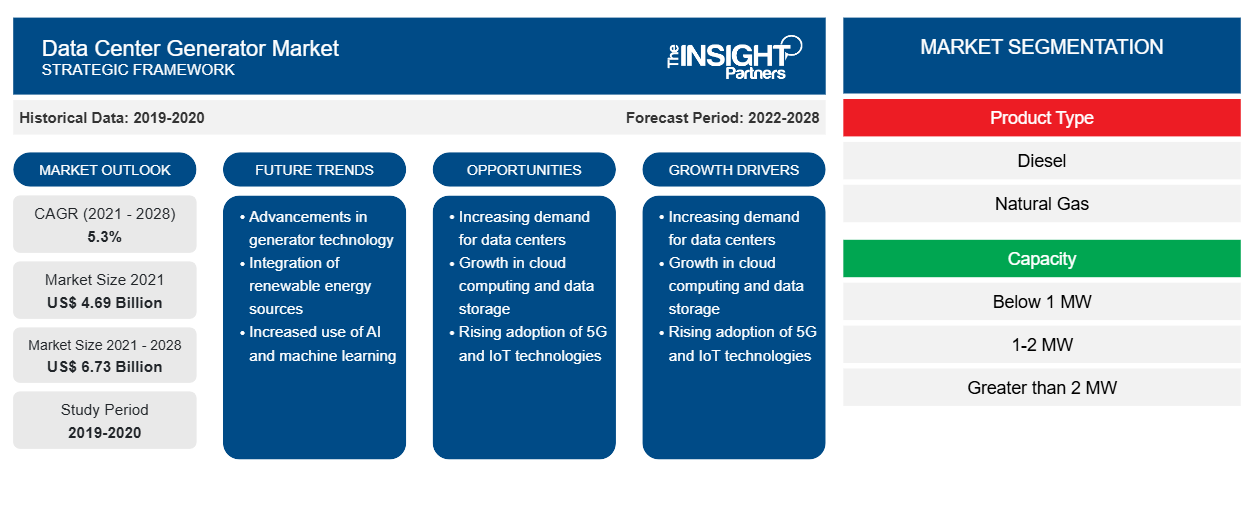

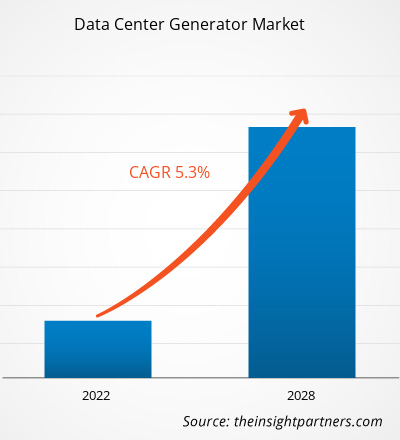

[Research Report] The data center generator market was valued at US$ 4,693.00 million in 2021 and is expected to reach US$ 6,729.53 million by 2028; it is estimated to register a CAGR of 5.3% from 2021 to 2028.

Generators serve as a backup power supply reservoir for data centers during a power outage. A total power outage in a data center may need a system restart, resulting in system downtime, startup challenges, and data loss. Hence, data centers are always backed by a backup power supply provided by generators to avoid such abnormalities and failures. Such benefits are driving the data center generator market growth .

These generators do not require an existing power supply to operate, which is a significant driving element for the market. In addition, prominent manufacturers manufacture generators with customized capacity in response to changing customer demands. Such systems can scale up and down by the power requirements of the data center. This adaptability is likely to increase the demand for data center generators, thereby boosting the market growth. Several cloud service providers have increased their output because of the rise in demand for edge data centers worldwide. Google, for example, spent US$ 3.3 billion in 2019 to expand its data center presence in Europe. Furthermore, the market is likely to benefit from the increased development of hyper-scale facilities and the rise in implementing diesel rotary uninterruptible power supply (DRUPS).

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Data Center Generator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Data Center Generator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Data Center Generator Market Insights

Increase in Number of Data Centers

There are already around seven billion internet-connected devices in this age of data, and that figure is growing. Many of them produce huge amounts of data, which must be recorded, routed, stored, assessed, and retrieved. Manufacturers rely on big data and data analytics to improve the efficiency, productivity, security, and cost-effectiveness of their operations as the Internet of Things (IoT) and Industry 4.0 take hold. On the other hand, data management in-house is becoming increasingly complicated, time-consuming, and costly. To save energy and infrastructure costs, even huge firms like Cisco consider shutting down portions of their own internal data centers.

The rise in penetration of connected devices and easy access to the internet, coupled with the reduced cost of internet services, are propelling the demand for data storage globally. The need for data storage is also surging due to the increasing demand for big data analytics and cloud-based services, such as online content comprising movies, apps, videos, and social media. Therefore, cloud-based companies deploy IT space in their data centers. Several industries are exploring the cloud offerings and discovering the benefits of data center services to support their needs related to the cloud. These developments are directly influencing the increase in the use of the Internet of Things (IoT), thereby resulting in the construction of a large number of data centers across the world. For instance, Colt has announced the development of its hyperscale data centers in Europe and Asia-Pacific, following the sale of 12 edge colocation centers across Europe. The corporation has purchased ten new plots of land in London, Frankfurt, Paris, and undisclosed locations in Japan that will allow it to create roughly 100 MW of IT power. Therefore, the increasing number of data centers boosts the need for data center generators to get sufficient power supplies, which is driving the data center generator market growth.

Product Type-Based Market Insights

Data center generators have been experiencing a rise in demand from across the globe in recent years. Companies provide three types of data center generators – diesel, natural gas, and bi-fuel. In January 2022, Cummins Power Generation announced that it had been awarded for its power solutions by the China data center industry. The company manufactures diesel data center generators. In January 2021, TRG Datacenters announced the upgrade of its Texas data center. The company is planning to install a bi-fuel option for power backup

Capacity-Based Market Insights

In terms of capacity, the data center generator market size is segmented into below 1 MW, 1–2 MW, and greater than 2 MW. Below 1 MW is the most prominent capacity in data center generators. The facilities with a capacity of more than 10 MW are adopting generators of greater than 2 MW. Generators below 1 MW power capacity are usually adopted in modular data center deployments. The adoption of generators with below 1 MW power capacity is expected to increase the deployment of data centers. They are being adopted by small-scale data center operators in developing economies as they are less costly. The rise in manufacturing of hyper scale facilities in emerging economies would decline the dependency on generators having low capacity in the coming years.

The data center generator market players adopt strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key data center generator market players are listed below:

- ABB LTD has introduced new shaft generator technology. This new generator brings flexibility and ease of installation to many vessels, including bulk carriers and container carriers. The AMZ 1400 permanent magnet shaft generator is optimized for converter control and enables better efficiency than induction.

- Caterpillar to Launch Demonstration Project Using Hydrogen Fuel Cell Technology for Backup Power at Microsoft Data Center. This project enables Caterpillar to collaborate with industry leaders to take a large step toward commercially viable power solutions that also support the customers in making their operations more sustainable.

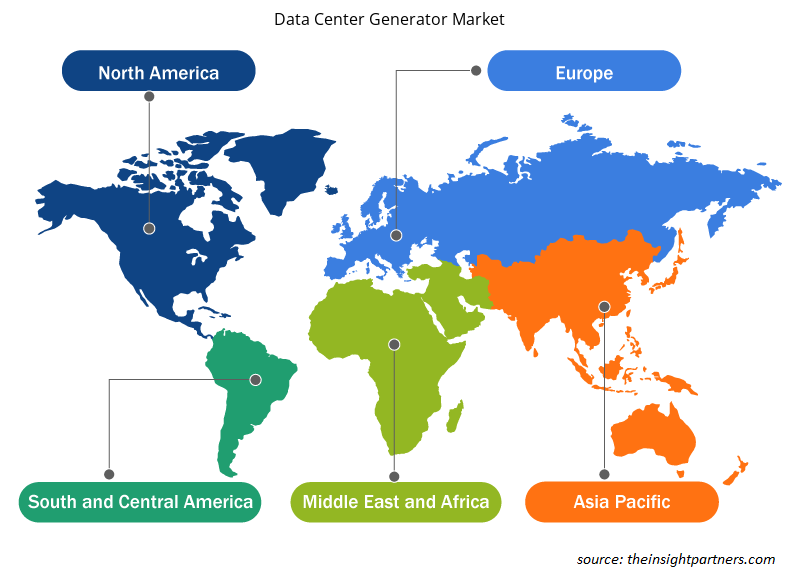

Data Center Generator Market Regional Insights

The regional trends and factors influencing the Data Center Generator Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Data Center Generator Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Data Center Generator Market

Data Center Generator Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 4.69 Billion |

| Market Size by 2028 | US$ 6.73 Billion |

| Global CAGR (2021 - 2028) | 5.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Data Center Generator Market Players Density: Understanding Its Impact on Business Dynamics

The Data Center Generator Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Data Center Generator Market are:

- ABB

- Atlas Copco AB

- Caterpillar

- Cummins Inc.

- DEUTZ AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Data Center Generator Market top key players overview

The global data center generator market is segmented based on product type, capacity, and tier. Based on product type, the data center generator market is segmented into diesel, natural gas, and others. In terms of capacity, the data center generator market is segmented into less than 1 MW, 1–2 MW, and greater than 2 MW. Further, based on tier, the data center generator market is segmented into tier 1 & 2, tier 3, and tier 4.

ABB; Atlas Copco AB; Caterpillar; Cummins Inc.; DEUTZ AG; Generac Power Systems, Inc.; HITEC Power Protection; Kirloskar; Kohler Co.; and MITSUBISHI MOTORS CORPORATION are the key data center generator market players considered for the research study. In addition, several other significant data center generator market players have been studied and analyzed in this research report to get a holistic view of the global data center generator market size and its ecosystem.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Employment Screening Services Market

- Hydrogen Storage Alloys Market

- Lymphedema Treatment Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Fixed-Base Operator Market

- Piling Machines Market

- Electronic Signature Software Market

- Volumetric Video Market

- Small Molecule Drug Discovery Market

- Smart Mining Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Capacity, and Tier

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Malaysia, Mexico, Russian Federation, Saudi Arabia, Singapore, South Africa, South Korea, Thailand, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The rising inclination towards renewables are environmental sustainability and energy savings is positively impacting the data center generator market. When rising and unpredictable energy costs and levies linked with pending carbon emission regulations are considered, it is easy to see why operators are becoming more interested in renewables' role in lowering and stabilizing energy costs. Google's hyper-scale data centers have been pioneers in renewable energy programs, researching their inherent financial, environmental, and social value. Google chooses locations for its data centers based on various considerations, including the availability of reliable service and the opportunity for renewable energy. Thus, these initiatives are further expected to contribute to the growth of the data center generator market over the forecast period.

The diesel segment led the data center generator market with a market share of 69.7% in 2020. It is expected to account for 68.7% of the total market in 2028.

Most data centers maintain enough fuel on hand to run the generator for 24-48 hours. To preserve sensitive data, data centers require dependable backup power. Thus, the global data center generator market is primarily driven by the increase in number of data centers and in backup power supply requirements in data centers.

North America dominated the data center generator market in 2020 with a share of 37.25%; it would continue to dominate the market during the forecast period and account for 31.67% share by 2028. Europe is the second-largest contributor to the global data center generator market, followed by Asia Pacific.

ABB; Atlas Copco AB; Caterpillar; Cummins Inc.; DEUTZ AG; Generac Power Systems, Inc.; HITEC Power Protection; Kirloskar; Kohler Co.; and MITSUBISHI MOTORS CORPORATION.

The less than 1MW segment led the data center generator market with a market share of 44.4% in 2020. It is expected to account for 46.1% of the total market in 2028.

Trends and growth analysis reports related to Energy and Power : READ MORE..

The List of Companies - Data Center Generator Market

- ABB

- Atlas Copco AB

- Caterpillar

- Cummins Inc.

- DEUTZ AG

- Generac Power Systems, Inc.

- HITEC Power Protection

- Kirloskar

- Kohler Co.

- MITSUBISHI MOTORS CORPORATION

Get Free Sample For

Get Free Sample For